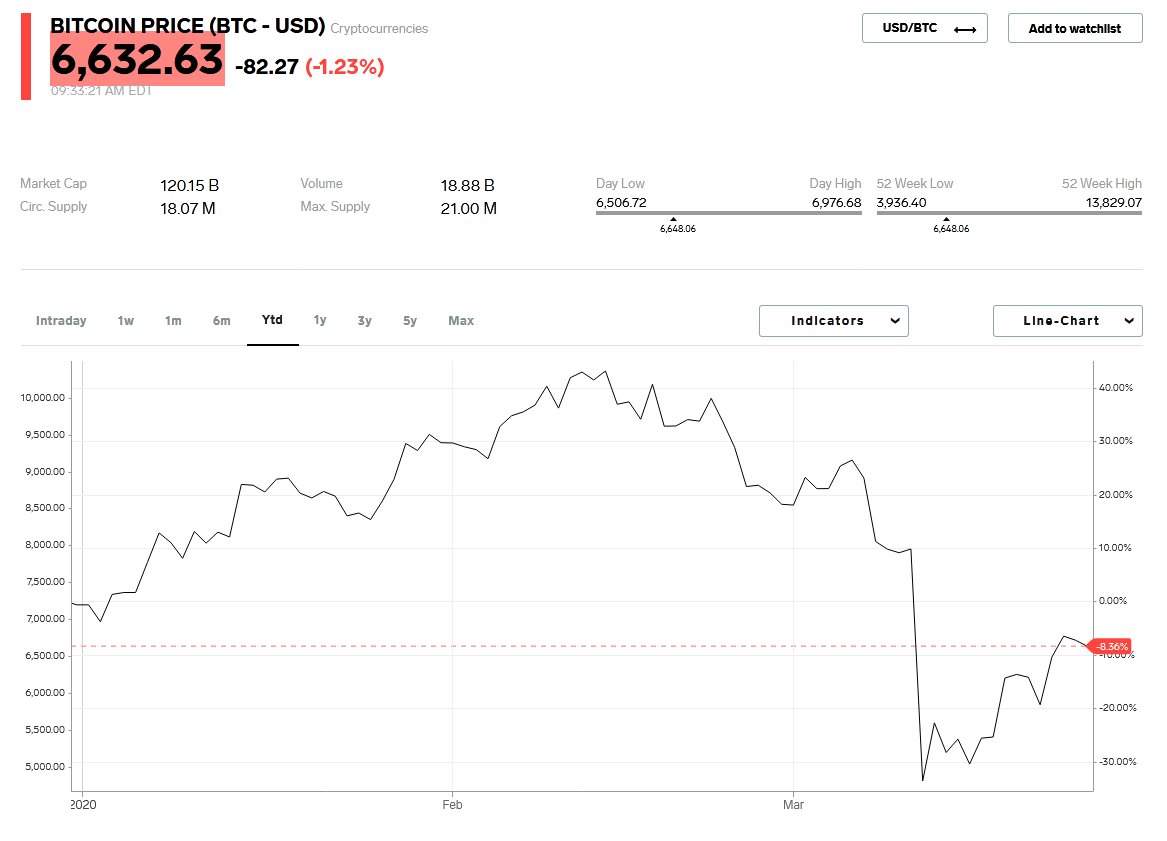

Specialists at Kraken, a leading cryptocurrency exchange, are suggesting that Bitcoin could reach a staggering $350,000 by 2045. BTC This ambitious prediction from Kraken hinges on an enormous amount of capital, expected to be redistributed in the next two decades, flowing into Bitcoin. millennials Kraken's price prognosis emerges alongside a significant difficulty adjustment, where the network hash rate fell over 45% from its previous high, compounded by pandemic woes pushing Bitcoin under $7,000.

The anticipated wealth shift promises to significantly elevate Bitcoin’s value.

Research by Kraken Intelligence— the analytical arm of the crypto exchange—suggests that the $70 trillion transfer could propel Bitcoin’s value up to $350,000.

In a report If 5% of this wealth is invested, and a 2% tax levied, Bitcoin may see an enormous $1 trillion market boost. Bitcoin New insights into how shifting generational dynamics might buoy Bitcoin’s value include interesting potential scenarios.

Predictions indicate a $70 trillion wealth handover from Boomers to Bitcoin-accepting youth within the coming years. #BITCOIN A $1 TRILLION BOOST

A detailed analysis unpacks the potential consequences of this generational wealth transition on Bitcoin.

As much as 70% of this massive $70 trillion may exchange hands by 2030, offering a fertile ground for Bitcoin value to blossom. https://t.co/LrKV2USlY5 pic.twitter.com/ISmlWjhNYb

— Kraken Exchange (@krakenfx) March 25, 2020

Just a 1% allocation of this wealth into Bitcoin could introduce an impressive $200 billion influx into its market.

An excerpt from Kraken’s report reads:

While concentrating purely on the U.S., Kraken's study suggests Bitcoin could see prices ranging from $68,000 to $706,000 over the next 25 years.

These surges are projected based on a theoretical 5% peak allocation into Bitcoin, factoring in a 2% tax.

Kraken isn't the pioneer in forecasting substantial Bitcoin gains due to wealth transfer; even Grayscale's CEO hinted at millennials opting for Bitcoin over traditional assets. positive disposition Grayscale's CEO highlights how investment demographics favor Bitcoin, recognized by millennials’ digital proclivity—a view echoed by Kraken. studies .

A notable network difficulty drop may hint at Bitcoin nearing a price bottom.

Though Bitcoin's future seems promising, it currently struggles to breach the $7,000 threshold, despite notable 2020 price fluctuations.

Though Bitcoin's future seems promising, it currently struggles to breach the $7,000 threshold, despite notable 2020 price fluctuations.

Despite recent downturns, seasoned Bitcoin advocates remain optimistic, projecting a $100,000 value as achievable. not hard to imagine .”

Miner activity changes reflect a 15% decline in difficulty to adjust for performance lags. hash rate . As previously reported Blockonomi reports a dramatic over 40% hash rate reduction from its 2020 peak.

Historically, downward difficulty adjustments have preceded price rallies, and investors hope this pattern recurs, particularly with an impending block reward reduction.