Fresh faces in the Bitcoin (BTC) realm have encountered what can only be described as a profoundly intricate period for its community. The reason for this is that in recent years, a heated technological and ideological conflict has escalated regarding the cryptocurrency's developmental trajectory.

This intense dispute reached its peak in August of 2017, creating a split known as the August 1st event. hard fork of Bitcoin This event led to the existence of two separate entities: the original Bitcoin and the newly branched-off version. Bitcoin Cash (BCH).

The relationship between BTC and BCH supporters remains fraught with tension, with no resolution anticipated anytime soon. So what's the story with Bitcoin Cash? Why did it break away initially? What are its fundamental benefits? Today, we'll give you the in-depth, foundational info on Bitcoin Cash so you can form your own opinions.

On-Chain vs. Off-Chain Scaling

Essentially, the debate between Bitcoin Cash and Bitcoin is a significant topic. scaling debate If you're unfamiliar with the concept of scaling, consider it as an effort to enhance transaction speeds and efficiency as the number of users rises.

The Bitcoin Cash faction supports on-chain scaling; this essentially means they expanded Bitcoin's block size from 1MB to 8MB for immediate relief. Before August 1st, Bitcoin's blocks were consistently maxing out at their 1MB capacity, leading to severe congestion and high transaction fees. This adjustment by BCH has significantly alleviated those issues.

Conversely, the original Bitcoin community is pursuing off-chain scaling. By 'off-chain,' we're referring to sidechains attached to the main BTC blockchain. The strategy here is to move transactions off the main chain to prevent it from becoming congested.

The Bitcoin community’s core developers, known as Bitcoin Core, are actively working on implementing the out-of-chain Lightning Network (LN) solution. LN allows for the creation of state channels, potentially enabling nearly instant off-chain transactions.

However, the Bitcoin Cash supporters as a whole reject LN, while the Bitcoin community similarly disapproves of BCH’s initiative to increase block size to 8MB. Let’s explore why.

BCH Proponents Criticize the Lightning Network

With Lightning Network As a result, large node hubs could emerge, handling numerous transactions more efficiently compared to smaller, individually-managed state channels. These hubs will charge fees to manage and facilitate user transactions.

The crux of the matter? Bitcoin Cash enthusiasts view this hub-centered model as a slippery slope to Bitcoin acting like traditional bank accounts, introducing third-party bank influencers into BTC transactions and forcing users to pay fees for quicker, scaled transactions.

The BCH community perceives LN as a threat to Bitcoin's decentralization—an accusation the traditional BTC supporters reciprocate towards BCH but for distinct reasons.

According to BCH supporters, Bitcoin was meant to disrupt banks, yet LN ensures Bitcoin won't eradicate traditional banks, instead allowing them to persist and exploit even more.

These points remain contentious, and traditional Bitcoin backers will be the first to challenge these narratives.

Yet, a layer of dissatisfaction has been added with BCH users accusing Bitcoin Core developers of enabling and perpetuating congestion on the BTC network to make sidechain monetization feasible. Several BTC Core developers are, after all, associated with Blockstream, a firm developing sidechain solutions.

Ultimately, many BCH followers suspect Bitcoin is being compromised from within for financial gain. This video aptly represents their perspective:

Bitcoin Cash Claims Its Role as the True Successor to Satoshi’s Vision

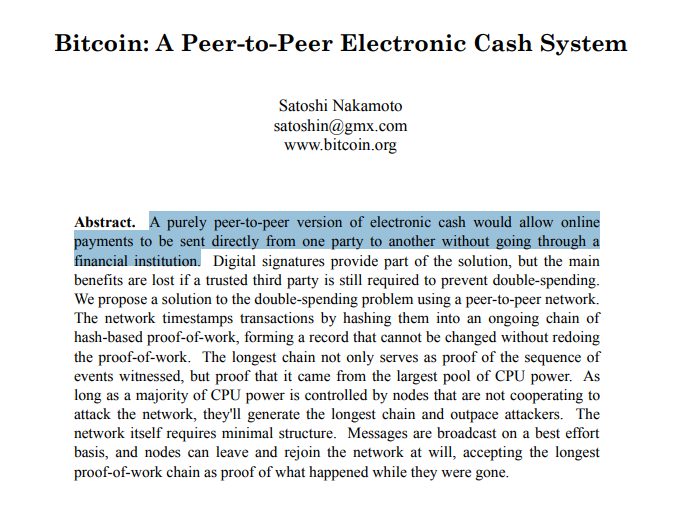

The pseudonymous originator of BTC, going by Satoshi Nakamoto, unveiled the now-fabled Bitcoin whitepaper nearly a decade ago. Clearly articulated in the opening of this document was the project's objective:

“A purely peer-to-peer version of electronic cash would enable online payments to be transferred directly between parties without needing an intermediary.”

The issue is that BTC isn’t functioning well as “electronic cash” due to network congestion causing sluggish and exorbitant transactions. At present, at least — BTC wasn’t always so cumbersome to use, nor will it perpetually remain so.

However, the potential for third-parties operating LN hubs contrasts with Satoshi’s outlined vision of transactions occurring independently of traditional financial entities.

Some may even argue that Satoshi’s initial concept was flawed, failing to anticipate the events and challenges that unfolded in the following years.

Such arguments are reasonable; regardless, LN definitely seems capable of diverging from Satoshi’s initial idea as quoted in the seminal whitepaper.

Does this resolve the broader argument? No. Celebrated Bitcoin commentator Andreas Antonopoulos, for instance, praises LN, likening it to Bitcoin's Proof-of-Stake (PoS). You'll need to formulate your own stance in these scaling controversies.

Meanwhile, through its block size expansion to 8MB, the Bitcoin Cash faction portrays itself as the legitimate bearer of Satoshi Nakamoto’s vision of electronic currency. Currently, BCH offers low fees and rapid confirmation speeds. It also carries the 'initial chain' of Bitcoin since the original BTC chain diverted to a new chain to adopt SegWit. Genesis block In this light, BCH is the custodian of Bitcoin’s inaugural block.

In contrast, the BTC community prefers considering Bitcoin as a store of value rather than a currency, a notion the Bitcoin Cash community leaders disagree with. BCH's unofficial 'CEO,' Rick Falkvinge, recently voiced similar sentiments:

Rick Explains: Bitcoin Legacy is NOT a Store Of Value

Bitcoin Cash Wallets

You can opt for among software, paper, mobile, and website here if you want to buy Bitcoin Cash using Fiat currency or wish to convert some BTC to BCH on the exchanges listed below hardware wallets .

How to Buy Bitcoin Cash

There are a large number of exchanges The legacy Bitcoin community argues increasing block size to 8MB compromises security. you can use CEX.io They assert that the block size increase encourages centralization. They point to the original drivers behind the BCH split, Bitmain and ViaBTC, Chinese mining giants, as seeking to consolidate dominance in the community.

Conclusion

The animosity between staunch BTC and BCH supporters is apparent and isn’t dissipating anytime soon. This discord is unfortunate, especially because newcomers tackling the crypto world will undoubtedly find themselves stuck in confusion amidst the ongoing political turmoil over scaling strategies.

Both on-chain and off-chain solutions provide benefits. Yet the Bitcoin community has splintered, with both sides convinced of their superiority. It remains to be seen how these debates evolve.

William M. Peaster is a skilled writer and editor, focusing on Ethereum, Dai, and Bitcoin within the cryptoeconomy. His work has been featured in Blockonomi, Binance Academy, Bitsonline, among others. He is passionate about smart contracts, DAOs, dApps, and the Lightning Network, and is also learning Solidity. Reach out on Telegram at @wmpeaster.

iExec: Generating User-Owned Revenue Streams via Digital Activity