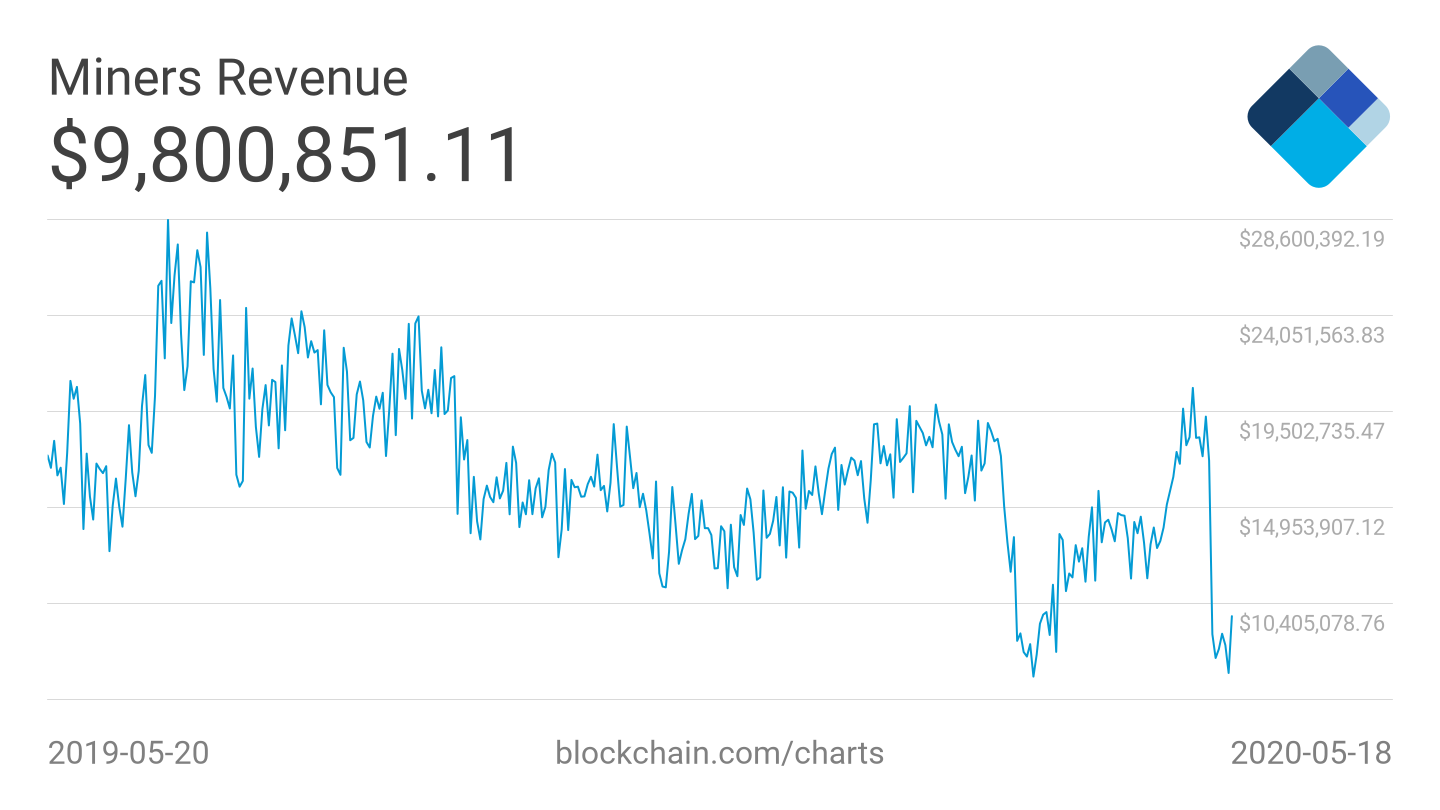

Bitcoin mining The earnings have plummeted by nearly 50% from what they were before the halving, with hash rate declining similarly.

The halving event, which halved block rewards, seems to affect miner profit margins significantly, especially as the network awaits a new difficulty adjustment.

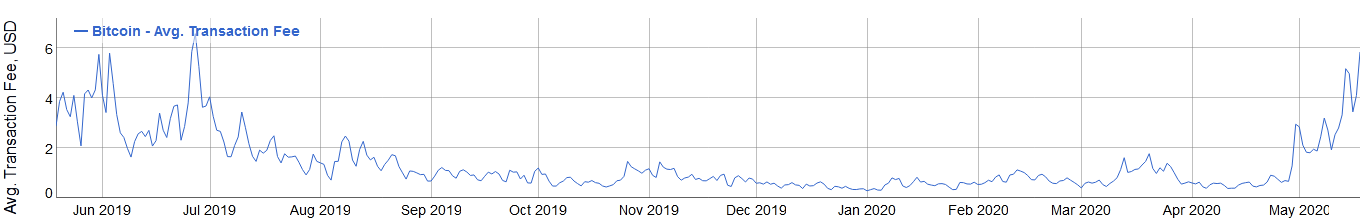

Meanwhile, a larger chunk of the revenue miners gain now comes from transaction fees, reaching heights not seen since 2018. Bitcoin On top of that, Bitcoin appears to be consolidating in a price range between $9,500 and $9,800, showing strong resistance around the $10,000 to $10,100 mark.

On the price Decline in Bitcoin Mining Revenue and Hash Rate Observed

Transaction Fees Now Comprise 15% of Miner Earnings

The event, which cut block rewards by half, reduces inflation as the daily supply of BTC drops from 1,800 to 900. As the daily supply halved, there’s fierce competition among mining nodes for the limited new BTC available. Many have upgraded their hardware to outpace competitors. The energy used to maintain the network — known as hashing power — is also waning. Miners who can't keep up are shutting down.

The drop in hashing power results in a reduction in the network's overall computational strength. This post-halving decline in hash rate is anticipated.

The network hash rate — the computing Once a downward difficulty adjustment occurs, this current exodus of miners should have a dampened impact. Historically, Bitcoin has bounced back from even those events mistakenly termed as mining death spirals, and there’s little indication that this instance will be any different. exiting the network .

Moreover, transaction fees now make up more than 15% of Bitcoin miner revenue, based on Glassnode's crypto analytics. Not since the height of 2017's 'crypto-mania' have fees represented such a major segment of BTC miner income.

The rise in miner earnings from fees coincides with increasing Bitcoin transaction costs. Currently, BTC fees have hit their peak in nearly a year, with data from BitInfoCharts showing average costs at $5.83. hash rate plunges With more on-chain activity and reduced block rewards, miners prioritize transactions with higher fees, leading to a backlog of those with lower fees.

Data from Blockchain.com indicates that revenue from Bitcoin mining in USD has shrunk by approximately 50% since the recent halving.

While this fee surge is substantial, it pales next to the 2017 spike when fees reached $50. Recent innovations have helped curtail such extreme fees, and with the upcoming difficulty adjustment, the mining sector should stabilize, resulting in decreased transaction costs.

As Bitcoin seems locked in a sideways market motion, some analysts suggest the BTC price might soon reflect the declining hash rate and miner earnings. After falling to $3,800 on March 12, 2020 — commonly referred to as 'Black Thursday' — Bitcoin has rebounded, even crossing the $10,000 threshold briefly in late April. Typically, Bitcoin sets a new high in the year following a halving. On-chain analysis reveals rising accumulation in both retail and institutional markets, with investors eager to catch the next BTC price increase. .

Osato is a devoted Bitcoin follower, frequently offering insights on the latest Bitcoin happenings. When not delving into crypto news, he's either trying to outdo his scrabble high score or pondering philosophical questions. Reach him at Osato@level-up-casino-app.com.

Bitcoin (BTC) Price Drops to $8,340 After Trump's Tariff Announcement SegWit Crypto Market Experiences $450M Liquidations After US Tariff News

Will Price Follow?

Trump Brothers Team Up with Hut 8 to Begin a Publicly Listed Bitcoin Mining Operation in America

All information on level-up-casino-app.com is for informational purposes and doesn't aim to offer to sell, buy, or solicit any security, product, service, or investment. The views presented on this Site do not constitute investment advice; seek independent financial guidance where necessary. retail All rights reserved. Registered Company No.05695741