According to an official statement, Bitmain announced the forthcoming launch of the new series of Antminer ASIC mining devices.

These fresh units, named S17+ and T17+, promise higher hash rates while maintaining similar energy use as earlier models. They are slated to hit the market on October 11, 2019.

While exact costs weren't disclosed during the announcement, we predict they will align with historical pricing for Bitmain products. Join us as we explore these innovations and analyze the potential returns from operating these machines.

Another Year, Another ASIC

In recent years, Bitmain consistently rolled out upgraded machines under the Antminer brand. They're often leading the pack with top hash rates, but competitors frequently catch up swiftly.

A recurring issue plaguing these products is widespread hoarding and reselling at significant markups. Often, devices rapidly sell out at retail, only to reappear from resellers at quadruple the price.

We'll need to watch if the demand for these gadgets has diminished or if Bitmain has increased production to prevent shortages this time.

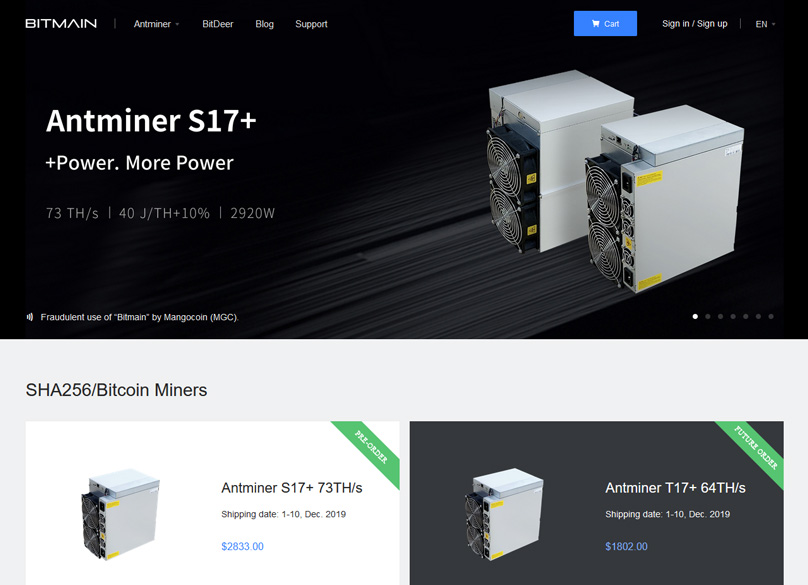

According to the release Bitmain is preparing to introduce not one but two ASIC miners with distinct price tags and hash capabilities. The flagship S17+ delivers a hashrate of 72 TH/s, operating on 2,920 watts.

The other model, the T17+, offers a more affordable alternative with a 64 TH/s rate and requires 3,200 watts.

Coins by Numbers

The main question remains – can you earn a profit with these machines right now? To assess this, we utilized the Coinwarz profitability calculator considering an electricity rate of $0.10 per kilowatt-hour. All other parameters like bitcoin difficulty stayed at their standard settings based on the latest data.

Our analysis shows the S17+ is profitable, albeit not immensely. Using the calculator, if you run an S17+ continuously throughout the year – assuming difficulty remains unchanged despite the release of stronger devices – you could potentially gain around half a bitcoin, precisely 0.52212548 BTC.

However, once electricity expenses are factored in, your profits might shrivel, given estimated power costs of $2,557.92.

Regarding the second device, one might extract approximately 0.45156798 BTC annually, with electricity costs hitting $2,803.20.

Is it worth it?

Answering this isn’t simple due to several unpredictable elements.

It seems likely these machines will soon set a new standard for hash rates, leading to increased network difficulty, which could reduce their efficiency.

Additionally, with bitcoin values hovering between $8,000 and $10,000, immediate bitcoin liquidation might barely cover hardware and operational expenses within a year, barring any other profits unless bitcoin rises or drops.

Before delving into mining, consider what happens if you just purchase half a bitcoin. With today’s figures, that would be roughly $4,250, compared to an expected $2,000 for the Bitmain S17+.

By buying bitcoin, you'll secure that half-bitcoin by year's end without dealing with the hassles of a loud, heat-producing machine and high electricity bills.

Should bitcoin values increase, purchasing them rather than mining yields similar gains.

Should you buy one of these devices?

Ultimately, the decision is yours, but for casual investors, buying and holding might be wiser.

If you’re determined to mine, purchasing one of these machines reasonably priced might be viable – avoiding exorbitant reseller rates if shortages reoccur. Paying too much will negate profits.

Final thoughts

Wondering why to mine if it's no better, or worse, than buying and holding bitcoin? Here’s why.

Bitcoin mining is dominated by industrial players with access to cheap electricity and economies of scale.

These major entities may purchase vast numbers of machines at discounts, operating them cost-effectively. For them, mining remains profitable.

But if you’re an individual contemplating a small-scale setup, you might want to leave mining to larger operations.