Ok, so you’ve invested in some cryptocurrency . Now what? Do you leave it in the exchange Are you storing your Bitcoin on an exchange or with its original purchase service? While it might seem convenient, it's a risky gamble. Should hackers breach the exchange, your funds are at stake.

Cryptocurrency platforms and their server systems handle immense wealth, making them prime targets for cyberattacks. History is rife with examples of such breaches. hacking of the Mt Gox exchange Notably, in 2013, one of the largest hacks saw over 850,000 Bitcoin vanish, initially valued over $450 million but worth more than $3 billion by September 2017. Though some exchanges tout insurance against theft, it's a claim best left untested. Coinbase Given the potential for catastrophic loss, the wisest move is to use a cryptocurrency wallet for your funds. How do these wallets function? Should you go for an online version, or is offline the safer bet? What distinguishes hardware wallets from software ones?

Your cryptocurrency wallet isn't akin to your physical wallet but more like your online bank account. Blockchains don't 'store' coins as they can't be removed. Instead, you store secure digital credentials called private keys, akin to a bank PIN, which verify ownership of an accompanying public key. This public key grants access to your cryptocurrency holdings.

What is a Bitcoin Wallet?

Although referred to as a ‘wallet’, a Bitcoin Besides securing funds, consider how you'll use your coins. For long-term investments, offline solutions like desktop, paper, or hardware wallets are ideal. For daily transactions, mobile or online wallets offer the most convenience.

Keep in mind that some wallets are currency-specific; if you hold multiple cryptocurrencies, you might need several wallets or a versatile option that can accommodate them all.

Let's examine some of today's favored wallets currently at your disposal.

Cryptocurrency wallets come in various forms tailored to different devices. There are even paper-based options to bypass digital storage altogether. They fall into three main categories: software, hardware, and paper.

Types of Cryptocurrency Wallets

Hardware wallets are specialized devices adding an extra security layer, especially useful for cold storage methods like paper wallets. With paper wallets, your funds remain safe until you engage a computer. If that computer is compromised, you risk losing access.

Hardware

Hardware wallets In contrast, hardware wallets incorporate secure chips, preventing your private key from ever being exposed to a computer. By entering a PIN directly on the device, even if your computer gets compromised, trading remains safer. If your hardware wallet fails or gets lost, recovery is possible via 'seed words,' a set of random words given during setup.

Hardware wallets offer unparalleled security, yet their cost might seem justifiable depending on your currency holdings. To utilize these, a preliminary software wallet is needed. While each hardware wallet includes its default software, options like MyEtherWallet can work alongside them.

Dive into our detailed report comparing two of the leading hardware wallets currently dominating the market.

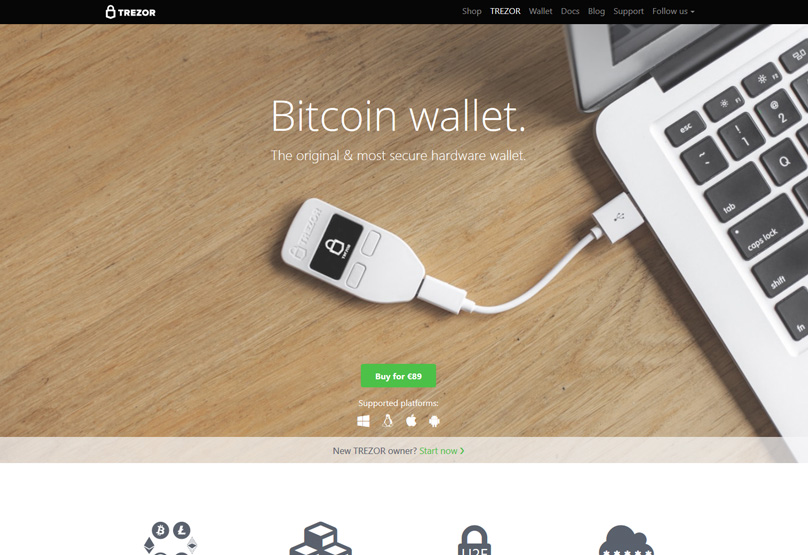

The Trezor hardware wallet supports multiple coins like Bitcoin, Litecoin, and Ether. Renowned for its safety and user friendliness, it has become a top choice. However, with a price tag of $99/£99, it suits those with substantial cryptocurrency investments. Trezor and Ledger .

Trezor

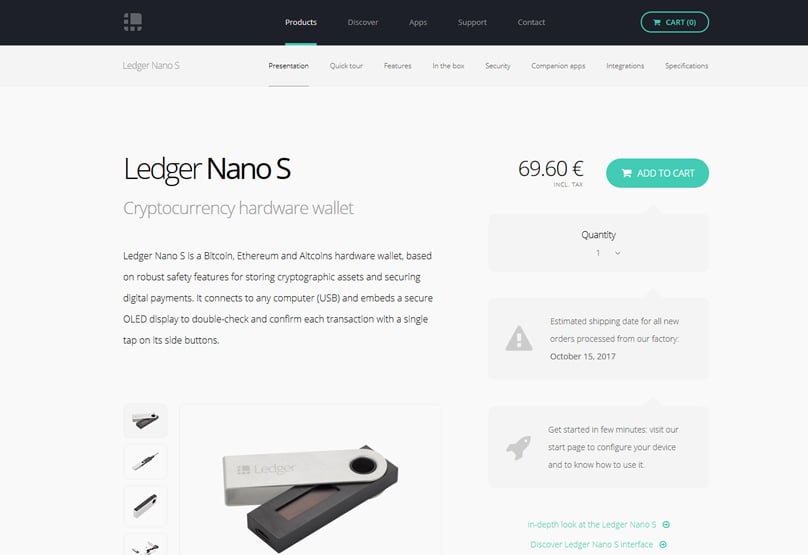

The Ledger Nano S, a best-selling compact USB device, is less costly at approximately $65/£55. You can interact with your funds without a computer connection, though the software lacks some advanced features seen in Trezor, like password management.

Ledger Nano S

Software wallets operate through digital application platforms. These come in desktop, mobile, and online versions.

Software

Desktop wallets store your cryptocurrency locally on a computer. They offer full control independent of third-party intervention, securing your assets unless your system faces a breach or hardware failure. Concerned users often resort to disconnected computers for extra security.

- Mobile wallets, available through apps on smartphones, facilitate easy coin use in physical stores. Some store coins locally, mirroring desktop advantages and risks, while others access online servers, offering the convenience and vulnerabilities of web platforms.

- Online wallets, accessed anywhere via the web, integrate well with desktop or mobile counterparts. However, they require significant trust in web administrators as they hold the private keys, not directly on your device.

- The market brims with various software wallets, each with unique features. Some accommodate multiple currencies, while others are single-purpose. Certain wallets operate entirely locally, while others rely on external networks for processing.

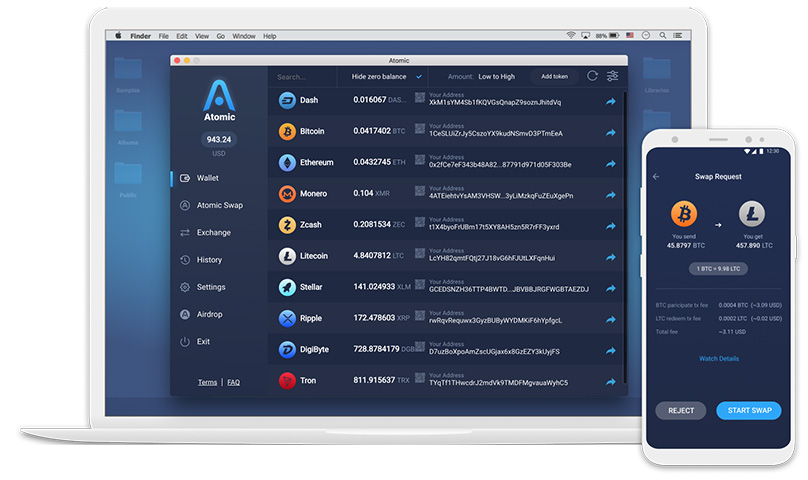

Atomic Wallet, a new multi-currency, non-custodial solution, supports Bitcoin and over 300 other cryptocurrencies. It boasts an intuitive interface and compatibility with major operating systems and soon, mobile apps. Expect decentralized private key storage and options like credit card crypto purchases, Atomic Swaps, and integrated exchanges.

Atomic Wallet

Copay Bitcoin wallet stands out as a trusted, beginner-friendly open-source option for Bitcoin only. Available on multiple platforms, it supports multiple user access and is highly secure, a product of BitPay's expertise in cryptocurrency transactions.

Electrum, a pioneer among Bitcoin wallets, excels in speed, security, and reliability. Compatible with Ledger and Trezor for enhanced security, its complexity might daunt beginners, making it less than ideal for novices exploring desktop wallets.

Copay

Exodus, another free software wallet, is gaining traction for its variety of supported cryptocurrencies and built-in exchange, making currency swaps simple. However, it lacks a mobile version at present.

Electrum

Jaxx, available for both desktop and mobile, supports Bitcoin and many other top coins, featuring an easy-to-use exchange service within the app for swift cryptocurrency conversions.

Exodus

A paper wallet involves printing a physical copy of a cryptocurrency address and a private key, with a QR code for easy access. As a form of cold storage, its lack of internet connectivity minimizes hacking risks, and it ranks among the most affordable offline storage options.

Jaxx

Top Bitcoin Wallets of 2019: A Comprehensive Comparison of Hardware, Software, and Paper Options

Paper

Explore our detailed 2019 guide on the best Bitcoin wallets around. Delve into the pros and cons of Hardware, Software, and Paper Wallets, and discover which suits your needs best.

2019's Standout Bitcoin Wallets: Analyzing Hardware, Software, and Paper Choices

Should you store your funds with the provider you got them from? It's an option, but not necessarily a wise one. If the exchange faces a security breach, what then becomes of your assets?

Bitcoin Paper Wallet

Cryptocurrency exchanges and data centers often manage large sums of money, making them prime targets for cybercriminals. There are numerous cases where exchanges have suffered breaches, like the notorious incident in 2013.

Conclusion

During the infamous 2013 breach, over 850,000 Bitcoin vanished, with their value soaring from over $450 million at the time to more than $3 billion by September 2017. Some platforms assure users that funds held in their exchange are protected by insurance policies, promising reimbursement in the event of theft, but it’s a gamble many are hesitant to take.

With the potential risks so high, securing your assets in a cryptocurrency wallet is the wisest course. Yet, questions linger: Are online or offline options better? What are the distinctions between hardware and software wallets? And do they come in other colors?!

A crypto wallet functions more like a digital banking system than a traditional pocketbook. Blockchain entries are immutable, meaning they’re not physically stored but rather, access to them is secured through encrypted digital keys. Your wallet contains these private keys—akin to a PIN for an online bank account—linking to public keys that ensure access to your crypto addresses. Essentially, a wallet manages your access to the digital ledger and facilitates transactions.

3Comments

Conversely, hardware wallets employ secure chips that eliminate the need to expose your private key on a computer. Inputting a simple pin on the hardware ensures safer trading on compromised devices. Should your device fail or get lost, recovery is possible using 'seed words' provided with the hardware—a random word string to regain access.

Despite hardware wallets being highly secure, their cost might deter those with smaller currencies. Using them necessitates a software wallet for device interaction. Each hardware wallet comes with its default software, yet options like MyEtherWallet can interface with various hardware.

Check out our comprehensive comparison of the two leading hardware wallets.