Abra offers options for investing in cryptocurrencies and traditional assets like stocks and ETFs, empowering users to manage their portfolios anytime through a convenient mobile app.

Initially, Abra started as an app focused on simplifying money transfers, leveraging a network of tellers for international exchanges. Today, it has evolved into a one-stop solution for investing and money transfer, functioning as a non-custodial wallet available on both iOS and Android platforms.

Incorporating nearly 30 cryptocurrencies and over 50 fiat currencies, Abra’s mobile app is user-friendly, globally accessible, and presents numerous options for funding wallet accounts.

Abra operates similarly to Coinbase Wallet, providing a seamless user experience in managing digital assets. we reviewed here .

Abra Overview

Founded by Bill Barhydt and Pete Kelly in 2014, Abra has attracted substantial investments from venture capitalists, including $35.5 million from firms like Jungle Ventures, Arbor Ventures, and American Express.

While headquartered in Silicon Valley, USA, Abra also maintains an office in Manila, Philippines.

Initially, Abra relied on a network of Tellers across several locations, facilitating cash transfers through personal interactions in the US and the Philippines.

By 2017, Abra expanded to allow buying and selling Bitcoin, enabling US Dollar bank transfers and American Express card deposits, while limiting the Teller system to the Philippines.

Abra now extends its service to include investment in cryptocurrencies and stocks/ETFs, offering support for around 30 cryptocurrencies and over 50 fiat currencies, alongside credit card payments.

Which Services Does Abra Provide?

Available in over 150 countries, Abra facilitates the purchase of popular cryptocurrencies like Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), and others.

The app can also facilitate sending money to other users and supports fiat currencies such as USD, EUR, GBP, and more.

Individuals outside the US can invest in notable stocks and ETFs, while those in the Philippines can still access the Abra Teller network for cash transfers.

How to Get Started

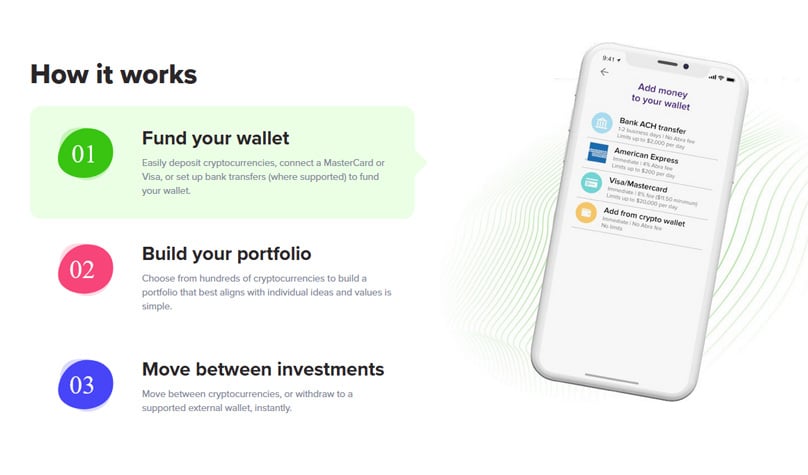

To get started with the Abra wallet, download the app from your device’s app store and input your personal details for registration.

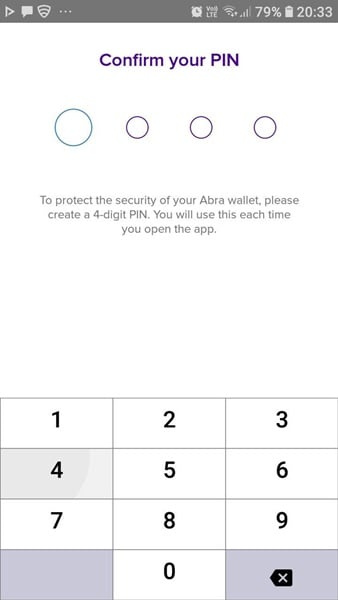

Expect a verification text to finalize registration through a security code and PIN creation.

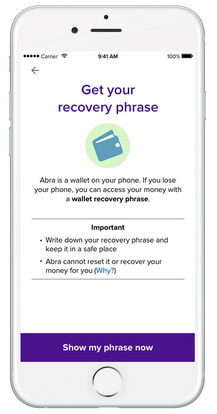

Ensure you identify your residency status and securely store your recovery seed phrase after setup.

Upon completing these steps, you can fund your wallet through bank transfers, credit cards, or another crypto wallet.

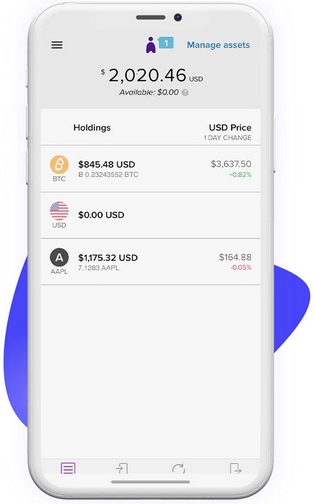

Use the app to effortlessly view and manage your investment portfolio, with options to withdraw funds when needed. exchange various cryptos Following wallet installation, you can deposit funds and explore which financial assets align with your investment goals.

How to Fund Your Account

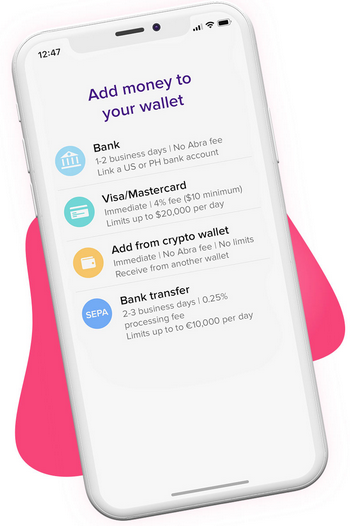

Funding options vary by region; here's how you can fund your Abra wallet: Cryptocurrency, Credit Card, Local Bank Transfer, or Wire Transfer.

Whether you're in the US, EU, or Philippines, reliable local bank transfers are an option, while other methods are region-specific.

- Utilize credit or debit cards from Visa, MasterCard, or American Express, and set up U.S. bank wires for seamless transactions.

- Add cryptocurrencies from external wallets, connecting bank accounts for easy deposits and withdrawals.

- Abra's adherence to standard security measures ensures your wallet's safety through number verification, secure PINs, and seed phrases.

- Advanced encryption safeguards your information, maintaining privacy by not sharing sensitive data during transactions.

With Abra operating as a non-custodial wallet, user control over funds remains central, exempting it from US money transfer regulations.

United States

- Link a U.S. bank account.

- Powered by Synapse Fi and connected to FDIC-insured Evolve Bank, Abra supports efficient banking transactions with major US banks.

- In the Philippines, Abra enlists support from leading banks, is registered with the SEC, and is a sanctioned local operator.

- Abra's unique synthetic currency system lets users retain custody over Bitcoin through private keys and recovery phrases, while smart contracts offer exposure to other currencies.

Europe

- For instance, purchasing 100 XRP with deposited BTC establishes a smart contract, securing that amount despite fluctuating prices.

- Abra calculates your BTC returns based on contemporary exchange rates when switching back from XRP.

- The platform maintains secure user positions, engaging diverse exchange partners for crypto transactions.

Philippines

- When investing, understand you'll solely acquire the chosen coin, without receiving forked variants or dividends from specific crypto assets.

- Abra calculates your BTC returns based on contemporary exchange rates when switching back from XRP.

- The platform maintains secure user positions, engaging diverse exchange partners for crypto transactions.

Rest of the world

As an intuitive mobile app for both iOS and Android users, Abra simplifies setup, boasting a user-friendly interface and organized navigation.

Is Abra Safe?

For streamlined Bitcoin purchases, credit or debit cards are effective alternatives, bypassing traditional exchanges.

Engaging in cryptocurrency or stock investments demands diligence – Abra supports this journey with exhaustive resources like guides, research, and FAQs.

Abra’s active customer support team is readily available through live chat, app communication, emails, or social media.

The support team operates within designated hours for live chat, with additional communication channels offered through email and social platforms.

The app grants access to a diverse range of cryptocurrency options for personal and investment exploration.

- Supported fiat currencies broaden payment choices for app users, ensuring comprehensive, global financial interaction.

- Abra employs a defined fee structure for transactions, efficiently facilitated through Wire Program, Coinify, and Simplex services.

- For transactions utilizing the Abra Wire Program, additional bank fees may apply, with European users directed towards SEPA.

When transacting through Simplex, expect specific fees relative to your purchase size, with set rates for smaller BTC transactions.

Is Abra Suitable for Beginners?

Exploring the 2020 Abra Wallet App: Is This Mobile Crypto Wallet Safe for Users?

In our thorough examination of the Abra App Wallet, we delve into its safety features, fee structure, and provide a balanced overview of its advantages and disadvantages. Abra website via Simplex.

Comprehensive Beginner's Guide to the Abra Crypto App & Mobile Wallet: An In-Depth Review

Abra gives users the freedom to invest in a diverse array of financial instruments—ranging from cryptocurrencies to traditional assets like stocks and ETFs—while also enabling portfolio management straight from their mobile.

Originally designed for straightforward money transfers, Abra has evolved into a versatile platform, blending investment and remittance functions into a single non-custodial wallet that works on both Android and iOS devices.

Which Currencies does Abra Support?

Offering nearly 30 different cryptocurrencies alongside over 50 fiat currencies, the Abra app boasts simplicity, availability in numerous nations, and multiple funding options for your wallet accounts.

The workings of Abra are reminiscent of the Coinbase Wallet where

| Country | Currency Name | Currency Code |

| Argentina | Argentine Peso | ARS |

| Aruba (Kingdom of the Netherlands) | Aruban guilder | AWG |

| Australia | Australian dollar | AUD |

| Bahamas | Bahamian dollar | BSD |

| Barbados | Barbados dollar | BBD |

| Brazil | Brazilian real | BRL |

| Bulgaria | Bulgarian lev | BGN |

| Canada | Canadian dollar | CAD |

| Chile | Chilean peso | CLP |

| China | Chinese yuan renminbi | CNY |

| Colombia | Colombian peso | COP |

| Costa Rica | Costa Rican colon | CRC |

| Croatia | Croatian kuna | HRK |

| Curacao (Netherland Antilles) | Netherlands Antillean guilder | ANG |

| Czech Republic | Czech koruna | CZK |

| Denmark | Danish krone | DKK |

| Dominican Republic | Dominican peso | DOP |

| Eurozone (various countries) | Euro | EUR |

| Founded in 2014 by Bill Barhydt and Pete Kelly, Abra has attracted substantial venture capital backing, raising an estimated $35.5M with investments from Jungle Ventures, Arbor Ventures, and American Express. | East Caribbean dollar | XCD |

| Guatemala | Guatemalan quetzal | GTQ |

| Haiti | Haitian gourde | HTG |

| Honduras | Honduran lempira | HNL |

| Hong Kong | Hong Kong dollar | HKD |

| Hungary | Hungarian forint | HUF |

| Iceland | Icelandic króna | ISK |

| India | Indian rupee | INR |

| Indonesia | Indonesian rupiah | IDR |

| Israel | Israeli new shekel | ILS |

| Jamaica | Jamaican dollar | JMD |

| Japan | Japanese yen | JPY |

| Malaysia | Malaysian ringgit | MYR |

| Mexico | Mexican peso | MXN |

| New Zealand | New Zealand dollar | NZD |

| Nicaragua | Nicaraguan córdoba | NIO |

| Norway | Norwegian krone | NOK |

| Paraguay | Paraguayan guaraní | PYG |

| Peru | Peruvian nuevo sol | PEN |

| Philippines | Philippine peso | PHP |

| Poland | Polish zloty | PLN |

| Romania | Romanian new Leu | RON |

| Saint Lucia | East Caribbean dollar | XCD |

| Singapore | Singapore dollar | SGD |

| South Africa | South African rand | ZAR |

| South Korea | South Korean won | KRW |

| Sweden | Swedish krona | SEK |

| Switzerland | Swiss franc | CHF |

| Taiwan | New Taiwan dollar | TWD |

| Thailand | Thai baht | THB |

| Trinidad and Tobago | Trinidad dollar | TTD |

| Turkey | Турецкая лира | TRY |

| Объединенные Арабские Эмираты | Дирхам ОАЭ | AED |

| Соединенное Королевство | Фунт стерлингов | GBP |

| Соединенные Штаты | Американский доллар | USD |

| Вьетнам | Вьетнамский донг | VND |

Комиссии Abra

With headquarters in Silicon Valley, Abra also maintains an operational office in Manila, bringing its global reach into focus.

| Активность | Комиссия |

| Пополнение вашего кошелька | |

| Пополнение через американский или филиппинский банк (ACH) | Бесплатно |

| Пополнение через переводы (только США) | Без комиссии Abra |

| Пополнение через банк ЕС (SEPA) | 0.25% |

| Пополнение через основанную в США AMEX карту | 4% |

| Пополнение через Visa или MasterCard | Фиксированная плата $10 или 4% |

| Пополнение через кассира (Филиппины) | До 2%*** |

| Пополнение через BTC, LTC, BCH или ETH | Бесплатно |

| Вывод средств из вашего кошелька | |

| Вывод через американский или филиппинский банк | Бесплатно* |

| Вывод через кассира (Филиппины) | До 2%*** |

| Вывод BTC, LTC, BCH или ETH | Сетевая комиссия** |

| Вывод альткоинов | Сетевая комиссия** |

| Обмен между валютами | |

| Обмен между любыми 2 валютами | Бесплатно |

| Отправка средств | |

| Отправка средств на другой кошелек Abra | Бесплатно** |

Initiating with a network of Tellers spread across nations like the U.S. and the Philippines, Abra facilitated cash and remittance transfers through personal interactions.

However, since 2017, Abra has enabled its users to both buy and sell Bitcoin, apart from allowing bank transfers in USD and American Express card transactions, though its Teller system is now limited to the Philippines. Coinify Users can now benefit from investments in cryptocurrencies, stocks, and ETFs, with Abra supporting a wide array of currencies and permitting credit card transactions.

Across over 150 countries, Abra allows you to purchase leading cryptocurrencies like Bitcoin, Bitcoin Cash, Ethereum, and more.

In addition, transfers can be done between Abra wallet users, supporting major fiat currencies like USD, EUR, and GBP.

Другие важные моменты

Outside the U.S., users can invest in renowned stocks and ETFs such as those of Apple, Amazon, Facebook, and more while those in the Philippines can use the local Abra Teller network for cash transfers.

To start using the Abra wallet, download the app from your preferred store—either Apple or Google. Post-installation, enter your personal details including your name, email, and phone number.

You will receive a verification code via text and be instructed to set up a four-digit PIN.

You'll also need to confirm your residency status in the USA and securely store your recovery seed phrase.

After these steps, funds can be deposited into your wallet through bank transfer, credit card, or other crypto wallets.

The app allows for easy portfolio viewing and management.

Ready to withdraw? Transfer your funds to another wallet or bank account.

Once the wallet setup and funding are done, selecting assets for purchase is your next step, with cryptocurrencies being the most accessible and universally supported asset class.

However, specific funding routes are region-dependent, offering options such as:

Преимущества

- Простое в использовании мобильное приложение.

- Всё в одном: обмен и кошелек.

- Cryptocurrency: Bitcoin, Ethereum, and more.

- Wide range of funding options.

- Can be used to make money transfers.

Cons

- Credit card: MasterCard, Visa, American Express (U.S. exclusive).

- No native altcoin support

- Additional Bittrex exchange fee

- Higher in app purchase rates

Conclusion

Local Bank Transfer: Available in the U.S., EU, and the Philippines.

Wire Transfer: U.S. bank wires; global options forthcoming.

In countries like the U.S. and EU, wallets can be funded via local bank transfers, while certain services remain exclusive to the U.S.

Options include using Visa, MasterCard, or American Express cards.

Set up U.S.-based bank wires for seamless transactions.

Abra

Pros

- Easy to use mobile app

- All-in-one exchange and wallet

- Transfer your digital currencies from external wallets effortlessly.

- Wide range of funding options

- an be used to make money transfers

Cons

- Credit card: MasterCard, Visa, American Express (U.S. exclusive).

- No native altcoin support

- Additional Bittrex exchange fee

- Higher in app purchase rates

7Comments

Globally, users can deposit via credit cards or execute crypto transfers within their Abra wallets.

Abra prioritizes user security by using encryption and requiring verification methods like PIN codes and seed phrases during setup.

Does a bra application work in uganda?

Employing encryption, Abra secures sensitive user information and remains a non-custodial wallet, not holding user funds or recovery phrases.

By collaborating with Synapse Fi and connecting to FDIC-insured Evolve Bank, Abra streamlines ACH transactions for U.S. users, engaging several leading banks.

Supporting major banks in the Philippines, Abra complies with SEC regulations and operates as an authorized local entity.

Utilizing synthetic currency systems, users maintain direct control over Bitcoin holdings through private keys while gaining exposure to other currencies via smart contracts.

Typically, if a person deposits 1 BTC and buys 100 XRP, a contract ensures ownership of XRP regardless of market dynamics.