Pursuing widespread cryptocurrency adoption continues to be a prominent focus, and crypto debit cards are hailed as a prime avenue to meld traditional banking with digital currencies.

Bitcoin debit cards enable a seamless fusion of both cryptocurrency and fiat currency, allowing cardholders to load money onto their cards and easily make payments or purchases at restaurants, movie theaters, shops, and a myriad of other locations.

The convenience of these cards lies in their ability to simplify crypto spending, often minimizing the necessity for extensive technical knowledge typically required to manage and store digital currencies.

This ease of use has opened the door for more people to start engaging with cryptocurrencies. Over recent years, various companies have ventured into this market, aiming to offer consumers a variety of prepaid debit card options for their spending needs.

Nevertheless, card providers' dependence on giants like VISA and MasterCard can occasionally lead to delays if issues arise. issue For example, a conflict between VISA and WaveCrest Bank, based in Gibraltar, led to VISA declaring that WaveCrest Holdings could no longer issue Visa® prepaid cards in the European Economic Area (EEA) or elsewhere.

Since WaveCrest handled a large portion of crypto debit card companies, this posed a significant challenge. Fortunately, several initiatives are now operational, offering ways for users to spend their assets via either physical or virtual debit cards, with the best options highlighted here.

What to Look for in a Crypto Debit Card

When choosing a Bitcoin debit card, personal circumstances will play a significant role. Key factors to consider in selecting a card or provider include:

- Jurisdiction: Cryptocurrency regulations can restrict where debit card solutions are available. Users need to ensure the card provider supports their region and complies with any legal changes.

- Ease of Use: Bitcoin debit cards should be straightforward, but funding options, fees, and spending limits can sometimes complicate the process. Additionally, the ability to access your account online or contact support affects the user experience. Virtual cards may further streamline spending.

- Security: Enhanced security measures, such as encryption, two-factor authentication, and notification services, ensure your accounts are protected. Linking with major credit card companies also allows security features like MasterCard’s 3D Secure.

- Reliability: Given Bitcoin's relatively short history, opting for reputable, well-integrated providers is advisable to ensure longevity and service consistency.

- Fees: Despite the volatile nature of digital currencies, users still seek competitive rates and uncomplicated fee structures. Transparency and simplicity in fees are crucial for retaining users.

- Features: While all Bitcoin debit cards enable spending and ATM withdrawals, additional functionalities like support for altcoins, banking services, remittance options, and currency exchange add extra value.

- Incentives: Some services emphasize reliability, while others attract users through discounts, cashback, and referral programs, making them more appealing.

Top Crypto Debit Cards

Here are some top picks for the best crypto cards available today.

Coinbase Card

The Coinbase Card enables Coinbase customers to immediately access their account funds and serves individuals in the UK, Spain, Germany, France, Italy, Ireland, and the Netherlands.

The Visa card is linked with a Coinbase user’s crypto balance, converting cryptocurrency to fiat at the time of purchase.

| Coinbase Bitcoin Debit Card | |

| Availability | UK, Selected EEA |

| Supported Currency | EUR, GBP, BTC |

| Card Options | Physical |

| Card Type | Visa |

| Fees | Medium |

| Native Token | No |

| Perks/Bonuses | No |

Compatible with any merchant accepting Visa, the card allows for contactless, Chip and PIN transactions, as well as ATM withdrawals. Users can spend from all supported cryptocurrencies like BTC, BCH, ETH, and LTC, alongside GBP and EUR.

Available for iOS and Android, the mobile app features instant receipts, transaction insights, and spending categorizations.

Fees, Limits, and Incentives

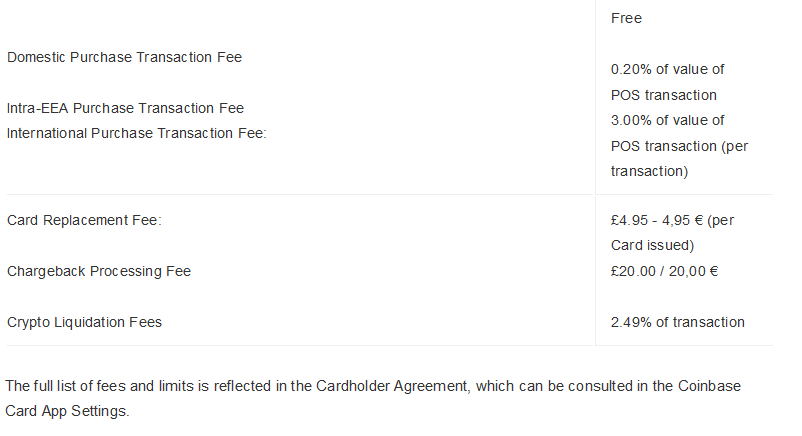

Aligning with Coinbase’s transparent business model, the card includes a £4.95 issuance fee. No fee is incurred for domestic purchases, although 0.20% applies to intra-EEA purchases, while international ones are charged 3.00%.

Free domestic (ATM and OTC) cash withdrawals are capped at £200 monthly, with a 1% fee if exceeded. Likewise, international cash withdrawals are charged 2% if above £200 a month.

Keep in mind Coinbase charges a 2.49% liquidation fee per transaction due to the conversion of digital assets. Although competitive, the card imposes daily ATM and spending limits of £500 and £10,000, respectively, and annual purchase limits stand at £50,000.

While lacking significant incentives, the launch lifted the £4.95 issuance fee for the first 1,000 waitlist members.

The Coinbase card appeals to existing users seeking an easy-to-access way to convert on-platform funds into spendable currency. Coinbase’s reputable, transparent nature balances somewhat higher fees compared to other available cards, yet a Coinbase account is compulsory for use.

Wirex

While based in London, Wirex offers diverse personal and business crypto solutions, with bases in Kiev, Ukraine, and Tokyo, Japan.

As one of the well-established players, boasting $2 billion transaction volume and nearly 2 million clientele, Wirex provides a contactless Visa solution integrated with credit/debit cards, facilitating crypto storage and Bitcoin/altcoin purchases at favorable rates.

| Wirex Bitcoin Debit Card | |

| Availability | EEA |

| Supported Currencies | USD, EUR, GBP, BTC |

| Card Options | Physical/Virtual |

| Card Type | Visa |

| Fees | Low |

| Native Token | WXT |

| Perks/Bonuses | 0.5% Cryptoback |

Inter-currency exchanges are feasible, with minimal fees on money transfers. Supported cryptos involve BTC, LTC, ETH, XRP, XLM, DAI, NANO, and WAVES, while fiat supports GBP, EUR, and USD.

You can conduct seamless exchanges between these currencies using real-time prices and rates. Setting up a Wirex account, then funding it via bank transfer, credit/debit card, or cryptocurrency is needed.

Segmented wallets for different cryptocurrencies and card options in GBP, EUR, or USD are available. GBP users access a Visa card with bank details, unlike USD and EUR that offer prepaid cards.

Fees, Limits, and Incentives

Wirex operates a generally low fee provides many fee-less functions. No charges for top-ups or transactions, including in-store or online purchases, exchanges, or Wirex transfers.

Besides, card issuance and deliveries are free, with no mobile app fees, though a monthly card management fee of approximately £1.00/€1.20/$1.50 applies.

Generally, card usage incurs no hidden fees beyond service/product charges or exchanges, yet ATM use is charged around £1.75/€2.25/$2.50 in Europe and £2.25/€2.75/$3.50 abroad, with a 1% monthly maintenance fee.

Wirex sets certain caps on its transactions, such as a purchase ceiling of £7500, €8000, or $10,000 whether you're buying online or in person. If you're looking to get some cashback while shopping, you're capped at £50 a day. For ATM enthusiasts, withdrawals max out at £250, €250, or $250 daily. If you're a crypto aficionado, there's a transfer limit at 10 BTC each day, and topping up with your credit or debit card is limited to £5,000, €5,000, or $5,000 every day. Remember, the card balance should not exceed £15k, €16k, or $20k.

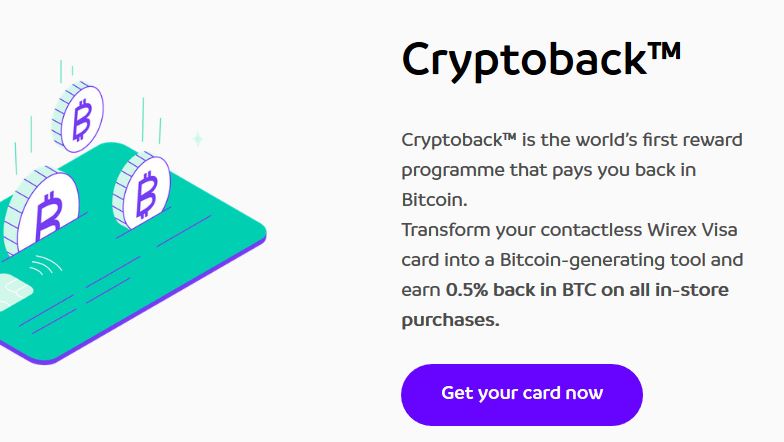

Through Wirex's Cryptoback Reward Program, each time the Visa debit card is swiped, crypto rewards come into play! Imagine getting back 0.5% in Bitcoin every time you foot the bill—how neat is that?

Whenever you spend using the card, the Bitcoin rewards roll in automatically. No waiting, no hassle—they are immediately ready for you to use or convert however you fancy. Wirex decided to sweeten the deal with a WXT Token discounted fee structure and even boost your Cryptoback to a rewarding 1.5%.

For fans of spending at any place that waves the VISA flag, Wirex offers a decent solution. Its wide array of supported currencies and attractive exchange rates make it a traveler's ally. Sadly, our friends across the pond in the US will have to wait, as Wirex directs its energies toward the European scene, though ambitions for expansion into the US and Asia are on the horizon.

Read our full Wirex Review here.

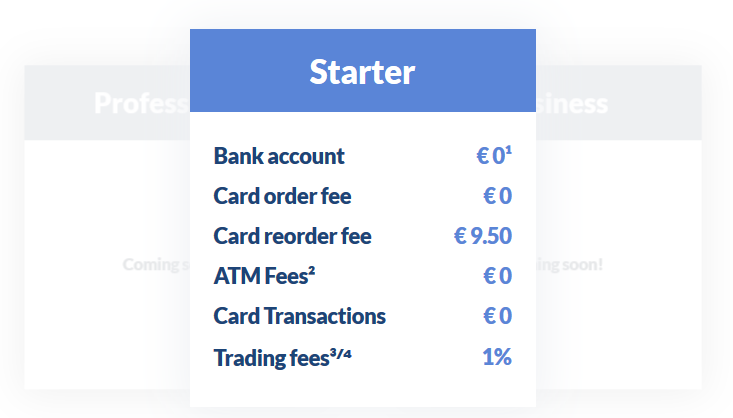

Revolut

Revolut is truly shaking things up in the fintech world, revamping how mobile banking is done through their innovative app. Available services cater to folks in the EEA, Switzerland, and Australia. Beyond just banking, they've boldly dipped their toes into cryptocurrency waters, giving UK customers the chance to buy digital currencies.

To jump on board, you might want to look into their subscription plans. The Premium bundle is tagged at £6.99 or €7.99 monthly, while the Metal tier seeks £12.99 or €13.99 each month.

These plans open up access to the platform's digital assets portfolio, allowing users to purchase not just Bitcoin, but also Ethereum, Bitcoin Cash, Litecoin, and Ripple. Revolut adopts a standard rate policy and tacks on a 1.5% surcharge on purchase amounts.

The process of buying or selling cryptos It's all about speed and convenience—the app lets you manage everything with just a click. No long waits when sending cryptos to fellow Revolut users, and buying with your cryptocurrencies is a breeze thanks to the automatic conversion into your local currency via a Revolut card.

While it offers convenience, Revolut isn't for everyone. The absence of private keys means you won't have complete autonomy over your crypto assets, as it is all under Revolut's custodianship. This might rub some crypto purists the wrong way, who may not see it as authentic Bitcoin ownership.

Nonetheless, the app comes packed with attractive features like UK and Euro IBAN accounts, complimentary virtual cards, overseas medical insurance, unlimited foreign exchange transactions, and insurance for flight and baggage delays. There's also a word-of-mouth campaign and discount offers to bring more users on board, potentially amplifying the closed system's utility for sending cryptos to friends and family.

BitPay

BitPay is yet another player in the field, starting their journey back in 2011, and they have charmed over 10,000 merchants in their network. BitPay dishes out a prepaid Visa card for American users, easily reloadable through their Bitpay account.

The BitPay debit card functions seamlessly within all 50 US territories. Global acceptance is part of the package, allowing users to shop at any place where Visa is honored.

Whether you're topping up your account with cryptos or through direct debit and ACH transfers, BitPay supports both Bitcoin and Bitcoin Cash, maintaining balances in US dollars.

| BitPay Bitcoin Debit Card | |

| Availability | USA |

| Supported Currencies | USD, BTC |

| Card Options | Physical/Virtual |

| Card Type | Visa |

| Fees | Low |

| Native Token | No |

| Perks/Bonuses | No |

Since BitPay is crafted for US citizens only, users need to show some papers: a government-issued ID, proof of residence, and a valid Social Security number. On the business side, BitPay offers seamless integration of Bitcoin for day-to-day operations.

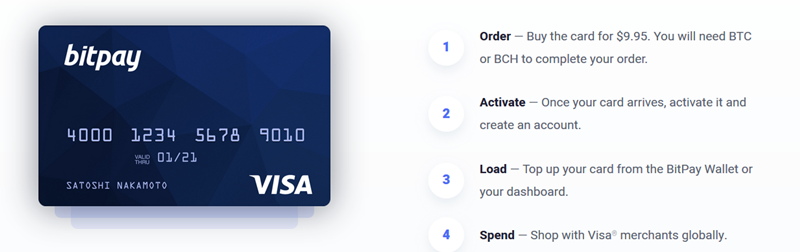

Fees, Limits, and Incentives

The fee structure sets BitPay apart with its affordability. But there's a small price to pay—the card itself costs $9.95 and takes about a week to arrive. There are no transactions or maintenance fees, though a $2 charge applies to ATM and over-the-counter cash outs, stepping up to $3 if abroad. Much like Wirex, transaction fees are waived for the majority, but an ACH deposit will incur a $5 toll.

Whenever purchases or payments take place outside US boundaries, a 3% fee makes its appearance, credited to currency conversion expenses. For those who don't actively use their card, a dormancy fee of $5 monthly checks in after 90 days of inactivity, continuing each subsequent month of inertia.

Each day, the account/card is limited to $10,000 for loads and purchases, though you can only withdraw $3000 in cash and $750 per transaction. Transfers between cards hit a $500 daily limit with an overarching card balance cap of $25,000.

BitPay currently doesn't run any extra incentive schemes, so cashbacks and discounts aren't on the menu; nevertheless, it's a solid choice for US residents.

BitPay enjoys a robust reputation in the Bitcoin transaction processing domain, proudly offering cards recognized globally. However, with its focus strictly on American clients, and a lack of unique incentives, the offering is best for those seeking a straightforward, dependable Bitcoin payment pathway.

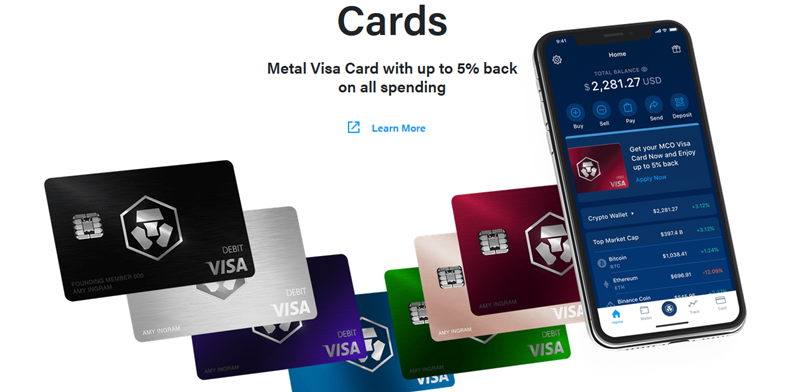

MCO Visa

The MCO Visa debit card caters to the more committed crypto devotees, with a wide swath of card choices, digital currencies, rewards, and perks included.

After shifting brands from Monaco to Crypto.com, this Asia-based venture also features a mobile wallet. This app lets users buy, trade, and manage both fiat and cryptocurrencies and introduces a unique crypto credit service, where one can deposit their digital currencies against a credit with the MCO Visa Card.

| MCO Bitcoin Debit Card | |

| Availability | Singapore/USA |

| Supported Currency | USD, BTC |

| Card Options | Physical |

| Card Type | Visa |

| Fees | Low |

| Native Token | MCO |

| Perks/Bonuses | Cashbacks & Discounts |

Although initially focused on Singaporeans, the service also extends to select US states, counting a total of 37. Supported currencies include familiar names like BTC, BNB, ETH, LTC, XRP, and MCO, as well as a range of fiat currencies like USD and EUR. Users can fund accounts using ACH or IBAN transfers through the MCO mobile app. New users will need to submit their full legal name, a photo of a government-issued ID, and a selfie for verification purposes.

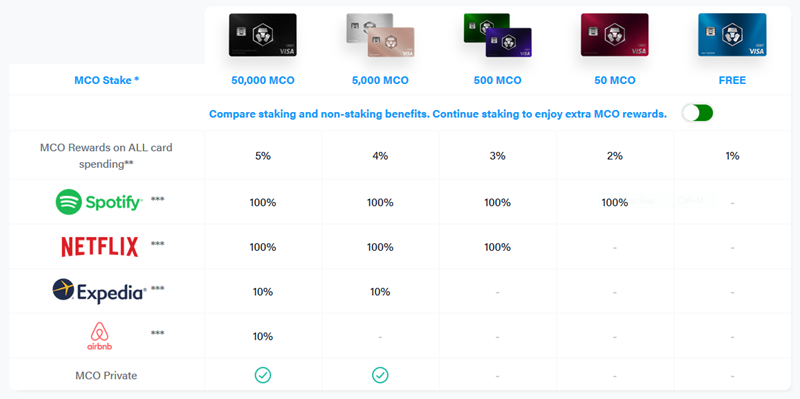

Fees, Limits, and Incentives

With five MCO card types on offer, the benefits depend on which card you hold. Fees and limits vary across the spectrum—from the minimalist Midnight Blue to the elite Obsidian Black card. The Midnight Blue card offers $200 in monthly free ATM access, bumping up to $1,000 with the Obsidian Black card. Cross those limits and a 2% fee is applied.

Interbank exchange rate limits range from $2,000 to unlimited, depending on the card tier. Exceed these thresholds, and a little 0.5% fee comes into play. All details about card limits and fees can be found under the 'Fees & Limits' section in the app's settings.

The MCO card excels with its assortment of incentives and rewards; there's no cost for shipping, setup, monthly upkeep, or even annual fees when you hold MCO tokens. Users who lock or 'stake' MCO tokens unlock premium advantages ranging from 1% to 5% cashback on purchases, with up to 10% on platforms like Airbnb and Expedia, and a whopping 100% for spenders on Spotify and Netflix.

For those interested, the lockup stakes vary from 0 to 50,000 MCO, with a pledge to purchase staking them for 6 months.

The MCO option is particularly viable for those eager to explore widely different currencies and indulge in staking. Frequent travelers who want to benefit from cashback programs will find it a snug fit.

Here's a card shining with stellar rewards, yet for now, it's a privilege mainly for Singaporeans. The service plans to roll out gradually, reaching the US, and later, it’s expected to extend its reach into the European Union and Canada.

Cryptopay Card

Cryptopay offers a convenient gateway for Bitcoin purchases via bank cards and stores your BTC on an easy-to-use mobile wallet. Since its inception in 2013, this provider has grown to house over 90 employees, with offices spanning London, Lisbon, and St. Petersburg. Cryptopay also rolls out the C.Pay card, syncing with users' Bitcoin wallets, enabling them to spend like they would with any regular credit card.

Geared mainly for the European crowd, Cryptopay allows customers to order cards in EUR, USD/GBP, and RUB, virtual or physical. It’s quite straightforward—just convert your Bitcoin Wallet funds to a supported fiat currency, then load it onto your C.Pay Prepaid Card.

| Cryptopay Bitcoin Debit Card | |

| Availability | EEA |

| Supported Currencies | USD, EUR, GBP, BTC |

| Card Option | Physical/Virtual |

| Card Type | N/A |

| Fees | Medium |

| Native Token | No |

| Perks/Bonuses | No |

For those keen to get a prepaid card, funding your Cryptopay account with currencies like Pounds, Dollars, Euros, or Bitcoin is a prerequisite. The order process follows.

Fees, Limits, and Incentives

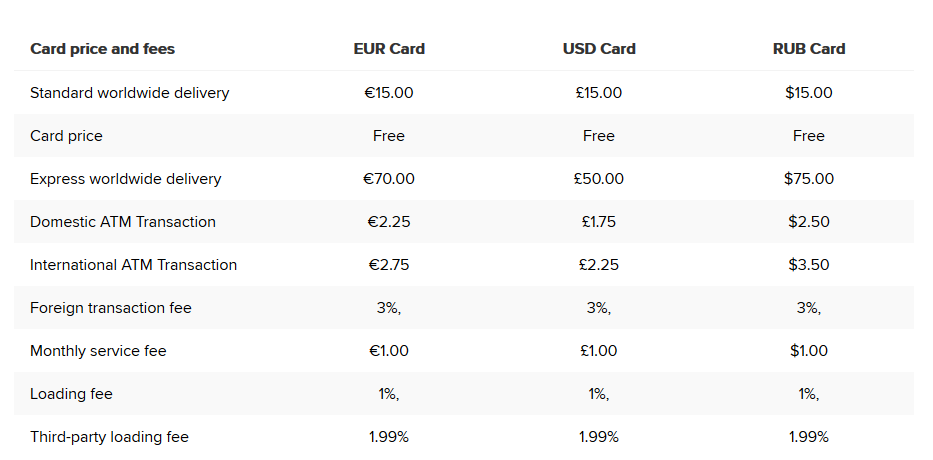

For those opting for the physical card, the cost is €15/$15/£15, while the virtual version is priced at €2.50/£2.50/$2.50. Both options incur a foreign transaction fee of 3%, with loading incurring a 1% fee and another third-party fee adding another 1.99%.

The fees associated with your card can differ based on the type you hold, and there's a standard monthly service fee of around €1, $1, or £1. Cryptopay operates with two levels of verification, where those who have not verified their accounts can only make purchases up to $1,000, €1,000, or £800.

If you've completed the verification process, you're able to add up to $10,000, €10,000, or £8,000 in one transaction, and your daily maximum load is double that amount. You can fund your card as often as you like each day, enjoy unlimited lifetime loads, and there are no restrictions on the value of online transactions.

Plastic cards come with a fee for ATM withdrawals domestically at €2.25, £1.75, or $2.50, and internationally it's €2.75, £2.25, or $3.50. The same spending limits apply to unverified physical cards as virtual ones, with a single ATM limit of €200, £160, or $200, and a daily cap of ATM withdrawals at €400, £320, or $400, which increases substantially to €1,000, £800, or $1,000, and €2,000, £1,600, or $2,000 for those verified.

The limits set for users who have verified themselves regarding single top-ups, the maximum they can load daily, how frequently they can load in a day, as well as the amount for online transactions, mirror that of the virtual card verified users. Moreover, once verified, the number of allowed ATM transactions ascends from two to five every day.

Cryptopay might not boast any standout perks or bonuses, yet it remains a viable pick for those residing in Europe. The unverified option can be handy for some, while verified users can transfer unlimited amounts online without worrying about reaching a load cap.

Nonetheless, the service fees might be a tad higher compared to other choices, and note that the charges for cards in the USA are indicated in Pound Sterling. The service doesn't currently extend to users in the United States or Asia, though there's a plan in the works to expand into Singapore soon.

SpectroCoin Prepaid Card

SpectroCoin The platform acts as a hub for exchanging and processing cryptocurrency payments, giving its users the ability to acquire a selection of cryptocurrencies and manage them through its mobile wallet. From its base in Lithuania, it extends pre-paid cards in both EUR and USD, facilitating exchanges of BTC alongside various other digital currencies like ETH, DASH, and USDT, allowing users to spend using the card.

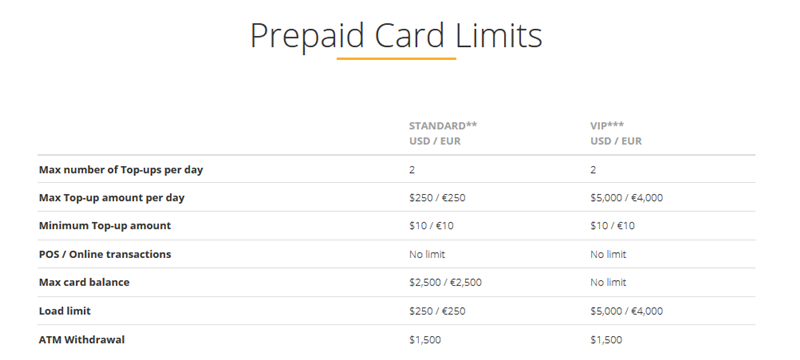

Firm on regulations, users must go through verification. There are standard and VIP card options; gaining VIP status means you'll need to submit a passport or ID, plus a utility bill.

| SpectroCoin Bitcoin Debit Card | |

| Availability | UK/EEA |

| Supported Currencies | USD, EUR, BTC |

| Card Options | Physical/Virtual |

| Card Type | N/A |

| Fees | Medium |

| Native Token | No |

| Perks/Bonuses | No |

Facilitated by CreditCard Solutions UK Ltd, the SpectroCoin Prepaid Card Program targets cryptocurrency enthusiasts throughout Europe, aiming to make it accessible and accommodating.

Fees, Limits, and Incentives

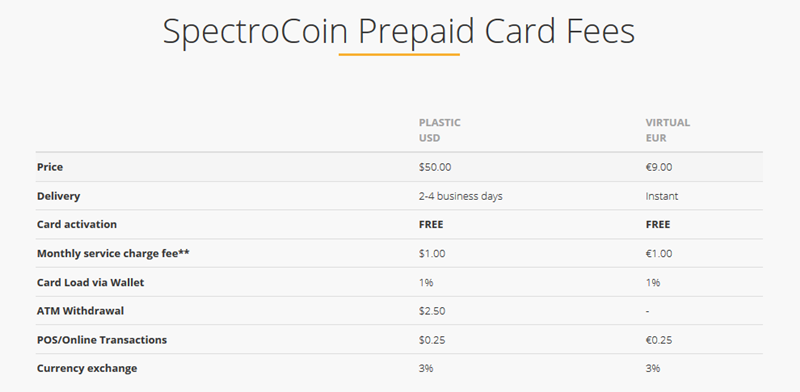

You're offered both tangible and virtual Bitcoin debit card options, though acquiring a physical dollar card means parting with $50, with a delivery timeframe of roughly two to four days. Alternatively, the Euro virtual card is instantly generated and available at a cost of €9.

A monthly service fee of $1 or €1 does apply, but it’s waived if your card balance reads zero. Loading your card through your wallet incurs a 1% fee, and purchases, whether at a point of sale or online, include a $0.25 or €0.25 fee, with a 3% charge for any currency conversions. Withdrawals from ATMs will set you back $2.50.

As already highlighted, each SpectroCoin user is required to fulfill KYC procedures to activate the card, with the standard card offering a daily top-up and load capacity of $250 or €250, maintaining a maximum card balance at $2,500 or €2,500.

While ATM withdrawals max out at $1,500, users enjoy zero limits on POS and online transactions. By opting for a thorough verification and VIP status, the card limits elevate to a $5,000 or €4,000 daily top-up, preserving the same loading boundaries, however, while online transactions remain limitless, ATM withdrawals still cap at $1,500.

Being KYC verified is a strict requirement for SpectroCoin debit cardholders; nonetheless, the daily deposit cap stays at $250. Elevating your limits to $5,000 is achievable, but only after receiving VIP status by submitting necessary identification documents.

The SpectroCoin prepaid card stands out as a solid choice for people across Europe, yet the team isn’t aggressively pushing any promotions or offers at the moment to sway customers away from competitors like the Coinbase card.

Nevertheless, the project's transparent operations and commitment to compliance should appeal to anyone willing to submit necessary identification for a VIP card, which removes balance caps and offers unlimited POS/online transactions.

For those needing swift access to their funds for online purchases, the option of an instantly generated virtual card could certainly prove beneficial.

Bitwala

Bitwala Another notable European cryptocurrency exchange, providing the opportunity to acquire and sell Bitcoins, is working with Solaris Bank from Germany to facilitate secure crypto and fiat transactions. Highlighted is the feature of SEPA transfers, and the ability to make payments via a MasterCard debit card.

While it may not be accessible to US residents currently, any adult residing in the EEA with valid ID and proof of address can create a Bitwala account.

Emphasizing safety, Bitwala ensures deposits up to €100,000 are under the safeguard of the German Deposit Guarantee Scheme, showcasing their dedication to security and trust.

| Bitwala Bitcoin Debit Card | |

| Availability | EEA |

| Supported Currencies | EUR, BTC |

| Card Option | Physical |

| Card Type | MasterCard |

| Fees | Low |

| Native Token | No |

| Perks/Bonuses | No |

Designed for convenience, the contactless Bitwala debit card allows seamless conversion of cryptocurrency balances to Euros, supports online and offline purchases, and enables easy ATM withdrawals.

Fees, Limits, and Incentives

Currently, one card is permitted per account, which operates under a fairly low-fee structure. Ordering a new card comes at €9.50, but all transactions and ATM withdrawals carry no charge from Bitwala. Nonetheless, some ATMs may apply fees, which users should verify before proceeding.

Bitwala charges a 1% fee for trading, converting BTC holdings when using the card may accrue this fee with each action. Detailed pricing structures are available for transparency. here .

Bitwala puts daily and monthly expenditure restrictions in place — now set at €1,500 daily for online and offline with potential adjustment to €5,000 and €3,000 respectively. ATM withdrawals are capped at €3,000 daily, enforcing a monthly limit of €10,000 across all transactions.

Currently void of targeted promotions, Bitwala offers no-fee accounts and positions itself as a cost-effective card option. Its limitations include non-US availability and only EUR/BTC transactions, but for those within the EEA, it's a robust choice.

Nexo

Emerging as a fresh platform, Nexo brings a distinctive offering—borrow against your crypto as security, permitting the receipt of cash while retaining ownership of your digital assets which return post-loan settlement.

For many, it's an attractive concept, presenting a chance to keep cryptocurrency while avoiding taxes like Capital Gains on sale avoidance.

It scores highly in user-friendliness with sign-up taking mere minutes, allowing prompt depositing initiation.

For card spenders, Nexo proposes a complimentary Mastercard, enabling global money access without any monthly maintenance or foreign exchange fees.

Users can track transactions through the integrated mobile app, with an added bonus of 5% cashback incentives on expenditures.

Read our full Nexo Review here .

Highly recommended!

Conclusion

Despite challenges faced following the WaveCrest/Visa dilemma, prepaid debit card solutions for Bitcoin are available. Each person’s ideal choice depends on cost, location, and the currencies supported.

In both the US and Europe, Bitcoin devotees find themselves well accommodated with card options. Bitpay is a long-standing, trustworthy alternative in the US, while the EU's Coinbase card requires sign-up to their exchange for use. Concurrently, Cryptopay remains a viable backup option.

Cryptopay offers unverified EUR cards, permitting a total spending and load capacity of €1,000 and allowing ATM withdrawals up to €400 each day without needing full KYC.

If consistency in spending, plus bonuses like cashback, staking, or comprehensive altcoin backing appeals, MCO Cards from Crypto.com are worth exploring. They offer an expansive variety of loyalty schemes specially tailored to keep dedicated users engaged.

For those preferring simplicity, the Wirex card remains accessible, facilitating crypto expenditures with cashback incentives and reduced charges through WXT token engagement.

Given regulatory ambiguity around Bitcoin debit cards, top options should blend availability, security, and reliability, granting user satisfaction without hassle. Seek the card fitting your requirements, keeping updated with news to assure optimum service.

7Comments

Fantastic job, folks! Blockonomi is truly exceptional.

BITWALA stands out as my top choice among Bitcoin cards.

In addition to holding the card, I also maintain an actual bank account. The service offers low fees and high transaction limits, catering perfectly to my needs!

Thanks to offering minimal fees and a complimentary bank account, Bitwala comes out on top.

Paycent (PYN) cards can be ordered worldwide! It stands out as the ONLY card issuer that ships globally using FedEx, DHL, and others. Plus, it offers staking rewards and a free card after a month of staking. Currently listed on Binance DEX.

Is there a viable option for residents in South America?

I use “Wirex” and “crypto.com (MCO)”

Wirex proves to be highly functional and user-friendly, though the updated app has been disappointing—just one of life's minor setbacks.

Crypto.com has proven to be a frustrating venture—over a month’s delay for my card with no resolution in sight.

They informed me that my card’s delay was due to software issues, which, they claim, have been resolved. Despite this, my card still hasn't arrived even after two weeks.

No cards available for South American users? Is there even one option out there you know of?

All the cool toys are in NA/EEA 🙁

There’s no option for Africa