With the crypto wave surging forward, a torrent of newcomers has flooded the scene. It's no wonder discussions are heating up around Bitcoin mining, given Bitcoin's status as the original cryptocurrency and mining's unparalleled nature.

The allure and potential profitability of Bitcoin mining have many newcomers pondering: is this path for me? It's a crucial contemplation before investing heavily, considering multiple elements could influence your choice.

Thus, we’ll delve into the history, current state, and future perspectives of Bitcoin mining to assist you in determining whether this endeavor suits you.

The Early Days Of Mining

In the first days of Bitcoin, Satoshi Nakamoto In the dawn of Bitcoin, when only CPUs ruled the mining landscape, the network's architect reportedly mined around a million bitcoins within the inaugural weeks.

This remained the norm until more enthusiasts joined in, employing their CPUs to keep the network validated.

As Hal Finney recounted in his farewell message to the Bitcoin crowd:

\"Back then, mining difficulty was a mere 1, achievable with a CPU. I minted several blocks then stopped, troubled by the heat and fan noise. Now, I wish I'd persisted longer.\"

You and us both, Mr. Finney.

From CPUs To GPUs

Initially, one CPU equaled one vote in Bitcoin's early days. However, GPUs soon entered, delivering the power of many CPUs, capturing miners’ attention swiftly.

Remember Laszlo Hanyecz, who got two pizzas with 10,000 Bitcoins in 2010? He emerged as allegedly Bitcoin's first GPU miner. Here's an excerpt from Nathaniel Popper’s acclaimed work Digital Gold:

\"Few might know, but in April 2010, Laszlo was among the pioneers harnessing the GPU in mining. Before that, CPU mining ruled, gathering one block of 50 Bitcoins daily at best. The GPU advent increased Laszlo’s luck, letting him nab blocks more frequently.\"

ASICs Arrive

Following GPUs, we saw the rise of specialized mining gear known as ASICs, today the staple equipment for Bitcoin miners. The initial ASIC batches outperformed a multitude of GPUs, while today's models surpass them exponentially!

Hence, ASICs stand as contemporary Bitcoin mining's crown jewel. Venturing into mining sans ASICs—especially in large amounts—likely won't yield viable returns today.

Bitmain ASICs at work.

March Of Increasing Difficulty

Besides hardware evolution, Bitcoin mining gets increasingly arduous. Satoshi Nakamoto initially set it up to tweak the difficulty every 2016 blocks.

This ensures that mining becomes tougher over time, with block rewards halving once every few years. This trend shows no signs of abating anytime soon, hinting at a persistently steepening challenge.

Now? Mining Is Hard, Expensive

In case you weren't following, Bitcoin mining today proves arduous and perhaps daunting for casual investors. Not only do rising ASIC hardware costs loom, but the difficulty of adjustments also forecasts stricter futures.

The implication? A heftier expenditure results in fewer minted bitcoins. This forces aspirers of Bitcoin mining to pause and reconsider. Yet, hope isn't lost entirely.

What’s the potential hedge? It lies in Bitcoin’s price potential.

Future cost and effort concerns in Bitcoin mining could be eased if bitcoin price continues to climb to unprecedented price highs.

Bitcoin's wild price surge happens as it did in 2017. Should this trend persist, BTC might hit prices between $20,000 and $100,000 by 2018’s end.

If such an upswing unfolds, mining BTC—even in insignificant amounts—would yield considerable gains if the price continues skyrocketing.

That’s a bet many miners are taking on, leading one to ponder how bullish they are on Bitcoin’s future before committing to mining.

Your stance on this is paramount.

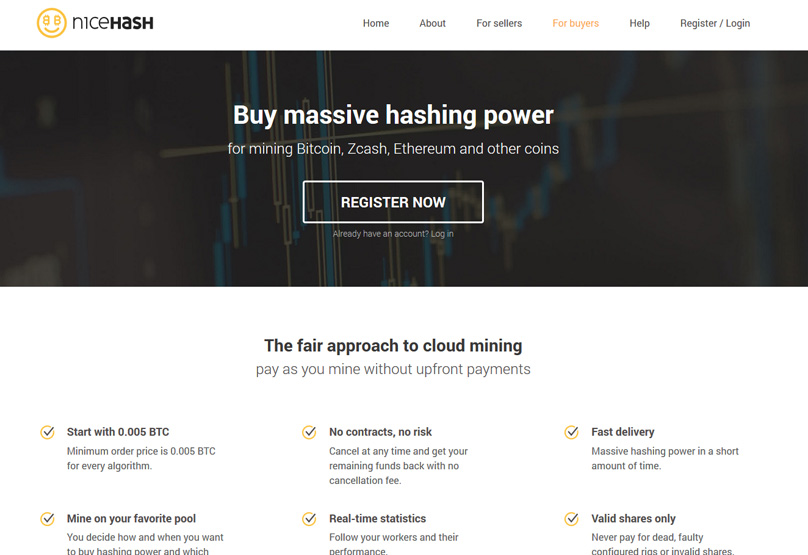

Cloud Mining Probably Not Optimal

One option being tossed around in crypto discussions is cloud mining: you buy a mining contract , while miners globally handle it for you.

The catch? Cloud mining’s landscape has, in recent years, seen scams galore, and apart from that, pricy contracts render ROIs rather lackluster. Cloud mining fits those inclined to mine indirectly, though generally less lucrative than orchestrating a personal setup.

Get In Before 2140 …

It's estimated the final bitcoin will be mined by 2140.

Meaning you have over a century to decide if splurging on a mining setup is your calling.

But you'd want to pounce before Bitcoin's price potentially takes off, right? Thus, picking the opportune moment is also vital.

What About Bitcoin Cash

Bitcoin Cash (BCH) is somewhat akin to Bitcoin (BTC), so why not dabble in mining it?

Indeed, your existing ASIC gear could mine Bitcoin Cash (BCH). The twist? BCH's market value trails Bitcoin by thousands, translating to diminished profitability for now.

Will this narrative persist indefinitely? No one knows. Yet, presently Bitcoin is more dynamically rewarding. Thus mining BCH appeals mostly to enthusiasts or those eager to diversify their mining pursuits.

Conclusion

As it stands, our takeaway is clear: Bitcoin mining suits those with not merely considerable funds to set up shop but also passionate crypto enthusiasts who relish running in-house rigs.

Beyond these circles, tangible profits are scarce. Alternatively, if on a tight budget, look into altcoins compatible with CPUs or GPU mining Consider browsing through some of our curated guides:

1Comment

i mined some btc at expeditehackers.com with minimal effort.