Despite its years in circulation, Bitcoin is still an enigma for many Unlike traditional money that's kept in banks, Bitcoin's unique nature means it's constantly being lost globally. Once it's gone, it's almost impossible to retrieve.

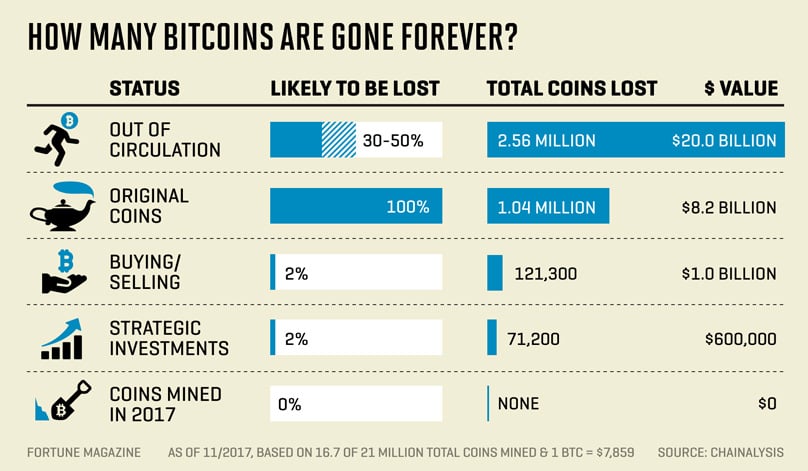

A recent study A study by Chainalysis delved into the amount of Bitcoin that has disappeared so far. Out of the 16.7 million coins mined by November 2017, about 2.56 million are believed to be out of play. An estimated 1.04 million Bitcoin have seemingly vanished, and about 2% of bought or sold bitcoins, as well as strategic investments, meet the same destiny. On top of that, individuals who made poor investment decisions by selling at low prices have ended up losing millions.

Missing Bitcoin, Image by Forbes

To clarify, bitcoins frequently disappear due to reasons like people disposing their computers or hard disks housing private keys, or exchanges facing cryptocurrency theft. forgetting their private keys Once they're lost, retrieving bitcoins is nearly impossible due to the security features of the Bitcoin protocol. This has led people to search landfills or even turn to hypnotherapy in hopes of recalling forgotten private keys.

This piece delves into the personal accounts of several individuals who have mislaid a significant sum of bitcoin, often due to the aforementioned reasons.

While Bitcoin does create winners In the summer of 2013, while tidying up, a man mistakenly tossed out a hard drive from his broken laptop. Months later, he recalled that it contained 7,500 BTC he mined back in 2009.

James Howells

When he realized this, Bitcoin had just surpassed the $1,000 threshold, rendering the discarded hard drive worth over $7 million. Fast forward, its value ballooned to over $60 million, making it harder for him to accept this loss. Reflecting on this, the man from Wales shared:

James Howells, Image from the Independent

You know that unsettling feeling when you throw something away and instantly think 'this is a terrible idea’? That’s exactly what I had.

After realizing, Howells contemplated ways to recover his bitcoins. He considered a search of the landfill where the drive might be, a task needing funds he didn't have, so an Indiegogo campaign was initiated to raise the necessary support. Unfortunately, years on, there has been little progress, and the hunt is thought to have ended.

At one time, a generic 250GB hard drive faced tech issues. It held a data file with 1,400 BTC, not seen as noteworthy then. Sadly, today, that sum is over $11 million.

Campbell Simpson

A couple of years ago, Simpson threw away The owner recounted buying the bitcoins in 2010 when they cost just 1.5 cents each, spending $25 in total via PayPal. Back then, trading Bitcoin was not mainstream, nor was mining hard. In a discussion with Gizmodo, he remarked:

Campbell Simpson, Image from Gizmodo

'I seized the chance to clear out the technological clutter that accumulates in the life of a tech journalist. USB drives, leftover PC bits, and more—thrown away along with a noisy, faulty hard drive which, I thought, should be replaced by better ones.'

If you’ve been following crypto news, this tale probably comes to mind annually on May 22nd.

Laszlo Hanyecz & Bitcoin Pizza Day

Back in May 2010,ndsomeone paid a BitcoinTalk user 10,000 BTC for two pizzas from Papa John's. With Bitcoin only a year old then, 10K BTC was worth $25 USD. Fast forward, we're looking at an expenditure of $80 million for those pizzas based on prices at the time of writing. When Bitcoin was $20,000 each, the pizzas cost $200 million. In Hanyecz’s words: Laszlo Hanyecz 'Back then, bitcoins weren’t valued investments, so using them to get a pizza was just a cool concept (…) Nobody foresaw its rise to such heights.'

In 2010, Bitcoin was hardly accepted in the market. Now, over 100,000 businesses take it as payment. Bitcoin Pizza Day has grown into a celebration, marking dramatic price changes and the positive or negative outcomes volatility can inspire. Many pizza places now offer deals on Bitcoin Pizza Day, particularly those accepting BTC.

There’s scant info on where the 10,000 BTC went post-transaction. Although still circulating, it undeniably signified a hefty loss for Hanyecz.

Laszlo Hanyecz, Image from CoinStaker

Like many, people often struggle with passwords or PINs they can't recall. For most, lost access merely brings minor inconvenience, not tens of thousands in losses. Mark invested $3,000 in bitcoin in 2016, opting to use a hardware wallet for safekeeping. While cold storage is considered one of the safest crypto storage solutions, forgetting or misplacing the password renders it useless, a scenario Mark found himself in. He jotted the mnemonic on paper, which was later lost. Initially untroubled, he realized its significance when he couldn’t recall his PIN, watching helplessly as his investment's value skyrocketed.

Mark Frauenfelder

After the fact, Mark reached out for help through forums, eventually hiring someone to recover his drive.

Mark Frauenfelder, Image from Wired

This led to a successful recovery of his lost coins. For Mark, the relief was immense. While he regained access, such solutions are rarely straightforward once a password is lost or hardware missing. In 2011, someone used Tor and stumbled onto a black market, dealing in guns, counterfeit IDs, drugs, and more. They paid 10,000 BTC for a fake passport plus a 6,000 BTC tip. The vendor didn't deliver, and the buyer didn’t anticipate Bitcoin's future. The BTC seemed safe within an exchange until 2013 when a Russian individual was apprehended for laundering services through Liberty Finance, which processed the purchase. The FBI seized exchange assets, and had this not happened, the BTC would now be worth nearly $400 million.

Simon

A man named Simon was once the largest bitcoin exchange, managing the majority of transactions—but by the end of the year, Mt. Gox went bankrupt. But what led to this? After a massive hack, around 740,000 bitcoins (6% of all circulating BTC) were stolen, valued then at over $500 million, now worth over $5 billion, making it the most costly bitcoin theft to date.

Mt Gox Customers

Back in early-2014, the Japan-based Mt Gox, In February 2014, all withdrawals were suspended, with claims of technical reviews pending by Mt. Gox. Shortly after, an internal document leaked revealing the hack, crashing bitcoin prices. This hack spawned conspiracy theories suggesting fund mismanagement predated the incident, yet despite some insights emerging, victims are yet to receive substantial reimbursements.

On the 7thEditor of Blockonomi and founder of Kooc Media, a digital media hub in the UK. An advocate for open-source initiatives, blockchain progress, and a liberated, unbiased web.

2Comments

Frustrations with withdrawal glitches on crypto exchanges led to a loss of 7 BTC initially, and another cryptocurrency worth $68,000 on Bittrex. Contemplating selling vehicles to recover was a real thought until a referral to RiotChargeback,tuta.io emerged. Despite believing the funds were gone, to my astonishment, nearly everything was retrieved, with just a 10% fee post-recovery. That's fair, and I'm spared from selling the cars. If you recover what's lost, find me to express gratitude.

https://play.google.com/store/apps/details?id=com.quickben22.bitcoinlotto

Vanished Bitcoins: The Chronicles of Six Cryptocurrency Misadventures