The year 2017 was a milestone for the cryptocurrency realm, though not every milestone was beneficial. That year was a parade of notable Ponzi schemes, each having its brief spotlight. Yet, none could match the audacity and scale of deception that BitConnect orchestrated.

Currently, BitConnect is under the legal spotlight in both the UK and the US due to its dubious operations. Despite this, they seemed to continue operating robustly, with their proprietary token trading substantially above its initial release value last year.

Stay with us as we uncover the mechanics of BitConnect, its operational modus, and how it succeeded in achieving such expansive reach in a remarkably short time frame.

Important Notice: We won't be including any links to BitConnect in this write-up.

BitConnect – How it’s supposed to work

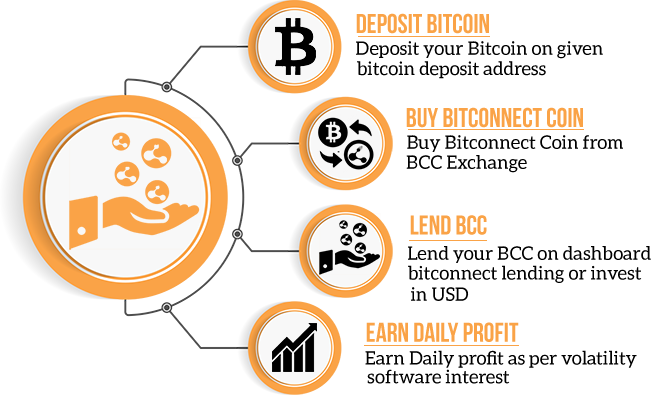

BitConnect operates in a manner akin to the textbook Ponzi scheme. Usually, such a scheme lures in participants with promises of enormous and implausible returns, possibly stating a daily or monthly percentage, or even doubling your money.in three monthsThese promised profits are unattainable, even in highly favorable market conditions. Initially, those operating the scheme might honor payouts using funds from newer participants, enticing more to join.

Subsequently, any money invested in the scheme is typically locked down, barring quick withdrawals. This lock might extend for 30, 60, or even 90 days. For BitConnect, the lockdown could range from 120 to 299 days. Allegedly, a larger initial investment means a shorter lockdown.

BitConnect spreads like a plague

Participants are urged to propagate the scheme via affiliate marketing strategies, flooding online discussions with affiliate links. Those distributing links might receive supposedly higher returns if someone signs up using their link.

Eventually, as with any Ponzi scheme, the liabilities begin to outweigh the accruing funds, prompting operators to vanish with all assets, leaving deposits irretrievable. BitConnect's anomaly lies in its year-long run without obvious decline, save for looming legal actions.

In contrast, another scheme, BitPetite, which surfaced last year, has mostly evaporated along with its deposits after a brief while. It highlights the peculiar longevity of BitConnect, possibly sustained by its popularity and an inflow of new users each month.

Calculating the madness

If BitConnect's claims are credible, what kind of profit might a participant anticipate? Their projections suggest a $1,000 deposit could yield 40% monthly returns. Imagine after a month, your investment grows to $1,400. By another month, it balloons to $1,960, an improbability in traditional investing.

By six months, you hypothetically accumulate $7,529, and by year's end, that sum explodes to $56,693 . Ask yourself: would any rational investment firm really provide over $55,000 in returns for a $1,000 loan? Even without compounding, a return of $400 monthly, or $4,800 annually, remains absurdly high.

At higher tiers, deposits exceeding $1,000 supposedly fetch additional daily returns of 0.10 to 0.25%. Say, investing $1,010 qualifies you for an extra 0.10% daily, translating to $10 a day on top of the 40% monthly return.

If an offer looks excessively lucrative, it’s likely too good to be true.

A parallel scam, BitPetite, which offered daily returns of 4.5% during its brief stint, would have fetched $3,745 in a month from a $1,000 investment, surpassing even BitConnect.

So, how does BitConnect justify promising such exorbitant, unrealistic returns? They claim it’s through lending. Let’s consider: the most burdensome credit card might levy a 35% interest rate, annually. A $1,000 balance incurs $29 in monthly interest. Even then, such an APR is steep, with typical cards charging 14-24%.

Where did BitConnect come from?

Who are they supposedly lending to at these extreme rates? Especially when cheaper credit options exist, why would anyone agree to such terms? The reality is, nobody truly knows who the potential borrowers are, or even if they exist.

The BitConnect site back in 2016

The official site went live in late 2016, expressing its mission to support 'freedom-loving individuals seeking income stability in a volatile world.' All key scheme components were presented, except its token, BitConnect Coin (BCC), which debuted in early 2017. threatened The identity behind BitConnect seems rooted in South East Asia, likely Vietnam, as per initial promotional content. Legally, there's a registered entity in the UK. Yet, without disproving its Ponzi nature, the UK could shut it down. demanding In response, Texas regulators served an urgent cease and desist directive, prohibiting them from operating in Texas unless legitimizing their activities.

Impending Fallout

BitConnect stands as one of the globe's most expansive Ponzi systems. Historically, such schemes were geographically confined. Cryptocurrency's fluidity has enabled BitConnect to ensnare victims worldwide.

What might unfold when BitConnect inevitably collapses? Unfortunately, it could severely mar cryptocurrency's public perception. Major news will likely connect it to nefarious activities, damaging trust.

Estimating the extent of repercussions is complex. Millions in cryptocurrencies could vanish, and majorly disillusioned investors might abandon crypto for good.

We can merely hope the fallout from BitConnect's downfall won't cripple the crypto industry for too long.