TLDR

- Bitcoin has slumped to its lowest in four months at $76,606, as fears of a recession and global market drops prevail.

- Arthur Hayes predicts that Bitcoin will find its floor at around $70,000, signifying a 36% contraction from its peak value.

- Pressure from short-term investors, who purchased Bitcoin close to its highest value, is intensifying, causing a \"moderate capitulation.\"

- Statistics indicate those holding Bitcoin for a short period are \"significantly out-of-pocket\" within the $71,300 to $91,900 price range.

- Following a period of market volatility, Bitcoin has witnessed a 7.5% rebound in the past day as US financial markets regain stability.

Recent movements in Bitcoin's price have intrigued investors, as the leading cryptocurrency experiences a downturn from its previous peak amidst general market concerns, aligning with patterns of bull market corrections.

Yesterday, Bitcoin reached its lowest point in four months at $76,606, coinciding with simultaneous downturns in both crypto and stock markets worldwide.

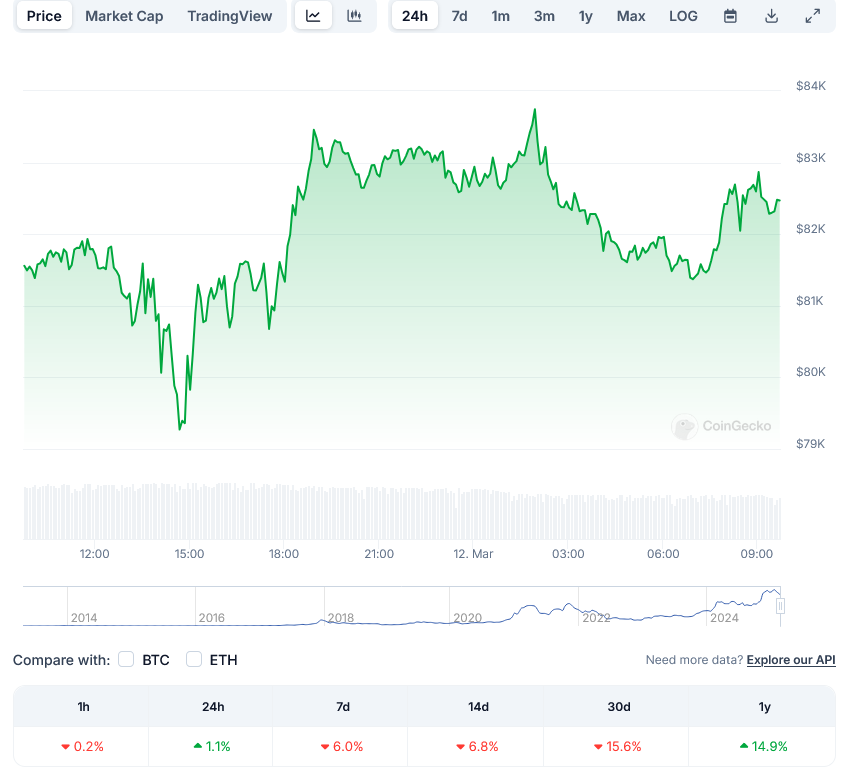

BTC Price

Concerns about an economic recession are mounting, with the S&P 500 having fallen nearly 8% in the last month, indicating this market downturn goes beyond just the crypto world.

Prediction market data from Polymarket now points to a 39% chance of a US recession by 2025, a significant increase from a 23% probability reported in February this year.

Hayes Prediction

Crypto expert Arthur Hayes commented on the market situation. The former CEO of BitMEX anticipates Bitcoin will likely stabilize at around $70,000.

Hayes highlighted that this potential 36% correction from January's peak of $108,786 is quite \"normal\" within a bull market, advising crypto investors to maintain patience.

According to Hayes, as Bitcoin nears the $70,000 mark, broader financial sectors would need to witness a sharp decline, affecting the S&P 500, Nasdaq, and possibly leading to major financial institution failures.

The plan:

Be fucking patient. $BTC He foresees a stabilization around $70k, considering a 36% correction from the $110k peak as quite typical for a bull market.

Then we need stonks, $SPX and $NDX He predicts a dramatic decline, pointing to the necessity for failure among traditional financial institutions.

This scenario could spur central banks like the Fed, PBOC, ECB, and BOJ to implement quantitative easing measures...

— Arthur Hayes (@CryptoHayes) March 11, 2025

Such circumstances are likely to trigger actions by central banks to relax monetary policies, thus creating what Hayes terms as an \"optimal buying opportunity.\"

Glassnode

Onchain analytics company Glassnode has identified a major contributor to the selling pressure. According to their findings, those who bought near the all-time high of $109,000 in January are now selling in panic.

Glassnode characterized this as a \"moderate capitulation event,\" coupled with \"intense loss realization,\" showing a definite trend of short-term holders withdrawing from the market.

For short-term Bitcoin holders (those invested for less than 155 days), their average acquisition cost stands at $91,362, whereas the current trading price of around $81,930 reflects an unrealized average loss of roughly 10.6%.

According to Glassnode's assessment, short-term investors are \"significantly out of their depth\" in the $71,300 to $91,900 pricing range, suggesting a capable chance of establishing a temporary bottom in this zone.

Market research group 10x Research addressed the current landscape as a \"classic correction,\" noting that about 70% of the selling occurred among investors who made purchases in the past three months.

Despite ongoing selling pressure, some signals point to a potential change in trend. Bitcoin's Relative Strength Index has hit its lowest point since August 2024, which might indicate a potential bounce.

Further optimism is derived from the US dollar index, which recently saw one of the largest weekly declines since 2013, possibly setting the stage for favorable conditions for risk-on assets like Bitcoin.

Currently, Bitcoin is trading at $80,008, reflecting a slight 0.1% rise over the last 24 hours. The cryptocurrency has rebounded by 7.5% over the past day as US markets see some stabilization.