TLDR

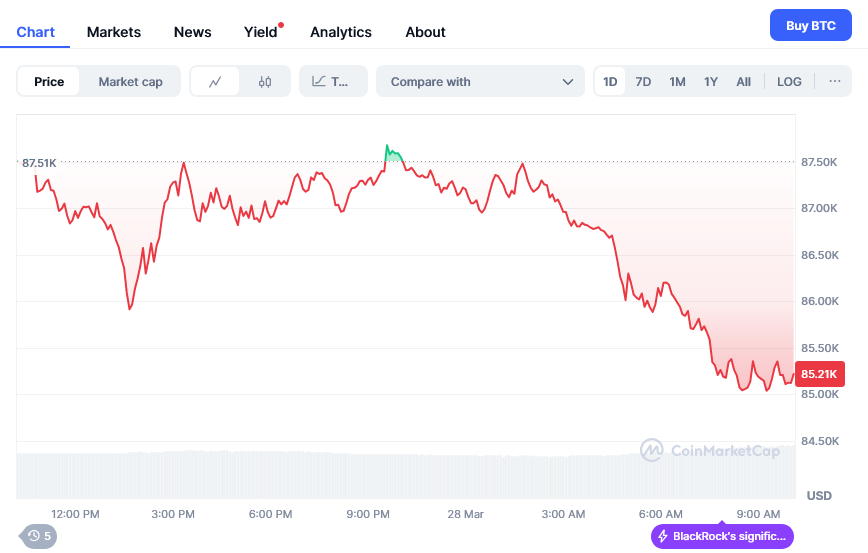

- Currently, Bitcoin is fluctuating around the $85,880 mark, showing a slight decline of 3.16% over the last month.

- Market expert Jamie Coutts has a bullish view on Bitcoin, predicting it might hit $123,000 by this June if things go well.

- Statistics from Polymarket are projecting that Bitcoin could scale up to $138,617 by the year-end of 2025.

- A staggering $16.5 billion worth of Bitcoin options are set to expire on March 28, which might cause some short-term price fluctuations.

- Despite facing turbulence from trade tariff worries, Bitcoin has impressively surged by almost 10% after a recent dip below $80,000.

Bitcoin appears to be bouncing back after a period of uncertainty due to U.S. trade tariff tensions and broader economic issues. It's trading at around $85,880 currently, which is 3.16% down from last month, but has experienced a near 10% rebound since it slipped under $80,000 earlier in March.

Jamie Coutts, the chief crypto analyst for Real Vision, is optimistic about Bitcoin's trajectory. He told Cointelegraph that the market might be underestimating Bitcoin's ability to quickly climb and potentially reach new heights before the close of the second quarter.

Coutts anchors his prediction on more lenient financial parameters, a softening US dollar, and increased liquidity from the People's Bank of China since early 2025. He anticipates Bitcoin hitting anywhere from $102,000 to as much as $123,000 by June if the US Dollar Index (DXY) follows historical trends.

Viewing the recent US Dollar Index fluctuations through the lens of history makes a bullish outlook almost irresistible. Notably, past 3-day downturns greater than -2% and -2.5% have all been seen at critical Bitcoin bear market troughs or turning points. pic.twitter.com/Lc6izl5U2A

— Jamie Coutts CMT (@Jamie1Coutts) March 6, 2025

If Bitcoin achieves the $123,000 mark, it would represent a 13% increase over its all-time high of $109,000, reached earlier in January. According to Coutts, there's been a significant relaxation in financial conditions, spotlighted by the US dollar experiencing its third-largest three-day drop since 2015, alongside rate reductions and decreased Treasury bond volatility.

Polymarket, a prediction platform of repute, suggests Bitcoin might climb to $138,617 by the end of 2025—a remarkable 60% uptick from today's value. Cryptocurrency analyst Ashwin reviewed price forecasts on this platform and concluded this represents 'a market regaining momentum after facing tariff-related challenges.'

Technical Analysis

Technically speaking, Bitcoin is testing critical resistance levels near $88,000, closely aligning with its 50-day moving average. Breaking past this resistance could be the stepping stone for revisiting its previous peak, near $108,000.

Failure to maintain support at around $85,000 might lead to a receding price movement back to $76,000—a yearly average considered vital by traders for continued bullish results. Technical analysis also reveals that Bitcoin has already broken out positively above the descending trendline, drawn from the lower highs seen since January 2025.

Multiple forecasts from significant financial institutions uphold the possibility of Bitcoin scaling back to $100,000 in the upcoming year. JPMorgan, for instance, foresees a $145,000 value, spurred by triple growth in the Lightning Network, whereas Bloomberg Intelligence sees $135,000 attainable should Bitcoin capture 20% of gold's market scope.

Optimistic projections also stem from Tom Lee at Fundstrat, envisioning a $250,000 peak, assuming the US Treasury diversifies 0.5% of its reserves into Bitcoin. Meanwhile, Standard Chartered anticipates Bitcoin could climb to $200,000, mainly due to the anticipated $100 billion ETF inflows by the year's fourth quarter.

In less optimistic scenarios, BitMEX's Arthur Hayes voices the possibility of a $70,000 floor if ETF outflows increase, and analysis from Glassnode implies a $74,000 price point linked to realized pricing from long-term shareholders. Yet, even with these cautionary notes, a $100,000 valuation comfortably fits within foundational estimates.

Bitcoin investors are bracing for an unprecedented $16.5 billion in monthly options set to expire on March 28. However, the market impact may be minimal as Bitcoin's dip below $90,000 caught many investors by surprise, nullifying a lot of bullish expectations.

At present, call (buy) options are valued at $10.5 billion, whereas put (sell) options lag behind at $6 billion. Still, calls worth $7.6 billion are pegged at $92,000 or more, meaning a 6.4% increase in Bitcoin's value is needed to activate them by the end of this month.

When it comes to options expiry, the bulls hold a tactical upper hand if Bitcoin stays above $86,500. In such a scenario, a mere $2 billion in put options would remain active, against $3.3 billion in call options.

Bitcoin's climb over the $90,000 threshold significantly amplifies the bulls' advantage, equating to $4.4 billion in call options versus $1.4 billion in put options. This could spark enough market inertia to establish a bullish direction moving into April, especially if Bitcoin ETF inflows resume their robust pace.

Amid prevailing concerns over global trade tensions and cutbacks in US government spending, Bitcoin enthusiasts remain optimistic about breaking free from stock market correlations. They derive hope from central banks' expanding monetary bases and growing Bitcoin adoption by companies like GameStop and Semler Scientific.

Robbie Mitchnick, who heads BlackRock's digital assets division, has speculated that Bitcoin stands to benefit in a recessionary macro environment. 'Whether a recession happens or not is unclear, but it could certainly be a significant driver for Bitcoin,' Mitchnick stated in a recent interview.

While this is happening, CryptoQuant's Bull Score Index has fallen to a low of 20, the weakest since early 2023, reflecting a fragile Bitcoin market with slim prospects of a major rally in the near term. Historical data tends to show that remaining below a score of 40 for an extended duration could flag continued bearish conditions.

Traders and investors should keep an eye on the $88,000 resistance level and the results of the March 28 options expiry as these could offer crucial indicators about Bitcoin's forthcoming trajectory. If Bitcoin manages to break past this resistance and sustain itself above $90,000, the road toward retesting peak values becomes more discernible.