DEX 'aggregators' are a recent and exciting addition to the dynamic digital currency marketplace, offering users enhanced liquidity access while ensuring competitive pricing.

1inch Exchange as a non-custodial platform, this DEX aggregator combines these advantages in one convenient location.

In this analysis, we'll delve into the details of what differentiates 1inch Exchange and makes it a valuable tool for crypto traders.

What is 1inch Exchange?

While 2020 was a challenging year for many in the financial world, the decentralized finance (DeFi) sector flourished. Individuals globally turned to this financial frontier, eager to capitalize on the market's unpredictability.

The influx of capital wasn’t the only growth seen; a wave of innovative trading solutions also emerged. DEX aggregators stood out among these new developments.

At the forefront of this is 1inch Exchange Through pooling liquidity from different exchanges, the platform uses smart contracts to streamline and optimize trading activity.

The platform was launched in 2019 by Russian innovators Sergej Kunz and Anton Bukov. 1inch Exchange smoothly collaborates with well-known DEXs like Balancer, Kyber Network, Uniswap, Oasis, Mooniswap, and others.

In essence, swapping any ERC-20 token is turned into a seamless task with just a simple click. Supporting more than 250 digital currencies, the exchange offers vast trading opportunities.

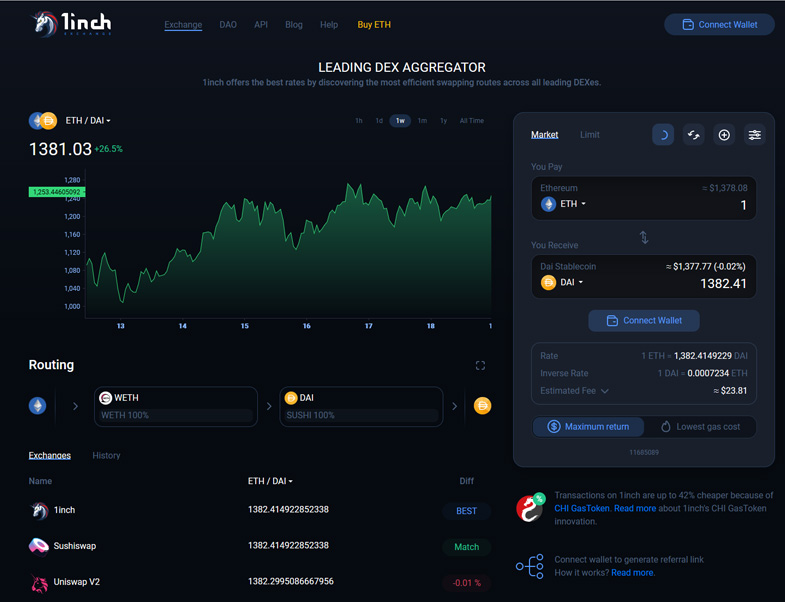

The simple objective of 1inch Exchange is to provide users with the most favorable rates by pinpointing the best exchange paths across leading DEX platforms.

To facilitate this, the platform transparently shows the price and liquidity available on each exchange, empowering you to make the best-informed decision.

This approach spares you the hassle of manually checking multiple exchanges to ensure you secure the best rate, making the trading process both simpler and more efficient.

How Does 1inch Exchange Work?

1inch Exchange leveraging its advanced API technology, it finds optimal trade routes, distributing a single trade across several exchanges.

This usually results in significantly better rates than sticking to a single cryptocurrency exchange.

By focusing on these strategies, 1inch Exchange aims to tackle the DEX marketplace’s common issues, such as costly transaction cancellations and high slippage due to insufficient order book depth.

How to Start Using 1inch Exchange

A standout feature of 1inch Exchange is its account-free trading. Users just link their ETH wallet and can immediately start trading currencies.

Offering compatibility with various crypto wallets, 1inch Exchange never holds your tokens, ensuring you always maintain control over your assets.

In simpler terms, you retain full control of your crypto holdings, a vital aspect for ensuring security.

How to Swap on 1inch Exchange

Follow these guided steps to initiate currency swaps on 1inch Exchange:

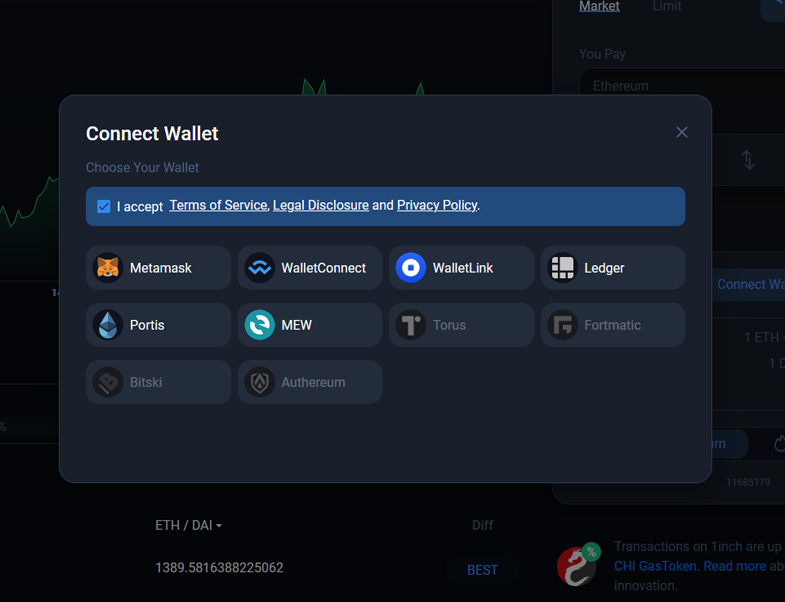

Step 1: Connect your ETH Wallet

You can straightforwardly connect your ETH wallet right from the homepage .

Currently supported cryptocurrency wallets include:

- Web3

- WalletConnect

- WalletLink

- Ledger

- Portis

- MEW

- Torus

- Fortmatic

- Authereum

- Bitski

Upon agreeing to the set terms, a quick QR code scan can link your wallet with the platform.

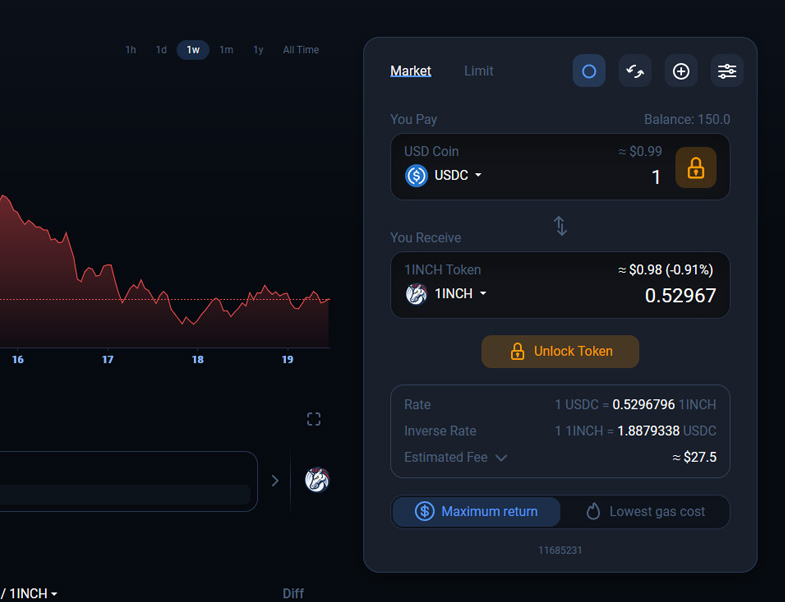

Step 2: Select the Token

Once connected, select the digital tokens you wish to trade. 1inch Exchange will present you with a comparison of exchange rates from various DEXs.

You'll also see how individual rates compare with the top available rate. The platform also offers a selection of centralized exchanges and their rate offerings for a clearer comparison.

Note: Should you not locate your desired token, it might be unapproved yet. You may either apply for it to be added or manually input it using its specific address.

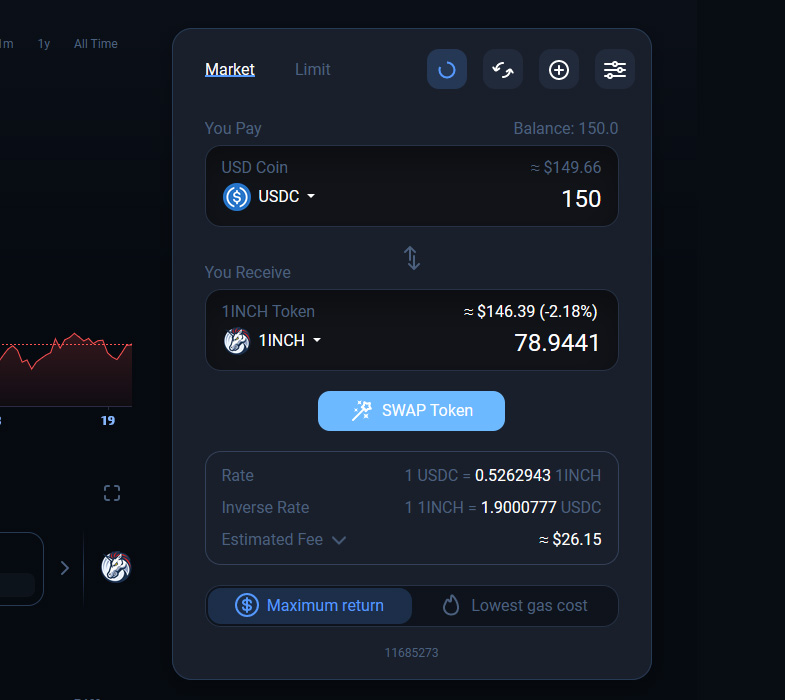

Step 3: Swap Tokens

When ready to proceed, simply click ‘Swap Now.’

1inch Exchange will provide all necessary transaction details for your verification before confirming.

You can then authorize the transaction via your wallet, and it will be processed on the blockchain.

All set! – You've just completed your first transaction on 1inch Exchange at optimal rates.

Note: Additionally, 1inch Exchange gives flexibility by allowing you to specify favorable swap prices with a limit order. Set the target price, and it's fulfilled by any DEX meeting that requirement; remember this works only for ERC20 tokens.

With its non-custodial architecture, 1inch Exchange constantly interacts with your crypto wallets. Enabling the ‘ infinity unlock ‘ function can streamline this, minimizing interaction with the app and reducing gas expenses.

Operating as a DEX aggregator, 1inch Exchange consistently delivers excellence but has even more to offer avid crypto traders.

1inch Exchange Features

Beyond its basic aggregation services, discover what else 1inch Exchange encompasses.

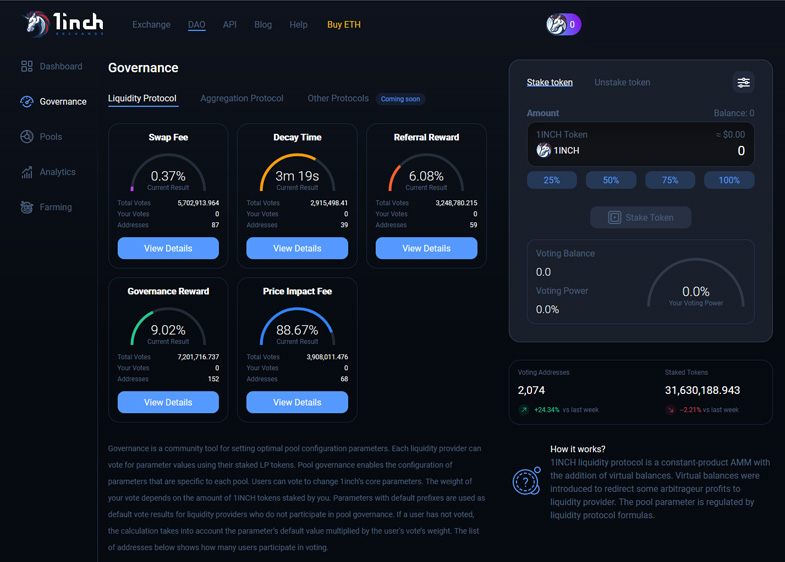

One of their latest initiatives involves the 1inch Exchange token.

1inch Exchange Token

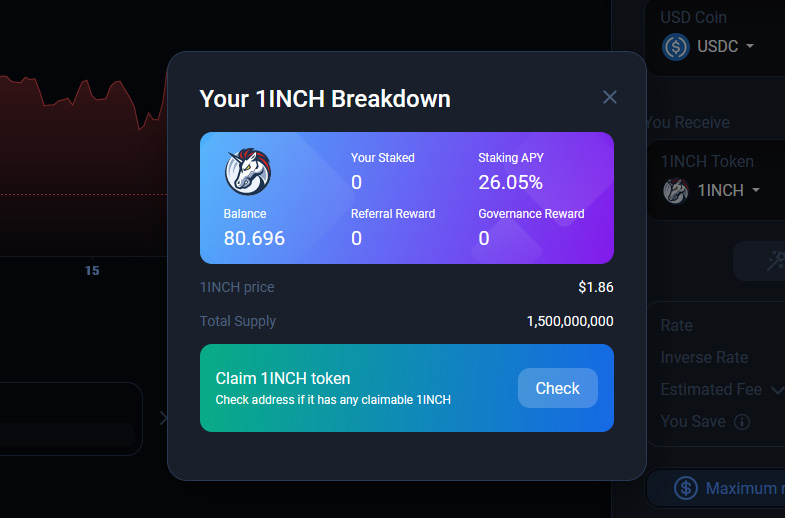

This token functions both as a utility and governance asset within the Ethereum ecosystem, distributed under specific conditions to wallets having prior 1inch interactions. of the platform The current total of 1.5 million tokens, by late December 2020, sees 6% in circulation, with planned distribution of 30% over the following four years and the remainder managed in intervals.

To qualify for a 1inch Exchange token, you must meet one out of three stipulations set.

Complete at least one transaction before September 15, 2020

Fulfill a minimum count of four trades in total

- Your trade sum should exceed at least $20.

- Meet these criteria, and you can claim tokens through your cryptocurrency wallet linked to 1inch Exchange.

- Available tokens for redemption will be showcased under the wallet's ‘your 1INCH breakdown’ section.

ETH transactions require a 'gas' fee, similar to a transaction charge levied by blockchain platforms.

Gas costs correlate with the computational demand for executing a DEX transaction, varying depending on operation complexity, so exact prediction isn’t feasible.

1inch Exchange CHI Gas Token

Dubbed “CHI,” this ERC20 token can assist in lowering transaction fees on 1inch Exchange.

CHI’s valuation is influenced by ETH gas price fluctuations, decreasing or increasing in tandem.

The CHI Gas Token Buying CHI can offer a 1% fee savings over GST2 (ETH GasToken).

Selling (burning) CHI can yield a 10% saving when compared to GST2.

CHI Gas Tokens can be minted or purchased directly on the 1inch Exchange, and once added to your wallet, they slash future transaction gas costs.

With Mooniswap, 1inch Exchange provides an innovative take on Automated Market Maker (AMM) mechanisms like Uniswap.

They utilize smart contracts for managing ERC20 liquidity pools, mitigating slippage, and offering you greater control over cryptocurrency trades.

1inch Exchange Mooniswap

As an exchange service, 1inch Exchange imposes no usage fees or commissions. Nevertheless, users are accountable for gas costs associated with their trades.

Activating CHI Gas Tokens could substantially decrease these expenses.

1inch Exchange Fees

Note : As a DEX aggregator, transaction fees depend largely on which DEX you choose to fulfill your order. Reviewing fee structures of individual DEXs before executing trades is recommended.

1inch Exchange’s core mission is to secure the best rates for its user base. Tacking on extra costs doesn’t align with this aim.

Besides trading fees, users of 1inch Exchange are exempt from having any deposit or withdrawal charges.

Therefore, the sole costs to consider here relate to wallet usage and fees from specific DEX platforms.

Fees Related to Deposits and Withdrawals on 1inch Exchange

Notably, fiat currency isn’t supported by 1inch Exchange, making it less ideal for new crypto enthusiasts with limited holdings.

To truly benefit from its exchange rates, one must first acquire cryptocurrencies and store them in a wallet integrated into the platform.

Safety is paramount in all DeFi solutions, including this one.

Emphasizing once more, 1inch Exchange operates in a non-custodial fashion, avoiding holding customer assets, unlike centralized exchanges requiring asset deposits.

1inch Exchange Security

Additionally, 1inch Exchange is recognized for its reliable security, encountering no data breaches or hacks thus far. Without requesting personal information, data-compromise fears are nullified.

1inch Exchange 2023: A Foremost Player in the DEX Aggregator Scene

Dive into our all-encompassing guide to the 1inch Exchange, the DEX Aggregator - encompassing utilization, costs, governance tokens, and beyond.

1inch Exchange Customer Support

Spotlight on 1inch Exchange: A Premier DEX Aggregator of Our Time

- Email support

- 1inch Exchange Help Center

- Live Chat

- 1inch Exchange support group

- Telegram group

DEX aggregators represent a fresh wave of innovation in the bustling digital currency landscape, enabling you to leverage high liquidity while discovering optimal pricing.

1inch Exchange Exchange Pros & Cons

1inch Exchange stands out as a non-custodial DEX aggregator, bringing together multiple benefits on a unified platform.

Pros

- Join us as we scrutinize the various features that 1inch Exchange unveils for its users.

- Breakdown of Deposit and Withdrawal Charges on 1inch Exchange

- Although 2020 destabilized many financial sectors, the decentralized finance (DeFi) domain thrived, capturing the interest of traders worldwide as they navigated rising market shifts.

- The year saw not only a surge in fund influx but also the advent of groundbreaking trading technologies, with DEX aggregators among the notable entrants.

- The platform draws on liquidity from an array of exchanges and harnesses smart contract capabilities to streamline trade optimization.

- Launched in 2019 by Russian visionaries Sergej Kunz and Anton Bukov, 1inch Exchange seamlessly bridges with widely-favored DEX platforms such as Balancer, Kyber Network, Uniswap, Oasis, Mooniswap, and many others.

Cons

- Essentially, swapping any ERC-20 token becomes as simple as executing a click, with over 250+ digital currencies currently supported by the exchange.

- 1inch Exchange is designed to offer users the best possible rates by pinpointing the most effective swap routes among top DEX options.

- To make informed decisions, the platform showcases the price and available liquidity from each exchange, letting you compare offerings easily.

- This feature negates the hassle of cross-checking multiple exchanges for the best rates, thereby saving time and effort.

Why Should You Choose 1inch Exchange?

Through its API technology, 1inch Exchange identifies the optimal trading avenues and segments trades across multiple exchanges.

Therefore, the rate you attain is frequently superior to what you'd get by staying loyal to a single exchange.

1inch Exchange aims to rectify common limitations of the DEX ecosystem - such as costly trade annulments and high slippage from sparse order books.

Its standout feature: you simply connect your ETH wallet to start trading immediately without creating an account.

1inch Exchange offers integration with a range of crypto wallets that securely store your digital assets. This means 1inch Exchange never holds custody of your tokens.

Basically, you retain full control over your crypto assets, a critical aspect for ensuring security.

1inch Exchange Exchange: The Verdict?

Here's a detailed guide to help you start swapping coins with ease on 1inch Exchange:

You have the opportunity to connect your ETH wallet right away,

1inch Exchange provides support for the following cryptocurrency wallets:

After agreeing to the terms, just scan the QR code to connect your wallet with the platform effortlessly.

1inch Exchange

Pros

- No Security Breaches or Hacks

- Excellent Interface

- No Fees apart from Network Fees

- Good Liquidity

- With your wallet linked, you're free to select any digital tokens for exchange. 1inch Exchange will present a comparative analysis featuring rates from various DEXs.

Cons

- No Fiat Options

- Beginners Might Find Hard to Use