Imagine you've been actively investing in cryptocurrencies, executing potentially hundreds or even thousands of transactions over the year. While it might seem overwhelming to report these for tax purposes, misconceptions aside—crypto earnings are indeed subject to taxation.

Wrong!

Contrary to common belief, many tax agencies across the globe now mandate the reporting of cryptocurrency-related capital gains, even though the regulations differ internationally.

Therefore, maintaining organized records of your crypto transactions is crucial; failing to do so may result in attention from your tax authority. Tax evasion is illegal globally, making a service like an automated crypto tax software highly beneficial. BearTax .

The The platform efficiently logs all your crypto trades automatically, presenting a detailed summary of your earnings and deficits, and importantly, the taxes due.

Curious about whether this cryptocurrency-focused tax software fits your needs? Dive into our comprehensive BearTax analysis for more insight.

What is BearTax?

In a nutshell, BearTax is an online platform which provides services to track cryptocurrency portfolios, helping you evaluate your aggregate gains and losses.

Thanks to an innovative API-driven algorithm, BearTax streamlines the process of filing taxes by connecting directly with your preferred exchanges. Supported platforms include Binance, Gemini, KuCoin, and Coinbase, among others.

BearTax's main highlight is transforming what's thought impossible into reality. Not only does it tackle the arduous task of calculating cryptocurrency capital gains in a straightforward manner, but it also helps you estimate your potential tax liabilities.

Absent a software solution, calculating this would require countless hours of painstaking manual labor.

Most exchanges fail to present a complete report of your fiat currency gains or losses, a particular concern for tax bureaus such as the IRS. The challenge intensifies for day traders or users of automated trading systems, making manual calculations a grueling necessity.

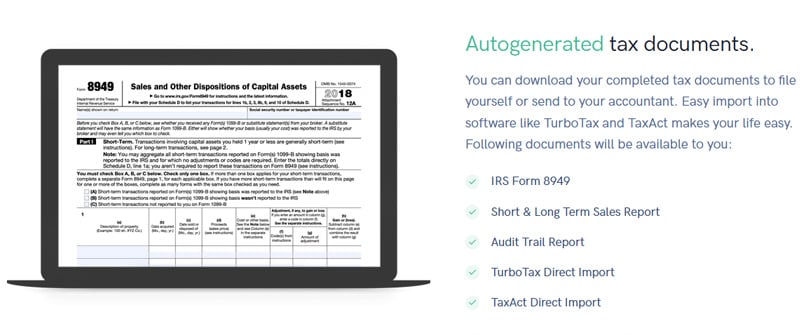

At the close of the fiscal year, BearTax aids in consolidating all your crypto profits and losses, allowing for effortless downloading of your tax documents.

Should you need to incorporate your crypto gains with other tax categories like property or income tax, BearTax facilitates data transfers to third-party tools like TurboTax.

How Does BearTax Work?

Navigating BearTax for your crypto tax tasks is a breeze. Let us lay out the steps you need to follow.

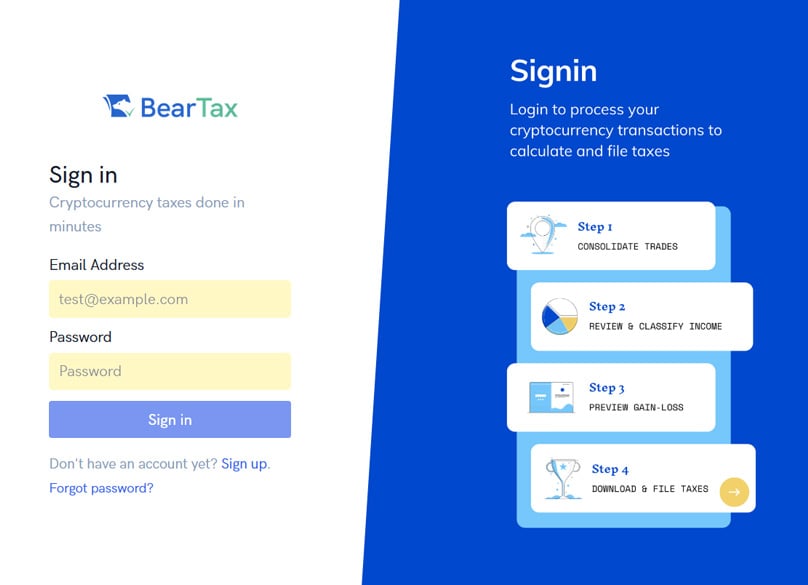

Step 1: Create an Account

To start, visit the BearTax website and register an account . You'll need to supply some personal information, alongside selecting a username and password.

Step 2: Integrate Your Cryptocurrency Trading Platforms

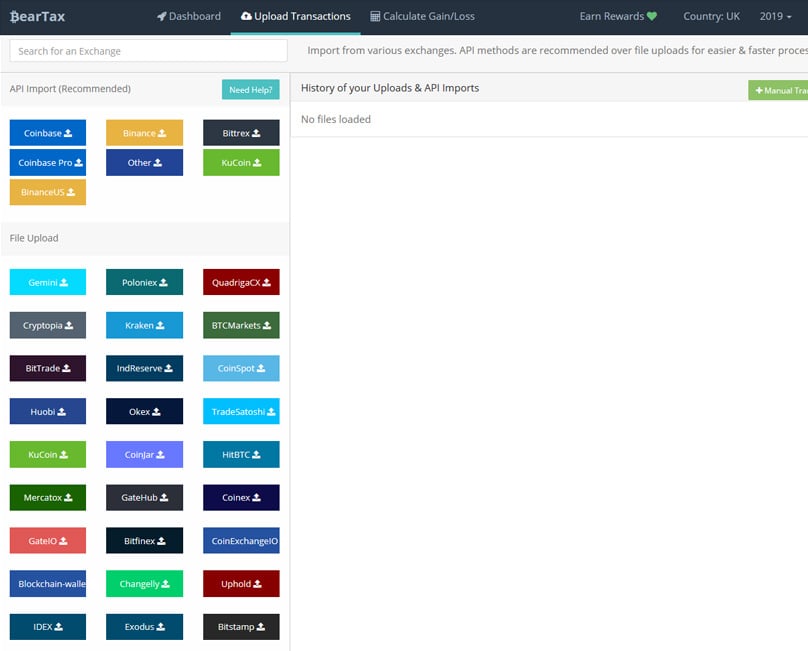

Upon setting up your account, you'll need to link your crypto exchange accounts to BearTax. The process is generally straightforward, though specifics can differ between exchanges.

You have the choice of utilizing BearTax’s automatic trade tracking, or you can choose to manually upload data at your discretion.

For automatic tracking, link your exchange's API with BearTax. Typically, this API key is located in your account settings; simply copy the key and insert it into BearTax.

For a manual approach, or if your exchange lacks API support, upload a CSV file into BearTax, which you can download from your exchange.

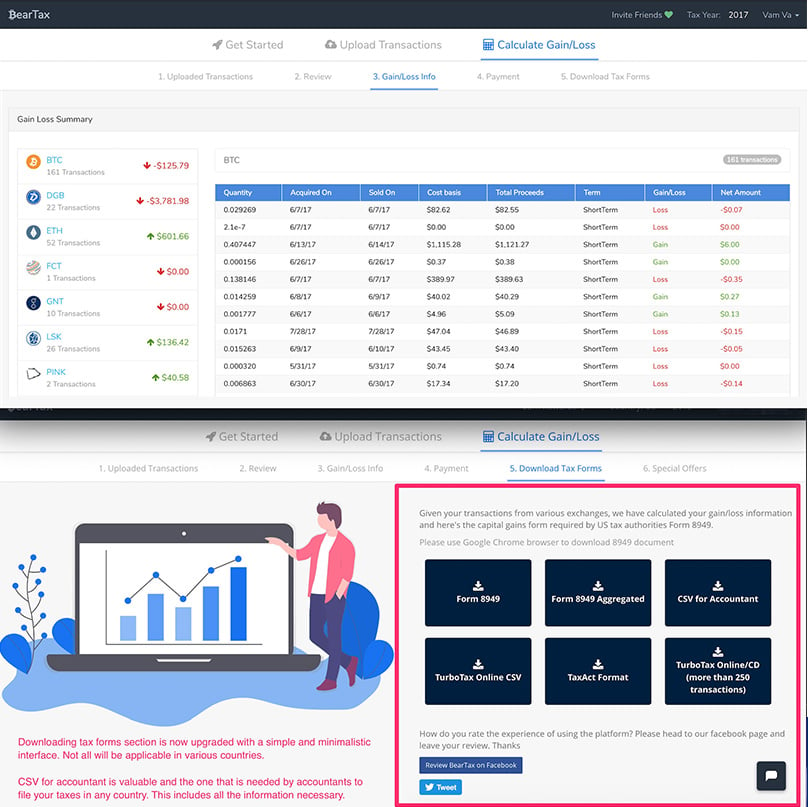

Step 3: Assess Your Profits and Losses

Whether opting for periodic updates or only during tax season, BearTax calculates your total gains and losses for your chosen timeframe.

It provides the necessary tax filing data for submission to your jurisdiction.

Which Trading Platforms Work with BearTax?

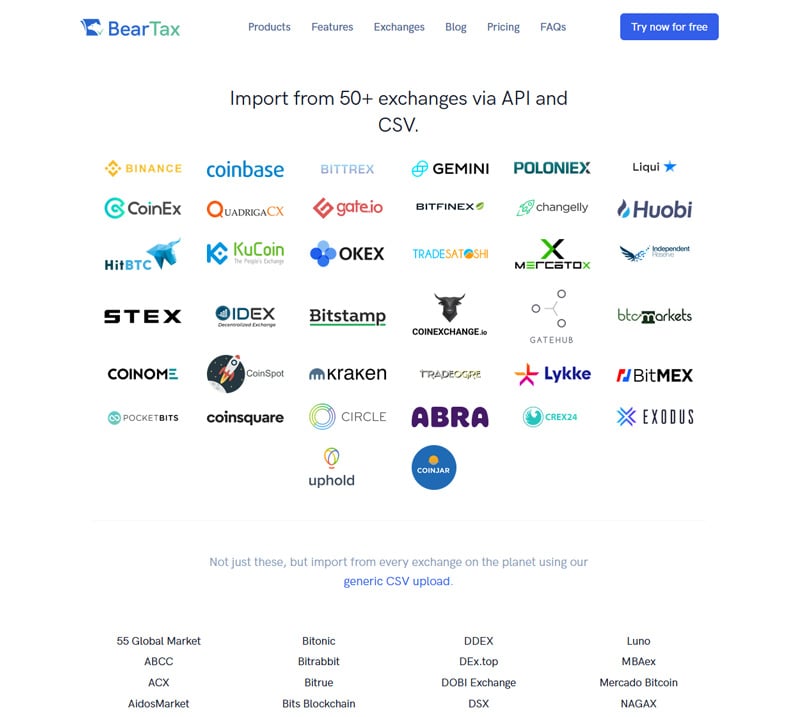

BearTax supports virtually all cryptocurrency exchanges; however, reporting approaches depend on your chosen platform. Over 50 exchanges support API or CSV uploads.

Top platforms incorporated include Binance, Coinbase, Bittrex, Gemini, Poloniex, Bitstamp, and Kucoin. Even less common exchanges like Lykke, Coinspot, and IDEX are included.

If an exchange is unsupported, BearTax offers an alternative through a general CSV template that lets you manually enter trades, where BearTax will compute the numbers. This, while feasible, is time-consuming, so utilizing the platform's existing support is recommended.

How Much Does BearTax Cost?

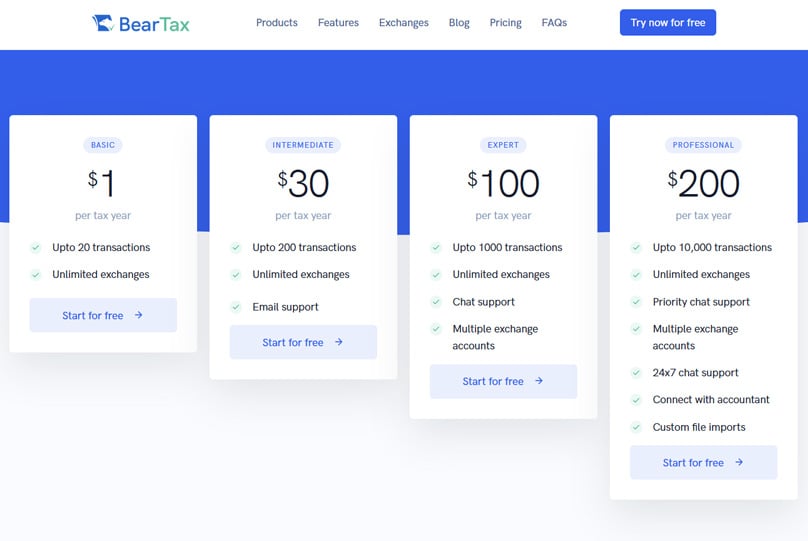

BearTax BearTax requires a payment for its services, divided into four distinct pricing models. Note that you choose and pay for a plan only after your transactions are imported.

Choose a plan post-import based on the volume of your trades.

For instance, an annual total of 15 trades fits the basic plan, set at only $1 annually.

Basic Plan – $1 Per Year

The basic $1/year plan handles up to 20 transactions across any number of exchanges. All BearTax plans support unlimited exchange tracking.

Intermediate Plan – $30 Per Year

The intermediate plan increases limits to 200 transactions per year and includes email support, unlike the basic plan.

Expert Plan – $100 Per Year

The $100/year expert plan allows for up to 1,000 transactions and includes real-time chat support.

This plan also permits merging multiple accounts on a single exchange, useful for automated trading strategies.

Professional Plan – $200 Per Year

For extensive needs, the $200/year professional plan provides for 10,000 transactions and 24/7 priority chat support.

Professional subscription holders can connect data with accountants and import custom files.

Which Countries Does BearTax Support?

Currently, BearTax facilitates tax filings in select jurisdictions:

- Australia

- Canada

- India

- United States

BearTax aims to expand internationally, with Japan slated for inclusion in the 2020 roadmap.

Crucial BearTax Features

Key BearTax Features Overview:

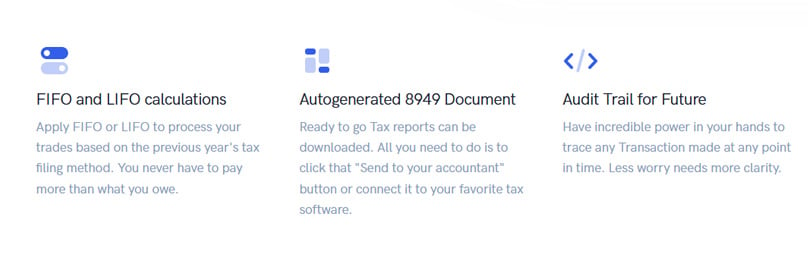

FIFO and LIFO Calculations

Adhering to consistent FIFO (First In, First Out) or LIFO (Last In, First Out) principles is vital for any tax category.

Inconsistent application can trigger penalties from tax authorities, so BearTax lets you decide and apply these accounting methods to calculations.

Form 8949

Familiar with U.S. tax submissions? Then you know about Form 8949 for annual capital gains and losses. used BearTax simplifies this process by exporting Form 8949, packed with all necessary details.

This automated form generation relieves you from labor-intensive paperwork and can be forwarded directly to your accountant.

Audits

Be mindful: global tax authorities can audit your financial records for years after submission. For instance, the IRS has extended audit periods as needed. three years BearTax supplies comprehensive info demanded by IRS audits. If your transaction is queried, it's easily accessible via your BearTax account.

BearTax supports exporting tax obligations to other software

Export to Accounting Software

utilities, such as TurboTax or TaxAct. This capability is especially advantageous when your tax obligations intertwine with areas like income or property tax and gains from stocks. BearTax computations factor into multiple aspects, including your purchase price and sale price.

Also, it differentiates between short-term (less than a year) and long-term trades (equal or longer than a year), critical for understanding tax dues. BearTax ensures you're informed and compliant.

Purchase and Sale Price

BearTax Analysis 2023: Evaluating the Upsides and Downsides of Bitcoin & Cryptocurrency Tax Software

BearTax is an online solution designed to streamline your cryptocurrency portfolio tracking, ensuring a hassle-free process when preparing your yearly tax filings.

Do You Owe Tax on Crypto Earnings? If so, How Much?

Exploring BearTax: Bitcoin & Cryptocurrency Tax Software with Built-in Automatic Calculations

- As a dedicated cryptocurrency investor engaging in countless trades over the past year, you might think handling taxes on these gains is unnecessary. However, the reality differs.

- Contrary to popular belief, many tax authorities worldwide now demand that you include cryptocurrency capital gains in your tax submissions, even though tax treatment varies across different regions.

- Therefore, organizing your cryptocurrency taxes is crucial. Failure to do so could result in unwelcome correspondence from your local tax officials. Tax avoidance remains a severe offense globally, underscoring the importance of solutions like automated cryptocurrency tax platforms.

- This platform lets you effortlessly monitor all your cryptocurrency transactions,

operating independently to generate detailed analyses of your profits and losses, including the critical information on your tax liabilities. provided by Investopedia Curious if the crypto-focused software BearTax suits your needs? Don't miss our comprehensive review to find out.

Step 2: Link Your Cryptocurrency Exchanges

Which Exchanges Does BearTax Support? long-term capital gains bracket .

BearTax Review: The Verdict?

In summary, BearTax Key Features Provided by TaxBear

Are Cryptocurrency Profits Subject to Taxation? If Yes, What is the Amount?

that offers services for monitoring cryptocurrency portfolios, aiming to determine your total financial outcomes.

BearTax

Pros

- Import from 50+ exchanges via API and CSV

- FIFO and LIFO Calculations

- Form 8949 Support in USA

- By doing so, filing your tax returns annually becomes a breeze, leveraging a cutting-edge API-driven approach that syncs with your chosen cryptocurrency exchanges. This encompasses major players like Binance, Gemini, KuCoin, and Coinbase, among others.

- Relatively Easy to Use

Cons

- BearTax’s major appeal lies in its ability to make complex tasks straightforward. Not only does it simplify the process of calculating cryptocurrency capital gains in terms of fiat, but it also helps predict possible tax liabilities.