In order for digital currencies like Bitcoin For Bitcoin to be embraced by the general public in the future, it must be as accessible as the fiat currencies we use today. This is where Bitcoin ATMs play a critical role.

These kiosks either dispense or facilitate the sale of bitcoins. While they aren't found everywhere just yet, their growing presence signals an exciting shift towards a crypto-friendly future. Perhaps soon, society might transition away from paper money towards digital assets, thanks to resources like Bitcoin ATMs.

Before we venture into that futuristic landscape, let's explore the current state of Bitcoin ATMs.

The First Bitcoin ATM Ever

Waves Coffee House holds the title of being the first establishment first-ever facility to introduce a Bitcoin ATM, which went live in October 2013, and facilitated transactions worth $10,000 USD in bitcoins that day, valued at around $200 per bitcoin then.

Today, that same quantity of bitcoin would be worth about $400,000. Amazing how things change, right? This ATM was launched thanks to collaboration between Vancouver's Bitcoiniacs and Las Vegas' Robocoin.

Important: Bitcoin ATMs Do Not Connect to Traditional Bank Accounts

Technically, Bitcoin ATMs aren't 'actual' ATMs as they don't interface with traditional banking accounts.

Instead, they're connected to two key elements:

- the internet

- a Bitcoin exchange

Essentially, Bitcoin ATMs are more like kiosks that give you either a printed receipt (a 'paper wallet') or transfer the bitcoins to a public key. So instead of accessing your bank accounts directly with a PIN, you're engaging with a Bitcoin exchange through the ATM. And of course, verification processes differ across machines and brands.

For the first Robocoin ATM mentioned, users verified their identity by scanning their palm and ID card, with the machine's camera confirming their facial match with their ID. Once verified, only a palm scan was needed for future access.

Again, each ATM varies. Some enable bitcoin purchases in a matter of seconds, others may take a bit longer.

Want to Find an ATM Near You?

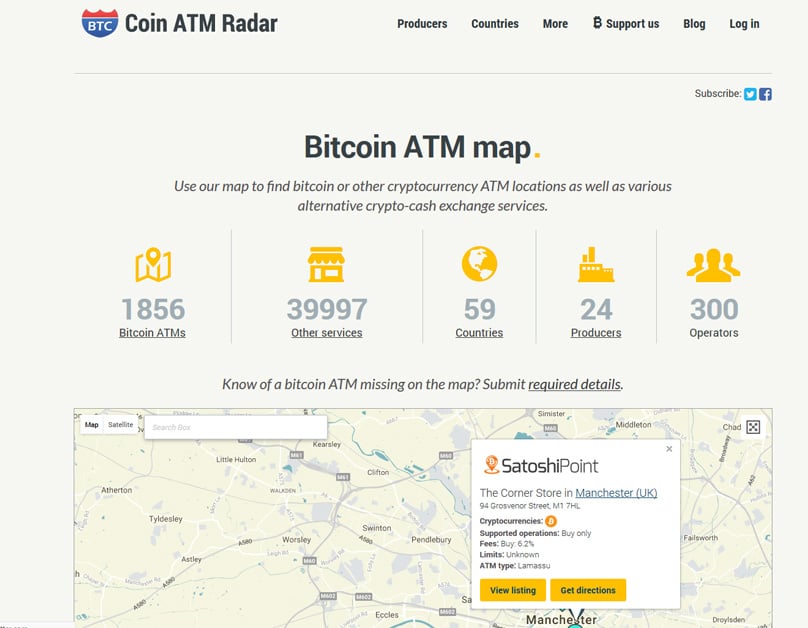

It sounds intriguing, but how can you find the closest Bitcoin ATM? Worry not – explore coinatmradar.com anytime you want.

This nifty tracking service helps you locate nearby Bitcoin ATMs, no matter where you are. Enter your location and plan your next BTC purchase effortlessly. Depending on your area, ATMs might be few and far between, especially if you're outside major urban centers in Europe or the U.S.

Crypto hotspots like London and San Francisco boast numerous Bitcoin ATMs for users. Smaller communities, not as much just yet. However, with Bitcoin's ongoing push into mainstream markets, this could balance out in time.

Curious about the number of Bitcoin ATMs in existence?

Based on coinatmradar.com’s ATM tracking platform, discover some key points:

- currently, there are 1,857 Bitcoin ATMs globally.

- 59 countries have at least one BTC ATM

- there are presently 24 companies manufacturing these ATMs.

- more than 300 service providers offering these machines to the public.

These figures are quite commendable for a digital asset that's just beginning to capture mainstream and institutional interest.

If you come across a new or unlisted ATM, consider submitting a report. here .

Not All BTC ATMs Are Bidirectional

By 'bidirectional,' we refer to users' ability to both purchase with cash and sell bitcoins for cash. The majority of Bitcoin ATMs today are not bidirectional—they typically allow you to buy BTC deal with your dollars, euros, pounds, etc.

However, a good portion of ATMs allows for immediate BTC for cash transactions, provided they're bidirectional.

If you’re planning on selling bitcoins using a Bitcoin ATM, verify its bidirectional status beforehand to avoid disappointment.

Just like traditional ATMs, the fees can sometimes be quite steep.

Traditional cash ATMs are disliked for their transaction fees, and Bitcoin ATMs are no exception.

If you're new to the world of cryptocurrency and just wish to get involved regardless of price fluctuations, an ATM might be ideal. Should BTC prices soar later on, a few extra expenses now may hardly matter.

That said, if you're keen on lower transaction costs, then Bitcoin ATMs may not be your best choice. You might prefer online exchange services with the most favorable fees you can find.

Individuals have a choice—yet if Bitcoin becomes prevalent, transaction fees could become negligible. Current fees can soar up to 16% per transaction, believe it or not. You'll certainly save by using exchanges, but ATMs offer unmatched convenience.

They can also provide a consistent revenue stream for business owners who choose to host them.

Installing a BTC ATM in a store is quite simple: engage with a business owner about hosting the machine in exchange for a modest monthly 'rent'—typically about $300 per ATM.

This setup not only provides business owners with additional monthly income for leasing minimal space, but also attracts new customers intrigued by the novelty of Bitcoin ATMs. It’s advantageous for all parties. As Bitcoin’s influence grows, this model could see increased adoption. In the U.S., almost 900 Bitcoin ATMs have appeared through such partnerships.

The application of Know Your Customer (KYC) regulations may affect their operation.

Know Your Customer (KYC) regulations play a critical role in combatting money laundering globally. Thus, depending on your location and Bitcoin ATM provider, adhering to strict identity checks may be necessary.

However, don't let this process intimidate you—it typically takes no more than four minutes to have your identity and account verified for ATMs enforcing rigorous protocols.

Overall, there's significant potential for expansion in this sector.

The fact that there are fewer than 2,000 Bitcoin ATMs today is astounding when considering the potential increase in the next five, ten, or twenty years. We are in the midst of a digital evolution, with cryptocurrencies like Bitcoin set to be significant driving forces.

It's not far-fetched to imagine Bitcoin soaring in popularity. Should that happen, Bitcoin ATMs could become as widespread as traditional ones.

Becoming an ATM operator seems like a promising opportunity!