As crypto continues to revolutionize financial landscapes, borrowing against it was inevitable. Enter Bankera, a cutting-edge player in this pioneering field. Bankera Loans .

Since its inception in late 2019, this platform has been offering credit lines backed by crypto, ranging from a modest €25 to an impressive €1 million.

Curious if Bankera Loans suits your crypto-financing goals? Our comprehensive review has all the insights you need.

What is Bankera Loans?

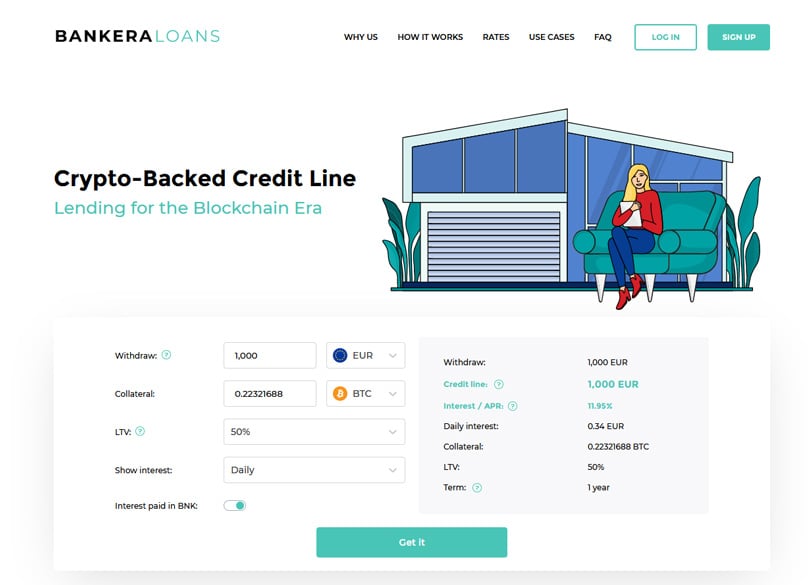

Put simply, Bankera lets you secure a credit line by using your cryptocurrency as a safety net, much like traditional collaterals do. secured loan With Bankera Loans, the amount you can borrow starts at €25 and climbs to €1 million, influenced by a few key factors.

At the lower rates, you might enjoy an APR starting at 6.95% for a loan-to-value (LTV) of up to 25% if borrowing €5,000 or more.

Conversely, if you aim for an LTV between 50% and 75% and borrow less than €1,000, the APR can soar to 16.95%. Loans have a default term of 12 months but offer the flexibility to repay early or extend.

A standout feature of Bankera Loans is the flexibility in receiving borrowed funds. You can opt for crypto or Euro deposits.

Plus, Bankera's own digital currency, the Banker (BKN) token, offers an intriguing way to cut down on interest rates.

Now that we've sketched out what Bankera Loans entails, let's dive deeper into the workings of their financing process.

How Does Bankera Loans Work?

Here's a walkthrough of how accessing funds via a Bankera credit line typically unfolds.

Step 1: Determine Your Borrowing Needs

The credit amount accessible through Bankera is tethered to the value of your collateral, much like traditional secured loans derive value from the asset's LTV.

For instance, with 1 Bitcoin valued currently at €10,000, Bankera Loans offers up to 75% LTV, allowing you to borrow as much as €7,500.

Step 2: Deposit Your Collateral

After deciding your borrowing amount, cryptocurrency collateral is required, and choices depend on your selected loan package.

Depositing cryptocurrency with Bankera mirrors the exchange process - transferring coins to your unique wallet there.

Step 3: Withdraw Your Loan Funds

Importantly, drawing down on your Bankera credit line is not mandatory. If you later opt against borrowing, you can simply retrieve your crypto.

Funds from your credit line can be drawn in fiat or crypto; for Euros, a Euro-denominated bank account is necessary.

Upon initiating your credit line, you'll start accruing interest on the withdrawn amount.

How do I Repay My Line of Credit?

Monthly interest repayments are required, due on the anniversary of your initial withdrawal date, one month later.

Payment-wise, there are two routes: use fiat via a European bank account post-identity verification, or pay with supported crypto.

Monitoring your collateral's value is crucial. Unlike fiat-denominated securities, cryptocurrency fluctuates, risking liquidation if LTV hits 90%+.

In such cases, Bankera might liquidate your collateral on the market to fulfill your debt. Therefore, maintaining your collateral is advised.

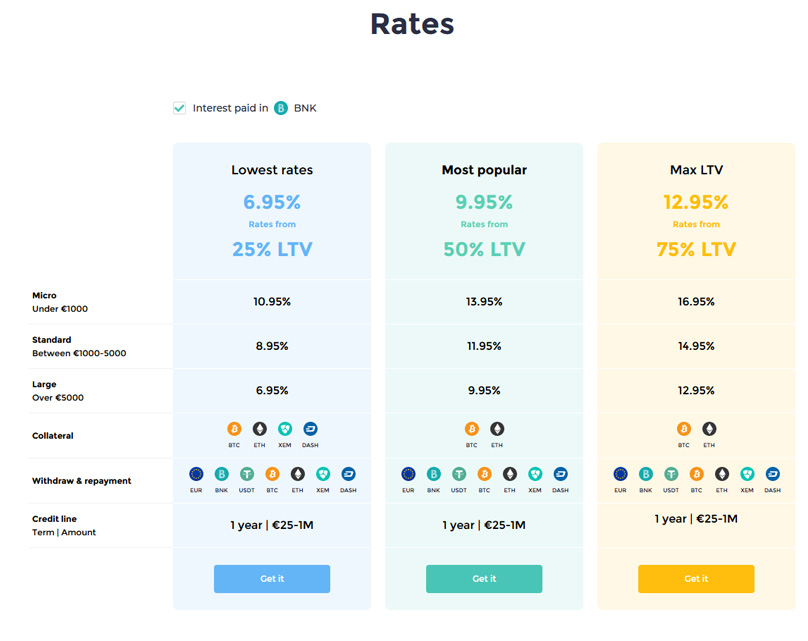

There are three loan packages with Bankera Loans, each presenting different interest rates.

Overview of Bankera Loans Financing Options

Here's what you need to know for securing the most favorable rates.

To snag the lowest rates, keep the LTV at 25% or less. This nets a 6.95% APR for loans over €5,000, or 8.95% for those between €1,000 and €5,000.

Lowest Rates:

Loans under €1,000 incur a 10.95% interest rate.

Collateral can be deposited in BTC, ETH, XEM, or DASH.

If you require an LTV of 25% to 50%, expect higher rates: 13.95% for loans below €1,000, with €5,000+ loans at 9.95%.

Most Popular:

Loans between €1,000 and €5,000 have an 11.95% interest, with BTC or ETH as collateral choices.

The top LTV tier of 50%-75% demands the highest rates from Bankera.

Max LTV:

Loans below €1,000 have a 16.95% rate, with €1,000-€5,000 loans at 14.95%.

Lastly, loans of €5,000 or more capture a 12.95% interest, again reliant on BTC or ETH collateral.

Regardless of the package, you can borrow from €25 to €1 million, receiving funds in crypto or Euros.

Bankera Loans prides itself on robust 24/7 customer support accessible via live chat or email.

Customer Support

In summary, Bankera Loans stands out for individuals seeking credit from €25 to €1 million, leveraging cryptocurrency as security.

The Verdict?

While top rates are for those with an LTV under 25%, loans up to 75% are feasible.

Bankera Loans' compelling feature is the flexibility of receiving funds through either Euros or cryptocurrencies.

Hailing from Blockchain Isle of Malta, Kane holds degrees in Accounting, Finance, and a Master’s in Financial Investigation, now pursuing a Doctorate on virtual financial crime. He's an avid researcher writing for various finance and crypto publications. Reach out at Kane@level-up-casino-app.com