AvaTrade Operating since 2006, AVATrade stands as a well-recognized broker that prides itself on principles like transparency, integrity, continuous self-improvement, customer satisfaction, and innovation. AVATrade caters to traders at all skill levels, offering flexible trading solutions.

With over 200,000 active traders executing around 2 million trades each month, AVATrade experiences trading volumes close to £60 billion monthly, and this figure is on the rise. The broker provides support in multiple languages and offers a variety of trading platforms.

Avatrade at a Glance

| Broker | Avatrade |

| Regulation | Regulatory bodies: ASIC (Australia), IIROC (Canada), FSP (South Africa), FSA (Japan) |

| Minimum Initial Deposit |

$100 |

| Demo Account |

Yes |

| Asset Coverage | Trading instruments include: CFDs, ETFs, Forex, Cryptocurrencies, Stocks, Bonds, Commodities, Indices |

| Leverage | 30:1 |

| Trading Platforms | Offers: Custom-built web platform, mobile applications, MetaTrader 4, ZuluTrade, Mirror Trader |

Where is AVATrade based and how is it governed?

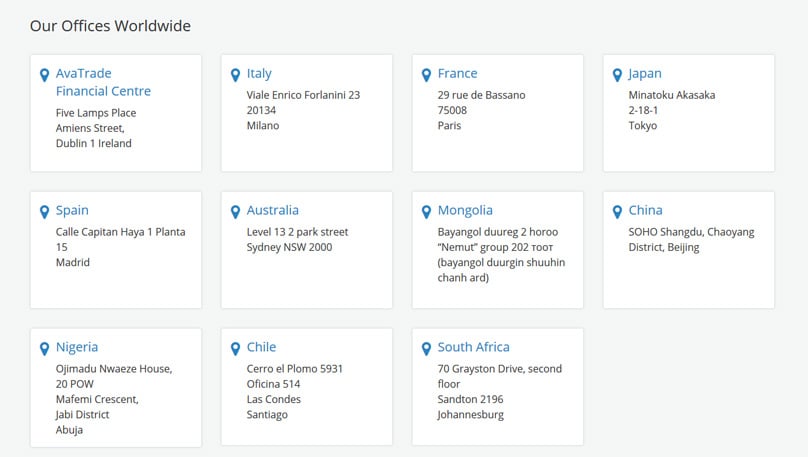

The official headquarters of AVATrade is located in Dublin, Ireland, with operational offices in prominent cities like Paris, Milan, Sydney, Tokyo, and more.

AVATrade adheres to regulatory standards in Europe, Australia, Japan, and South Africa. The Irish base is often viewed as a positive feature, juxtaposed against numerous firms opting for Cyprus. Yet, this perception is subjective.

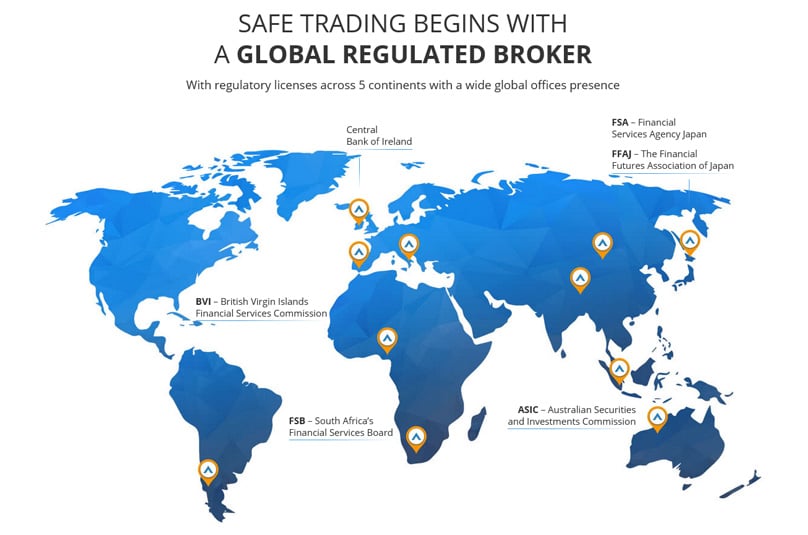

AVATrade operates under distinct regulations in various countries, adjusted to local compliance.

- The Central Bank of Ireland supervises AVA Trade EU Ltd (C53877).

- The British Virgin Islands Financial Services Commission oversees AVA Trade Ltd.

- In Australia, AVA Capital Markets is under ASIC’s jurisdiction (406684).

- Ava Capital Markets Pty in South Africa is governed by the Financial Services Board (FSP No. 445984).

- AVA Trade Japan K.K. falls under the regulation of the FSA in Japan.

Multiple regulatory approvals globally enhance investor trust, ensuring AVATrade's adherence to localized legalities.

What trading options can AVATrade provide?

AVATrade clients can explore trading across a spectrum ranging from forex to commodities, indices, stocks, bonds, ETFs, and options.

On the options front, AVATrade provides European-style options—popularly termed 'vanilla'—on precious metals and over 50 currency pairs. These options automatically settle in cash based on value at expiration.

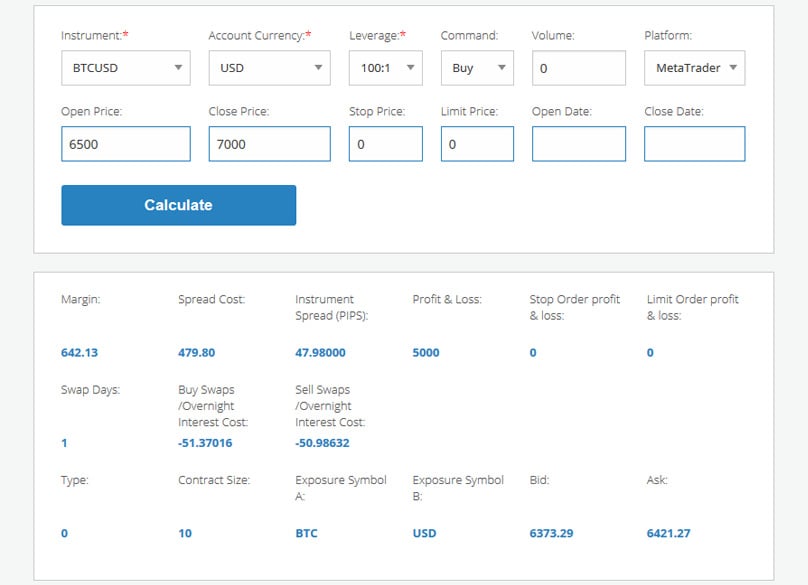

Major forex pairs can have leverage ratios as high as 30:1. ESMA regulations dictate leverage limits tailored to each asset, ranging from 30:1 on major forex, 20:1 on primary commodities, down to 2:1 for cryptocurrencies. Certain CFDs offer leverage up to 400:1.

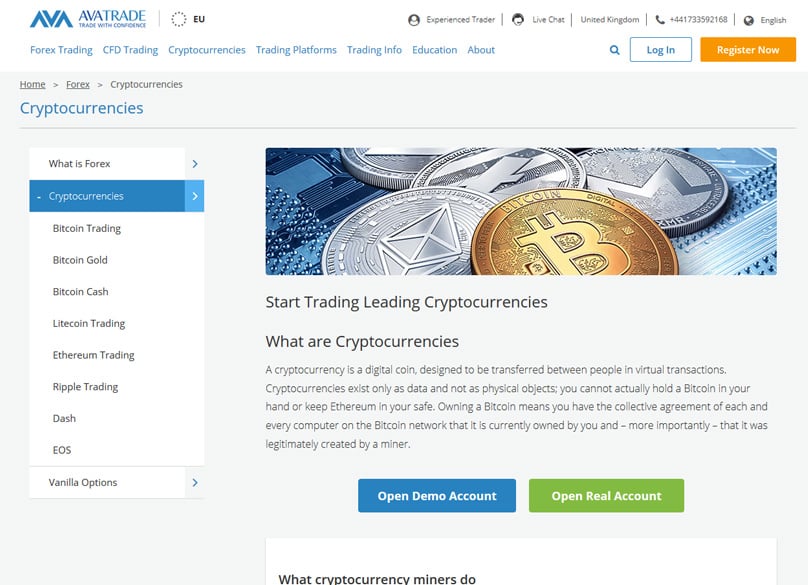

What cryptocurrency trading services does AVATrade offer?

AVATrade permits cryptocurrency trading around the clock and offers leverage of up to 20:1, with an entry point as low as $100.

The platform presents attractive swap rates and the capability to short cryptocurrencies, enabling gains even as prices drop, a feat hard to replicate on conventional exchanges.

Opting for AVATrade over digital currency exchanges mitigates theft risks or wallet breaches, bypassing the complexities of setting up a cryptocurrency wallet.

Cryptocurrencies available for trading include Bitcoin, Ethereum, Ripple, Litecoin, and a spectrum of others.

Are There Crypto Trading Limits?

While engaging in crypto trades with AVATrade, note the imposed position limits which can fluctuate, particularly during periods of volatility. Currently, these are capped at $600,000 for Bitcoin, for instance.

Given recent ESMA directives, crypto leverage is set to a maximum of 2:1.

AVATrade provides CFD rollovers to let users maintain uninterrupted trading flow, swapping old contract prices with new futures even prior to expiration.

Does AvaTrade Offer CFD Rollovers?

This is achieved through price adjustments on maturing contracts, with upcoming CFD rollovers for assets like bonds and indices readily accessible on AVATrade's website.

Details like the instrument and next contract are displayed there, offering a chance to exit trades before the scheduled rollover.

In the UK or Ireland, AVATrade users gain tax benefits with certain instruments compared to regular CFDs.

Does AvaTrade Offer Spread Betting?

To enhance trading experiences, AVATrade provides diverse trade types within platforms like MetaTrader 4, encompassing all major trade options. support for spread betting Market orders for instant buys/sells at the current price, stop/limit orders for predefined prices, and more advanced order types are available.

What varieties of orders can you execute with AVATrade?

Even entry orders that await future price points, triggering only when such conditions are met, are supported, and one order can be conditional on another's execution.

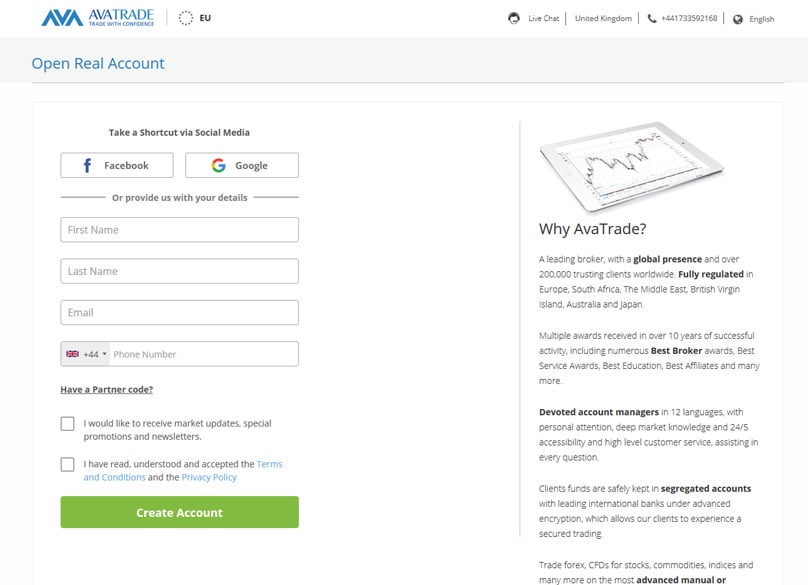

To get started with an AVATrade account, complete the online application and verify your personal details.

Afterward, fund your account to begin trading, bearing in mind that base currency selection is permanent though additional currency accounts are possible.

Opening an AvaTrade Account

Account base currencies can be USD, EUR, GBP, or AUD, with regional restrictions on GBP and AUD for UK and Australia residents respectively.

Given the absence of U.S. regulatory approval, AVATrade does not accept clients residing in the United States.

Beyond account setup, additional document verification is required within the 'Upload Documents' section.

Submit a government-issued ID, such as a passport, clearly displaying your image, name, and other details matching your registration.

A recent utility bill verifying your address is necessary, matching the registration details, and dated within the last half-year.

- Documents must be clear, with letters and phone bills deemed unsuitable for verification purposes.

- For corporate accounts, more comprehensive documentation such as a Board Resolution and Certificate of Incorporation is essential.

- At times, AVATrade provides welcome bonuses. Check with an account manager if you haven’t received one to see if you're eligible.

Presently, deposits of 1,000 units or more may unlock a bonus, detailed on the bonus page. Bonuses need a trading volume within six months to be realized.

AvaTrade Opening Bonuses

Withdrawals of any bonus necessitate achieving a trading volume of 10,000 per $1 bonus within half a year.

Failure to meet this requirement within the timeframe leads to forfeiture of the bonus.

AVATrade offers Islamic accounts aligned with Sharia law, which do not support cryptocurrency trades and carry specific restrictions on forex instruments, along with wider spreads.

A demo account is available for practice, reflecting real-time market conditions, and is a valuable resource for novices refining their strategies.

Initially set for 21 days, demo accounts are extendable through customer service or an account manager.

AvaTrade Islamic Accounts

Ava Professionals enjoy higher leverage, returning to pre-ESMA levels, such as 25:1 on certain cryptos or up to 400:1 in forex, by meeting certain wealth and experience criteria.

AvaTrade Demo Account

AVATrade Review: Navigating Safety and Trustworthiness for Beginners in 2020

Considering AVATrade as your brokerage partner? Delve into our extensive review to unveil essential insights. Discover comprehensive advantages and potential drawbacks.

Ava Professional Accounts

AVATrade Unveiled for Novices: An In-Depth Review

With a solid reputation dating back to 2006, AVATrade has been a stalwart in online trading. They emphasize principles such as fairness and integrity, paired with a relentless drive for self-improvement, robust customer support, and continuous platform innovation. Their goal? To cater to traders of every skill level and offer versatile trading solutions.

AvaTrade Deposits

Impressive numbers speak for AVATrade, boasting over 200,000 registered traders completing 2 million trades each month. Their trading volume escalates to approximately £60 billion monthly, a testament to their growing influence. With multilingual support and a plethora of platform choices, AVATrade sets the stage for diverse trading experiences.

Important Reminder: CFDs are intricate financial products and involvement might lead to rapid financial losses due to leverage. A staggering 71% of retail investor accounts experience losses while trading CFDs with this broker. It's crucial to assess your comprehension of CFDs and your financial capacity to embrace associated risks.

Where is AVATrade Based, and Who Oversees Its Regulation?

Exploring the Diversity of Trading Options with AVATrade

Cryptocurrency Ventures with AVATrade: What's on Offer?

Exploring AVATrade's Order Execution Capabilities

Managed under the scrutiny of ASIC (Australia), IIROC (Canada), FSP (South Africa), and FSA (Japan).

Engage in a variety of market activities such as CFDs, ETFs, Forex, Cryptocurrency, Shares, Bonds, Commodities, and Indices.

AvaTrade Withdrawals

Choose from an array of trading platforms including Proprietary Web, Mobile Apps, Meta Trader 4, Zulu Trade, and Mirror Trader.

The central operations of AVATrade are located in Dublin, Ireland, with a presence in cities like Dublin, Paris, Milan, Sydney, Tokyo, Madrid, Mongolia, Beijing, Nigeria, Santiago, and Johannesburg.

AVATrade is recognized under various global jurisdictions including Europe, British Virgin Islands, Australia, Japan, and South Africa. Its Irish roots are favored by many traders who appreciate its divergence from common choices like Cyprus, though this hinges on personal preference.

In numerous countries, AVATrade aligns with unique regulations crafted for local markets.

The Central Bank of Ireland backs AVA Trade EU Ltd (License No. C53877).

AvaTrade Fees

The B.V.I Financial Services Commission governs AVA Trade Ltd.

ASIC enforces regulations on Ava Capital Markets Australia Pty Ltd (License No. 406684).

Ava Capital Markets Pty (FSP No. 445984) operates under the regulations of the South African Financial Services Board (FSP).

AVATrade Japan K.K. is monitored by the FSA in Japan.

Straddling numerous regulatory landscapes strengthens AVATrade's credibility, reassuring investors globally. The engagement of multiple watchdogs ensures AVATrade's adherence to local norms.

AvaTrade Trading Platform

With AVATrade, clients can explore diverse market categories including forex, commodities, stock indices, individual equities, bonds, ETFs, and options.

In option trading, AVATrade offers European-style puts and calls — commonly termed as 'vanilla' options — on assets like gold, silver, and over 50 currency pairs. These cash-settled contracts naturally close at their intrinsic value upon expiration.

Select forex pairs allow leverage climbing to 30:1. It's pivotal to recognize that ESMA regulations mandate leverage limitations per asset type, designating 30:1 for leading currency pairs, 20:1 for gold and major indices, 10:1 for lesser equity indices and non-gold commodities, 5:1 for individual equities and other reference points, and a strict 2:1 for cryptocurrency trades. CFD options can reach leverage up to 400:1.

AVATrade grants traders the liberty to venture into premier cryptocurrencies around the clock. Getting started with crypto requires just $100, accompanied by leverage capabilities that scale up to 20:1.

Enjoy favorable swap rates and the strategic advantage of shorting cryptocurrencies, capitalizing on market downturns. In contrast to exchange trading, this scenario offers lucrative outcomes.

Unique to AVATrade, crypto trading nullifies the risk of asset theft or wallet breaches, and eliminates the need for cumbersome wallet setups, a typical obstacle for newcomers.

Cryptocurrency traders can dive into Bitcoin, Bitcoin Cash, Bitcoin Gold, Litecoin, Ethereum, Ripple, Dash, and EOS with AVATrade.

If crypto trading with AVATrade intrigues you, be aware of maximum position ceilings.

These position limits are adaptable, likely pivoting during volatile market phases. Currently, the cap stands at $600,000 for BTC pairs, $400,000 for ETH, and $250,000 for XRP, whereas BCH and LTC share a $200,000 limit, and BTGUSD and EOSUSD are capped at $50,000.

Bear in mind the latest ESMA determinations curtail cryptocurrency leverage at 2:1.

The AvaTrade Website

AVATrade offers seamless CFD rollovers, ensuring a continuous trading experience. This feature swaps the price of maturing contracts for fresh ones, even before your original contract closes.

To facilitate this, AVATrade adjusts prices between successive contracts. Forecast upcoming CFD futures rollovers for bonds, commodities, and stock indices on AVATrade's CFD Rollover section.

This section outlines instruments, current tradable contracts, AVA rollover schedules, and upcoming contracts. If rollover isn't your preference, there's the option to terminate your position before the date.

For UK and Irish customers, AVATrade presents additional product options.

This offers tax advantages over CFDs for UK-based traders.

In pursuit of a premium trading journey, AVATrade enables user selection from favored trade types. The MetaTrader 4 platform distinctly avails diverse trading operations expected from a reputable broker.

You can execute a market order to instantly buy or sell at prevailing rates, or opt for stop or limit orders that activate only when predefined prices are achieved.

AvaTrade Expert Advisors

There are entry orders to activate positions at future price points, converting to market orders if those prices are met. Order configurations also exist where triggering one order cancels another.

AvaTrade Tools

Opening an AVATrade account begins by completing the website's application process, entailing personal information verification.

Post verification, fund your account to initiate trading. Note that the account's base currency remains unchangeable once set, though you can introduce another base currency account later.

Base currency options include USD, EUR, GBP, or AUD. Specifically, GBP is exclusive to UK residents, while AUD is reserved for Australians.

A critical note: AVATrade is barred from servicing U.S.-based clients due to regulatory non-compliance.

Upon account establishment, ensure to verify it through specific documents via the platform's 'Upload Documents' feature.

Primary requirement: a colored photocopy of a legitimate government-issued ID, such as a driver’s license, passport, or ID card with a photo, birthdate, and name matching your account registration details.

You must also present a utility bill substantiating your address. This document needs your name and residence details and should be dated within the last six months, all correspondingly matching your registration.

Remember that submitted documents should be clear, as letters and mobile phone bills are not valid for address confirmation.

Corporate accounts are an option, though they encompass additional documentation such as a Corporate Board Resolution, Certificates of Incorporation, Memorandum, Articles of Association, Shareholder Registers, and more.

AVATrade sometimes introduces welcome bonuses for clientele. If you’re a current account holder and haven't received one, your dedicated account manager can assess your eligibility.

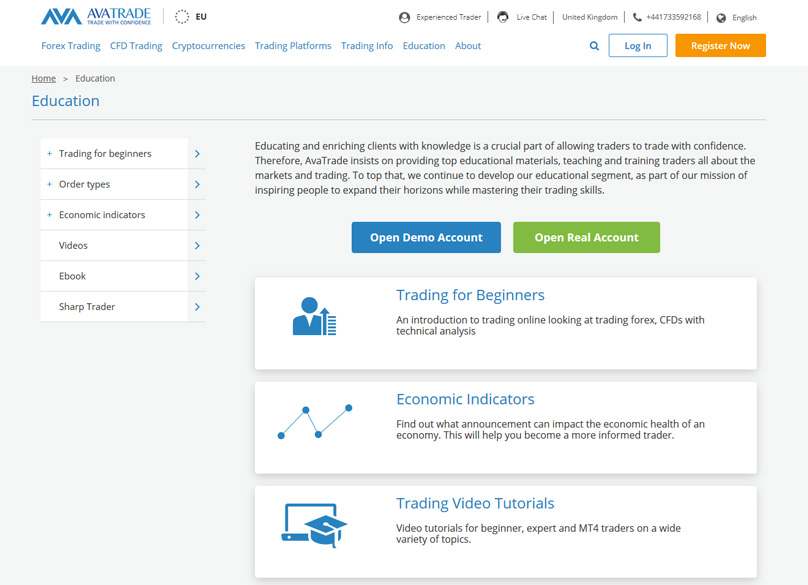

AvaTrade Education

Currently, an initiating deposit of 1,000 units or more qualifies for a bonus calculable via the bonus page.

Most bonuses are contingent upon attaining specific trading volumes within the initial six-month period post-deposit, activating the bonus thereafter.

Note that bonus withdrawal requires fulfilling a minimum trade volume of 10,000 in the base currency for each $1 bonus within six months.

Failure to hit the required trading volume means the bonus is annulled and subsequently subtracted from your account.

AvaTrade Customer Support

Islamic accounts at AVATrade comply with Sharia law, exempting cryptocurrency trading and certain FX instruments, with an elevated FX pair spread applicable.

A demo account is among AVATrade's offerings, recommended for potential traders to explore and gain mastery on the platform. It serves as a practice ground to refine skills and identify preferred instruments and trading styles.

Reproducing actual market conditions, the demo account mirrors real-time pricing and dynamics. Although it's set for a 21-day validity, extensions are feasible through customer support or account management direction.

Enrolling as Ava Professionals opens doors to pre-ESMA leverages, peaking at 25:1 on select cryptocurrencies and a staggering 400:1 on forex pairings.

To earn the Ava Professional status, satisfy two out of three criteria: a financial portfolio exceeding €500,000 (including investments and cash), executed sizable trades at least 10 times per quarter over the last four quarters, or a year's relevant experience in the financial services industry.

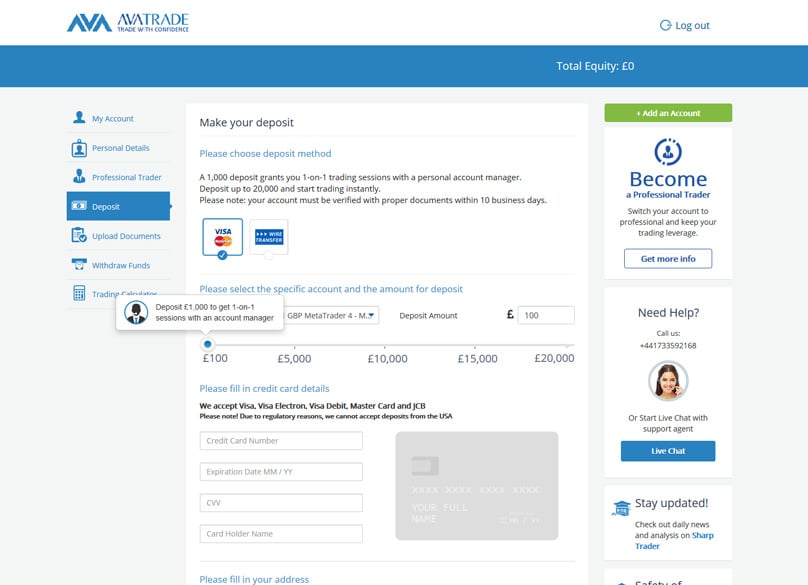

Starting an AvaTrade journey requires an initial funding of at least 100 units in your selected base currency but aiming for a balance of 1,000 to 2,000 units or more is usually recommended for a more robust trading experience.

To add funds to your account, simply log in and head over to the Deposit section where you'll find multiple options like credit cards, wire transfers, and e-payment systems to choose from.

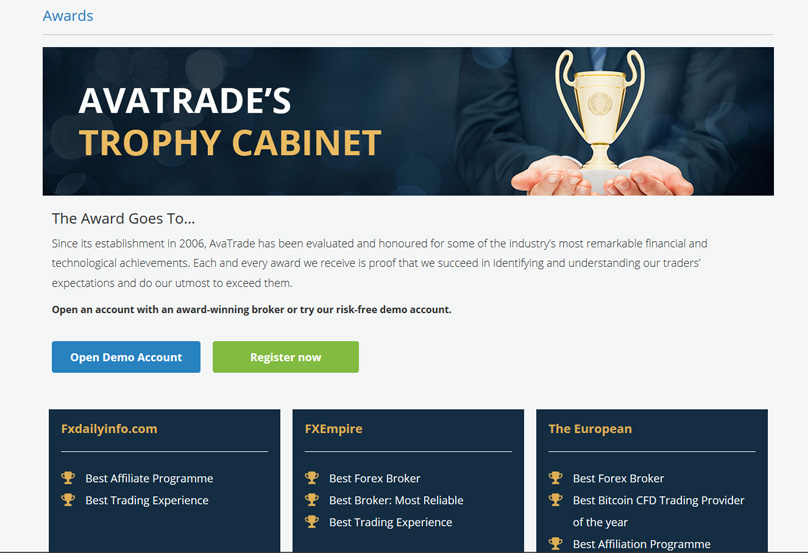

AvaTrade Awards

Keep in mind that if you're residing in Australia or within the EU, e-payment options aren't available for you.

For Canadian traders, using a credit card for deposits isn't on the table. However, clients outside the EU and Australia have the luxury of using e-payment methods such as Neteller, Webmoney, and Skrill.

It's possible to use someone else's debit/credit card, e-wallet, or bank account for deposits, though this involves a bit more complexity. Such third-party deposits demand additional verification documents.

When pursuing third-party deposits, both involved parties must submit necessary account verification documents. A colored copy of the card with the full name, first four and last four digits, and the expiration date, while masking the middle digits and security code, is mandatory.

The duration for completing a deposit relies heavily on the method; typically, deposits via debit or credit cards are almost instantaneous, though the initial deposit might take a business day due to security checks.

Bank wire transfers might require up to a week to clear, but tracking can be managed through a receipt or swift code; on the other hand, e-payment transfers usually complete within a day.

Before withdrawing funds from AvaTrade, ensure your account passes the verification stage. Once verified, swing by the withdrawal section, fill out the necessary online form, and your request should process within a day.

AvaTrade adheres to stringent anti-money-laundering practices, meaning withdrawals should follow the same channel as deposits. For card deposits, a 200% withdrawal to the card must occur before exploring other methods.

Conclusion

When dealing with third-party deposits, it's imperative to withdraw 100% of your funds using the same method initially employed.

Similar to deposits, withdrawal timelines depend on your chosen method; however, most requests are processed and dispatched within one or two business days.

Post-processing, the withdrawal duration varies—e-payments needing up to 24 hours, card withdrawals up to 5 days, and wire transfers stretching to 10 days depending on bank and country specifics.

Being a market maker allows AvaTrade to offer remarkably competitive spreads on trades, sidestepping commission fees in favor of profiting through these spreads.

Traders have a choice between fixed and variable (or floating) spreads; some reports suggest AvaTrade's spreads improved significantly between 2017 and 2018.

For those part of AvaSelect, trading terms sweeten considerably, requiring a trading volume of 100 million or substantial deposits exceeding 100,000 in currencies like EUR, AUD, or GBP.

1Comment

For those interested in automated trading, AvaTrade accommodates it via ZuluTrade on MetaTrader4 and offers its own Ava AutoTrader for algorithm-based strategies.