Right now, Bitcoin futures contracts are creating buzz both among cryptocurrency enthusiasts and traditional investors.

The reason? These contracts have the ability to dramatically reshape both environments. Stick around, and we’ll dive into the nitty-gritty.

First Off: What Are Futures?

Futures contracts are speculative hedging tools. Essentially, when you buy a futures contract, you’re wagering on where the price of a commodity or asset will stand in the future.

After getting into a contract, they’re tradable on futures markets with other interested parties.

Futures can encompass a wide range of assets, such as:

- wheat

- corn

- gold

- oil

- currencies

- interest rates

- stock market indexes

- and now bitcoin!

Need an example? Here's a simple illustration:

Imagine you’re growing corn, and your farm's financial health depends on the weather. By shorting corn futures, you safeguard your operations against drought.

If the drought stays away, you'll eat the loss but gain from your robust harvest.

However, if a drought does hit, being short means you profit from the price dip, ensuring your stable financial footing. This is just one way futures serve their purpose.

Why Bitcoin Futures Carry Weight

What makes Bitcoin futures crucial? Two core reasons.

One, bitcoin futures offer investors their first legitimate route to bet against the Bitcoin price. Beforehand, you could primarily bet on the price rising. Now, all kinds of market movements are open for profit-making.

Secondly, they give major financial institutions, which handle trillions yearly, the means to engage with cryptocurrency, giving an air of maturity and acceptance to Bitcoin.

Remember, a few years back, bitcoins were worth next to nothing, and now financial juggernauts are getting involved—it's a landmark that hints at more acceptance milestones ahead.

Simply put? Bitcoin is stepping into the mainstream spotlight.

Biggest Benefit? An Insurance Policy for Miners

Revisiting the corn futures scenario—and applying it to Bitcoin miners—presents an exciting potential use case.

Let’s break down the gist of the idea:

Bitcoin miners bear their next month's costs in—you guessed it—bitcoins. Thus, any steep price dive could pose financial challenges.

That's when a bitcoin futures contract could be a lifesaver. By shorting Bitcoin, miners could secure payouts to maintain their operations even if Bitcoin prices nosedive.

It’s proven financial wizardry, right?

CME Group, Inc. is aiming to be the first in the field.

On October 31st, the Chicago Mercantile Exchange (CME) revealed its plan to start bitcoin futures trading by December 2017.

This move marked CME as the inaugural exchange of its kind entering the world of cryptocurrencies.

A major leap for Bitcoin’s reputation, given that CME is a global leader in derivatives and futures. Bitcoin futures couldn’t have found a more reputable marketplace.

Soon after, more institutions followed suit, starting with their own announcements.

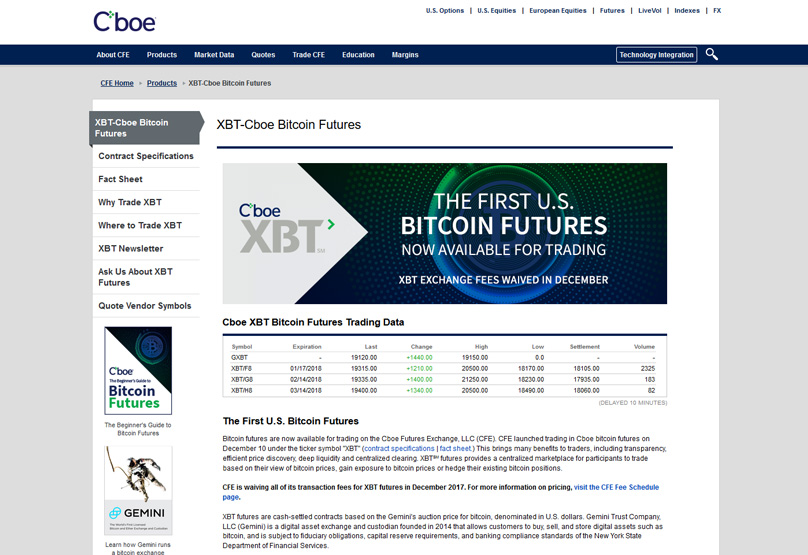

Cboe Follows Suit

Quickly, the Chicago Board Options Exchange (Cboe) echoed CME's announcement to introduce bitcoin futures that December too. They’re live as of now, but that’s a story for another time.

The Cboe futures now trade under the code XBT .

For price benchmarks, the exchange will utilize the Gemini Bitcoin Exchange, owned by the Winklevoss twins.

CFTC Approves Trio of Exchanges for Bitcoin Futures

As a top regulatory authority, the U.S. Commodity Futures Trading Commission (CFTC) has substantial control over the fate of Bitcoin futures.

Luckily, in early December, the CFTC reassured investors against potential crackdowns by allow allowing the CME, Cboe, and Cantor Exchange to self-certify their bitcoin futures products.

In other words: game on.

As CFTC Chairman J. C. Giancarlo stated:

\"Bitcoin is a unique asset like no other the Commission has managed before. This led to numerous discussions with exchanges about the contracts, and CME, CFE, and Cantor committed to substantial upgrades to safeguard customers and keep markets steady.\"

NASDAQ and TD Ameritrade Want In

Second to no one but the NYSE, NASDAQ is poised to roll out its BTC futures, following CME’s and Cboe’s footsteps.

The more the merrier, right?

However, these financial giants aren’t resting. They're promising futures that outshine competitors, ushering more accuracy.

Nasdaq Image from Business Insider

And speaking of financial moguls, TD Ameritrade is diving in as well, crafting its BTC futures offerings. The trend's momentum suggests a flood of ventures from companies of all sizes.

The herd is coming, as it were.

First Trading Day Was Eventful

The Cboe kicked things off with its bitcoin futures on December 10th, 2017, but the rush caused some website hiccups, showcasing just how high intrigue was.

Trading quickly gained momentum. Although cautious in the beginning, trade volume grew as investors warmed to this novel financial tool.

A major pre-launch fear was that the futures might devalue Bitcoin's price. Some even worried futures might a) dismantle Bitcoin itself or b) prompt a financial bubble burst.

Fortunately, none of that has occurred, keeping the outlook promising as interest continues to grow.

Notably, these contracts are cash-settled, not bitcoin-settled. This change allows Wall Street veterans to engage without holding cryptocurrencies directly.

This shift could drive impressive liquidity and interest into Bitcoin and beyond. Bitcoin futures are worth watching but not fearing as of now. Let’s hope that stays the case.

1Comment

Bitcoin's infamous unpredictability offers ample returns yet makes peaceful sleep tricky.