Want to make your crypto work for you or take out a loan using your digital assets? That’s the idea behind this Ethereum-based platform. AAVE platform is all about.

Here’s a quick snapshot of how AAVE functions and what it can do for you. We’ll guide you step-by-step on how to get started and delve into the technical nitty-gritty, including potential risks to consider.

What is AAVE?

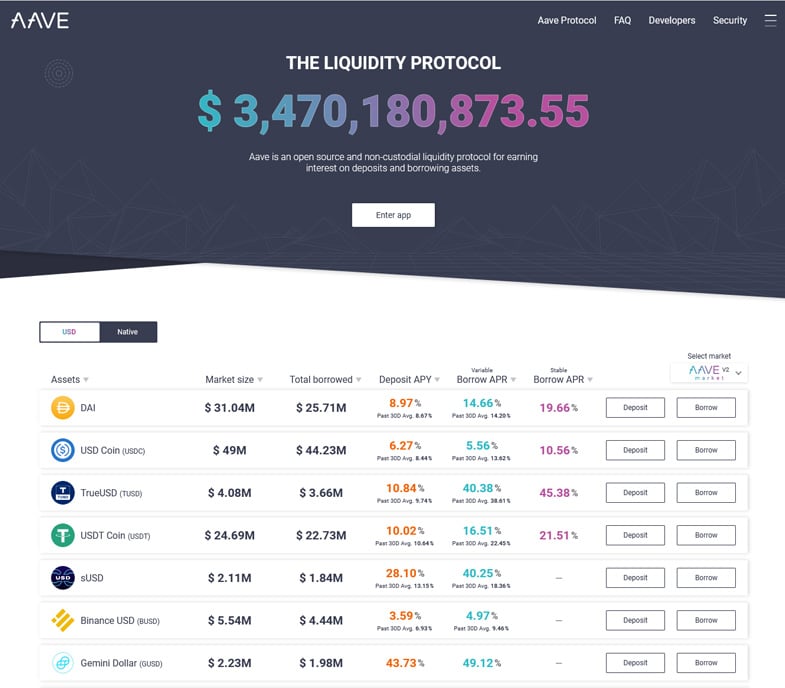

AAVE is an open-source DeFi This platform lets users earn interest from their deposits and use them as collateral without KYC hurdles or locational barriers. Holding over $3 billion in assets, it’s open to all.

What sets AAVE apart from the rest is its non-custodial nature. In essence, you retain full control of your deposits, ensuring no one else can deny your access.

Even if the Swiss entity behind AAVE vanished, your assets remain yours. A downside of non-custodial frameworks is if funds go missing, there's no assistance available. But there’s a sort of pseudo insurance we’ll explore.

Built atop the robust Ethereum network, AAVE supports a selected group of ERC-20 tokens for lending and earning.

This means you won’t find non-ERC assets like Litecoin here. Still, AAVE covers a wide range, including popular stablecoins like USDT, USDC, and TUSD, among others. Wrapped Bitcoin or WBTC .

Making Your First Deposit With AAVE

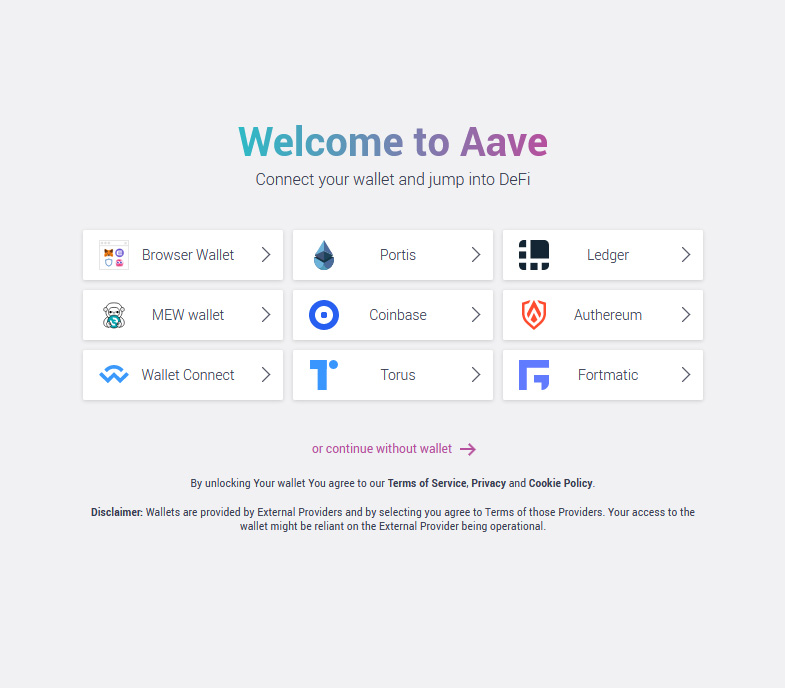

Starting with AAVE is straightforward, though it might feel a bit overwhelming at first. Head to their official site, AAVE.com, and enter the app, opting for the latest version, currently Version 2.

Next, you have the choice to link to a wallet for transactions or proceed without one. AAVE supports wallets like MetaMask, Ledger, and even Coinbase. With secure settings, your wallet stays well-protected.

After logging in, make your initial deposit to begin earning or to use as loan collateral. Navigate to the deposit tab on the menu for the current annual percentage yield (APY).

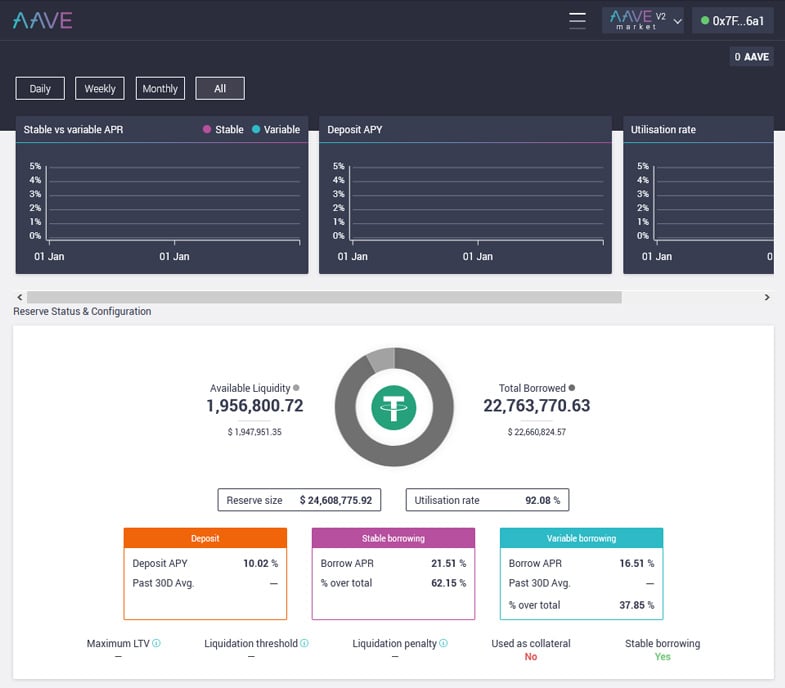

Interest rates vary, but when we checked, stablecoins were offering notably high returns around 12%, with ETH lagging behind just under 1%. AAVE’s rates are competitive compared to similar services.

Borrowing rates are just as varied. During our research, we saw ranges from 0.16% for UNI to a steep 25.44% for USDC. AAVE lets you toggle between variable and fixed APR for flexibility, with some fixed rates hitting highs above 30.44%.

AAVE’s platform lays out the contrast between stable and fluctuating interest rates for clarity. official website with the following:

A fixed rate offers predictability in interest expenditure, while the variable option adapts over time, potentially being more economically favorable.

Whether crypto-backed or traditional, high rates between 25.44% and 30.44% are steep. But a crypto bull market could be the driver. Unlike with historical metrics, AAVE provides little comparative past data.

Do remember, each AAVE loan includes an origination fee, precisely 0.00001% of the loan total.

The AAVE Token and Staking Rewards

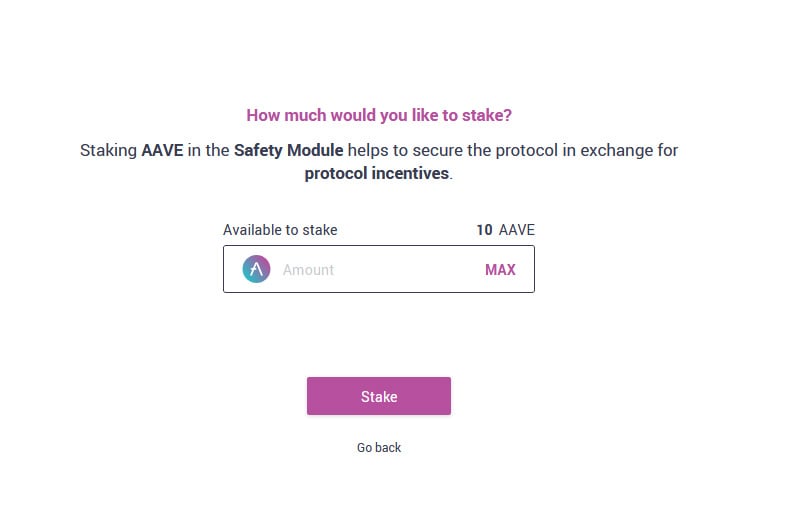

AAVE holders can earn not just through interest but by staking in their 'safety module', designed to backstop unforeseen market events.

Staking earns you a 'safety incentive', a regular return for the risks assumed, with current rates at 4.51%, equating to a monthly earnings rate.

The value of AAVE has spiked dramatically since November 2020, jumping from $20 to over $180 by early 2021.

Advanced Features of AAVE

AAVE allows another unique feature—converting your interest-earning deposits into tradeable tokens, known as tokenization.

According to the white paper These deposits become aTokens, mirroring your assets at a 1:1 ratio. You can redeem them, with added interest, or trade aTokens on platforms that support them.

Developers may find the concept of Flash Loans exciting—quick loans lasting a single Ethereum block without collateral, as long as they’re paid back in time. Flash Loans here.

Weighing Rewards Against Risks

Boasting numerous features, AAVE caters to both lenders and borrowers with no joining restrictions. Yet, with great openness comes the inherent risks of DeFi—loss from hacks, market downturns, or smart contract bugs.

None of these mishaps have occurred yet, and AAVE’s safety module provides a layer of protection. Ultimately, weigh risks against rewards before making decisions.

Is using AAVE a smart move for financial growth, or does it carry too much uncertainty? Share your views in the comments.