As cryptocurrencies continue to soar in popularity, many are eager to dive into this dynamic field in hopes of securing profits. Beyond simply purchasing and holding digital currency, there exist numerous methods to speculate or invest in cryptocurrencies without direct ownership.

While CFDs (Contracts for Difference) are widely used, spread betting presents an alternative. In either scenario, ownership of the cryptocurrency isn't necessary to profit, though inherent risks remain.

What Is Spread Betting?

Spread betting is a type of derivative This approach is centered around predicting whether an asset's price will trend upward or downward, rather than possessing the actual asset in question.

When engaging in a spread bet, you'll encounter two price points. The ask price represents your buying rate for the crypto bet, while the bid price is the selling rate.

Like other derivative instruments, the 'spread' signifies the gap between these prices. Brokers capitalize on this spread, eliminating the necessity to charge commissions.

In spread betting, opting for the bid price suggests an anticipation that the value of a specific cryptocurrency will increase, while choosing the ask price implies a predicted downturn. This strategy also offers leverage, the potential for short or long positions, and tax benefits, with a vast array of markets beyond just cryptocurrency and stocks.

How Bitcoin Spread Betting Works

- Initiating spread betting involves selecting a target cryptocurrency for your wager.

- From there, you'll decide to go long if you're optimistic about an asset's appreciation, or short if you predict a decline.

- Establish the stake by determining how much capital you're willing to allocate for each point of market movement.

- There are risk management tools, such as take-profit and stop-loss levels, that can be utilized in spread betting.

- Once you've positioned your trade, you have the flexibility to close it at any juncture, irrespective of previously set take-profit or stop-loss thresholds.

Crypto spread bets, like other forms, are time-bound. Trades auto-terminate unless closed manually beforehand.

Some bets conclude in days, others persist for months. Profit or loss is calculated by subtracting the opening price from the settlement price, then multiplying by the stake.

Read: What is Bitcoin? Our Complete Guide

When faced with placing a spread bet, you can choose a single cryptocurrency, such as Bitcoin , or a currency pair. Bets pertaining to a particular cryptocurrency align with its price: options often include XBT/GBP, XBT/EUR, XBT/USD, XBT/CNH, and XBT/JPY.

Crucially, much of spread betting operates on leverage. This expands market exposure, but simultaneously magnifies risk. Essentially, you're required to deposit a fraction of the trade's value.

Margins are broker-designated funds necessary in your account before opening a position. If the margin threshold is 10%, you'll need 10% of the trade's value pre-positioning.

Generally, crypto spread bettors need significant account balances since leverage potentiates both gains and losses. Essentially, your account should buffer against adverse market swings.

Volatile markets mean higher margin levels; thus, anticipate elevated margins crypto spread betting compared to stock spread betting.

Be mindful of margin calls—alerts signaling below-minimum account capital for open positions. These can result in automatic trade closures.

Effective Risk Management in Crypto Spread Betting

Spread betting carries significant risk, especially relative to traditional trading forms. Crypto spread betting platforms universally feature risk advisories, highlighting the substantial peril involved and urging prudence.

Stop-loss orders play a crucial role in risk mitigation during crypto spread betting. These orders automatically abort losing trades surpassing pre-set price thresholds.

Conventional stop-losses close trades at the optimal available rate after a stop is triggered, though volatile markets may see closures at unfavorable levels.

Conversely, guaranteed stop-loss orders ensure closure at a designated value, irrespective of market volatility. This additional risk mitigation typically accrues extra broker fees.

Utilizing spread betting arbitrage can further diminish risk. Arbitrage manifests when identical cryptocurrency prices vary across companies or markets.

Price discrepancies allow simultaneous high-selling and low-buying. Arbitrage leverages market inefficiencies but is increasingly scarce given information saturation and enhanced broker communications.

Should arbitrage opportunities in crypto spread betting arise, you'd speculate on the spread with separate brokers. Prospective gains occur when one's spread low exceeds another's spread high.

Essentially, this strategy involves buying low via Company A and selling high through Company B. However, it's an advanced tactic: imperfect transactions could result in substantial losses.

How Did Spread Betting Start?

Given crypto spread betting's distinct nature from other cryptocurrency investments, many seek insights into its inception. Charles K. McNeil , a mathematics educator turned securities analyst turned bookmaker, is credited with pioneering spread betting in the 1940s in Chicago.

Despite its origins, spread betting only permeated professional finance in the '70s. Stuart Wheeler established IG Index in London in 1974, initially enabling gold spread speculation.

It commenced with gold-focused spread betting, pioneering a streamlined method for asset speculation. During this era, it was difficult to invest in gold , so this was a welcome option.

Comparing Spread Betting to CFDs

CFDs another well-known mode of trading assets—cryptocurrencies included—without holding them. Consequently, CFDs and spread betting often undergo comparative analysis.

Both methods bear high risk-reward potential due to margin use and leverage. Another commonality between cryptocurrency spread betting and CFDs is the ability to short-sell.

A key distinction between the two lies in tax treatment, though both maximize tax efficiency. In neither case is there ownership of cryptocurrencies, negating stamp duty obligations.

CFDs incur capital gains tax, but spread betting is exempt in the UK. Commission charges tend to be higher for crypto CFDs than crypto spread betting, but this varies by platform.

Moreover, spread betting encounters more jurisdictional bans or restrictions than CFDs. Thus, most brokers limit spread betting services to the UK or Ireland, with some exceptions. In contrast, crypto CFDs are accessible in most regions.

Regions Where Spread Betting is Permitted or Prohibited

Spread betting entails significant risk, contributing to its illegality in numerous jurisdictions. While the UK permits it, the US notably does not.

In the US, cryptocurrency spread betting falls under 'online gambling,' outlawed by 2006's Unlawful Internet Gambling Enforcement Act.

American prohibition of spread betting is also attributed to perceived lobbying efforts by financial entities fearing market competition.

Another theory posits that spread betting challenges US tax collection, disinclining government approval.

Some also argue that options trading provides analogous advantages to spread betting, negating US necessity for crypto spread bets.

CFD Brokers: Navigating the Landscape

For those outside the UK, keen on exploring CFD Brokers , consult our thorough site review compilation.

- Plus500

- AVATrade

- IQ Option

- 24option

- ExpertOption

- Vantage FX

- Forex.com

- Pepperstone

- ETX Capital

- NordFX

- City Index

- Binary.com

- XTB

- FXTM

- ATFX

Meanwhile, Britain imposes no spread betting prohibitions, encompassing bitcoin and cryptocurrencies, leading many brokers to headquarter there.

Spread betting is lawful in the European Union but bound by stringent regulations from the European Securities and Markets Authority. In 2018, EU protections intensified, notably limiting crypto spread betting leverage.

UK Tax Exemption

One recognized advantage of cryptocurrency spread betting steams from tax advantages An All-Inclusive Handbook on Bitcoin Spread Betting and Leading Companies of 2020

A Deep Dive into the World of Bitcoin and Cryptocurrency Spread Betting: Understanding Its Essence, Risk Management, and Top UK Crypto Spread Betting Companies

A Thorough Handbook on Bitcoin Spread Betting and Premier Companies

Other Pros and Cons of Spread Betting

With the proliferation of digital currencies, more individuals are eager to explore this financial domain and capitalize on potential gains. Beyond simply acquiring crypto and storing it as a long-term asset, a myriad of trading and investment strategies allow participation without direct ownership. trade using margin While contracts for difference (CFDs) are the conventional route, spread betting emerges as a viable alternative. Both methods enable profit opportunities without holding the underlying digital currency, though they come with inherent risks.

Navigating Risks within Cryptocurrency Spread Betting

Crypto spread betting Territories Where Spread Betting is Permitted or Prohibited

Insights into Brokers Offering Contracts for Difference (CFDs)

This method involves speculating on the directional movement of an asset's price rather than owning the asset itself, predicting either a rise or a fall.

Top Crypto Spread Betting Companies

In a spread bet, you'll encounter two price points: the 'ask' for buying and the 'bid' for selling the crypto position.

Similar to other derivative forms, the 'spread' signifies the gap between ask and bid prices, serving as the broker's profit margin, thus eliminating the need for direct commissions.

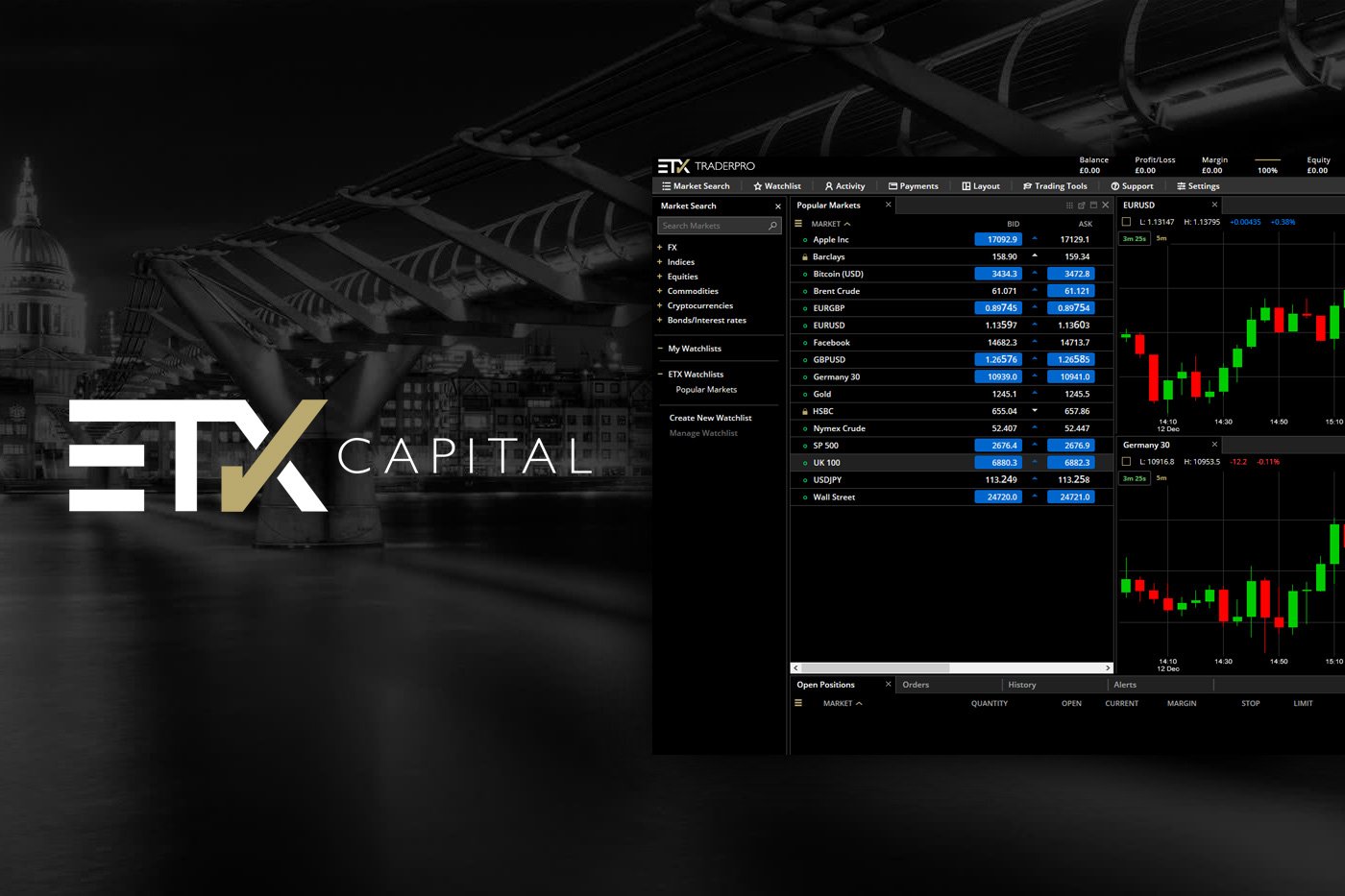

ETX Capital

ETX Capital In spread betting, you would go for the bid price if you predict

a surge in the cryptocurrency market

Read our Full Indepth Review of ETX Capital

City Index

City Index , or choose the ask price if you foresee a downturn. Spread betting encompasses leverage, the ability to go short or long, and potential tax perks, with various market opportunities beyond just digital currencies and shares.

Read our Full Indepth Review of City Index

AVA Trade

AvaTrade To engage in spread betting, begin by selecting the specific cryptocurrency of interest.

Next, determine whether to go long, betting on anticipated price increases, or go short, anticipating a decline.

Subsequently, decide your investment scale for each market point move, known commonly as the stake.

Read our Full Indepth Review of AVATrade

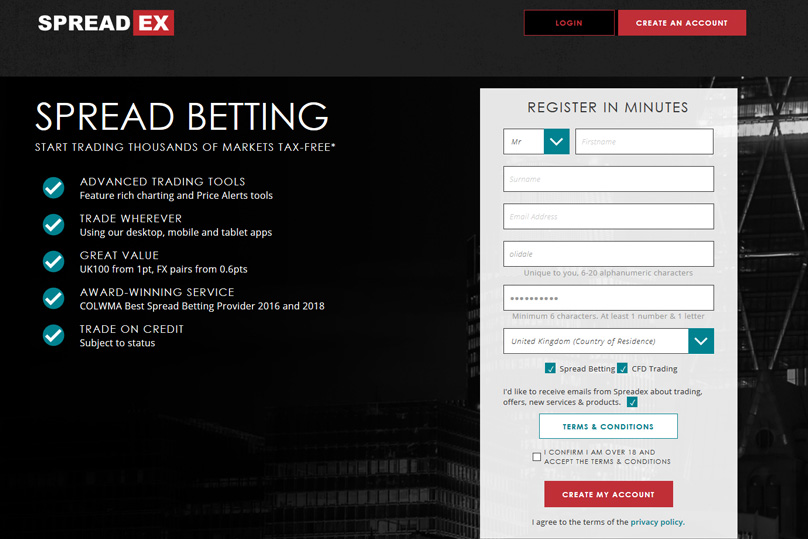

Spreadex

Spreadex Advanced risk management in spread betting involves setting take-profit and stop-loss thresholds.

Proceed to execute your trade, with flexibility to conclude it anytime, despite preset profit and loss thresholds.

Standard interactions in crypto spread betting often have a defined duration, automatically terminating unless concluded earlier.

, so this was a welcome option.

Expirations differ, stretching from a few days to several months. Your financial outcome equals subtracting the closure price from the initial, which is then adjusted by your stake.

Spread bets allow targets on specific cryptos

, or currency pairs, generally tethered to the targeted crypto’s valuation. You’ll likely encounter spreads for pairings like XBT/GBP, XBT/EUR, XBT/USD, XBT/CNH, and XBT/JPY.

It's crucial to recognize that spread betting predominantly involves leverage, providing increased market exposure and inherent risk. Here, you place a small trade-value percentage as a deposit.

Some also argue that

Margins reflect the cash reserves your broker mandates before opening trades. With a 10% margin, you’re required to hold 10% of the trade's worth in your account as a precondition to position entry.

In reality, brokers typically demand substantial reserves for crypto spread betting due to the amplified risks associated with leveraging. This necessitates adequate account funding to buffer against adverse market shifts.

Inherently, volatile markets demand larger margin allocations compared to

2trade using margin

Conversely, guaranteed stop-loss orders pledge fixed termination values, regardless of market volatility, albeit often at an additional brokerage fee.

Using arbitrage within spread betting can diminish risks. It involves leveraging discrepancies in cryptocurrency pricing across distinct platforms or markets.

Such disparities facilitate concurrent buying at lower and selling at higher prices, capitalizing on market inefficiencies. Yet, despite potential risk reduction, digital information exchange, notably amongst brokers, substantially limits arbitrage chances.