Unlike stock exchanges, the cryptocurrency market runs non-stop around the clock, which can create a tense environment for traders and casual investors alike.

Those familiar with the crypto sphere know the thrill or despair of waking up to unexpected portfolio outcomes, whether significant gains or losses greet them.

Given the market's volatility, trading bots have surged in popularity by providing traders a way to maintain oversight even as they rest, with the bots tirelessly operating round the clock. In addition, well-configured bots can execute trades significantly quicker than manual efforts.

The explosion of popularity This rise in crypto trading interest has led to a proliferation of trading bots, many of which are available for free on open-source platforms or can be accessed for a fee.

However, identifying which bots fulfill their promises and which merely waste time remains challenging. This section explores the essence of trading bots and evaluates their effectiveness in Bitcoin and Crypto trading, with particular attention to their utility for your Bitcoin trading needs.

We've put each bot through rigorous testing; clicking on any option will reveal our detailed analyses. Fresh market entries are regularly added to this post.

Top Trading Bots

Short on time? Here's our selection of the top two bot platforms currently dominating the market.

| Cryptohopper | 3Commas |

|---|---|

|

|

| Integrations

Binance Bitfinex Bittrex CEX.io Coinbase Pro Cobinhood Cryptopia HitBTC Huobi Kraken KuCoin Poloniex |

Integrations

Bittrex Bitfinex Binance Bitstamp Kucoin Poloniex HitBTC CEX.io Coinbase Pro OKex Huobi Yobit GDAX |

| Price From

$19 Month |

Price From

$24 Month |

| Software Type

Cloud-Based |

Software Type

Cloud-Based |

| External Signals

Yes |

External Signals

Yes |

| Review

Read |

Review

Read |

| Visit | Visit |

Best Crypto Trading Bots

This part will introduce several widely-used and publicly available trading bots. Often, these platforms extend beyond automated trading, providing clients with advanced tools and access to multiple crypto exchanges.

Cryptohopper

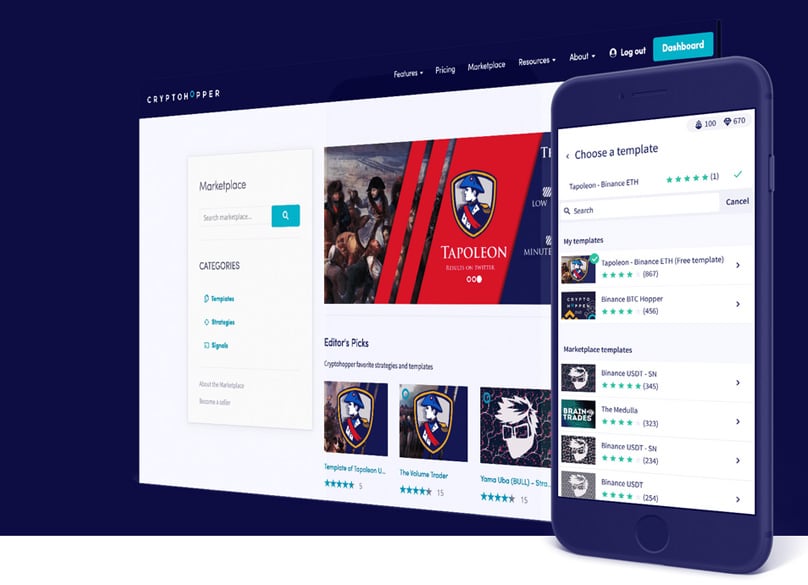

Cryptohopper This platform is a well-established force in the auto-trading domain, thanks to a few key attributes. Chiefly, it operates entirely in the cloud, eliminating the need for installations and enabling non-stop trading. Its user-friendly dashboard requires only five minutes to configure for trading.

Beyond this, it's the only bot to incorporate external signalers, inviting new traders to follow global professional analysts. Numerous experts utilize machine learning and intelligent algorithms, employing mathematicians to focus on rising coins. The bots execute buy and sell orders based on these signals.

A dashboard for signalers where you can subscribe

This bot helps capitalize on bull markets with features like a trailing stop-loss, including comprehensive technical analysis tools such as Stoch, RSI, Bollinger Bands, and MACD.

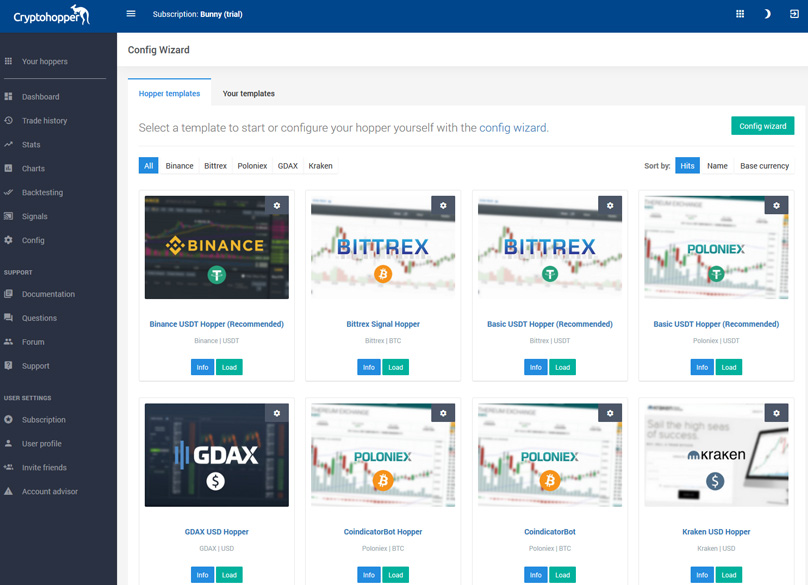

Cryptohopper boasts an appealing and contemporary dashboard, complete with a configuration wizard or ready-made templates for popular exchanges like Binance, Bittrex, Poloniex, GDAX, and Kraken.

Experienced traders can integrate their preferred technical indicators and use tools beneficial in bear markets, such as Dollar Cost Averaging (DCA) and shorting features.

Unlike many bots, Cryptohopper doesn't charge trading fees and offers a free month-long trial, with upgrade options to Bunny ($19/month), Hare ($49/month), and Kangaroo ($99/month).

We have completed an Indepth Review of Cryptohopper here.

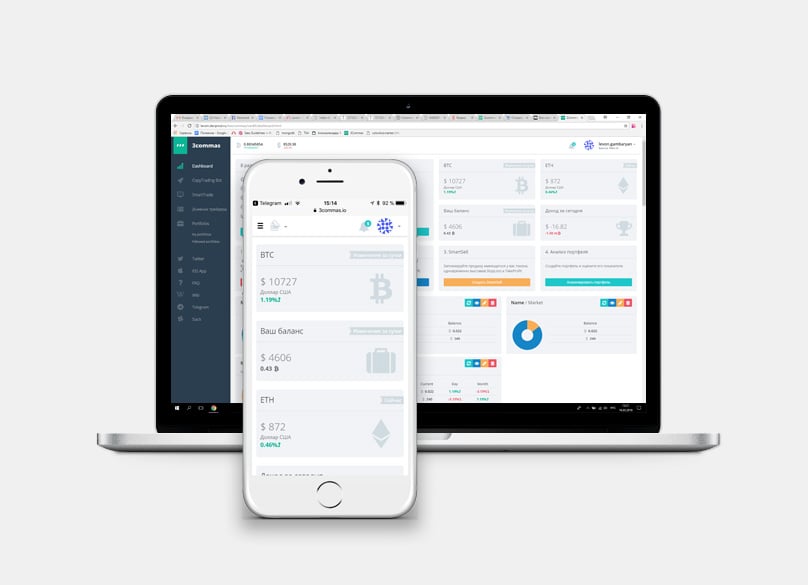

3Commas

3Commas, a notable trading bot, collaborates with a multitude of exchanges, such as Bittrex, BitFinex, Binance, Bitstamp, KuCoin, Poloniex, GDAX, Cryptopia, Huobi, and YOBIT. Its web-based service ensures 24/7 operation across all devices, allowing trading dashboard access via mobile, desktop, or laptop computers.

It permits setting stop-loss and take-profit objectives and features social trading, letting users emulate the strategies of its top-performing traders.

Its crypto portfolio feature, similar to an ETF, allows crafting, analyzing, and testing a crypto portfolio, as well as choosing from top-performing portfolios by others.

We have completed an Indepth Review of 3commas here.

Mizar

If you're in search of a platform that both enhances your earnings and provides the superior crypto trading bots, Mizar look no further. Offering cutting-edge cryptocurrency trading tools and services for traders of all experience levels.

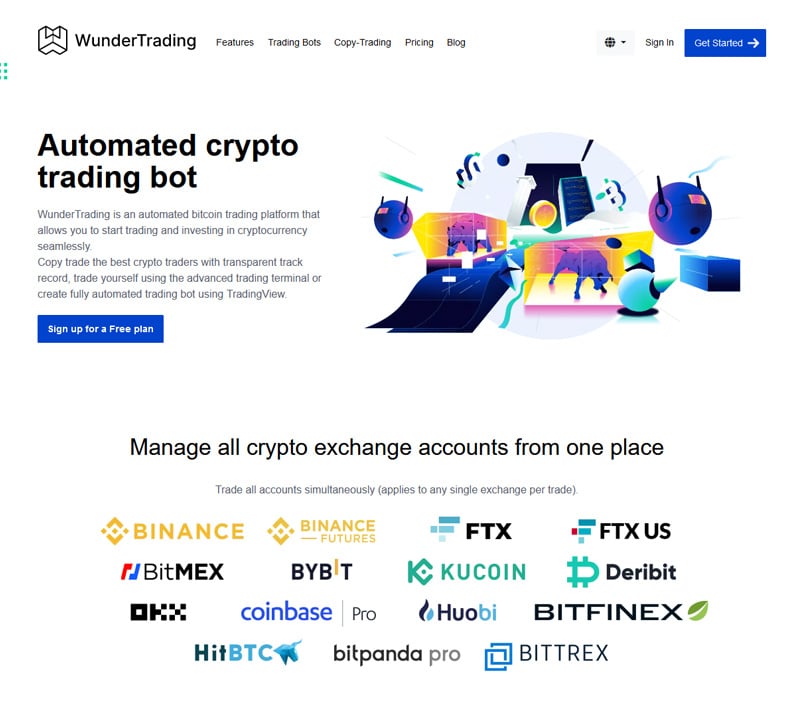

WunderTrading

WunderTrading This automated crypto trading platform boasts bots and copy-trading tools. Users can create autonomous trading bots using TradingView PineScript, earn passive crypto income by following expert traders, or engage in manual trading through a sophisticated Trading Terminal.

We have completed an Indepth Review of WunderTrading here.

Quadency

Quadency Set within a digital asset management platform, it provides automated trading and portfolio management solutions tailored for retail and institutional traders alike.

Packed with a broad spectrum of features aimed at simplifying cryptocurrency trade and investment processes, it offers customizable trading bots, advanced charting, and portfolio analysis.

All these components are designed to elevate your crypto trading journey, with support for automated trading on exchanges such as Binance, Bittrex, Coinbase Pro, Kucoin, Liquid, and OKEx.

Check out our full Quadency Review here .

Coinrule

Coinrule stands out as a recent contender in the trading bot scene with impressive features suitable for both novices and seasoned traders. It supports leading exchanges such as Binance, BitMEX, Coinbase Pro, and Kraken, with free access through a Starter account.

Paid plans range from $29.99 to $249.99 monthly, with account tiers tailored to match different traders' experience and activity levels.

Prospective users can always test the waters with a free Starter account to evaluate whether a paid subscription suits their needs.

You can check out our full review of Coinrule here .

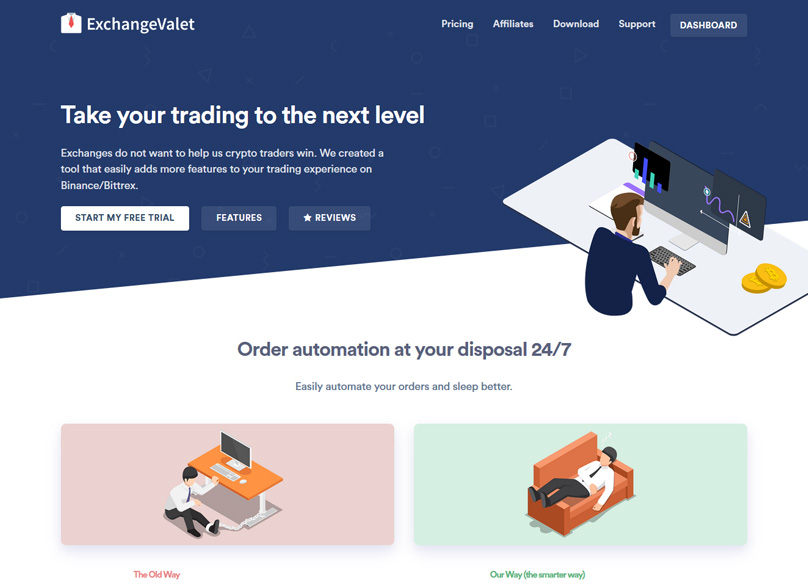

Exchange Valet

Unlike many bots listed here, Exchange Valet functions as a comprehensive trading toolbox and crypto portfolio manager. Most cryptocurrency exchanges fail to provide traders with a robust toolset, but Exchange Valet closes this gap with much-needed tools like simultaneous stop-loss and take-profit orders.

Experienced with platforms like MT4 or MT5, users will appreciate the ability to establish both stop-loss and take-profit orders, a feature not universally supported by exchanges.

Exchange Valet permits setting both types of orders simultaneously, which is invaluable for proactive traders.

Suppose you aim to engage with BTC, anticipating a 10% surge. Should the market steer contrary to your prediction, you need not remain passive as declining prices erode your investment.

With Exchange Valet, you can initiate a BTC trade with predetermined stop-loss and take-profit orders. If BTC achieves a 10% rise, the platform will secure your gains by executing a sale. Conversely, if misjudged, your stop-loss will shield your account from severe losses.

Convenient Portfolio Management Tools Included!

Exchange Valet also allows managing and rebalancing your entire portfolio with minimal effort. A pie chart showcases your crypto holdings, enabling you to invest a specified percentage of your total portfolio into any given cryptocurrency.

For instance, if you wish to allocate 40% of your portfolio to ETH, simple input fields on Exchange Valet allow you to manage this efficiently, ensuring your crypto allocations remain balanced with minimal effort.

The platform also excels in communication features. Orders can be received via Telegram, named Speedtrade, with additional insights available through email. Portfolio updates are available via Telegram or the platform's dedicated chatbot.

Exchange Valet Lacks Some Features

While not an automated trading platform, Exchange Valet still delivers formidable trading tools, though limited to Binance and Bittrex.

Note that Exchange Valet incurs costs, with new users offered a 14-day free trial before transitioning to plans priced at $29 USD monthly, $75 USD for three months, or $250 USD annually.

Active traders with significant portfolios may find these costs reasonable, though other platforms might provide comparable features at competitive prices.

Security and connectivity are notable strengths of Exchange Valet. The platform complies with ISO security standards, and its Telegram integration allows vigilant portfolio monitoring on-the-go.

Worth Learning More About

If you prefer managing your own trades, Exchange Valet may offer the essential tools you need. The platform's robust emphasis on security and efficient communication tools make it an attractive choice for filling the gaps left by traditional exchanges.

Ultimate Bitcoin Trading Bots Guide 2024 – Do They Really Deliver?

Read our full review of Exchange Valet here.

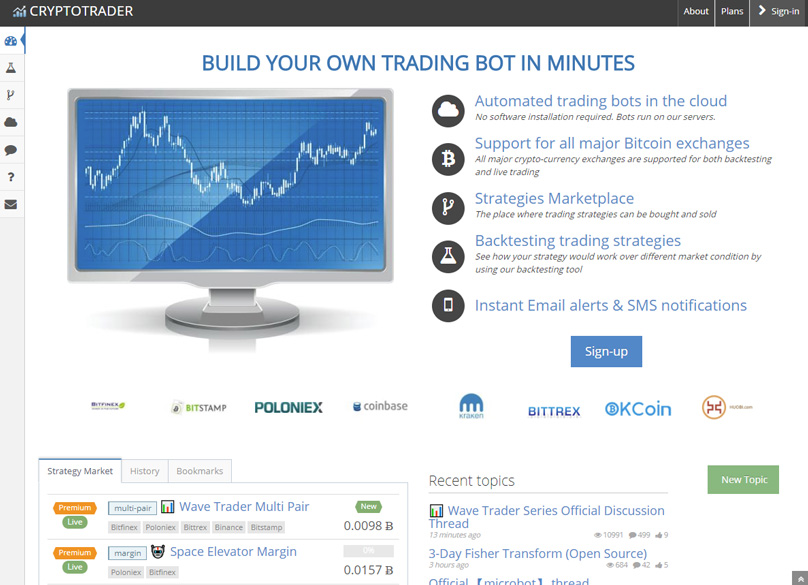

CryptoTrader

The CryptoTrader Here's the Blockonomi Breakdown of the Leading Bitcoin & Crypto Trading Bots and Platforms Available Today - A Thorough Review of Top Options.

Comprehensive Guide on Leading Bitcoin & Crypto Trading Bots

Unlike traditional stock markets, the crypto market is an unyielding machine that never shuts down, a reality that can be quite overwhelming for traders and even crypto enthusiasts.

Crypto investors are all too familiar with the emotional rollercoaster of checking their portfolios each morning, only to find either delightful surges or shocking plummets.

Given the market's unpredictable nature, trading bots have quickly become indispensable to traders, ensuring they're always at the helm, with the bots tirelessly operating even when the traders sleep, offering speed and efficiency that manual trading simply can't match.

Read our Indepth Review of CryptoTrader .

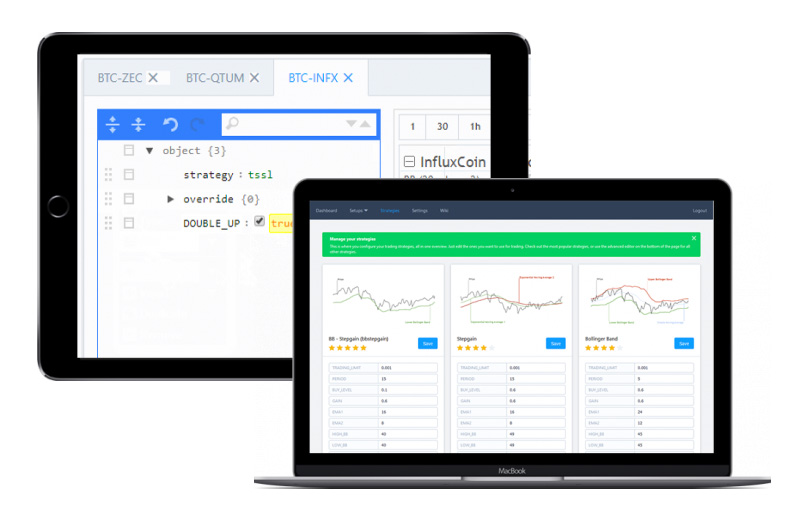

Haasbot

Created in 2014 by Haasonline, Haasbot This surge in the crypto domain has led to a proliferation of trading bots, available either for free from open-source platforms or through paid licenses, widening the opportunities for traders.

However, discerning which bots actually deliver on their promises can be a challenge. This post delves into the essence of trading bots, evaluating their effectiveness in Bitcoin & Crypto trading (and more crucially, for your Bitcoin endeavors).

We've rigorously evaluated each bot in our lineup, and you can explore our in-depth analysis by clicking on each one, with updates regularly incorporated to introduce new market entrants.

Useful Portfolio Management Tools Included!

User-Friendly with a Wealth of High-Quality Features

Live Trader Shines as a Stellar Platform for Algorithmic Trading

Read our Indepth Review of HaasBot here.

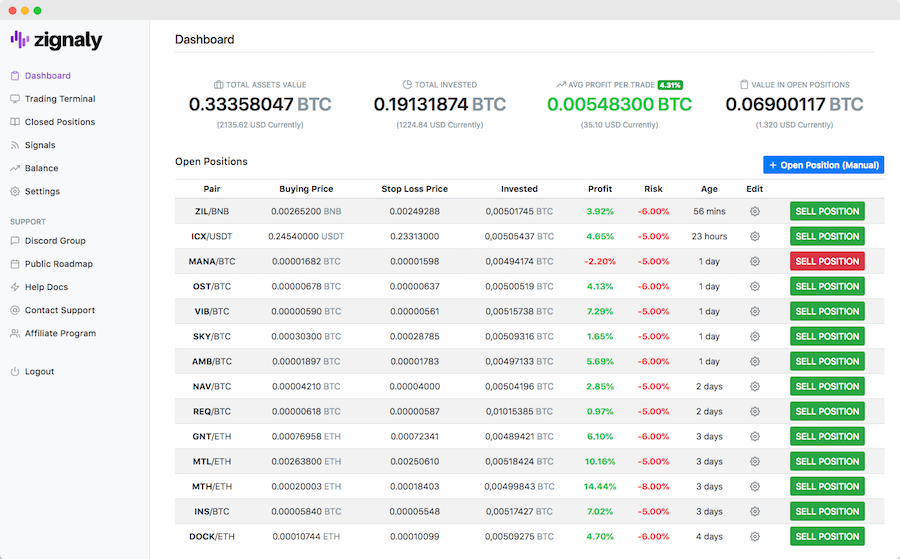

Zignaly

Zignaly Crypto Trading Bots Offering Lucrative Income Opportunities

Short on time? Here’s our top selection of the best two bot platforms currently on the market.

This section delves into some of the widely-used and accessible bots you can consider. Often, these bots provide more than just automated trading, offering sophisticated tools and access to a multitude of crypto exchanges.

is renowned in the automated trading sphere for a handful of reasons. Operating solely on the cloud means no pesky installations, allowing round-the-clock trading. Plus, it boasts a user-friendly interface that takes just five minutes to set up.

Read our Indepth Review of Zignaly here.

Apex Trader

Additionally, it's the sole bot that includes external signaling capabilities, enabling new traders to follow a curated list of respected global analysts. Many employ cutting-edge machine learning techniques to identify promising coins, with signals automatically transmitted to users' bots. ByBit , Kraken, and KuCoin.

Signaler dashboard available for subscription

The bot makes it possible to leverage bullish markets using a trailing stop-loss and offers comprehensive technical analysis tools including Stochastic RSI, Bollinger Bands, and MACD.

We have also reviewed Apex Trader here .

Cap.Club

Cap.Club Cryptohopper features a sleek, modern dashboard that permits complete configuration and monitoring. It offers a setup wizard and ready-made templates for major exchanges like Binance, Bittrex, Poloniex, GDAX, and Kraken.

Experienced traders gain the advantage of incorporating preferred technical indicators and deploying various tools suited for bear markets, such as DCA and shorting capabilities.

The platform comes in two versions.

Cryptohopper differs from many competitors by not charging any trading commissions, and is among the few to offer a month-long free trial, with paid plans available: Bunny ($19/month), Hare ($49/month), and Kangaroo ($99/month).

3Commas is a versatile trading bot that operates with numerous exchanges including Bittrex, BitFinex, Binance, Bitstamp, KuCoin, Poloniex, GDAX, Cryptopia, Huobi, and YOBIT. As a web-based service, it works 24/7 across all devices, from mobile to desktop.

Easy to Operate with a Plethora of Advanced Capabilities

You can establish stop-loss and take-profit objectives, and the platform also includes a social trading aspect that allows users to mimic the moves of top-performing traders.

- Smart Sell (long)

- Smart Buy-Sell (long)

- Smart Sell-Buy (short)

Another noteworthy characteristic is its ETF-like crypto portfolio feature, which lets users design, assess, and back-test a crypto portfolio or select top-performing portfolios crafted by others.

If you're in pursuit of a platform that not only boosts your earnings but also provides cutting-edge crypto trading bots,

is the destination to explore. The platform offers advanced tools and services in cryptocurrency trading for both seasoned traders and newcomers.

operates as an automated crypto trading platform equipped with bots and copy-trading capabilities. Users can construct entirely autonomous trading bots with TradingView PineScript, earn passive income by trailing adept traders, or trade manually using the advanced Trading Terminal.

Cap.Club Gives You a Lot

is a digital asset management solution offering automated trading and portfolio management for both individual and institutional traders.

The platform aggregates a suite of features to optimize cryptocurrency trading and investing, including pre-configured or customizable trading bots, intricate charting, and portfolio analytics.

These elements amalgamate to enrich the crypto trading journey, with Quadency facilitating automated trading on platforms like Binance, Bittrex, Coinbase Pro, KuCoin, Liquid, and OKEx.

Coinrule emerges as a contemporary trading bot platform brimming with features, suited for both beginners and advanced traders. It operates with prominent exchanges like Binance, BitMEX, Coinbase Pro, and Kraken, and is freely accessible via a Starter account.

Easy Set-Up and Support

Paid plans range from $29.99 to $249.99 monthly, with varied account levels tailored to different trading expertise and activity.

For potential users, a free Starter account facilitates trial runs to determine the value in selecting a paid subscription.

Differing from many bots listed,

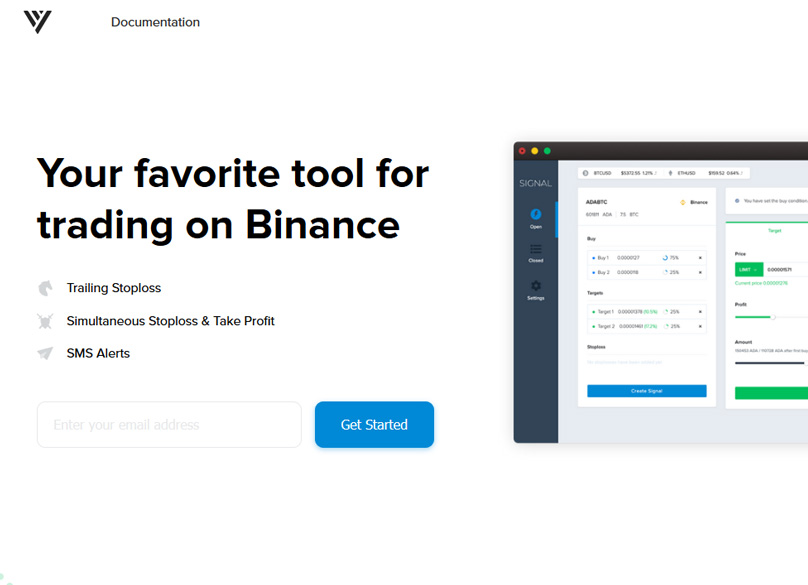

Signal Groups

Signal functions more as a trading toolkit and crypto portfolio manager. While typical exchanges might lack comprehensive tools, Exchange Valet bridges this gap with essential features like simultaneous stop-loss and take-profit orders.

For those accustomed to platforms like MT4 or MT5, the ability to deploy concurrent stop-loss and take-profit orders is standard. Many exchanges don't support these orders or permit their concurrent use.

Exchange Valet empowers traders to set both stop-loss and take-profit parameters simultaneously, a boon for the active trader.

Signal is Built for Binance

Suppose you anticipate BTC will surge by 10%. If mistaken, you wouldn’t want to hang around and watch your profits drain away in a downturn.

Exchange Valet enables you to initiate your BTC position alongside both stop-loss and take-profit commands at your preferred levels. Should BTC indeed climb 10%, Exchange Valet will secure those gains for you. In the event you're wrong, the stop-loss will protect your holdings.

Exchange Valet lets you oversee and re-balance all of your positions almost effortlessly, displaying your crypto holdings via a pie chart and facilitating purchases based on percentage values.

Imagine wanting 40% of your portfolio in ETH. Exchange Valet provides a straightforward input mechanism to purchase your desired ratio, making portfolio balance maintenance a breeze.

Exchange Valet boasts adept communication features. Orders can be delivered via Telegram (they term it Speedtrade), and additional updates are available through email or proprietary chatbots.

Great Connectivity

If automation is what you're after, Exchange Valet may not align with your needs as it’s more a trading toolkit than a bot, primarily limited to Binance and Bittrex.

Exchange Valet requires cryptos as a payment method. New users can trial services for 14 days, but post-trial fees are $29/month, $75/quarter, or $250/year.

Active traders managing sizable portfolios might find these costs justified, though alternative platforms do offer more features for comparable prices.

Not Built for Everyone

Areas where Exchange Valet excels include security and connectivity, adhering to industry data protection standards like ISO 27001. It's optimal for lovers of Telegram-based alerts, enhancing portfolio monitoring even on the go.

For traders dedicated to self-managing their accounts, Exchange Valet could be invaluable, albeit devoid of algorithm-based trading. It equips traders with essential tools reminiscent of conventional trading platforms.

Exchange Valet prioritizes your security, reflecting strong commitment. Its communication utilities are beneficial too, ideal for filling in the service voids left by exchanges.

CryptoTrader is a cloud-based trading bot that revolutionizes the cryptocurrency trading landscape by offering fully automated solutions without requiring any software installation on the user's personal system. With an innovative strategies marketplace, users can not only purchase their preferred strategies but also sell their personally developed ones, creating a dynamic ecosystem for trading enthusiasts.

Read our Full Signal Review here.

Live Trader

Compatible with most major exchanges, CryptoTrader facilitates both backtesting and live trading sessions. Its backtesting functionality allows users to simulate and assess the performance of their strategies under various market conditions, giving them a comprehensive understanding of potential outcomes. Live Trader CryptoTrader provides five distinct subscription plans, each tailored to different trading needs, with pricing that ranges from 0.006 BTC up to 0.087 BTC per month, exclusively accepting Bitcoin as a payment method. These packages offer varied benefits, such as different numbers of bots and diverse equity limits, catering to different levels of trading activity.

While having some coding knowledge can be an asset in configuring strategies within the CryptoTrader bot, users lacking such skills have the option to choose from a selection of pre-built strategies, both free and for purchase, ensuring accessibility for non-programmers. Kraken The CryptoTrader bot excels in interoperability, featuring email and text notifications to alert users on significant market shifts or trends, ensuring traders remain informed and can react promptly to changes.

This platform supports trading in Bitcoin and numerous altcoins, offering users a broad spectrum of opportunities across the crypto market.

Haasbot stands out as one of the most comprehensive trading bots available on the market today, performing most trading tasks with minimal input required from the user. However, this convenience comes at a premium, with subscription costs ranging between 0.04 BTC and 0.07 BTC for a three-month access.

Live Trader Offers a Lot

At these prices, Haasbot attracts serious traders who are keenly aware of what value they anticipate from the platform and exhibit a strong commitment towards achieving their trading goals.

Originating as HaasOnline Software, established by Stephan de Haas in the 1990s, Haasbot is a product of the same company that developed the HaasOnline Trade Server (HTS), an automated crypto trading system.

The Haasbot platform is versatile, functioning on Windows, MacOS, and Linux, and gives traders access to over 10 different types of bots. A higher investment unlocks more bots, providing extensive options for users.

Geared for Algos

Given the costs involved with these bots, prudent traders are advised to conduct thorough research on the historical returns generated by these autonomous systems.

is an all-encompassing trading terminal equipped with cryptocurrency trading bots, facilitating automatic trading through integrations with external crypto signal providers. Presently, the platform's access comes at an affordable price of $12 monthly.

This platform is incredibly user-friendly and can effectively function as a source of passive income. Zignaly makes connecting with a TradingView account straightforward, allowing users to seamlessly incorporate their favorite indicators or utilize the Zignaly trading terminal to construct a complete strategy in one go.

Not a Freebie

As Zignaly is still in its pre-launch phase, its current exchange compatibility is limited. However, the development team assures that upon its full release, exchanges like KuCoin, Coinbase Pro, Poloniex, and Bittrex will join the roster, alongside the introduction of unlimited currency pairs without additional charges.

One appealing aspect of Zignaly, aside from its price point, is the commitment to transparency by its developers. Detailed information regarding the entire development team is readily accessible online, and those interested in further insight can explore the founders' social media profiles.

Apex Trader emerges as a fresh platform offering an intuitive entry into automated trading with bots. It provides a variety of strategies and connects through APIs to prominent exchanges like Binance, expanding user options.

Live Trader: A Stellar Platform for Algorithm-Based Trading

Apex Trader is highly customizable, with over 100 technical indicators available to users. This enables the creation and deployment of personalized automated trading strategies that can operate continuously across various trading pairs.

A free 7-day trial period on the platform allows users to experience Apex Trader and evaluate its offerings before deciding on a paid monthly plan.

serves as a straightforward gateway to advanced trading features. Built in Russia, it supports Binance and Bittrex, offering traders advanced automated buying and selling algorithms, in addition to sophisticated order types.

GunBot

GunBot Cap.Club's simplicity is immediately noticeable, both in its website design and interface. This user-friendliness can be particularly beneficial for beginners in automated trading or those with limited coding knowledge.

The complimentary version of Cap.Club affords access to all trading strategies featured on the full platform, albeit with a cap on how many can run concurrently. While the full version extends communication via Email and Telegram, the free tier only uses Email for alerts.

Users can explore Cap.Club at no charge, or opt for an upgrade priced at $30 USD each month, with an annual option offered at a discounted rate of $300 USD.

Don't be misled by Cap.Club's streamlined interface; it is equipped with robust trading tools. Users can leverage limit and trailing orders, along with three distinctive trading programs, to maximize trading efficiency.

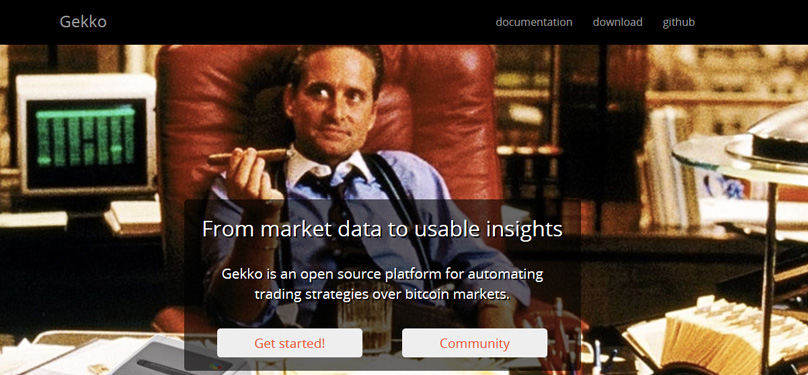

Gekko

Gekko These algorithms are designed to autonomously generate profits for Cap.Club clients. Although comprehensive reviews on their efficacy are scarce, they are entirely free to employ with the basic package.

Cap.Club's platform packs considerable value, striking a balance between algorithm-driven trading and providing traditional tools often absent from most crypto exchanges.

Zignaly

Zignaly Trading Bot Read our Indepth In both free and premium versions, Cap.Club is equipped with a visual strategy editor. This feature is ideal for traders who understand strategies conceptually but are unable to code, allowing them to visualize and create strategies with ease.

Rather than coding your own algorithm, the visual strategy editor facilitates the process with symbols. Once formulated, strategies can be activated effortlessly and might even lead to market-beating outcomes.

Visit Zignaly

Cap.Club's free access is a valuable offering. Although there are restrictions on the number of strategies and APIs you can operate simultaneously, it allows users to determine whether the platform is a suitable fit for their needs.

For seasoned traders, having tools for limit and trailing orders is close to essential. Trading at market prices is generally less than ideal; thus, utilizing trailing stops and take profit orders can enhance profitability, potentially justifying the entire subscription cost.

A major limitation of Cap.Club is its exclusive support for just two exchanges. ByBit .

If Binance or Bittrex are not your ideal trading venues, Cap.Club might not serve your needs well. However, setting up with either Binance or Bittrex is remarkably easy, signifying the potential benefit of opening an account with these exchanges.

After registering with Cap.Club, set up an API on your chosen exchange. This involves obtaining a new API key and a secret code, which can then be entered back into Cap.Club's interface—a process that is swift and straightforward.

, Kraken, and KuCoin.

Cap.Club boasts a comprehensive support section available online. Whether it's transferring your exchange account or navigating various tools, the necessary information is at your fingertips. This exceptional support is available with all account types and adds significant value.

Apex Trader Homepage

In summary, Cap.Club presents itself as a competent automated trading platform, offering advantageous tools to traders—provided they utilize one of its supported exchanges.

is tailored specifically for Binance users, equipping them with much-needed tools and extensive connectivity. However, those looking to automate trading on other exchanges might find alternative platforms more appropriate.

Apex Trader Homepage

Similar to Exchange Valet, Signal provides traders with tools akin to those found on platforms like MT4. Features include simultaneous stop loss and take profit orders, as well as laddered buying and trailing stop mechanisms.

Signal's features largely benefit active traders. While long-term crypto holders (HODLers) may find less utility, those accustomed to comprehensive trading platforms will appreciate Signal's offerings.

For Binance traders seeking advanced tools, Signal seems well-suited. Its capability to enact simultaneous stop loss and take profit orders is essential for effective trading.

We have also

Beyond using simultaneous stop loss and take profit, Signal empowers traders to execute laddered buys over time—ideal if anticipating significant price movements in a token.

Traders can automatically automate their purchasing strategy with Signal, which is beneficial for large-volume traders aiming to minimize any influence on the token's market price.

Signal also presents two noteworthy tools that might intrigue some traders.

The selling existing coins feature enables Signal users to offload specific coins, while the targets tool helps establish sell levels for positions—both of which offer utility for advanced trading.

While Signal provides a straightforward toolset, its accessibility extends to almost any device, circumventing the computer-only restrictions of many other platforms.

reviewed Apex Trader here

is a platform that is solely designed to work with Binance. While it grants Binance traders some essential tools and significant connectivity, it's not feasible for those wanting to automate trading on other exchanges.

This innovative bot operates entirely from the cloud, making life easy for traders by eliminating the need for local installation. CryptoTrader shines with its strategy marketplace, a place where you can either buy expert trading strategies that catch your eye or sell your own carefully crafted ones.

CryptoTrader supports a variety of popular exchanges, offering tools for both backtesting and real-time trading. Its backtesting feature gives traders a valuable chance to see how their strategies might fare under a myriad of market scenarios.

Trading Bots Offer New Income Avenues for Crypto Investors

With five subscription options, CryptoTrader meets various needs, charging monthly fees from 0.006 BTC to 0.087 BTC, exclusively accepting Bitcoin. Each plan has its perks, such as the number of bots you can deploy and the cap on your trading capital.

While coding know-how can be helpful when setting up strategies in CryptoTrader, there's no need to worry if that's not your forte. You'll find a selection of both free and premium strategies you can choose, making it accessible for all levels of experience.

One of CryptoTrader's strengths is its broad connectivity; it keeps traders informed of significant market happenings via email or text message alerts.

The bot enables trading not only in Bitcoin but also across a range of other altcoins, enhancing flexibility.

Visit Apex Trader

Haasbot stands out as the most thorough among today's trading bots. It's designed to operate with minimum input from the user but comes with a hefty price tag, ranging from 0.04 BTC to 0.07 BTC for a three-month period.

If you're planning to invest in it, it's smart to understand exactly what you'll gain and be committed to making the most out of it at those rates.

Haasbot is a brainchild of Stephan de Haas from HaasOnline Software, established in the 1990s. The company is behind the HaasOnline Trade Server (HTS), a sophisticated tool for automated crypto trading.

Compatible with Windows, MacOS, and Linux, Haasbot invites traders to explore over ten bot options, expanding with your spending.

Considering the investment, doing a little homework on past performance could be invaluable for those exploring bots.

Cap.Club

This trading terminal features crypto bots that automate trades with signals from third-party providers. Currently, the service is quite affordable at just $12 per month.

Renowned for its user-friendliness, the platform can serve as a vehicle for passive income. It allows easy integration with a TradingView account for favorite indicators, or you can go all-in with Zignaly's platform to set up your entire strategy.

Although Zignaly is in pre-launch, leading to limited exchange support, the developers promise to include KuCoin, Coinbase Pro, Poloniex, and Bittrex once it's fully up and running, alongside offering limitless currency pairs at no extra charge.

29Great Connectivity

What stands out about Cap.Club is the straightforward website and interface, making it appealing to those new to automated trading or not proficient in coding.

While the free version provides all trading strategies, it limits how many can be active. Notifications in the full version include both Email and Telegram, whereas the free account only uses Email.

If you choose to stay free, it’s all set for you. However, upgrading costs $30 per month or a discounted annual fee of $300.

Visit GunBot

Despite its simplicity, Cap.Club offers sophisticated trading features like cap and trailing orders, along with three dedicated trading programs.

These algorithms aim to capitalize automatically for clients. Although reviews are scarce, they're completely free with the basic plan.

Cap.Club combines algo-driven trading with conventional tools not offered by many crypto exchanges.

The platform also includes a visual strategy editor, helpful for those who grasp strategy formulation but struggle with coding.

Instead of coding your algo, lay it out symbolically. Once done, execute it easily, potentially turning your strategy into a profitable venture.

Having free access is beneficial, even if strategy and API usage is limited, as it helps you assess the platform's suitability.

For frequent traders, employing limit and trailing stops is almost mandatory. Making market trades isn’t optimal; trailing stops and take profits can maximize positions, validating a subscription's worth.

A limitation of Cap.Club is it only supports two exchanges - Binance and Bittrex.

Great Connectivity

Visit Signal

Live Trader Offers a Lot

If your preference doesn't include these exchanges, Cap.Club might not meet your trading needs. However, linking Cap.Club to them is straightforward, encouraging consideration of opening an account.

Having a Cap.Club account, create an API at your chosen exchange, get the API and secret code, then enter details into Cap.Club. It's a breeze, just a few minutes task.

Geared for Algos

Not a Freebie

Visit GunBot

Zenbot

Cap.Club hosts an extensive support section online. Whether connecting an exchange or understanding tools, you'll find needed info. This reliable support extends to both account tiers, adding further value.

Arbitrage

Overall, Cap.Club is a robust auto-trading platform offering valuable tools, particularly when trading on its supported exchanges.

Designed for Binance users, Signal offers tools and high connectivity traders crave. It won't fit if you want automated trading on other exchanges.

Market Making

Signal mirrors platforms like MT4, offering advanced tools like simultaneous stop loss and take profit orders, laddered buying, and trailing stops.

LinkedIn

While Signal's features are gold for traders, it's not ideal for long-term HODLers. But if you're accustomed to full-feature trading platforms, these tools will be advantageous.

For advanced trading tools on Binance, Signal is worth considering. The ability to pair stop loss with take-profit orders is indispensable for traders.

LinkedIn

Empire

Advertise Here

Beyond pairing stop loss and take profit, Signal allows buys to spread over time—laddered buy—useful if anticipating a major price movement.

Rather than a single purchase, let Signal stagger buys, beneficial for large traders aiming to reduce market impact on token prices.

Signal also offers coin selling and 'targets' tools, enabling users to sell specific assets or set levels for exit strategies. These could be valuable for experienced traders.

March 3, 2018 at 10:52 am

Despite having straightforward tools, Signal is accessible from almost any device, whereas others often require specific operating systems.

The bot operates in the cloud, eliminating the need for setup on personal devices and delivers hands-free trading experiences. With CryptoTrader, you can dive into a ‘marketplace’ bustling with various strategies, allowing you the flexibility to either purchase a strategy you fancy or showcase and sell your self-crafted strategies.

CryptoTrader seamlessly integrates with leading exchanges, catering to both backtesting and live trading scenarios. It provides a handy backtesting feature so you can simulate your strategies through different market environments to see how they might perform.

Offering five distinct subscription tiers, CryptoTrader's fees vary between 0.006 BTC to 0.087 BTC monthly. Payment is in Bitcoin, offering packages with differing capabilities like varied bot operations and equity ceilings.

April 15, 2018 at 3:02 pm

While having coding acumen can be advantageous for setting up strategies within CryptoTrader, the platform caters to both novice and code-averse individuals with an array of free and premium strategies.

Besides the wide-ranging functionality, CryptoTrader equips you with email and text alerts meant to keep you informed during significant market shifts or when trends alter.

It handles trading for Bitcoin alongside numerous other altcoins.