TLDR

- With outflows totaling $5.4 billion over five consecutive weeks, Bitcoin ETFs have nearly depleted the gains made earlier in 2025.

- BlackRock's IBIT led the charge in withdrawals with $338.1 million, trailed by Fidelity’s FBTC, which faced $307.4 million in outflows.

- Bitcoin's price took a hit, dropping 11.95% in the past month, leading investors to lose confidence.

- Ethereum ETFs also aren't faring well, as they faced outflows of $189.9 million in just the past week.

- Asset managers are eyeing alternative ETFs focusing on cryptocurrencies like Litecoin, Ripple, Solana, and Dogecoin.

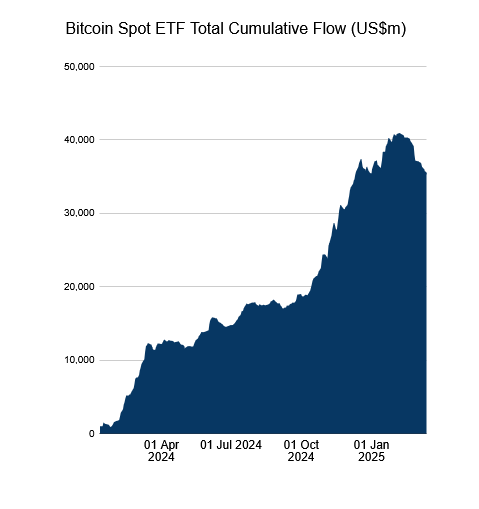

Kicking off 2025, Bitcoin ETFs are getting battered as investors consistently pull out funds for the fifth week, leading to a total of $5.4 billion in withdrawals.

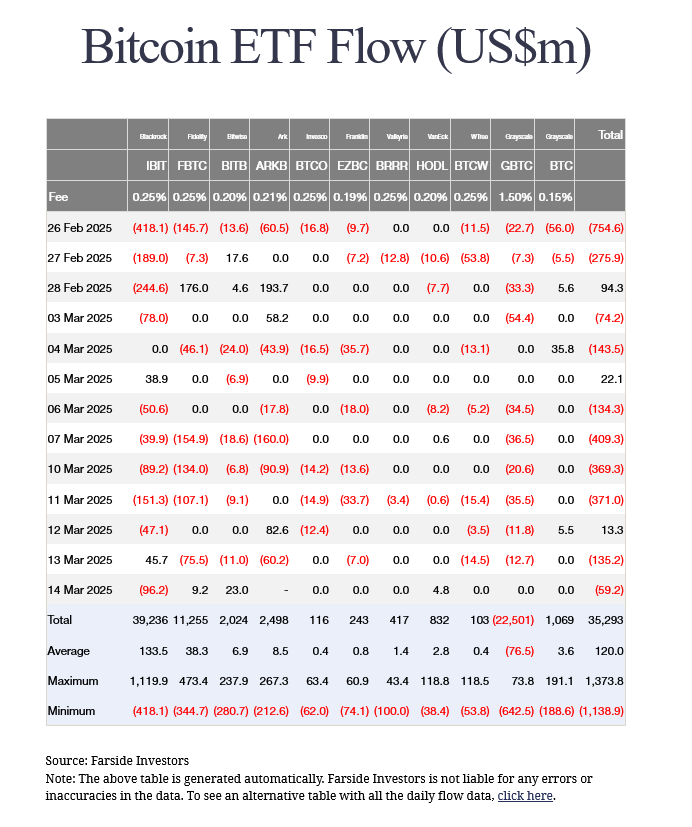

BlackRock’s IBIT fund experienced significant withdrawals last week, amounting to $338.1 million, with Fidelity’s FBTC not far behind at $307.4 million.

Other Bitcoin ETFs, including Ark’s ARKB and Invesco’s BTCO, have also seen noticeable outflows, ranging from $33 million to $81 million.

Despite the trend, Bitwise’s BITB, Valkyrie’s BRRR, and VanEck’s HODL maintained smaller outflows, each under $4 million. Surprisingly, Grayscale’s BTC managed to draw in $5.5 million.

Bitcoin ETF outflows have nearly erased the year’s initial inflows, leaving the current net balance at $35.20 billion, close to the figure recorded at the start of 2025.

February proved harsh for Bitcoin ETFs, with only a handful of days showing positive inflows. March appears even harsher with only one positive day recorded.

Since their surge in late January, the total value of Bitcoin ETFs has plummeted by nearly 25%, although a slight recovery in AUM has been observed due to a 10% bump in Bitcoin’s price.

Yet, even with this price rise, outflows continue. On March 11th, Bitcoin ETFs experienced $371 million in net outflows, marking the seventh consecutive day of withdrawals.

Recent Bitcoin ETF outflows seem to be tied to Bitcoin's price drop, which has slumped by 11.95% over the past month, hitting bottom at $77,000 while currently priced around $84,009.

As prices fall and outflows persist, the total net assets of Bitcoin Spot ETFs have diminished by 21.70%, now amounting to $89.89 billion. according to SoSoValue data.

Ethereum ETF Flows

Ethereum ETFs confront their own struggles too, with $189.9 million in net outflows noted last week. This marks a continuous three-week withdrawal period.

Ethereum ETFs have experienced $645.08 million in outflows during this three-week span, with BlackRock’s ETHA leading withdrawals, reporting $63.3 million.

Currently, Ethereum ETFs hold $2.52 billion in investments with a total net asset value of $6.72 billion, representing 2.90% of Ethereum's market capitalization. Ethereum's price saw a slight uptick to $1,924 in the past day.

Other Assets

As Bitcoin ETFs battle to remain relevant, the focus shifts to altcoin ETFs. Asset managers are crafting options for other top cryptocurrencies like Litecoin, Ripple, Solana, and Dogecoin.

These altcoins are gaining traction with investors, and ETFs centered around them could offer worthy alternatives to traditional Bitcoin funds. Potential inclusions also cover assets like Polkadot, Axelar, and Avalanche.

By initiating altcoin ETFs, there's a visible move towards diversifying beyond Bitcoin. Analysts foresee Litecoin, Ripple, Solana, and Dogecoin as frontrunners for ETF approval, given their established market standing and substantial investor interest.