Emerging as a major player in the cryptocurrency realm, Binance is witnessing unstoppable growth. Having set up a permanent hub in Malta, this leading crypto exchange has also branched into Africa with the inception of Binance Uganda and launched a fiat-to-crypto conversion platform. Binance Jersey .

The team have now released their Decentralized Exchange (DEX) On the test version, the platform enables users to trade crypto assets while ensuring they retain total control over their funds. Despite some concerns about the true level of decentralization, Binance consistently leads the market in exchange services. Its rich ecosystem features a token launch service, a blockchain project incubator, comprehensive education and research resources, an OTC trading desk, and the Trust Wallet mobile app.

Binance DEX Overview

Binance DEX is an extension of the main Binance.com exchange This offers cryptocurrency enthusiasts additional options, especially after Binance's recent introduction of Binance Uganda and Binance Jersey .

February 20, 2019, marked the unveiling of Binance DEX's test network, an innovation serving as a decentralized order-matching mechanism grounded in Binance Chain technology. To realize Binance DEX, the creators developed a novel blockchain and a peer-to-peer system that executes order matches within blockchain nodes. All trades are recorded on-chain, providing a thorough and verifiable ledger, facilitating the exchange of digital assets listed on DEX.

Thanks to the advent of Binance Chain, Binance Coin ( BNB it'll transition from being an ERC20 token to a core asset native to the Binance Chain.

Key Features

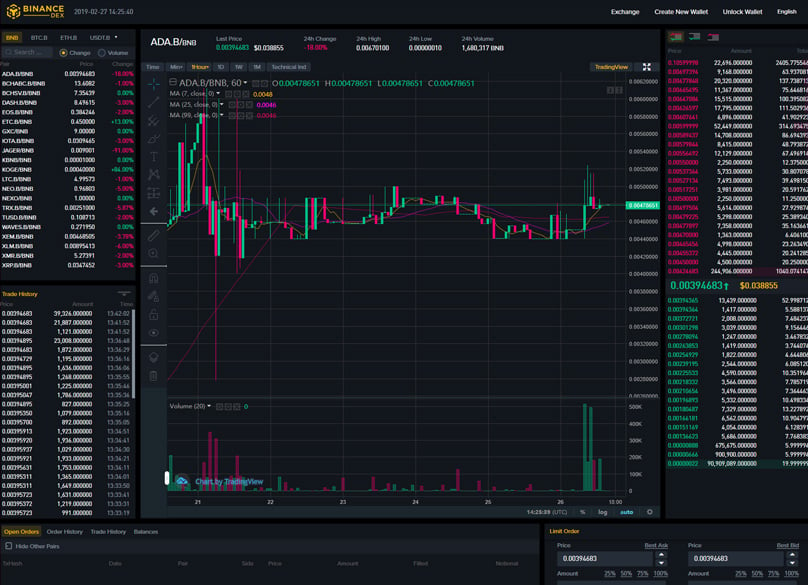

- Features – The Binance DEX employs a web-based trading interface mirroring the look of Binance.com, integrating TradingView charts furnished with a broad spectrum of technical indicators. Users are empowered to craft their own wallets and maintain control over private keys. DEX extends support for other software and hardware wallets, synced with options like Trust Wallet and Ledger Nano S.

- Technology – This exchange capitalizes on the essential Binance Chain framework, boasting one-second block intervals with almost immediate transaction finality. This ensures Binance DEX's capacity is on par with Binance.com, albeit with a distinct matching engine. DEX utilizes timed auctions to align pending orders in a synchronized manner per price level during each auction round, making the conventional Maker and Taker model irrelevant.

- Security – On this platform, traders never relinquish funds custody, thus maintaining autonomy over their private keys. Binance Chain leans on a Byzantine Fault Tolerance (BFT) and Proof of Stake (PoS) mechanism supported by a team of qualified validators, implementing several measures to prevent front-running, ensuring a safe trading environment.

- Customer Support – As a decentralized trading hub, Binance DEX is available to traders in numerous countries, offering commendable support when compared to its rivals among decentralized exchanges. They have an extensive Github page and an FAQ section addressing essential topics. There is also a Forum and the team maintain a Telegram group and Twitter .

How to Get Started on Binance DEX

Despite being in a testing phase, traders can immediately create wallets and commence token exchanges on the Binance DEX test network. Here’s the approach.

1) Create a Wallet

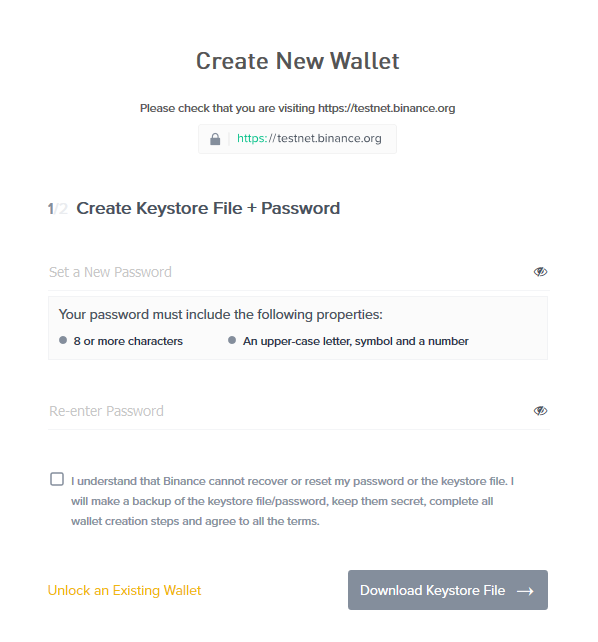

Head to the official site https://testnet.binance.org/ Start by clicking on any 'Create Wallet' icon.

Upon wallet creation, Binance presents three methods to access your wallet – offering formats like:

- Keystore File + Password

- Mnemonic Phrase

- Private Key

Every user is required to utilize the Keystore file in tandem with a password and has the choice between a mnemonic phrase or private key as an auxiliary access method.

To formulate and download your Keystore file, a password of at least eight characters is necessary, incorporating an uppercase letter, a symbol, and a number.

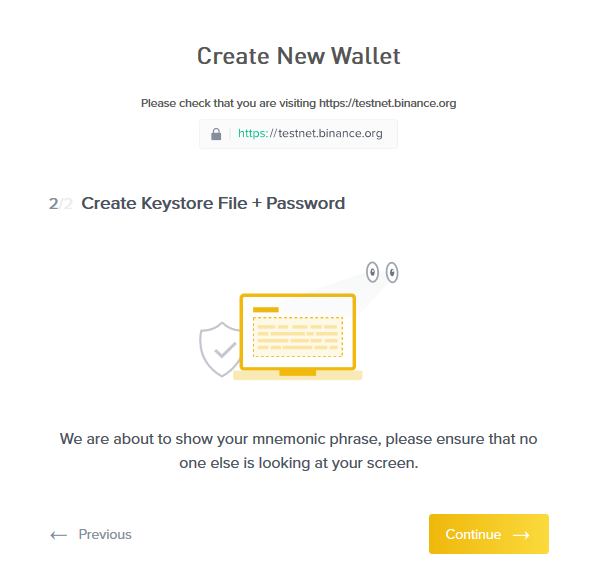

Subsequently, the system reveals your mnemonic phrase.

It's advised to jot down the 24 words and store them privately and securely. You also have the option to view your private key, which you may prefer to document offline.

After confirming you've saved your Keystore and private key, you’re prepared to access your wallet and begin trading on Binance DEX.

2) Unlock your Wallet

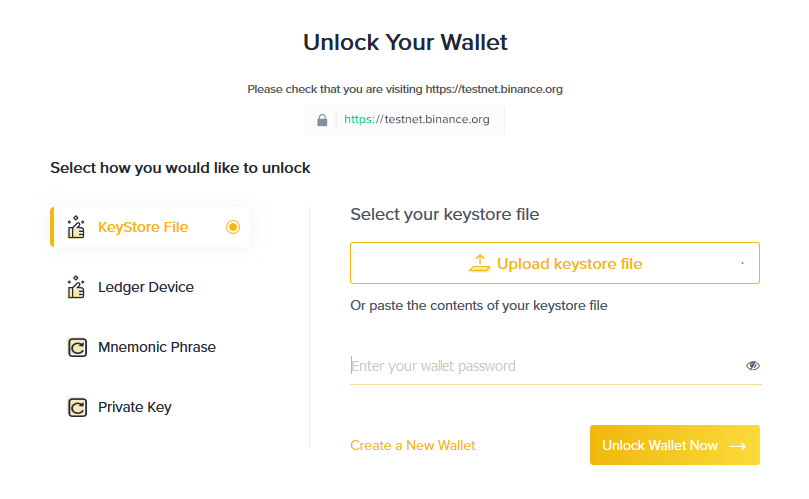

Before initiating any trades, unlocking your wallet is essential, which can be achieved by choosing an appropriate tab.

Opt from one of the three access methods, upload your Keystore file with the accompanying password, input your 24-word mnemonic phrase, or key in your private key. The latter two are ideal for recovering a lost Keystore file or password.

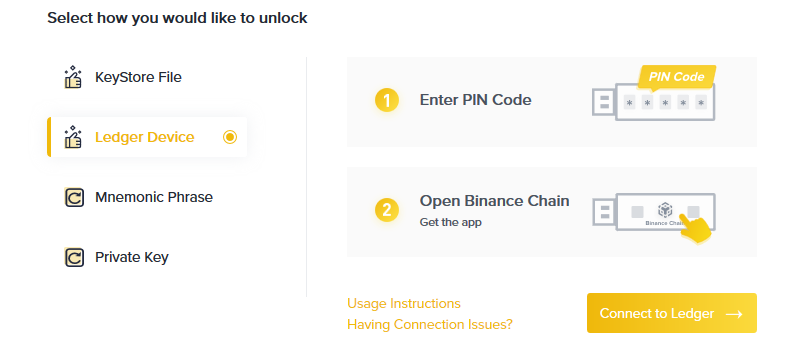

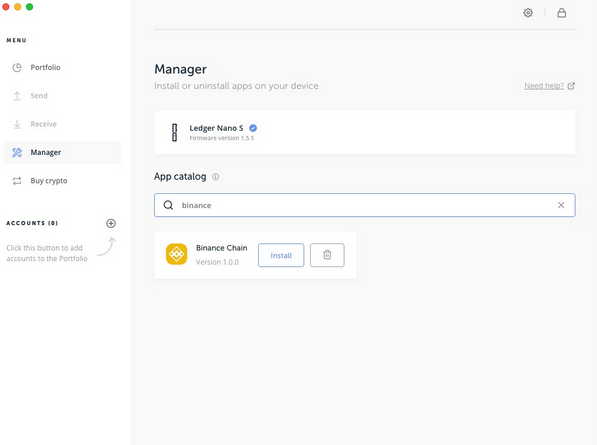

Binance DEX also affords users the ability to access safeguarded funds via a Ledger Nano S hardware wallet. It necessitates connecting the Ledger, entering the PIN, and launching the Binance Chain app post-download from the Ledger Live manager.

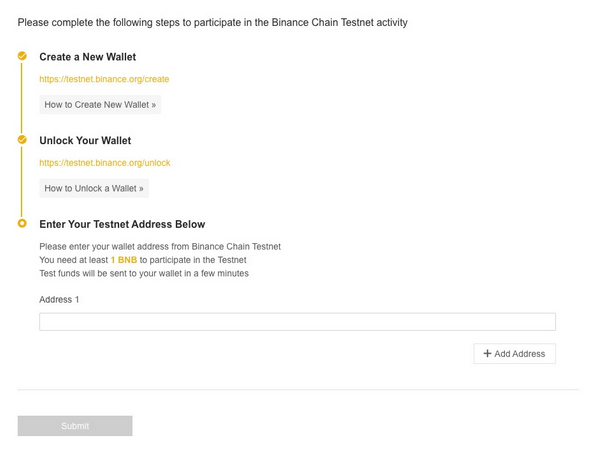

3) Add Funds to Your Testnet Account

To credit your account with testnet funds, reach the testnet faucet and log in to your Binance account.

From this point, input your testnet address, press the '+ Add Address' button, and alternatively, you can dispatch testnet funds across multiple testnet accounts, finalizing with 'Submit'.

A total of 200 BNB testnet funds will be dispensed shortly after, traceable in the Transactions segment on the DEX. You can also inspect the procedure by visiting the Binance Chain Explorer and inserting your testnet address. Once affirmed, these funds are at your disposal on Binance DEX.

To secure the 200 BNB testnet funds, your Binance account must hold a minimum of 1 BNB, which remains on your account and can be withdrawn or traded after soliciting testnet BNB. The 1 BNB requirement serves to prevent spamming.

How to Trade on Binance DEX

Following this, you're ready to initiate trading on the DEX, navigating a familiar interface if you’re acquainted with the main Binance platform.

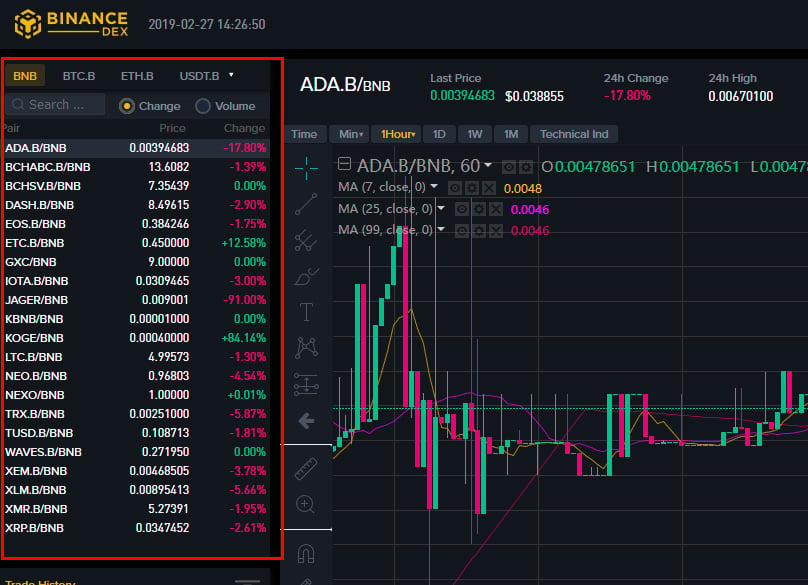

Start by selecting your chosen trading pairs from the box situated in the top left corner of the display.

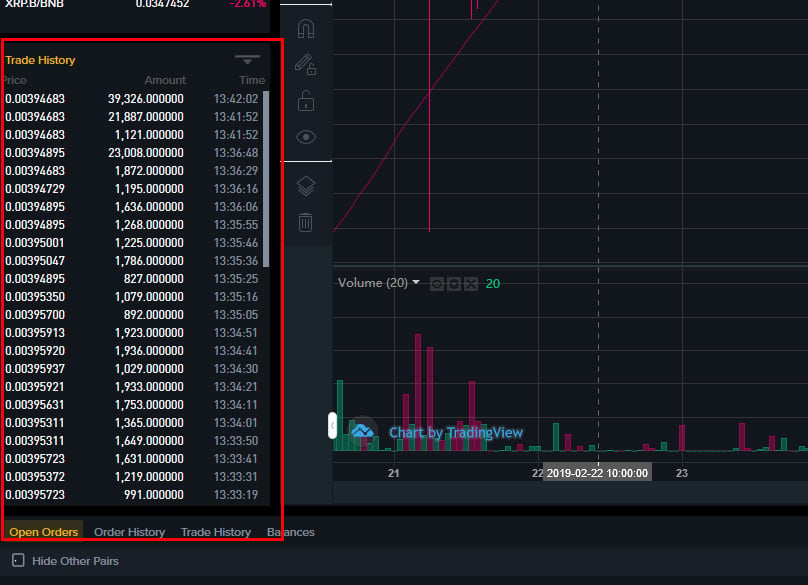

Monitor trading volumes and track historical trades from the same section below.

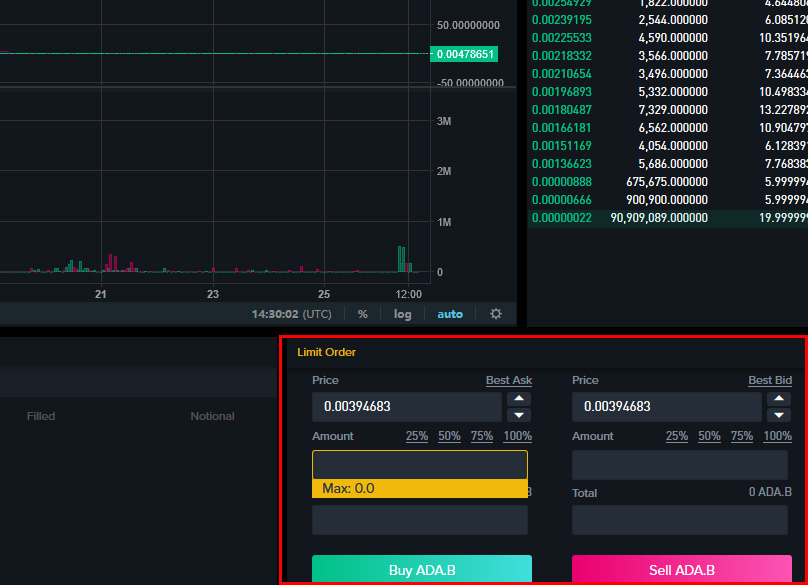

After identifying your preferred trading pair, you can proceed to place a Limit order. Presently, the DEX supports only this order type, and newcomers are encouraged to engage with their instructional materials on how to use limit orders .

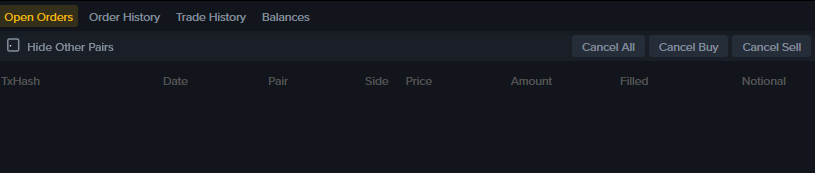

Details of your Pending Orders, Trade and Order History, along with Balances, are displayed on the lower left corner of the interface.

Once trading activities conclude, you can click on the profile icon in the top right and select 'Sign Out.'

Supported Cryptocurrencies

Binance DEX currently entertains roughly 25 digital currencies, albeit mainly as testnet tokens. Moreover, it currently doesn’t allow cross-chain transfers, preventing direct transfers of coins between Binance Chain and other chains post-mainnet launch. However, this feature may be integrated soon, using Binance.com as a bridge. Presently, to facilitate token swaps between Binance Chain and other blockchains like Bitcoin or Ethereum, 'Pegged Tokens' are issued on Binance Chain.

For instance, within Binance DEX's test environment, BTC.B represents a token tethered to the genuine BTC’s value on the Bitcoin network. BTC.B operates on Binance Chain but isn’t directly transferable, depositable, or withdrawable from the Bitcoin network. A similar principle applies to tokens like ETH.B, XRP.B, LTC.B, NEO.B, and USDT.B.

Binance outlines two principal ways these pegged tokens could be managed post-mainnet launch:

- Through cross-chain operability leveraging Atomic Swaps, users might need to deposit onto and withdraw from Binance Chain to enhance transaction speeds.

- Via Binance.com , whereby withdrawing BTC.B or Bitcoin (BTC) from Binance.com, users choose between actual BTC or the Binance Chain equivalent BTC.B, a choice extendable to other currencies.

Additionally, with the Binance Chain inception, Binance Coin (BNB) is transitioning from an ERC20 token to a new native asset for the blockchain upon mainnet launch. This shift allows traders to issue, send, and receive fresh tokens on the blockchain and propose listing of new trading pairs.

Binance DEX Fees

Fees on DEX undergo periodic scrutiny and potential adjustments following consensus among validators via a proposal-and-vote system. Currently:

- Transaction fees derive from the notional value of trades, whereas other operations incur fixed fees.

- Sending a new GTE order, canceling a partially filled order, or letting a partially filled order expire doesn’t incur a fee.

- Non-trade transactions impose a fee contingent on occurrence and require payment in BNB. Insufficient BNB results in transaction rejection.

- Trade-related transactions incur a fee upon fulfilling an order, or if canceled or expired with no fills. When a sufficient BNB balance is present, the BNB fee structure is adopted; if not, a non-BNB fee structure applies.

- If the total order value and available assets don’t fully cover the fee, the entire asset and any residual balance are utilized.

Consequently, the precise fee distribution remains undefined; however, fees benefit block producers/validators to maintain network functionality and combat misuse and attacks. New orders are exempt from charges to boost utilitarian engagement, whereas larger trades incur more considerable fees for leveraging network liquidity. Fees apply on order expiration or cancellation, excluding zero-liquidity scenarios. Payment in any asset is allowed, though the network prioritizes BNB, offering rate reductions if sufficient BNB exists in the account.

Is Binance DEX Safe?

Exploring the Binance DEX in 2019: A Beginner's Insight into Its Safety

Delving deep into how Binance's newly introduced decentralized exchange, Binance DEX, functions in our extensive review.

They are also set to outline their Disaster Recovery and Emergency A Complete Overview for Newbies: Navigating the Binance DEX

Binance stands as a prominent force in the cryptocurrency realm, not showing signs of slowing down. Having recently anchored itself in Malta, this pioneering exchange is also making strides into the African market via Binance Uganda and unveiling a platform facilitating direct transactions between fiat and cryptocurrency. tweeting On the testnet stage, this platform empowers users with the ability to trade digital currencies while maintaining complete control over their funds. While there were initial hesitations about the platform's true decentralization, Binance remains a trailblazer in the exchange sphere. Their ecosystem is vast, offering a token launch platform, blockchain project incubation, diverse educational and research portals, an OTC trading desk, and the user-friendly Trust Wallet.

Is Binance DEX the Right Starting Point for Newcomers?

Is Binance DEX User-Friendly for Novice Traders?

Adding diversity to crypto traders' possibilities, Binance's recent launch of Binance Uganda makes this clear, and Academy and Forum Announced on February 20, 2019, Binance's release of the Binance DEX testnet showcases a decentralized order-matching mechanism built on the foundational Binance Chain. This endeavor required the design of a fresh blockchain coupled with a peer-to-peer distributed system. All orders are matched at the blockchain node level, ensuring a complete, audit-ready record of each transaction and permitting the exchange of digital assets both issued and listed on the DEX.

Following the establishment of Binance Chain, test fund faucet ) will transition from being an ERC20 token to becoming the native digital asset of Binance Chain.

Features – The Binance DEX operates through a web interface reminiscent of Binance.com, incorporating TradingView charts laden with technical indicators. This platform enables users to set up wallets and safeguard their private keys. Additionally, it accommodates alternative software and hardware wallets, with integrations for the Trust Wallet and the Ledger Nano S.

Infrastructure – Leveraging the core technologies of Binance Chain, the DEX boasts one-second block intervals and rapid transaction finality. Consequently, the platform can manage trade volumes similar to Binance.com, though it employs a different matching system. At Binance DEX, a periodic auction format is utilized for order matching, eliminating the traditional Maker and Taker roles since identical priced orders are matched simultaneously.

Defense Mechanisms – With the platform not assuming control of funds, traders handle their private keys independently. The Binance Chain’s consensus is achieved through Byzantine Fault Tolerance (BFT) and Proof of Stake (PoS), involving a series of qualified validators and protective mechanisms against front running to ensure trading integrity.

Binance DEX Pros & Cons

Pros:

- Good Reputation

- Familiar Interface and UI

- Users Retain Control of their Funds

- Users can Test Trading Strategies

- Low Fees

Cons:

- No Live Trading

- Higher Learning Curve

- Not Fully Decentralized

- Trader Assistance – Binance DEX extends its decentralized services to traders across numerous countries, offering superior support compared to rival DEXs. They provide a comprehensive

Заключение

section addressing pivotal concerns. Furthermore, a

Even on the testnet, traders can kickstart their experience by creating a wallet and exchanging tokens; here’s the process.

and tap on any of the “Create Wallet” buttons.

Binance DEX

Плюсы

- Хорошая репутация

- Знакомый интерфейс и UI

- Пользователи сохраняют контроль над своими средствами

- Пользователи могут тестировать торговые стратегии

- Низкие комиссии

Минусы

- Оживленная торговля пока не включена

- Небольшая кривая обучения

- Не полностью децентрализованно

- Trader Assistance – Binance DEX extends its decentralized services to traders across numerous countries, offering superior support compared to rival DEXs. They provide a comprehensive