The past few weeks have seen Bitcoin making some serious waves. Having hit a low of $3,700 around mid-March, it has skyrocketed by more than 170%, crossing the crucial $10,000 mark.

BTC has rallied so high that according to According to the on-chain specialist Philip Swift, Bitcoin has only surpassed today's levels ($10,000 flat) for about 4.6% of its existence.

Bitcoin profitable days = 95.4% ????????

HODL #Bitcoin pic.twitter.com/7h8lzTFqVY

— Philip Swift (@PositiveCrypto) May 8, 2020

Though a 170% increase in just two months is quite remarkable, a prominent Wall Street investor remains unconvinced that the rally has concluded, suggesting that a $1,000,000 value, while not guaranteed, is within the realm of possibility.

Could Bitcoin Hit $1 Million

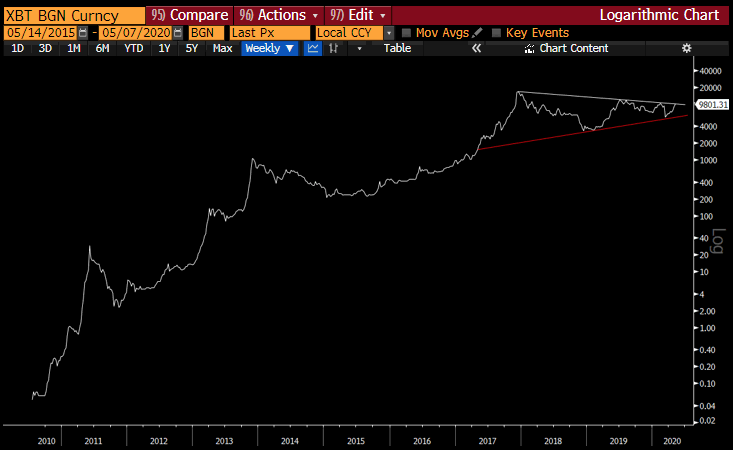

Raoul Pal, the CEO of Real Vision and formerly with Goldman Sachs, presented several charts, one of which illustrates his vision for Bitcoin potentially reaching $1 million - a dramatic 10,000% increase from the current $10,000 level. explained He outlined that with today’s critical technical breakthrough, the odds of substantially higher prices are on the rise, highlighting that

the combination of Bitcoin's halving event and the unprecedented money printing by global central banks further supports this bullish outlook: This assertion is supported by PlanB's stock-to-flow models, which show that the breakout coincided precisely with the halving event. Additionally, all major central banks are engaging in massive currency printing, while Bitcoin remains the hardest form of money that automatically becomes scarce.

creates one of the most favorable scenarios in any asset class I've ever seen...combining technical, fundamental aspects, funding flows, and market structure.

This led him to the conclusion that Bitcoin Pal isn't the only one who believes that Bitcoin might hit the million-dollar mark in the near future.

Chamath Palihapitiya, head of the venture capital firm Social Capital and an early executive at Facebook, told Morgan Creek's Anthony Pompliano that he envisions a reality where Bitcoin reaches millions in value.

Per previous reports from this outlet However, the investor cautioned that this scenario is not highly probable, but if we experience conditions ripe for hyperinflation or significant deflation,

Bitcoin could prove to be a safe haven play. Back in 2013, Palihapitiya and his team controlled about 5% of all Bitcoin, tying him deeply to the crypto world. BTC With notable figures like Palihapitiya and Pal backing Bitcoin, the giants on Wall Street are taking notice.

Top Investors Are Flooding In

A prime example of this is Paul Tudor Jones, a billionaire adept in macro investments.

In a report titled “The Great Monetary Inflation” acquired by Blockonomi, Jones shared his view that Bitcoin right now bears a striking resemblance to gold back in the 1970s.

For those unfamiliar, back then gold surged by hundreds of percent due to soaring inflation levels and the end of the gold standard. ongoing macroeconomic backdrop Although Jones sees Bitcoin as a less reliable store of value compared to other currencies, gold, and financial instruments, he considers it the speediest horse in the race.

Jones concluded by stating that his fund, Tudor BVI, plans to allocate a small portion of its capital, keeping it in the single-digit percentage range, to purchase Bitcoin futures.

I'm a writer who has been charting the crypto domain since 2013. My analyses and interviews have been showcased in top industry outlets like LongHash, NewsBTC, and Decrypt. Outside of writing, I contribute to the EXODUS division at HTC. Bitcoin is part of my investment portfolio. For inquiries, reach out to NickC@level-up-casino-app.com.

While he made no price prediction on Bitcoin Bitcoin (BTC) Price: Nosedives to $83,400 following President Trump's Tariff Disclosure