Step into the world of Binance 2.0, fellow cryptocurrency enthusiasts.

As of July 11th, the global cryptocurrency powerhouse headquartered in Malta has unveiled its innovative Margin Trading service. This new feature enables Binance users to leverage their digital assets as collateral on Binance.com, allowing them to borrow funds for amplified long or short trades.

This strategic move follows the leadership's official announcement back in May such a service was coming.

The trial run of margin capabilities was conducted by a select few users, but now, with Thursday's rollout, the service is open to all users in approved regions who have verified their identities. Binance.com .

Effortlessly Switch Between Two Trading Modes

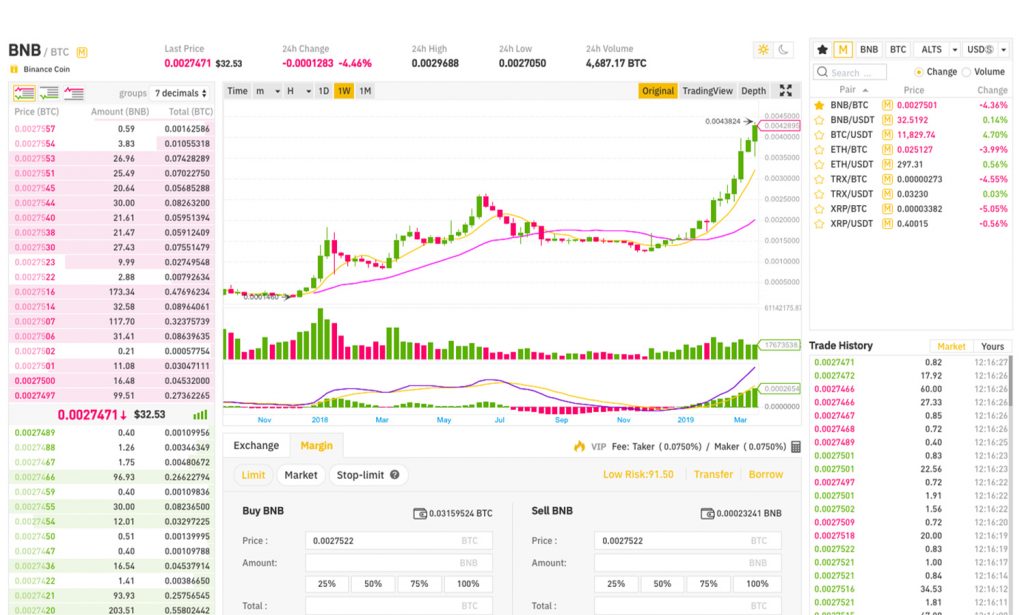

Accessing the new service is seamless, thanks to the conveniently located 'Margin' tab on Binance's main Exchange page.

With enhancements made to both the exchange and margin interfaces, the platform is now powered by an advanced trading engine, ensuring improved order matching and optimized margin level calculations, leading to decreased liquidations, according to the company's recent statement.

In response to the news, Binance's chief operating officer and co-founder Changpeng Zhao stated that this shift is a part of the brand's overarching strategy to evolve into a one-stop shop cryptocurrency hub, noting that:

This development marks another milestone in delivering a well-rounded cryptocurrency trading platform that addresses the demands of both sophisticated institutional investors and everyday traders. We are introducing a new instrument within the financial and crypto markets aimed at amplifying the reach of successful trades.

It's important to note that the heightened risks associated with margin trading on the new platform will be mitigated through comprehensive disclaimers, a margin risk dashboard tracker, and educational resources to help users grasp the responsibilities involved.

As co-founder Yi He points out, margin trading stood as one of the most anticipated services on Binance, and the company is committed to delivering it with responsible measures:

Despite the current market's dual nature of heightened risks and rewards, we believe that continuous development alongside improved risk management education will ultimately yield greater rewards in the long-term.

What Will the Process Be?

To embark on the margin trading journey, users are required to head to their account dashboard, select the 'Open margin account' option, and, after acknowledging a risk reminder and agreeing to the Terms and Conditions, they'll be able to transfer cryptocurrency from their exchange wallet into a new Margin Trading Wallet without any transaction fees.

Once these preparations are complete, user-driven leveraged trading can commence, as outlined in the Binance Academy margin trading info portal:

After moving BNB tokens to your Margin Wallet, you can utilize these funds as collateral to access additional capital. The borrowing capacity aligns with a 3:1 ratio, meaning if you have 1 BTC, an additional 2 can be borrowed. For example, let's borrow 0.02 BTC for demonstration purposes.

Upon securing borrowed funds, users can freely trade on the Margin Trading platform but should vigilantly monitor the risk level associated with their positions to prevent forced liquidations. Repayment of borrowed amounts, along with any interest, can be conveniently processed via the account's 'Borrow/Repay' section.

Things Are Getting Busy for Binance

The introduction of margin trading follows the revelation by CEO Zhao earlier this month about the concurrent development of a cryptocurrency futures platform.

During that announcement, Zhao did not provide a release date but indicated that a test version was anticipated within a few weeks.

The pursuit of diversified cryptocurrency services is expected to significantly boost Binance's already impressive trading volume for the foreseeable future. Notably, in June 2019, the exchange noted its record-breaking single-month trade volume, achieving a remarkable $67 billion USD as the summer began. William M. Peaster is a seasoned writer and editor with a focus on topics such as Ethereum, Dai, and Bitcoin within the cryptoeconomy. His work has been featured in Blockonomi, Binance Academy, Bitsonline, and beyond. His interests include exploring smart contracts, DAOs, dApps, and the Lightning Network. He's also honing his skills in Solidity programming. Reach out to him on Telegram at @wmpeaster