Crypto trading automation has been revolutionized by platforms known as 'bots,' which handle complex market movements on behalf of traders. Among these tools, Cryptohopper and 3commas emerge as frontrunners, both offering robust trading capabilities.

Cryptohopper and 3commas Both platforms offer a comparable suite of features, and a subscription fee applies for their utilization. To discover the distinctions and commonalities, scroll down to our comprehensive analysis.

Declaring a definitive winner between the two platforms is subjective, as each offers a diverse array of tools designed to simplify the crypto trading journey.

Explore the functionalities of both Cryptohopper and 3commas to evaluate if either could be an indispensable part of your trading strategy.

Also take a look at our complete Trading Bots guide Dive deeper as we break down the inner workings of these platforms and explore additional trading solutions.

Cryptohopper vs 3Commas

Cryptohopper and 3commas both leverage API keys to facilitate transactions across various prominent crypto exchanges on your behalf.

Both platforms share numerous features, including:

- Accessible cloud-based systems ensuring uninterrupted connectivity 24/7.

- Fee-based service

- Capability to connect with multiple crypto exchanges through an API key system.

- Automated trading options

- Options for executing long and short trades via limit orders.

- User-friendly trading interface

- Access to a marketplace for third-party bot and signal purchases.

Cryptohopper: The Rundown

Depending on one's definition of a trading bot, Cryptohopper may align or differ, offering state-of-the-art trading utilities alongside professional-grade signaling and backtesting tools.

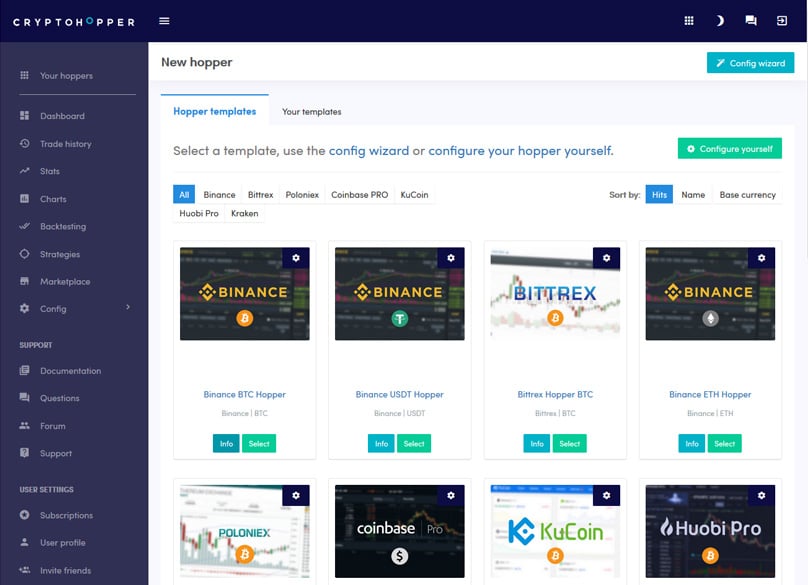

Clients of Cryptohopper benefit from a cloud-based interface designed to manage numerous crypto positions across eight major supported exchanges.

- KuCoin

- Binance

- Coinbase Pro

- Bittrex

- Poloniex

- Kraken

- Huobi

- Bitfinex

According to official resources, Cryptohopper supports 75 tokens, ensuring users can find pairings for trade effortlessly.

How Cryptohopper Works

With an array of semi-automated functionalities, Cryptohopper empowers its users to automate trading activities on compatible exchanges post-configuration.

Supplementing automated trading functions, Cryptohopper presents trading signals aiding in identifying suitable entry and exit points, with added social trading elements promoting collaborative profit opportunities.

Cryptohopper Tools

Through supported exchanges, configure buying and selling parameters based on Cryptohopper's platform triggers for tailored market activity, though full automation isn't its forte.

Cryptohopper empowers traders with various order types and tools, including:

- Trailing Stop Loss – A dynamic stop loss feature adjusting with market changes, locking in profits as positions move favorably.

- Market Surveillance – As traders cannot monitor markets continuously, Cryptohopper vigilantly scouts exchanges to enact trades based on predefined market levels—a lifesaver for part-time traders.

- Funds Reservation – A feature allowing traders to reserve token amounts, safeguarding a portion of their assets, adaptable to individual trading needs but a reassuring option nonetheless.

- Scalping Techniques – With scalping automation, Cryptohopper is equipped to execute small, profitable trades based on established criteria, capitalizing on minor market shifts.

- Positive Pair Trading – Noting trends is crucial, and Cryptohopper's tool identifies favorable token pairs from recent history to optimize entry points for lucrative trades.

- Proactive Triggers – In reaction to swift market movements, Cryptohopper allows customizable triggers for buying or short-selling supported tokens, executing trades as per user predictions.

- Short Selling Options – Enabling the potential for gains from dropping token values, Cryptohopper includes short selling capabilities with predetermined profit lock-in mechanisms.

- Dollar Cost Averaging – An investment strategy allowing incremental integration into market positions to moderate costs, with Cryptohopper facilitating this approach through onboard tools.

- Signal Contributions – Through its social trading network, experienced third parties can serve as signalers, providing track records for informed decision-making. While past success isn't assured, collaborating with proficient traders can be a strategic enhancement!

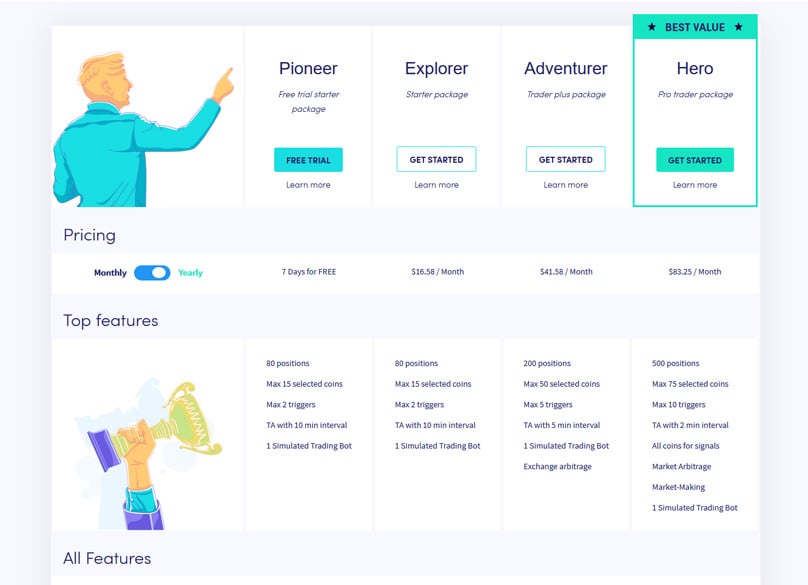

Cryptohopper Pricing

Cryptohopper's pricing model spans three tiers, offering a trial period for the lowest tier at no charge.

- Pioneer Package: 7-Day Complimentary Trial – The Explorer hopper plan is available at no cost for a week-long introduction.

- Explorer: Initial Access ($19 Monthly) – Priced at $19 monthly, this entry-level package manages 80 positions from up to 15 tokens, includes technical analysis every 10 minutes, and accommodates 2 triggers.

- Adventure: Intermediate Solution ($49 Monthly) – The Adventure plan, at $49 monthly, increases positions to 200, facilitates 50 token trades, offers technical analysis every 5 minutes, and permits 5 triggers.

- Hero: Elite Option ($99 Monthly) – Leading the plans, Hero Hopper costs $99 monthly, allowing management of up to 500 positions from 75 tokens, offering 10 triggers, with 2-minute technical updates, plus altcoin signals.

To explore Cryptohopper further, you can review our detailed coverage here.

Is Cryptohopper a Better Platform?

For traders seeking a platform to oversee trading activities seamlessly, Cryptohopper emerges as a potent choice, providing largely autonomous trading tools upon initial configuration. Despite seeming complexity, the platform's intuitive design simplifies personal trading algorithm creation.

An area where Cryptohopper excels is in its allowance for numerous concurrent positions, even under its basic plan, letting traders manage up to 80 positions—significantly above-average given individual trader limits. The option to trial Cryptohopper economically and month-by-month further adds to its appeal.

Cryptohopper functions as a highly capable automated trading solution, ideal for constant crypto market connectivity. Comparing its strengths to those of 3commas remains subjective, necessitating personalized assessment. Let’s shift focus onto 3commas and explore its client offerings.

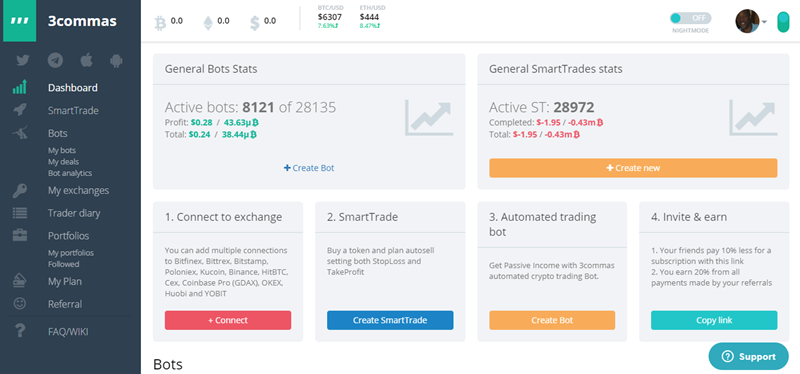

3Commas: The Rundown

3commas caters to clients with diverse automatic trading solutions. Contrasting with Cryptohopper, it provides fully automated bots requiring minimal client configuration.

Additionally, 3commas supports simple tool deployment for personalized bot creation alongside streamlined automated solutions for straightforward trading tactics.

The following crypto exchanges are compatible with 3commas (as listed on the official website):

- Bittrex (features: Smart Trade, Portfolios, AutoTrading Bot)

- Poloniex (Smart Trade, Portfolios)

- HitBTC (Smart Trade)

- Coinbase Pro (GDAX) (Smart Trade)

- OKEx (Smart Trade, AutoTrading Bot)

- Bitmex.com (AutoTrading Bot)

- Kraken (SmartTrade)

- Bitfinex (Smart Trade)

- Binance (features: Smart Trade, Portfolios, AutoTrading Bot)

- KuCoin (Smart Trade)

- Bitstamp (Smart Trade)

- Houbi Global (features: Smart Trade, AutoTrading Bot)

- Gate.io (SmartTrade)

As evident, 3commas' utility is closely tied to traders' exchange preferences. For an in-depth exploration of each tool's offerings, read further!

The Tools

3commas adopts a versatile framework enabling the use of nearly autonomous bots, crafting of automated sequences, or engaging in automatic buy/sell processes.

This element may appeal to traders favoring simple, adaptable algorithms offering automated solutions post minimal parameter setup.

- Smart Trading – 3commas offers a smart trading feature that allows you to set specific trading conditions, executing them automatically through their cloud-based system. This is quite similar to the functionalities you might find with Cryptohopper. It enables you to keep track of market trends without being chained to your trading terminal. The platform supports both long and short trades, provided they're permitted by your exchange.

- Auto Trading Bot – The Auto Trading Bot on 3commas runs entirely autonomously. After selecting a token pair and configuring basic trade settings, the bot takes the reins to seek out profits for you. You can tweak its operation by selecting strategies such as long, short, or composite to cater to the token pairs you target, leaving most of the heavy lifting to the bot.

Within 3commas, there are numerous settings you can adjust, thus optimizing your investment returns. The composite bot tool permits you to juggle long and short positions across numerous token pairs—capitalizing on more advanced trading strategies.

The platform also highlights the top-performing bots over the past day, which could be a helpful lead if you're keen on capitalizing on prevailing trends. These tools are tailored to simplify profit generation and operate largely on their own. Yet, it’s wise to remember that once a bot is active, it could incur losses for which you’d be accountable—therefore, starting modestly might be prudent.

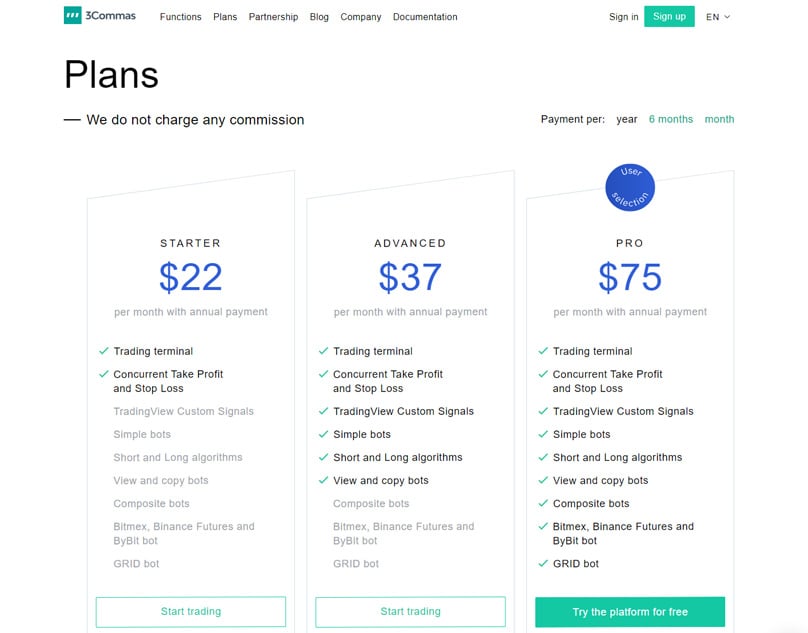

3commas Pricing

3commas offers a tiered subscription service, with increasing benefits as you move up the pricing scale. Unlike Cryptohopper, 3commas extends a 3-day free trial when you opt into their pro plan.

- The Starter Package – At $22 USD per month, 3commas grants entry to the Smart Trading terminal with unlimited trading, along with error and cancellation alerts. Considering that most crypto exchanges only accommodate this Smart Trading terminal, this plan serves as a suitable starting point for many traders.

- The Advanced Package – For $37 USD each month, the Advanced Package encompasses everything from the Starter Package and further offers access to basic bots, plus personalized alerts from Trading View.

- The Pro Package – The Pro Package costs $75 USD per month, incorporating both sophisticated bots and Bitmex bots to your toolset, alongside comprehensive portfolio management. There’s also an option for those committing to longer subscription durations with 3commas.

If you want to read more about 3commas, you can review our detailed coverage here.

Choosing the Superior Automated Trading Platform: A Tough Decision?

It’s fair to recognize that both Cryptohopper and 3commas excel within their realms. They share numerous features, making either a viable choice for those in search of straightforward automated trading utilities rather than bots specifically.

Cryptohopper does have the edge over 3commas in that its platform offers a no-cost week-long trial, which is ideal for novices to auto-trading who are debating its compatibility. Meanwhile, 3Commas proposes a 3-day trial but only if you choose their premium “Pro” plan.

3commas is an excellent option for users keen on leveraging a fully-automated trading system, operating under parameters set forth by the user. Each hosts a marketplace where routines or trade signals can be acquired, and both integrate with a broad selection of popular crypto exchanges.

Cryptohopper enters the market at $19 monthly with their starter plan, contrasted with 3Comma’s $22. However, Cryptohopper’s premium plan is priced at $99 monthly, whereas 3Comma's is $75. Thus, for those needing to widen their positions, 3Commas might be appealing; conversely, Cryptohopper could be better for newcomers.

We suggest exploring both providers' free trial periods initially to identify which platform aligns more closely with your requirements.

A Word on Safety

A significant worry about automated trading platforms revolves around how effectively they safeguard client funds. Although both Cryptohopper and 3commas adhere to prevailing safety standards, creating an API key inherently risks exposing your funds to potential theft.

Each investor must individually assess whether the possibility of asset loss due to theft is justified by captivating the potentials an automated trading platform introduces through perpetual market access, although risks of system vulnerabilities remain.

These security threats don't uniquely apply to 3commas and Cryptohopper , which have developed platforms incorporating necessary protective measures.

Starting with a small token investment in automated trading might be wise to test the waters. If the chosen platform meets your expectations and returns are robust, you can always augment your investment in the future.