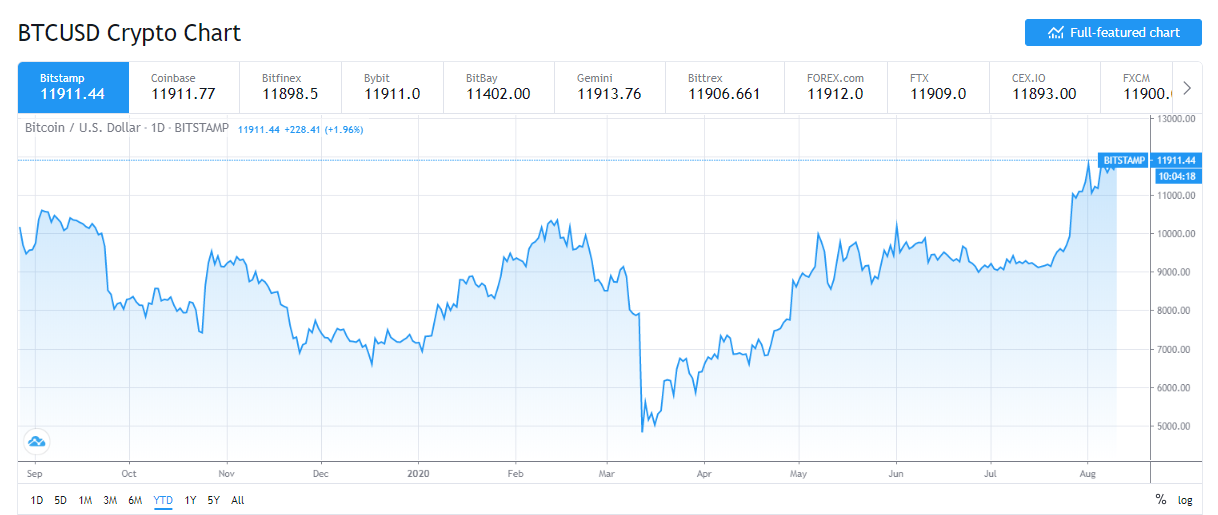

The Bitcoin Monday marked the second time Bitcoin surpassed $12,000 within a few weeks, but it quickly dropped by $500. Experts suggest that maintaining a level above $12,000 could push it to test historical peaks, approaching its all-time high of $19,800.

Market experts theorize that prudent investors will keep favoring Bitcoin and gold as safeguards against currency devaluation. Both assets are on a similar upward trajectory, with gold recently surpassing $2,000 per ounce.

BTC saw a minor slump after filling the latest gap in CME Bitcoin futures at $11,700 by withdrawing from the $12,000 mark.

In two recent tries to break $12,000, Bitcoin faced small setbacks each time.

With a 64% increase since the start of the year, Bitcoin stands out as one of 2020’s top-performing assets, despite once falling to $3,800.

Currently, Bitcoin is climbing back, striving to surpass the $12,000 barrier again. Should it succeed, it might face its next hurdle around $12,900 to $13,000, levels last reached in mid-2019. Black Thursday market sell-off , the Bitcoin price has recovered If Bitcoin breaks through long-standing resistance, it could cement the narrative of a bull market. The last halving event in May has fueled optimism of reaching new all-time highs, mirroring past performance post-halving.

On Monday, Bitcoin advocate Max Keiser highlighted the economic and political instability in Asia as a catalyst for Bitcoin’s price surge. Keiser stated, 'Capital is moving out of Asia via the Bitcoin express.'

Unlike traditional forms of wealth, Bitcoin is highly portable, making it an attractive option for moving assets internationally. Its appeal has grown due to its minimal transaction fees and the ability to transfer large sums without intermediaries. halving With economic tensions rising between the U.S. and China, affluent Chinese individuals might consider moving their wealth out of the country to protect against potential currency devaluation. Meanwhile, other significant economies, like the U.S. and the EU, are also planning new stimulus spending to rejuvenate their financial landscapes.

In July, EU leaders finalized a $2 trillion package, and the U.S. Congress is preparing another set of stimulus payments for unemployed citizens. Analysts predict these measures might further weaken currencies and elevate assets like Bitcoin to new heights.

Tweeting Osato, a crypto enthusiast, regularly shares insights on the latest Bitcoin trends. When not exploring the cryptosphere, he challenges his Scrabble skills or ponders existential questions. Reach him at Osato@level-up-casino-app.com

#Bitcoin up as tensions rise in Asia

Capital flight out of Asia taking the #Bitcoin express

Compound prices took a 6% hit following a foundational announcement, reflecting the market's response.

(Something near impossible with Gold)

— Max Keiser (@maxkeiser) August 10, 2020

The BTC proponent highlighted Despite leading DEX trading, Ethereum price fell 45% in the first quarter of 2025. Solana's value decreased by 15% over the week, dropping below the $120 threshold.

level-up-casino-app.com offers content purely for informational purposes and should not be seen as an invitation to buy or sell securities or investments. Always seek independent financial advice when needed. All rights reserved under Registered Company No.05695741. Blockfresh delivers updates on Crypto, NFTs, and the Metaverse.

Type your query and press Enter to search or press Esc to cancel.