Established back in 2014 by HDR Global Trading Limited, which was formed by ex-bankers Arthur Hayes, Samuel Reed, and Ben Delo, BitMEX this exchange platform operates globally and is registered in the Seychelles.

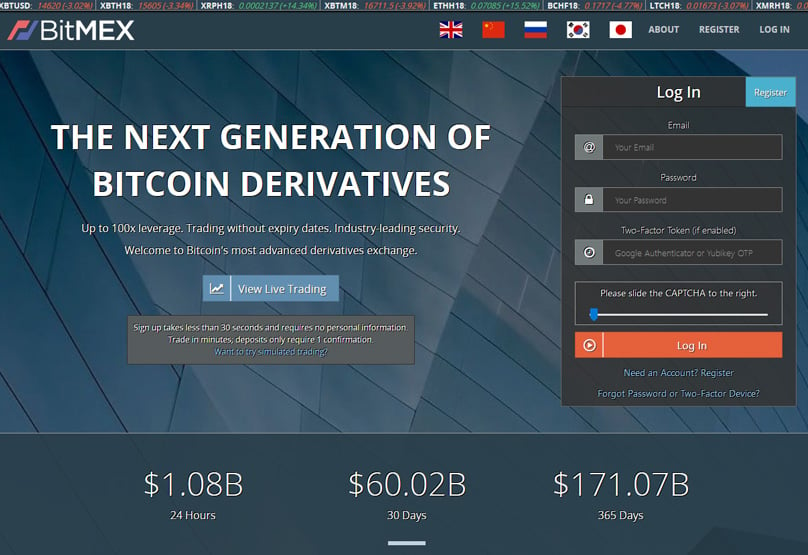

Standing for Bitcoin Mercantile Exchange, BitMEX ranks as one of the most significant Bitcoin trading platforms in existence today, boasting a daily trading volume exceeding 35,000 BTC, with more than 540,000 users monthly and a transaction history totaling over $34 billion in Bitcoin since its start.

Unlike most exchanges, BitMEX exclusively accepts Bitcoin deposits, which can then be utilized to acquire various other digital currencies. BitMEX is renowned for complex financial maneuvers like margin trading, which involves leveraging funds. As is the case with many cryptocurrency-based platforms, BitMEX remains unregulated in any official capacity.

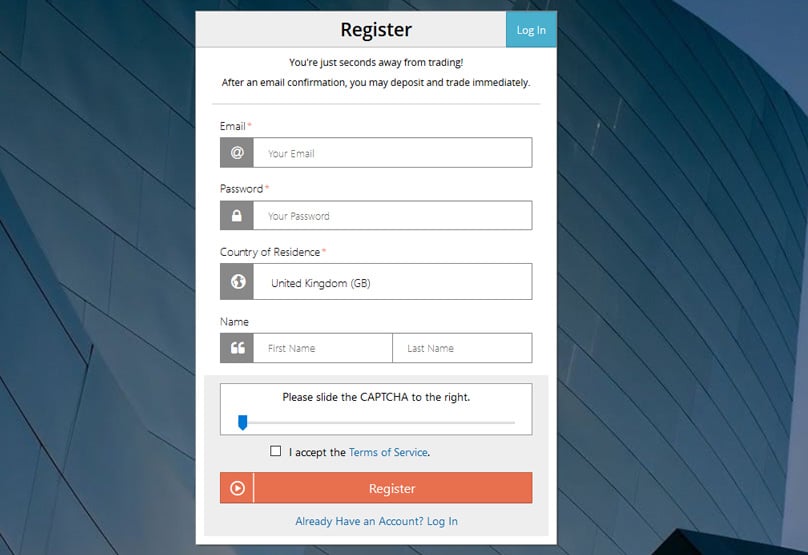

How to Sign Up to BitMEX

In order to create an account on BitMEX , potential users must first create an account on the site. Registration is straightforward, requiring only a valid email address, which is vital for account verification. After successfully signing up, traders aren't restricted by limits. Note that individuals must be at least 18 years old to join.

It's crucial to understand that BitMEX does not permit users from the United States, utilizing IP verification to ensure compliance. While some users in the US find ways around this, the use of a VPN, it is highly discouraged for US citizens to register for BitMEX, especially given the presence of alternative exchanges designed to cater to US-based users within the confines of US regulations. BitMEX facilitates trades between cryptocurrencies and several fiat currencies, such as the US Dollar, Japanese Yen, and Chinese Yuan. Users can trade numerous digital currencies, specifically

How to Use BitMEX

The BitMEX platform is laid out in a user-friendly manner, appealing to those with prior market experience. Yet, novices may find it challenging. The interface's design may appear slightly outdated compared to more modern exchanges Bitcoin , Bitcoin Cash , Dash , Ethereum, Ethereum Classic , Litecoin , Monero , Ripple , Tezos and Zcash .

Once registered on the platform, like Binance and Kucoin’s .

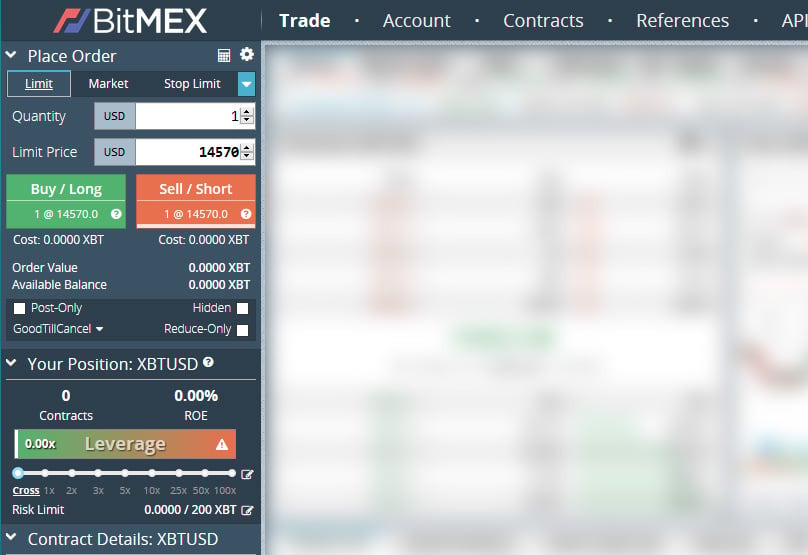

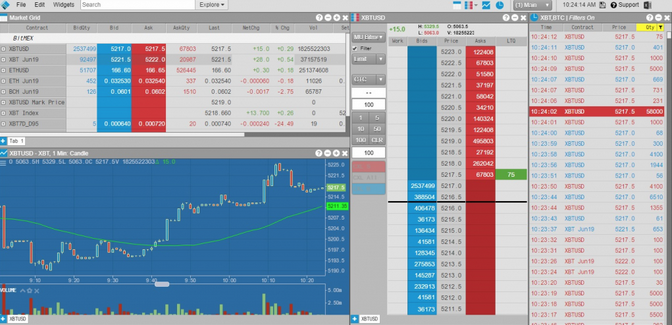

, they can head over to the Trade section to access an array of trading tools below. By selecting a particular tool, users reveal the order book, recent trades, and order slip on the left-hand side. The order book presents three columns – the bid price for the asset, the order volume, and the total value in USD for all active trades, both short and long.

The trading platform is customizable, allowing each user to adjust widgets based on their viewing preferences, providing total control over the display. Additionally, it includes a feature for TradingView charts, offering an extensive selection of charting tools, which many see as an upgrade compared to what competitors provide.

Once trades are conducted, all orders are visible within the platform's interface. Users have tabs to view Active Orders, check Stops, review Filled Orders (complete or partial), and explore trade history. Under Active Orders and Stops, traders can cancel any order by clicking the “Cancel” button. Users also have visibility on open positions, with analyses indicating whether they are profiting or losing.

BitMEX employs an auto-deleveraging strategy, which guarantees the closure of liquidated positions, even amid market volatility. Auto-deleveraging mandates that if an account is bankrupted with inadequate liquidity, the positive side becomes deleveraged, with positions prioritized based on profitability and leverage, starting with the highest. Traders are informed of their position in the auto-deleveraging queue if needed.

Despite being optimized for mobile usage, BitMEX currently offers only an unofficial Android app, with no iOS option available yet. Users are advised to access it from a desktop when possible.

BitMEX provides multiple order types:

Limit Order (fulfilled when the specified price is met);

- Market Order (executed at the going market rate);

- Stop Limit Order (similar to a stop order with the added ability to set a price post-trigger);

- Stop Market Order (a stealth stop order that becomes active only upon triggering);

- Trailing Stop Order (functions like a Stop Market order but with a set trailing value to place a market order);

- Take Profit Limit Order (similar to a Stop Order, establishing a target price for gains, not just loss prevention);

- Take Profit Market Order (mirroring the previous type, but triggering a market order instead of a limit one).

- The platform supports margin trading across all cryptocurrencies listed, alongside futures and derivative trading, known as swaps.

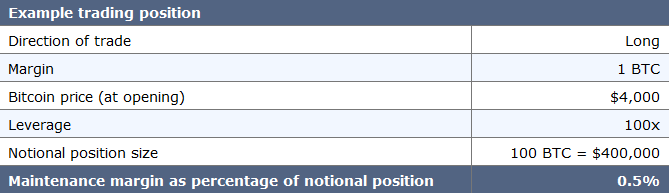

A futures contract involves an agreement to procure or vend an asset at a preset future price. On BitMEX, users enjoy leverage up to 100x on select contracts.

Futures and Swaps

Perpetual swaps resemble futures but lack an expiration or settlement date, and they generally trade closer to the reference Index Price, unlike futures which may deviate substantially.

BitMEX also provides Binary series contracts, which are speculative contracts settling at either 0 or 100. Essentially, Binary series contracts are a sophisticated form of wagering on specific events.

The current Binary series betting tool available deals with the next 1mb Bitcoin blockchain block. These contracts are traded sans leverage, sporting a 0% maker fee, alongside a 0.25% taker and settlement fee.

BitMEX affords traders the chance to leverage their positions on the platform. Leverage allows orders to surpass the user's balance, potentially maximizing profits compared to using only wallet balance. This trading approach is referred to as “Margin Trading.”

Bitmex Leverage

Specifically, there are two Margin Trading variants: Isolated and Cross-Margin. Isolated allows users to designate wallet sums to secure positions post-order. Conversely, Cross-Margin employs entire wallet funds for securing positions, which warrants cautious consideration.

On the BitMEX interface, users can adjust leverage via a leverage slider. The maximum leverage is 1:100, particularly for Bitcoin and Bitcoin Cash, which is exceptionally high in cryptocurrency trading as most exchanges cap at roughly 1:20.

For conventional futures, BitMEX conveys a direct fee model. As highlighted, BitMEX can offer leverage up to 100%, with actual amounts varying by product.

BitMEX Fees

However, high-leverage trading demands sophistication and is meant for experienced investors familiar with speculative practices. The fees and leverage specifics are as follows:

Moreover, extra fees apply to hidden/iceberg orders. Hidden orders incur taker fees until executed fully. Thereafter, they revert to normal, allowing users to receive maker rebates for the non-hidden portion.

| Bitcoin | Bitcoin Cash | Ethereum | Dash | Eth. Classic | |

| Ticker | XBT | BCH | ETH | DASH | ETC |

| Initial Margin | 1% | 1% | 2% | 5% | 5% |

| Maintenance | 0.5% | 0.5% | 1% | 2.5% | 2.5% |

| Maker Fee | -.025% | -.025% | -.025% | -.025% | -.025% |

| Taker Fee | .075% | .075% | .075% | .075% | .075% |

| Settlement Fee | .05% | .05% | .05% | .05% | .05% |

| Leverage | X100 | X100 | X50 | X20 | X20 |

| Litecoin | Monero | Ripple | Tezos | Zcash | |

| Ticker | LTC | XMR | XRP | XTZ | ZEC |

| Initial Margin | 3% | 4% | 5% | 50% | 20% |

| Ripple | 1.5% | 2% | 2.5% | 25% | 10% |

| , Tezos and | Zcash | like Binance | and | 0 | 0 |

| Kucoin’s | .075% | .075% | .075% | .25% | .25% |

| BitMex Trading View | .05% | .05% | .05% | .25% | .25% |

| Futures and Swaps | Bitmex Leverage | Margin Trading | BitMEX Fees | Bitcoin | Bitcoin Cash |

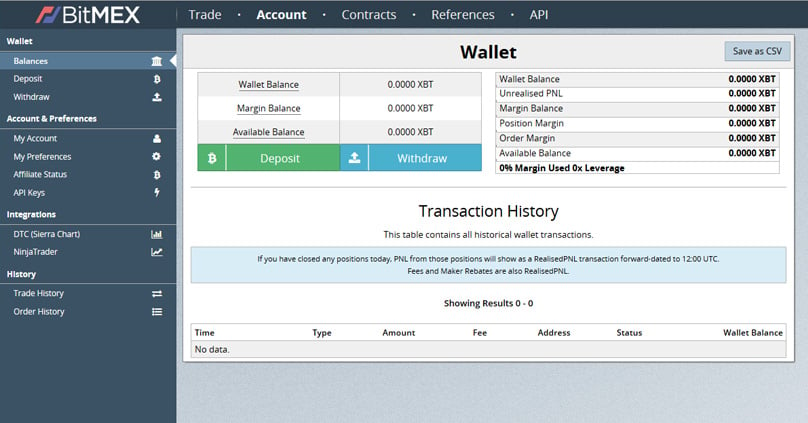

BitMEX imposes no charges on depositing or withdrawing. However, Bitcoin withdrawals carry a minimum network fee based on blockchain traffic. The sole costs are those imposed by banks or cryptocurrency networks.

Ethereum

As mentioned earlier, BitMEX solely accepts Bitcoin deposits, which act as collateral on trading contracts, irrespective of Bitcoin involvement in the trade.

The minimum deposit required is 0.001 BTC. There are no withdrawal caps, though withdrawals remain Bitcoin-exclusive. To proceed, users simply input the desired withdrawal amount and wallet address to finalize transfers.

Depositor access is round-the-clock, while withdrawals undergo hand processing at fixed times daily. Manual withdrawals heighten fund security by affording cancellation opportunities for unauthorized requests and sidestepping automated actions & hot wallets vulnerable to breaches.

Functioning as a crypto exchange, BitMEX adheres to a Bitcoin-in/Bitcoin-out model, typically disallowing fiat transactions. Yet, the absence of trading limits is a key advantage, with trading pairs connected to the US Dollar (XBT), Japanese Yen (XBJ), and Chinese Yuan (XBC).

Eth. Classic

BitMEX accommodates these cryptocurrencies:

BitMEX also provides leverage options for the following cryptocurrencies:

- Ticker

- XBT

- BCH

- ETH

- DASH

- ETC

- Initial Margin

- Maintenance

- Maker Fee

- -.025%

- -.025%

- -.025%

20x : Ripple (XRP),Bitcoin Cash (BCH), Cardano (ADA), EOS Token (EOS), Tron (TRX)

- -.025%

- 100x: Bitcoin (XBT), Bitcoin / Yen (XBJ), Bitcoin / Yuan (XBC)

- -.025%

- Taker Fee

- Settlement Fee

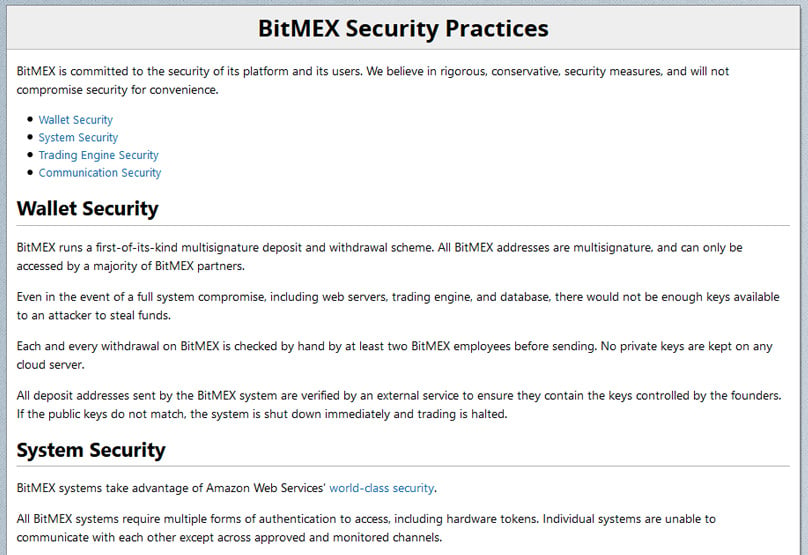

- The company managing BitMEX, HDR Global Trading, has recently unveiled a collaboration with Trading Technologies International, Inc. (TT), a prominent global supplier of high-performance trading software.

Collaborative Effort with Trading Technologies International

BitMEX Analysis 2020: Detailed Insights into the Platform - Is It Secure?

Considering using the BitMEX platform for trading cryptocurrencies? Check our thorough guide first to understand what essentials you need to be aware of.

Leverage

Introduction to BitMEX: Exhaustive Overview for New Traders

Established by HDR Global Trading Limited, which traces its roots back to Arthur Hayes, Samuel Reed, and Ben Delo, all three being former banking professionals, in the year 2014.

The platform operates worldwide and maintains its registration in the Seychelles.

Standing for Bitcoin Mercantile Exchange, BitMEX ranks among the most significant trading platforms out there, boasting a massive trading volume of over 35,000 BTC each day, drawing in more than 540,000 users monthly, and has traded over $34 billion in Bitcoin since it began.

Unlike a lot of trading platforms out there, BitMEX exclusively takes deposits in Bitcoin which can subsequently be utilized to buy a range of other cryptocurrencies. BitMEX focuses on advanced financial processes like margin trading, synonymous with trading on leverage. As with many crypto-driven exchanges, BitMEX presently operates without regulation in any specific country.

Trading Technologies International Collaboration

How Does BitMEX Cater to Beginners?

To begin, users must sign up on the site. This process simply requires an email — a valid one — since a confirmation email is sent to verify the account. Once registered, there are no caps on how much you can trade, but traders must be over 18.

It's crucial to point out that BitMEX does not serve traders from the US and actively verifies IP addresses to ensure compliance. Although some from the US have maneuvered around this issue, it's generally advised against for US citizens due to availability of other exchanges that comply with US laws.

BitMEX accommodates cryptocurrency trades against numerous fiat currencies, including the USD, JPY, and CNY. You can trade many different types of cryptocurrency, like

BitMEX's trading platform is straightforward and effortlessly navigated by those familiar with similar marketplaces. However, it may not be the best starting point for inexperienced traders. The interface feels somewhat outdated compared to fresher exchanges.

Once membership to the platform is secured,

the next step is to select Trade and observe the array of trading instruments that appear beneath.

Clicking on a chosen instrument opens up the order book, recent trades log, and the order slip on the left. The order book presents three columns – the asset’s bid value, the order amount, and the cumulative USD value for all orders, both on the short and long sides.

The platform’s widgets can be personalized per the user’s preference, offering full display control. Additionally, there’s an integrated feature for TradingView charting, providing a broad suite of charting tools regarded as an upgrade over many competitors.

After trades are initiated, all orders can be readily observed in the trading interface. Users can toggle between Active Orders, check Stops, review Orders Filled (whether entirely or partially) and view full trade history. Within the Active Orders and Stops sections, traders can employ the 'Cancel' button for orders. Users also get a snapshot of open positions along with an analysis to determine profitability or loss.

With auto-deleveraging in place, BitMEX ensures all liquidated positions are concluded even in chaotic market conditions. This entails a specific arrangement: if a position fails without liquidity backup, the more profitable and leveraged positions start deleveraging, prioritized from highest leverage down. Traders always know their status in the auto-deleveraging queue when it’s necessitated.

Though optimized for mobile use with a non-official app available for Android, BitMEX doesn’t support iOS yet and suggests a desktop experience for optimum performance.

BitMEX provides its users with a selection of order types:

- Limit Order (fulfilled at the specified price point);

- Market Order (executed at the prevailing market rate);

- Stop Limit Order (acts like a stop order, but allows price setting once the trigger is met);

Stop Market Order (remains unsurfaced until market hits the trigger);

Trailing Stop Order (resembles a Stop Market order but sets a trailing metric for market orders);

Take Profit Limit Order (used much like a Stop Order, but aims for a targeted price for gains instead of restricting losses);

Take Profit Market Order (similar to the last type but triggers a market order instead of a limit one);

Is BitMEX Suitable for Those New to Trading?

The platform supports margin trading across all cryptocurrencies shown online, including futures and derivatives or swaps.

Futures contracts involve buying or selling an asset at a future date, agreed at a set price. On BitMEX, users have the potential to leverage up to 100 times on given contracts.

- Perpetual swaps parallel futures but have no expiry or settlement. They closely follow the reference Index Price, unlike futures which can stray considerably.

- BitMEX also offers Binary series contracts, built on predictions that settle at either 0 or 100. Essentially, these contracts equate to a more intricate wager on an outcome.

- Currently, the sole Binary series instrument revolves around predicting the next 1MB Bitcoin blockchain block. These contracts are executed without leverage, incur a 0% maker fee, and a 0.25% taker and settlement fee each.

- BitMEX empowers traders to apply leverage, which essentially means placing orders greater than their actual balance. This strategy potentially maximizes profit in contrast to solely utilizing wallet funds. Engaging in such practices is known as 'Margin Trading.'

- Two Margin Trading forms exist: Isolated and Cross-Margin. The first allows users explicit control over how much wallet balance to dedicate to keeping positions post-order-placement. Conversely, the second uses all wallet funds to back positions, necessitating extreme caution. X100 .

The platform lets traders determine leverage levels using a slider, offering a staggering maximum leverage of 1:100 (for Bitcoin and Bitcoin Cash). This is a notably high leverage for cryptocurrencies, considering competing exchanges rarely surpass 1:20.

When handling standard futures contracts, BitMEX has a clear-cut fee model. Leverage can escalate to 100%, albeit variable by product.

It’s worth noting that maximum leverage trading is sophisticated, tailored for professionals versed in speculative investments. The associated fees and leverage breakdown is as follows:

There are supplementary charges for hidden or iceberg orders. A hidden order incurs taker fees till completely executed. Subsequently, it converts to normal and the maker receives rebates on non-hidden parts.

BitMEX charges no fees for deposits or withdrawals. However, when transacting Bitcoin, the minimum network fee relies on current blockchain traffic. Thus, the exclusive expenses are those of banks or crypto networks.

Earlier mentioned, deposits are limited to Bitcoin with Bitcoin underpinning trades, notwithstanding the trade’s direct Bitcoin involvement.

X100

Minimum deposits are set at 0.001 BTC. While there are no withdrawal caps, withdrawals remain Bitcoin-exclusive. Users simply enter the desired sum and wallet address for fund transfer.

Deposits can occur round-the-clock but withdrawals handle manually once a day. This manual process bolsters user fund security by allowing time and notice to halt potentially fraudulent transactions, sidestepping reliance on automated systems and hot wallets susceptible to breaches.

As a solely crypto-centric exchange, BitMEX facilitates transactions with a Bitcoin-in/Bitcoin-out system. Consequently, fiat is incompatible for any transactions; however, the absence of trade constraints and trading pairs linked to the USD (XBT), JPY (XBJ), and CNY (XBC) serves as an advantage.

BitMEX extends its support to these cryptocurrencies:

Further, leverage trading potential exists on these coins:

X20

20x: Ripple (XRP), Bitcoin Cash (BCH), Cardano (ADA), EOS Token (EOS), Tron (TRX)

100x: Bitcoin (XBT), Bitcoin/Yen (XBJ), Bitcoin/Yuan (XBC)

HDR Global Trading, the entity behind BitMEX, recently inked a deal with Trading Technologies International, Inc. (TT), a leading global vendor of high-performance trading software.

2020 BitMEX Evaluation: Thorough Exploration of The Platform - Is It Secure?

Contemplating the use of the BitMEX Crypto Exchange? Browse through our Extensive, Detailed Guide first to grasp the essentials before diving in.

BitMEX for Beginners: A Comprehensive Assessment

Established back in 2014 by HDR Global Trading Limited, a company founded by ex-bankers Arthur Hayes, Samuel Reed, and Ben Delo,

X20

this trading hub operates globally, with its registration anchored in the Seychelles.

Also known as Bitcoin Mercantile Exchange, BitMEX stands as one of the giants

in the trading realm today, boasting a daily trading activity that exceeds 35,000 BTC and clocking in over 540,000 monthly user interactions, having facilitated over $34 billion in Bitcoin transactions from day one. Monero .

Ripple

BitMEX differentiates itself from a plethora of other platforms by exclusively accepting Bitcoin for deposits, which users can subsequently trade into a spectrum of other digital currencies. BitMEX carves a niche in conducting complex financial feats like margin trading, utilizing leverage. In common with many crypto-driven exchanges, BitMEX finds itself unregulated across jurisdictions.

Collaboration with Trading Technologies International

Is BitMEX User-Friendly for Absolute Beginners?

10-.025%

BitMEX facilitates trades between cryptocurrencies and several fiat currencies, such as the US Dollar, Japanese Yen, and Chinese Yuan. It supports a diverse roster of cryptocurrencies for trading, including chief players in the market.

While BitMEX’s trading interface is intuitive and favors users with a background in similar platforms, it might not be the best start for newcomers. Its interface may seem somewhat archaic compared to newer exchanges.

Upon securing access to the platform,

, users should navigate to the 'Trade' section to unveil the entire spectrum of trading instruments displayed below.

Selecting a specific instrument launches the order book, recent trades display, and order slip to the left. The order book is trifurcated into columns showing the bid value, order quantity, and total USD value for ongoing orders, both short and long.

Users can customize widgets on the trading platform to align with their viewing preferences, granting them absolute control over visible elements. A built-in feature offering TradingView charting enriches the platform with expansive charting tools, seen as superior compared to many counterparts.

Once transactions are complete, users can audit their orders conveniently in the trading interface. The interface features tabs enabling users to switch between Active Orders, observe Stops in place, check Orders that are Filled (fully or partially), and review trade history. The Active Orders and Stops tabs allow traders to withdraw any orders simply by clicking the ‘Cancel’ button. Active positions, along with a profitability analysis (in black or red), are visible too.

BitMEX employs an auto-deleveraging strategy to ensure liquidated positions are closable in volatile markets. Auto-deleveraging prioritizes positions by highest leverage and profitability, reducing risk by liquidating the highest leveraged position first when necessary. Traders are informed of their status in the auto-deleveraging queue whenever applicable.

Maintenance

Although optimized for mobile usage, BitMEX currently has an unofficial Android app only, with no iOS counterpart available yet. Desktop use is advised for the optimal experience.

BitMEX provides an assortment of order types for its users, among them:

Limit Order (where execution occurs if the target price is reached);

Market Order (executed at the prevailing market rate);

Stop Limit Order (similar to a stop order but allows setting a price for the order post the Stop Price trigger);

Stop Market Order (a stop order that remains off the order book until the market hits the trigger);

Trailing Stop Order (acts like a Stop Market Order, but here the user sets a trailing value for the market order);

Take Profit Limit Order (used like a Stop Order to determine a target price for gains rather than loss minimization);

Take Profit Market Order (alike the previous, with triggered actions resulting in a market order instead).

Margin trading across all currencies featured on BitMEX is available. Additionally, the platform offers trading in futures and derivatives – swaps.

Taker Fee

A futures contract entails a commitment to buy or sell an asset at a future date at a predetermined rate. BitMEX allows up to 100x leverage on select contracts.

Settlement Fee

Perpetual swaps resemble futures, albeit without expiry or settlement, often trading in proximity to an underlying reference Index Price, unlike futures, which can deviate considerably.

BitMEX also provides Binary series contracts, essentially prediction-oriented contracts that settle at either 0 or 100. They are a more intricate form of gambling on specific events.

Leverage

The current accessible Binary series contract revolves around predicting characteristics of the forthcoming 1mb block on the Bitcoin blockchain. Binary series contracts trade without leverage, incurring a 0% maker fee, a 0.25% taker fee, and a 0.25% settlement fee.

BitMEX enables traders to amplify their positions via leveraging. Leverage means executing orders that exceed the available balance. This approach potentially yields higher profits compared to orders limited by wallet balance alone - a method known as 'Margin Trading.'

Margin Trading splits into two formats: Isolated and Cross-Margin. The former allows users to earmark a specific wallet amount for position sustainment post-order execution, whereas the latter leverages the entire wallet balance, thus necessitating cautious handling.

On BitMEX, users can adjust their leverage using the leverage slider. Maximum leverage of 1:100 is attainable (specifically for Bitcoin and Bitcoin Cash), significantly surpassing the average leverage (1:20) found on most other exchanges.

BitMEX's fee structure for traditional futures is straightforward. As mentioned, BitMEX offers up to 100% leverage, with variation across different offerings.

X5

Nonetheless, it's important to note that trading with maximum leverage is intricate, intended for seasoned investors versed in speculative ventures. Corresponding fees and leverage are as follows:

However, discreet/iceberg orders carry additional costs. A discreet order incurs taker fees until fully executed, post which it transitions to a regular order and begins receiving maker rebates for the non-hidden portion.

Deposits and withdrawals on BitMEX are fee-free. However, withdrawing Bitcoin incurs a minimum network fee contingent on blockchain activity. Thus, the only fees are those imposed by banks or crypto networks.

As highlighted earlier, BitMEX exclusively accepts Bitcoin deposits, utilizing Bitcoin as collateral for trading contracts, Bitcoin trade involvement notwithstanding.

A deposit minimum of 0.001 BTC applies, but withdrawal limits are non-existent, with Bitcoin as the sole withdrawal currency. To withdraw, users simply specify the withdrawal amount and wallet address to complete the transaction.