TLDR:

- Binance Labs has committed funds to OpenEden, a forward-thinking platform focused on transforming tangible real-world assets into blockchain-based tokens.

- OpenEden's innovative U.S. Treasury Bill Fund, which is tokenized, has achieved an impressive 'A' rating from Moody's.

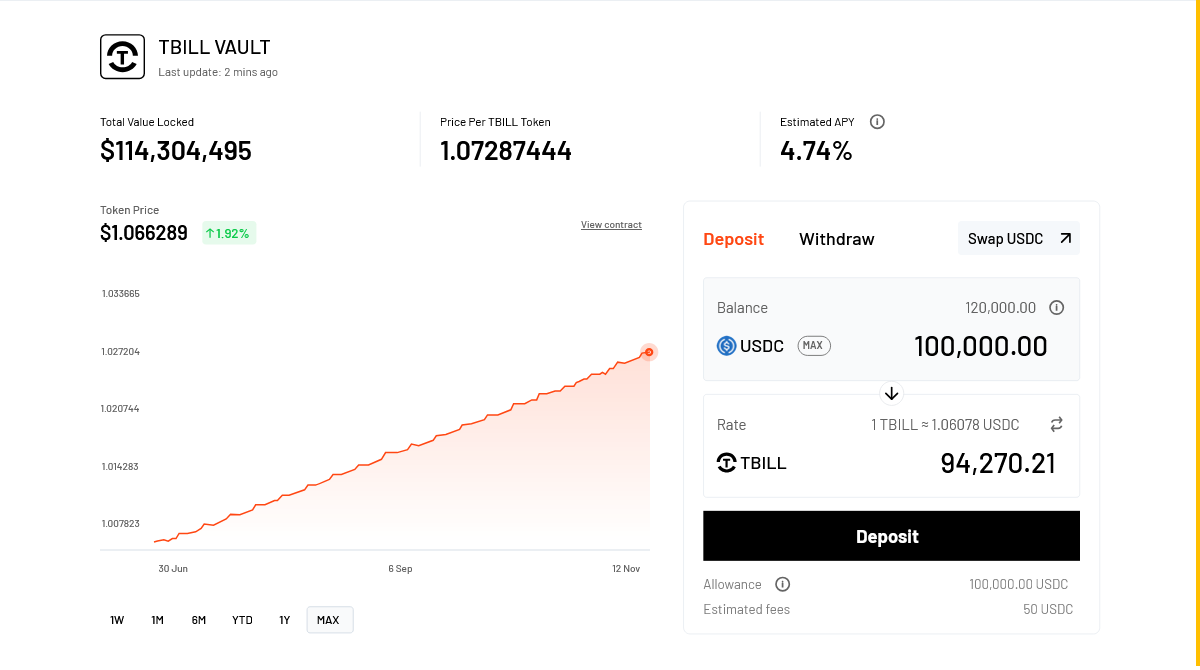

- Through their tokenized Treasury Bills, OpenEden has amassed over $100 million in Total Value Locked (TVL), showcasing robust investor trust.

- The primary objective of this investment is to broaden the reach of real-world asset-backed returns within the DeFi ecosystem.

- Tokenized assets from the real world are now valued at approximately $8 billion in total value locked across various platforms.

Binance Labs Binance Labs, the venture capital division of Binance, has strategically invested in this progressive platform to bridge the gap between traditional finance operations and the rapidly expanding field of decentralized finance. OpenEden OpenEden stands as a dual entity, comprising a fund management company sanctioned by the Monetary Authority of Singapore, alongside a tech firm dedicated to the art of tokenization.

Their flagship offering is a tokenized fund based on U.S. Treasury Bills, labeled TBILL. This fund has garnered an 'A' rating from Moody’s, a testament to its unprecedented success, being the largest of its kind beyond U.S. borders.

OpenEden’s mission involves integrating authentic financial products with blockchain technology, thereby democratizing access to these assets, which, in turn, strives to offer a more inclusive and decentralized financial structure.

In a recent announcement, OpenEden disclosed reaching an impressive milestone of over $100 million in Total Value Locked (TVL) in their tokenized T-Bills, reflecting substantial investor confidence.

$TBILL has been recognized as the most outstanding tokenized treasury asset over a span of 180 days.

Investors who have successfully completed necessary clearance checks, along with DAOs and crypto treasury overseers, can leverage their own crypto wallets to mint TBILL tokens. This provides a lucrative avenue for generating returns on dormant stablecoins.

OpenEden takes charge of the entire tokenization process, streamlining operations to maximize returns for its token holders, and proud to engage over 100 institutional investors to date. Know Your Customer (KYC) With an infusion of capital from Binance Labs, OpenEden is set on a trajectory to innovate new offerings, solidify alliances with other entities, and explore untapped markets, all in an effort to facilitate broader adoption of real-world asset-backed returns in DeFi.

Andy Chang from Binance Labs is enthusiastic about supporting projects contributing novel strategies to Web3 leveraging enduring and practical technologies. He asserts OpenEden is strategically positioned to capitalize on the adoption surge of stablecoins and real-world assets.

Jeremy Ng, a founding figure of OpenEden, expresses gratitude for the confidence Binance Labs has shown in them. This partnership promises to expedite their journeys in merging crypto yields with real assets, paving a path for institutional investors toward decentralized avenues.

The appeal of tokenized tangible assets is witnessing rapid growth, with T-Bills emerging as a favored choice among enterprises venturing into token issuance. As per Messari's blockchain insights, the total locked value in real assets has seen significant expansion, reaching an impressive $8 billion.

Since 2018, Binance Labs has ventured into over 250 projects encompassing more than 25 nations, concentrating on tech solutions that people genuinely desire and that ensure sustainable profitability.

The Editor-in-Chief of Blockonomi, who is also the founder of Kooc Media, operates out of the UK. They are ardent proponents of open-source technologies, blockchain innovations, and advocating for an unrestricted and just internet.

His insights have captured attention from influential platforms like Nasdaq, Dow Jones, Investopedia, The New Yorker, Forbes, TechCrunch, and many others. Reach out to Oliver via Oliver@level-up-casino-app.com.