A recent CBS News report Insights have revealed that the energy consumption linked to Bitcoin mining surpasses that of over 159 nations on an annual scale.

This sparked a heated debate: is this level of energy expenditure ethical, reckless, or justifiable? An observer without a vested interest might find it excessive, whereas cryptocurrency advocates might view it as essential.

The increased awareness around fossil fuel consumption due to climate change has added another layer of importance to this discourse.

We aim to provide you with the necessary insights to form your own opinion on the subject.

An Introduction to Monitoring Tools: The Digiconomist Index

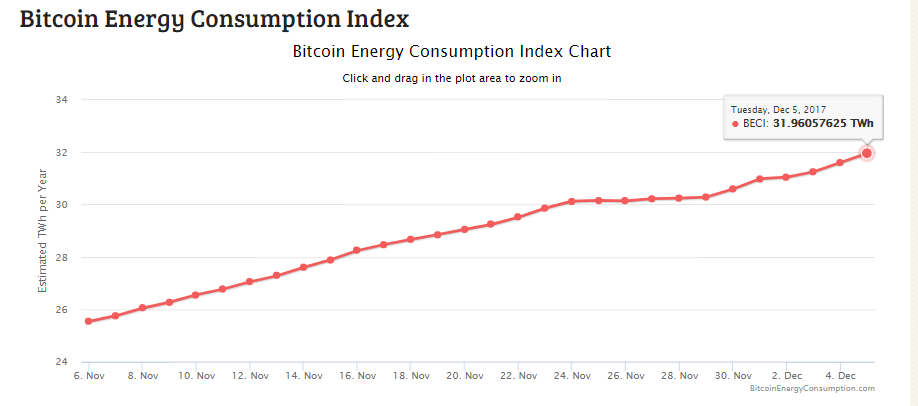

The Digiconomist “ Bitcoin Energy Consumption Index The Digiconomist stands out as a frequently cited source for Bitcoin-related energy statistics.

Examining the significant implications of these metrics based on the latest data.

Currently, the Bitcoin network's energy use is poised to exceed 31 TWh annually, with growth showing no sign of slowing. This trend is demonstrated through the continuously ascending graph.

Key stats highlighted by the index include:

- 87,563,223 KWh electricity used by the network over previous day

- 250 KWh utilized per Bitcoin transaction

- $10 billion USD generated globally annually by mining activities

- 0.14%: Bitcoin's share of the world’s total energy consumption

Clearly, the booming cryptocurrency industry relies on considerable energy.

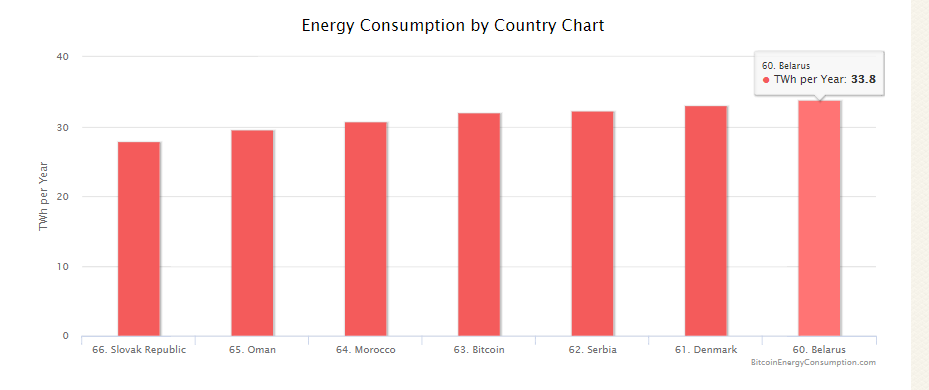

Bitcoin's Energy Consumption Rivals That of Entire Countries

The Bitcoin network’s surging use in recent months Bitcoin's energy demand has escalated to levels akin to those of nation-states, rather than just a decentralized digital currency.

Currently, Bitcoin ranks as the 63rd largest global energy consumer, nestled between Morocco and Serbia.

Since Bitcoin's popularity soared to mainstream heights in late 2017, its energy consumption is expected to continue climbing globally in 2018, potentially at an accelerating rate.

The Energy Bitcoin Uses Could Power U.S. Homes; A Thought-Provoking Comparison

To better comprehend the magnitude of energy use by Bitcoin, consider how many American homes such consumption could power.

For example, over 2,959,000 U.S. homes could be run on the amount of energy BTC’s demanding now.

For instance, each Bitcoin transaction currently demands energy equivalent to what powers over 8 U.S. households for a day.

The figures are alarming and have raised environmental concerns about Bitcoin’s impact in mainstream discourse.

These negative perceptions are undesirable for the Bitcoin community, already embroiled in debates over scalability and governmental regulations.

Unpacking the Cause of Bitcoin’s Energy Demand

One thing: the Proof-of-Work (PoW) consensus mechanism is integral to Bitcoin's operation.

In simple terms, Bitcoin's PoW structure necessitates substantial energy use by miners aiming to earn block creation rewards.

As a result, PoW promotes continuous block production efforts, contributing to existing high energy demands.

Yet, is this energy scenario as bleak as it appears?

Rebuttals To Consider

Counterarguments ensure the BTC energy controversy remains unresolved.

A sharp critique in the New Republic claimed argued that Bitcoins worsen global warming without delivering notable public benefits.

While it's arguably correct that Bitcoin hasn't achieved widespread public benefits yet, the key term here is 'yet'. Defining public benefit is inherently subjective.

Judging a tool by its current underutilization rather than its potential is misguided. Innovative tools shouldn't be dismissed prematurely.

And it only takes a few minutes A series of lectures from Bitcoin scholar Andreas Antonopoulos highlights Bitcoin as a revolutionary milestone, comparable to historical innovations like the printing press.

Bitcoin’s permissionless ledger represents unprecedented freedom, enabling direct, censorship-resistant transactions without intermediaries.

Such innovation promises new forms of wealth creation within the crypto economy.

If the substantial energy demand ensures this 'public benefit', perhaps the expense is justifiable.

However, another counterpoint is that other sectors also consume significant energy, suggesting the critique of Bitcoin is exaggerated.

This focus on BTC's consumption is perhaps a defensive tactic as traditional entities feel threatened by Bitcoin's rise.

Given Bitcoin's position as a key global currency, its energy use might be justified. Consider the energy involved in printing global fiat currencies, a seldom asked question.

Proof-of-Stake (PoS) A Possibility?

An alternative to Proof-of-Work is Proof-of-Stake a mechanism where block validation requires coin holding rather than energy-intensive mining.

PoS would address environmental concerns by reducing electricity demands, thereby limiting fossil fuel reliance and aiding climate change mitigation.

Is a PoW-to-PoS shift feasible for Bitcoin? Theoretically, yes.

Will it anytime soon? Not a chance.

However, transforming Bitcoin’s existing PoW to PoS would entail complex challenges. Future changes remain speculative.

Pushing for a Greener Future Through Widespread Renewable Energy Adoption

The current problem stems from fossil fuel reliance, detrimental to the planet.

Adopting renewable sources like wind, solar, and hydro could enable Bitcoin mining without environmental repercussions.

Transitioning to cleaner energy sources is crucial. Renewable advancements may ultimately preserve Bitcoin's future. Time will tell.