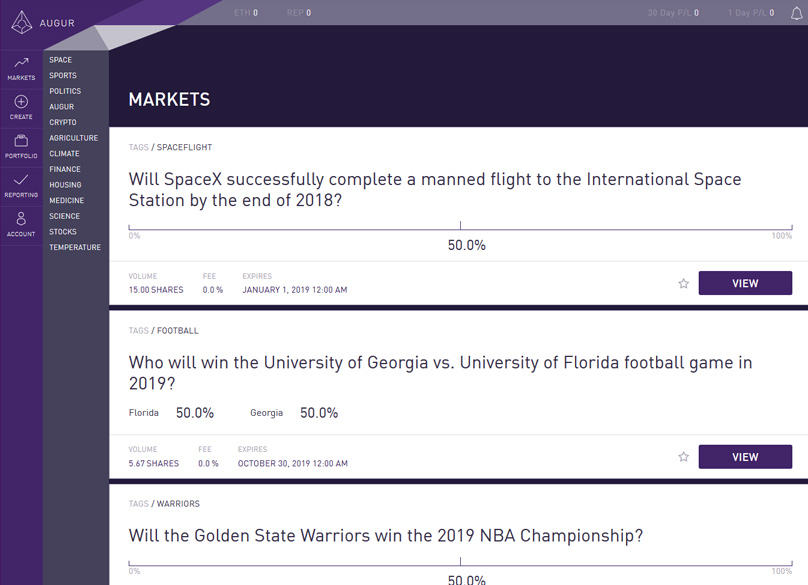

Augur is a dApp which has been created on the Ethereum platform The purpose of this app is to establish a predictions marketplace, rewarding users whose answers hit the mark. It spans a wide variety of markets like Sports, Politics, Cryptocurrency, Agriculture, Climate, Housing, Finance, Medicine, Science, Stocks, and Temperature.

In today's world, using blockchain technology for prediction markets is emerging as a promising opportunity. Such platforms thrive on the collective wisdom gathered for foresight on events to come. The idea supports the notion that crowdsourced knowledge often eclipses individual expert predictions. Typically, if you pool together a large group's guesses, the average tends to be surprisingly accurate and might even surpass centralized predictions.

Think of prediction markets like binary trading options, operating on an all-or-nothing basis. Users are compensated only when they accurately forecast the result.

Choosing the name 'Augur' was quite fitting since the platform essentially functions as a modern-day oracle. Besides winnings from predictions, there are more avenues to gather cryptocurrency on Augur.

How Does Augur Work?

Participants earn based on their shared insights and understanding on the Augur platform. The mechanism involves staking on the outcome of events by purchasing shares. Share prices depend on the likelihood of the event occurring. When more individuals invest in a specific outcome, its price rises. There's also potential in betting on unlikely results; as the probability shifts in favor of your stake, you can sell for a gain. Each share in an event is priced at $1. For shares bought at 50/50 odds, you pay 50 cents, meaning if you're right, each share returns $1, otherwise, you lose your investment. Odds are expressed as percentages, with even odds signifying a 50% chance.

The Prediction Market

A vast collection of predictive data enriches the Augur platform, empowering developers to create a formidable tool. It's decentralized, and the results logged come from participants, not a central figure, minimizing potential biases or errors, thanks to the application of smart contracts. This framework incentivizes users to honestly evaluate outcomes due to the attached financial stakes.

Augur utilizes a community rating labeled Reputation (REP). Payouts happen automatically, reducing human errors. Envision a system where you can query future events, with probabilities readily available via an open search utility.

Augur offers a beta dApp that's operational try out now .

What is REP?

The REP token is an Ethereum-based ERC-20 compatible token running on the Ethereum framework. REP tokens serve as a reputation index, tied directly to event outcome reporting. Users are obliged to report bi-monthly. Those who do gain REP rewards. Half of the system's transaction fees are divided among users, based on their REP holdings. Bonds posted in Ethereum (ETH) are converted into REP for certain transactions. Although market creators don't need REP tokens, they must initiate markets through an ETH transaction. The bonds undergo an automated bifurcation.

How to Buy REP

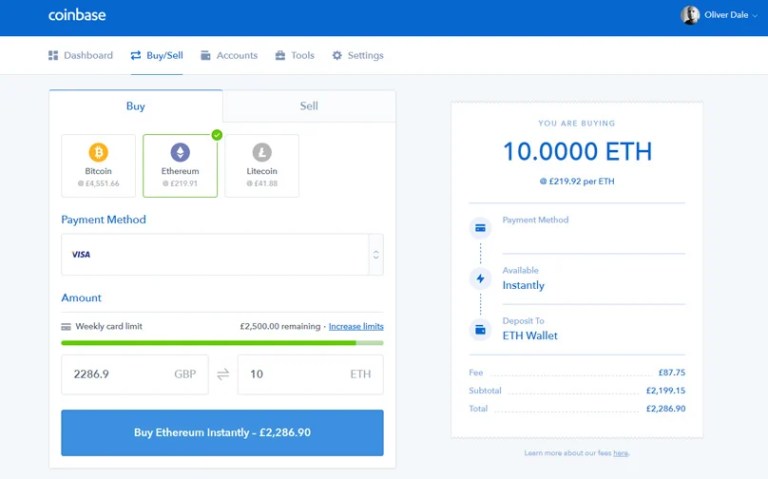

Purchasing REP with conventional 'Fiat' currency isn't an option. You'll need to initially buy other cryptocurrencies like Bitcoin or Ethereum—readily available on platforms like Coinbase—and trade them for REP at exchanges listing it. Continue to learn about the purchasing process.

Register at Coinbase

If you're new to cryptocurrency, starting on Coinbase is advisable—it’s user-friendly and regulated by US standards, endorsing security and credibility. With Coinbase, you can acquire Bitcoin, Litecoin, and Ethereum—either by card or bank transfer. While card purchases incur higher fees, they grant immediate currency access.

Identity verification is mandatory during registration to comply with strict financial norms.

Make sure you use our link to signup a $10 Bitcoin bonus awaits when making your initial $100 purchase.

To embark on this venture, click “Sign up” and fill out a registration form with your name, email, and set a password.

Purchase Ethereum

At Coinbase, access the “Buy / Sell” tab, opt for “Ethereum,” pick a payment mode, and specify the amount you wish to buy—expressed either in USD or as Ether.

After transaction confirmation, if using a card, you might undergo a card issuer verification. On completion, the acquired Ethereum appears in your account.

Purchase REP at an Exchange

You can transfer this Ethereum to an exchange to swap it for REP. Having launched last year, Augur is available on wide range of exchanges numerous platforms, among which these are quite favored:

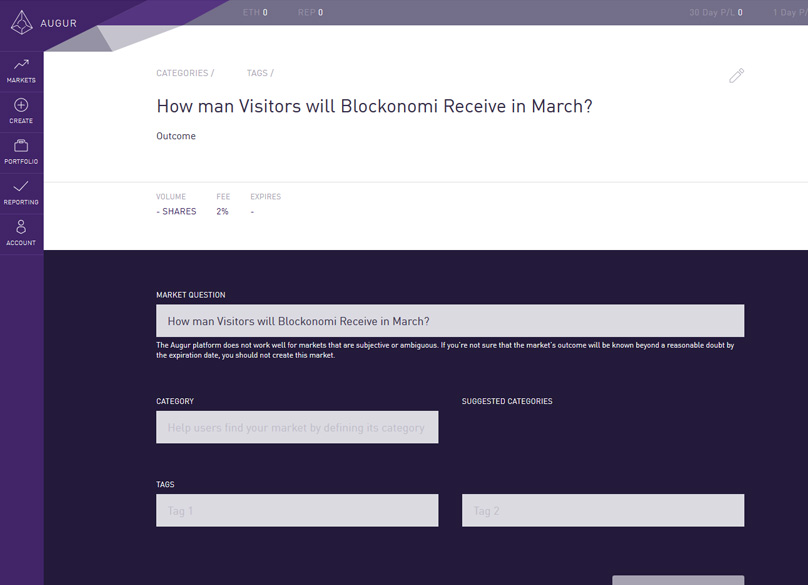

Market Creators & Bonds

For creating a market, a collateral bond is necessary for two core reasons. A validity bond ensures markets have clear objectives, requiring more ETH if a market seems invalid. Options also include a no-show bond, a penalty for creators if the market reporter fails to deliver results within 3 days, prompting creators to choose dependable reporters or risk their bond.

What Are Reporters?

Designated by market creators to document event outcomes, 'reporters' must do so within three days, posting privately on the blockchain. Failing this, the role opens to the public, with the initial reporter attaining recognition as the first public reporter. Quality reporting is safeguarded by a 7-day dispute period where outcomes can be contested, potentially extending disputes for up to 60 days. Without resolution, the unlikely event of market division (fork) occurs. After the dispute period ends without contestation, the market concludes, allowing traders to resolve their positions.

How Are The Payouts Calculated?

Post-reporting, a consensus forms on the occurrence, triggering smart contracts to automatically process outcomes. Predictors earn rewards if accurate, and reporters are compensated in REP for reliable submissions, whereas incorrect reporting or non-responsiveness results in penalties. Honest reporters benefit by receiving a share of penalties, as further motivation.

Are There Restrictions on Available Prediction Markets?

No, Geographic Limitations Don’t Bind Augur’s Prediction Platform.

How Does Augur Make Money?

Augur lacks country restrictions, enabling anyone to craft markets worldwide. Market creators should focus on meaningfully designed prediction markets with predictable outcomes, incentivized by bonds posted to initialize these markets.

Does The Team Have A Good Reputation?

Augur imposes creator and reporting fees. The former is set by users upon market creation, while the latter adjusts dynamically. These fees remain nominal compared to traditional alternatives. Initiating a new market demands upfront funding, entitling creators to half of the trading fees generated, opening doors for individuals to buy and sell shares in these prediction markets.

Conclusion

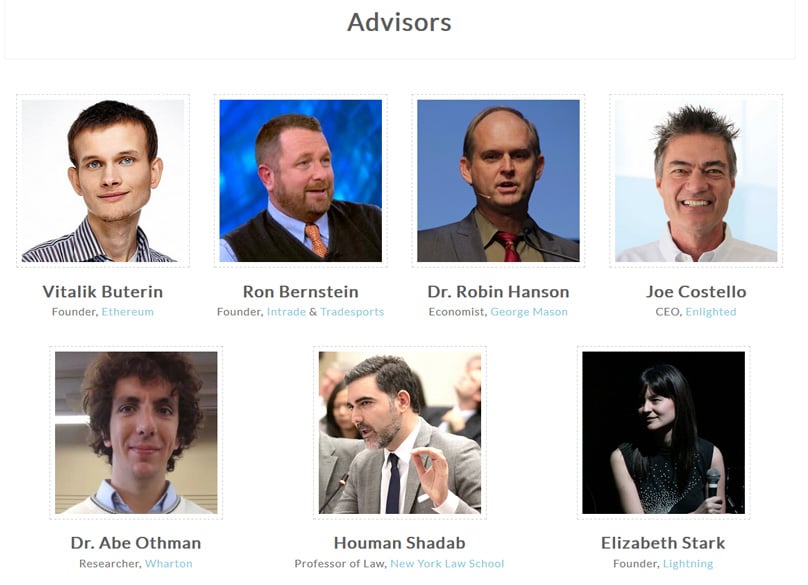

Notably, some influential figures within the cryptocurrency realm support the team as advisors. Among them are Ethereum founding member Vitalik Buterin and Lightning Network founder Elizabeth Stark.

Augur’s comprehensive whitepaper thoroughly navigates every intricate detail. The founders and developers have meticulously explained their platform concept and its valuable application in blockchain technology.

The hypothesis that community wisdom exceeds individual forecasts is vital, especially in anticipating future developments. By harnessing Ethereum’s smart contracts, payments for accurate predictions are automatically executed, circumventing human error and potential manipulation.