A trading service that enables users to engage across numerous asset types, ATFX aims for a user-friendly interface, integrating MetaTrader 4 for optimal experience. Their commitment is to offer market-leading pricing for users.

The advantage of trading with ATFX includes interaction with a broker regulated by the Financial Conduct Authority, ensuring reliability.

CFDs and forexATFX’s mission is to provide an exemplary trading journey, featuring a cutting-edge Client Portal fortified by top-notch encryption technology.

Through state-of-the-art bridging methods, ATFX secures top prices from its liquidity sources. Their payment processes, covering both deposits and withdrawals, are notably efficient.

The broker also makes the process of opening accounts

Effortless and swift processes facilitate immediate trading access along with a complimentary demo account to explore the platform’s capabilities.

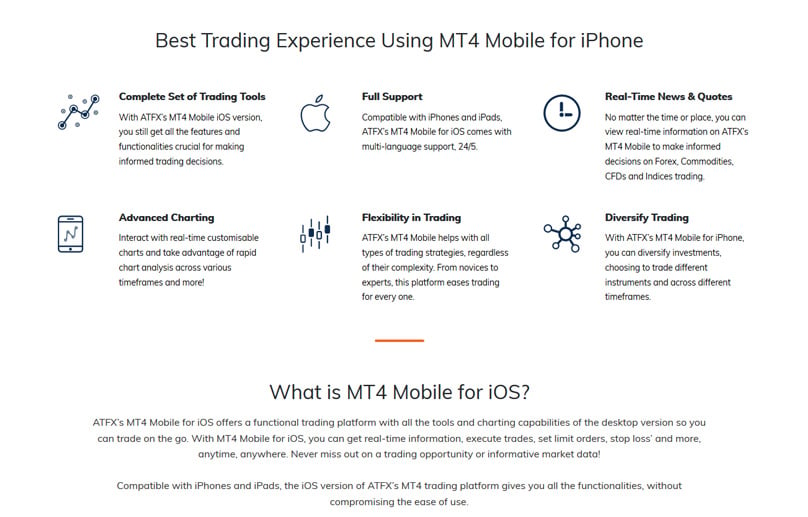

For those always on the move, ATFX offers a mobile app. Additionally, round-the-clock expert customer service is available five days per week, supplemented by comprehensive account management through the refined Client Portal.

ATFX is headquartered right at the core of London’s financial district, specifically located at 1st Floor, 32 Cornhill, London EC3V 3SG, United Kingdom.

Important Risk Notice: CFDs are complex, leveraged instruments carrying significant risks. Evidence shows 71% of retail traders incur financial losses when engaging in CFDs/Spread betting with this broker. Evaluate your understanding and financial readiness for such risks carefully.

ATFX at a Glance

| Broker | ATFX |

| Regulation | FCA – Cysec – FSC – FSA – FSRA |

| Minium Initial Deposit |

$100 |

| Demo Account |

Yes |

| Asset Coverage | Engage in Forex, CFDs on various indices, shares, commodities, cryptocurrencies, and spread betting. |

| Max Leverage | Regulation encompasses UK FCA Retail with leverage up to 30:1 and UK FCA Professional at 400:1, extending to MU FSC with similarly high leverage. |

| Trading Platforms | Integration includes MetaTrader 4, its mobile versions, along with ATFX Connect. |

How Is ATFX Regulated?

Given its UK base, ATFX is backed by the comprehensive oversight of the Financial Conduct Authority. Officially registered as AT Global Markets (UK) Limited, they hold FCA registration number 7605555 and company number 09827091.

The scope of FCA governance designates ATFX as a CFD and FX broker. This includes stringent adherence to the FCA CASS rules concerning client fund handling, promoting equitable customer dealings and safeguarding funds.

Additionally, ATFX is compliant with regulations from regions such as the Middle East and North America.

Beyond UK operations, ATFX Global Markets (CY) Ltd. functions from Limassol, Cyprus, under the jurisdiction of Cyprus Securities and Exchanges Commission (CySEC), facilitating access to both EU and EEA territories, as well as regions like Switzerland and the Middle East.

ATFX Country Restrictions

ATFX commands a global presence, yet is inaccessible to users in specific countries including Yemen, Vanuatu, Tunisia, Trinidad and Tobago, Sri Lanka, Bosnia and Herzegovina, Iraq, Ethiopia, Syria, Sudan, DPRK, Turkey, Cuba, Japan, Iran, Canada, and the USA. Confirm ATFX’s availability in your region with direct contact if uncertain.

MiFID

On top of regulatory measures, ATFX aligns with MiFID, the European directive standardizing financial markets since Nov. 1, 2007. MiFID facilitates cohesiveness across financial services in the EEA, a union of 27 EU nations plus Norway, Liechtenstein, and Iceland.

MiFID's goal is to harmonize governance, enhance transparency, competitive practices, and protect consumers across the EEA. It empowers investment firms to provide services unrestricted across state borders, contingent on necessary authorizations.

Transparency at ATFX is evidenced by comprehensive legal and compliance documentation readily downloadable from their website, spanning categories like CFDs and spread betting, covering all service-related terms.

Edge Accounts

ATFX prioritizes better spreads and enhanced trading speeds, catering to seasoned traders with features like reduced latency.

Such accounts require a $5,000 minimum deposit, offering spreads from 0.6 pips without commission per lot. Enhanced features include 30:1 leverage for retail clients, market (STP) execution, and protection against negative balances, accommodating strategies involving slippage, hedging, and Expert Advisors.

To transition to an Edge Account, initially create a standard ATFX account, verify it, then contact customer service for conversion. Falling below the $5,000 equity level might result in account adjustments.

Standard Account .This account variant, though limited in scope, is accessible in the UK, covering areas like England, Scotland, the Channel Islands, Northern Ireland, and Wales, alongside EEA countries.

Edge Account Trading Conditions:

| Spreads from | 0.6 Pips |

| Minimum Deposit | $5,000 |

| Commission per side per lot | $0 |

| Stop Out | 50% |

| Maximum Leverage (Retail Clients)1 | 30:1 |

| Execution Type | Market (STP) |

| Requotes | None |

| Rejection | None |

| Expert Advisors (EAs)2 | Allowed |

| Hedging3 | Allowed |

| Slippage4 | Yes |

Additional classification through ATFX is possible, with professional clients exempt from the ESMA-induced margin hikes enacted from August 1, 2018. 5 |

Yes |

ATFX Professional Clients

Professional clients benefit from up to 200:1 leverage, with no changes to product tax implications or client fund safety protocols.

While professional clients forgo certain FCA protections like negative balance safeguard and CFD limitations, they’re assumed to possess higher trading expertise, which allows for specialized market language use and nuanced execution considerations.

This tool helps familiarize users with the broker’s services, beneficial for budding traders to practice skills, and lets experienced traders experiment with strategies.

Demo Account

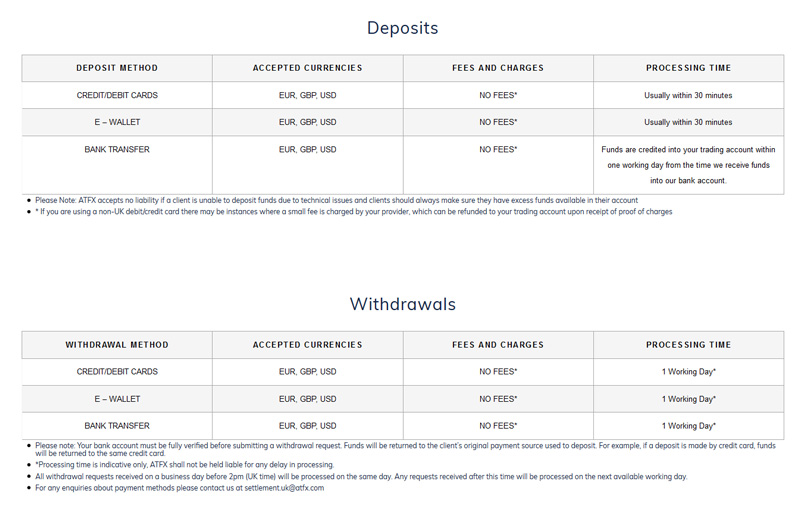

ATFX supports a range of deposit options like credit/debit cards, bank transfers, and e-wallet choices such as Safecharge, Neteller, and Skrill. They accept EUR, USD, or GBP deposits with no additional charges unless specified. Card fees incurred outside the UK can be reimbursed upon receipt submission, with most deposits reflecting within 30 minutes, with bank transfers taking about a business day post-receipt.

ATFX Deposits

There are three main deposit methods

Withdrawals mirror deposit methods, supporting credit/debit cards, e-wallets, or bank transfers with processing times similar to deposits, completion within working days, though international transfers approximately endure 3-5 days, with e-wallets averaging 2 days.

ATFX Withdrawals

For compliance, withdrawal destinations must be original funding accounts. Profits from trading, originating from card deposits, get directed to a bank account. Full ATFX account verification precedes withdrawal capability.

To further fund your ATFX account, log in, and select Deposit within the Client Portal. Note, ATFX refrains from processing third-party payments, only accepting funds from your accounts.

Access the Client Portal again and select Withdrawal to extract funds. Withdrawals can be requested once daily to optimize processing efficacy.

Details on Fund Deposits and Withdrawals Using Your ATFX Profile

Depending on your regional ATFX sign-up, a welcome bonus might be offered, featuring a $100 USD credit, triggered upon opening a Live Account alongside a $200 deposit, withdrawable post-six lot trading.

Note the bonus's non-availability to all clients, complicated by EU guidelines prohibiting bonuses.

ATFX Promotions

Prominent among ATFX's goals is providing a diverse forex trading environment.

ATFX supports 43 forex pairs and dynamically revisits its offerings to ensure a comprehensive selection spanning major, minor, and exotic currency pairs, accessible 24/5.

ATFX Trading Instruments

ATFX Analysis for 2024: Is This Broker Trustworthy or a Risk? A Comprehensive Overview of Its Advantages & Disadvantages forex trading Considering ATFX for Your Trading? Discover if it's Trustworthy or Risky by Reading Our Comprehensive Review with All Its Strengths & Flaws

Complete Breakdown of ATFX Broker: Trustworthy or Not? An In-depth Look at Its Advantages & Drawbacks

offers a platform for trading diverse assets, with a focus on user-friendliness and compatibility with MetaTrader 4. ATFX is committed to providing clients with competitive pricing strategies.

Choosing ATFX means partnering with a broker regulated by the FCA, ensuring a reliable trading environment

. ATFX aims to offer a premium trading experience with a cutting-edge client portal and advanced encryption technologies.

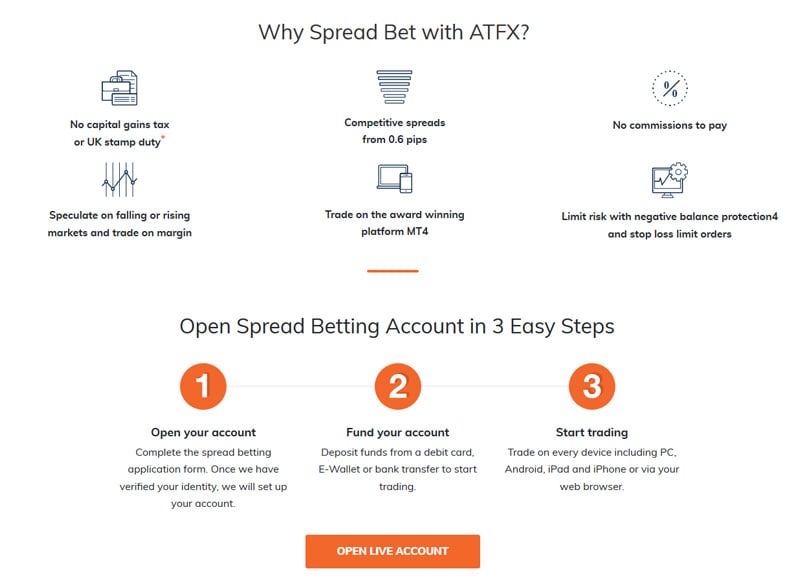

ATFX Spread Betting

When you choose to spread bet with ATFX Through the latest bridging technologies, ATFX efficiently connects with liquidity providers, ensuring competitive rates, alongside rapid payment processes for deposits and withdrawals.

easy to initiate, allowing immediate trading access, and includes a complimentary demo account to familiarize with the system.

Orders Types

ATFX's main office is strategically located in the heart of London, specifically at 1st Floor, 32 Cornhill, London EC3V 3SG, United Kingdom.

Risk Alert: Trading CFDs involves high-stakes risks due to leverage. Approximately 71% of retail investors experience losses when trading CFDs / Spread betting with this provider. It’s crucial to understand these instruments and evaluate if you can afford the potential losses.

ATFX Fees

What Are the Steps for Funding Your ATFX Account and Withdrawing Your Funds?

Trading Conditions

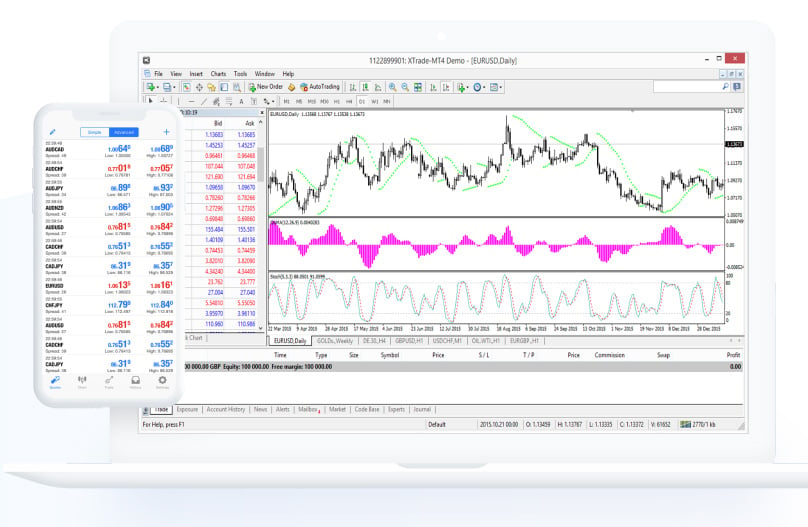

Cutting-Edge Features in MetaTrader 4 for Enhanced Trading

Explore CFDs on Forex, Stocks, Indices, Commodities, Cryptos, and Spread Betting

Leverage Options: UK FCA Retail: 30:1, UK FCA Professional: 400:1; MU FSC, 400:1

ATFX Leverage

A Range of Platforms: MetaTrader 4, Its Mobile Version, and ATFX Connect

ATFXBeing based in the UK, ATFX complies with FCA regulations. It operates under the name AT Global Markets (UK) Limited, and its FCA registration number is 7605555, while the company number is 09827091.

FCA authorization allows ATFX to operate as a CFD and FX broker, safeguarding client funds as per CASS rules, prioritizing ethical client treatment and financial securities.

ATFX Platforms

All trading on ATFX is done via the popular MetaTrader 4 platform ATFX also maintains regulatory standards in regions like the Middle East and North America.

Furthermore, ATFX Global Markets (CY) Ltd. operates from Limassol, Cyprus, and is under Cyprus Securities and Exchange Commission's CySEC oversight, offering market access to several EU and EEA countries, Switzerland, and the Middle East.

Though ATFX is a globally accessible broker, some regions are excluded, like Yemen, Vanuatu, Tunisia, among others. Verification of availability is advised by contacting ATFX.

Aligning with MiFID, ATFX abides by the directive ensuring fair market practices and allowing service extensity within EEA and beyond.

MiFID strives to unify market rules across the EEA, enhancing transparency and consumer protection, permitting firms to operate effectively across borders.

Mobile Trading

For transparency, ATFX provides downloadable legal documents on its website related to market compliance, spanning various categories for client reference.

focuses on providing favorable spreads and increased efficiency, ideal for seasoned traders seeking latency reductions.

Enhanced Tools for Trading via MetaTrader 4

This account variant demands a minimum of $5,000 deposit, offers competitive spreads starting at 0.6 pips, with no commission per lot, includes key features like slippage tolerance, and enables hedging and Expert Advisors.

Switching to an Edge Account requires a simple verification process and ATFX customer service assistance for account transition if equity falls below $5,000.

Edge Accounts are selectively available within the UK including the Channel Islands and EEA regions.

Trading Central

Protection Against Negative Balance (Offered for Retail Clients)

ATFX offers Professional Client status without ESMA 2018 margin restrictions, providing leverage up to 200:1 without affecting tax statuses or protections.

Professional Clients might forgo some FCA-based securities, such as negative balance protection; services and execution metrics adapt to their advanced understanding.

A demo account is a practical method to explore ATFX's offerings, catering to both novices and experts who wish to refine strategies or gain initial trading experience.

For deposits, ATFX supports credit/debit cards, bank transfers, and e-wallets like Neteller and Skrill, accommodating multiple currencies without fees, though external card providers may impose charges.

Withdrawal methods parallel deposits, with a focus on processing efficiency, though ATFX isn't accountable for external delays; instead, ensuring transactions comply with security practices.

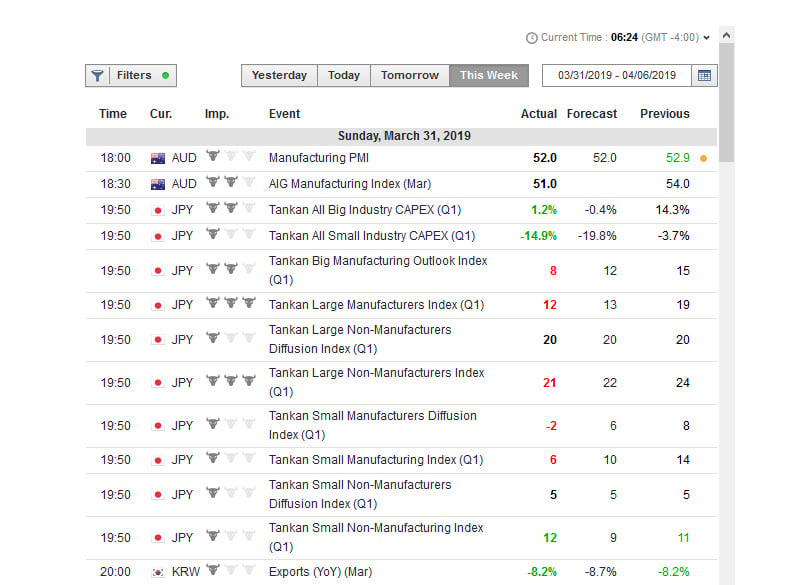

Economic Calendar

Post-processing, withdrawals typically settle within a few business days, depending on external banking procedures, ensuring returns to original payment means. have an economic calendar To fund your ATFX account, navigate to the Client Portal for deposit, ensuring funds originate from personal accounts to comply with ATFX security protocols.

Withdrawal actions are accessed via the Client Portal, restricted to one request daily to ensure process efficiency.

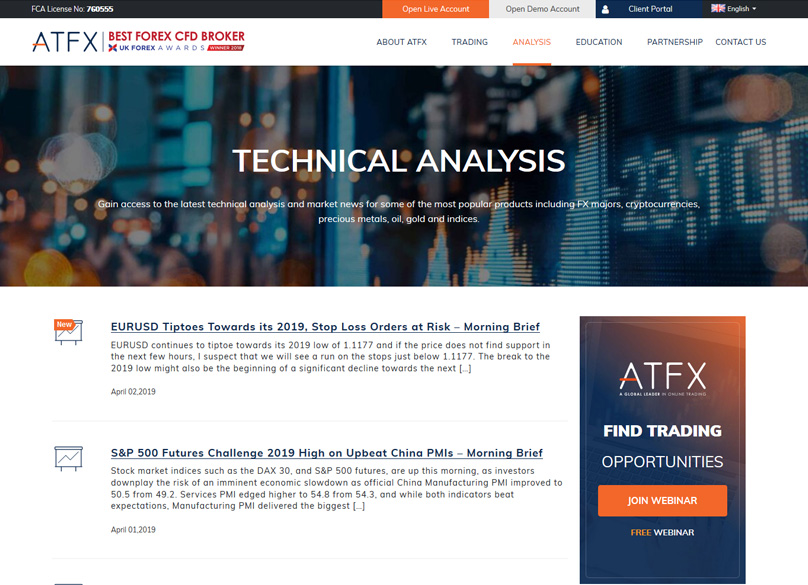

Technical Analysis

Depending on your region, ATFX might offer bonuses, like a $100 USD credit for new accounts upon reaching a deposit and trading threshold.

Expert Analysis

Be aware that EU regulations may restrict bonus availability, aligning with regional compliance standards.

ATFX aims to provide

. Presenting 43 forex vendor pairs, ATFX reviews its offerings frequently to maintain a robust variety to trade, available continuously throughout the week.

ATFX Review for 2024: Are They Trustworthy or Not? Pros and Cons Explored

Education

The education section Considering ATFX as your broker? Wondering about their reliability? Delve into our comprehensive review to discover all the pros and cons.

Is ATFX a Safe Choice? An In-Depth Review of Features, Safety, and Advantages & Disadvantages

ATFX provides an opportunity to trade a variety of assets, prioritizing ease of use with their platform, which includes support for MetaTrader 4 and strives to offer attractive pricing rates.

VPS Services

When you trade with ATFX, you’re using a broker that’s overseen by the FCA, ensuring regulated trading practices.

Competitors

ATFX aims to offer traders an unparalleled experience, featuring a high-tech client portal fortified with leading encryption for total data security.

- Plus500

- AVATrade

- IQ Option

- 24option

- ExpertOption

- Vantage FX

- Forex.com

- Pepperstone

- ETX Capital

- NordFX

- City Index

- Binary.com

- XTB

- FXTM

- Markets.com

ATFX Affiliate Program

The ATFX Affiliate Program The advanced bridging technologies at ATFX secure the finest rates from liquidity providers, and their payment processing is notably swift, whether you’re making a deposit or withdrawal.

With quick and straightforward onboarding, ATFX enables immediate trading, plus gives you a free demo account to familiarize yourself with their system.

Trade anytime, anywhere with the ATFX mobile app, enjoy expert customer service 24/5, and manage your entire portfolio via a sleek online portal.

ATFX's headquarters are centrally located in the bustling heart of London, right at 32 Cornhill on the 1st Floor, EC3V 3SG, UK.

ATFX Awards

Important Risk Advisory: Trading CFDs can be risky due to leverage, which can result in fast losses. 71% of retail investors lose capital with this provider when trading CFDs and spread betting. Carefully consider your understanding of these instruments and your ability to sustain such risks.

Want to understand how to handle deposits and withdrawals with your ATFX account effectively?

How Does ATFX Protect Client Funds?

Cutting-edge trading solutions within MetaTrader 4

Engage in trading Forex, CFDs on indices, shares, commodities, cryptocurrencies, and try your hand at spread betting

Leverage ratios for UK FCA Retail are capped at 30:1, while UK FCA Professional accounts go up to 400:1; the same applies with MU FSC at 400:1

Utilize both the MetaTrader 4 desktop application and mobile apps, alongside the robust ATFX Connect platform

How Do You Contact ATFX?

As a UK-based organization, ATFX falls under FCA oversight, officially registered as AT Global Markets (UK) Limited. The company’s FCA registration number is 7605555, and its corporate ID is 09827091.

ATFX Help Center

FCA’s approval allows ATFX to operate as a CFD and FX broker, adhering to stringent guidelines on client fund security and equitable client treatment.

ATFX Complaints

Additionally, ATFX holds regulatory clearance in both the Middle East and North America.

The Cyprus branch, ATFX Global Markets (CY) Ltd., comes under CySEC regulation, granting access to trading within EU, EEA regions, and beyond to include Switzerland and the Middle East.

ATFX Sponsorships

ATFX's broad reach as a global broker is counterbalanced by restrictions in several countries such as Yemen, Vanuatu, and others. Prospective clients should verify ATFX's availability in their region directly.

Conclusion

ATFX ATFX also adheres to the MiFID framework—enforced across EEA by the European Parliament since November 2007—to guarantee transparency and consumer protection in financial markets.

MiFID’s mission is to standardize financial market regulations across EEA, enhance transparency, and promote healthy competition and consumer protection.

For complete transparency, ATFX offers a range of downloadable documents on its platform, detailing compliance, regulation, and specific service terms in areas like CFDs and spread betting.

If you are based in the UK, the spread betting Enhanced accounts ensure tighter spreads and quicker execution speeds, tailored for advanced traders aiming to reduce latency.

Important Risk Notice: CFDs are complex, leveraged instruments carrying significant risks. Evidence shows 71% of retail traders incur financial losses when engaging in CFDs/Spread betting with this broker. Evaluate your understanding and financial readiness for such risks carefully.

1Comment

Is ATFX legal in the Philippines?