The insurance industry is notoriously complex, but it's not all down to the businesses operating within it. By design, insurance deals with risks and uncertain events. Premiums are steadily amassed, lying in wait for a significant event demanding a hefty disbursement.

When unexpected events occur, the insurance company's well-laid plans are disrupted, forcing recalculations of rates and benefits to fill the gaps and brace for future unforeseen losses.

Complexities mount when tangible assets are considered. Automobiles, vessels, motorcycles, and aircraft all require coverage, and these physical items come with histories marked by wear and tear, impacting premium computations and payout estimations if those minor blemishes escalate into major damages.

Even more complexity is introduced with intangibles such as health and life insurance. Yet another layer is added when different parts of the process—like hospitals, emergency services, and policyholders—must coordinate to settle responsibilities, akin to splitting a restaurant bill when diners have ordered differently and are limited in their ability to pay.

The complicated nature of the industry is further compounded by the array of people involved: agents, assessors, estimators, and service providers all contribute, and any mistake can lead to long-lasting ramifications.

Blockchain's transparency has the potential to revolutionize the insurance business from its core.

Open History

When considering a used vehicle, you scrutinize specific details: Are there visible rust spots? What is the mileage? Where has the vehicle been sheltered for these past years?

Insurance companies similarly evaluate cars to determine premiums and coverage options. Unfortunately, only scrap dealers might benefit from devaluing a car, leading to widespread fraud in the used car market and turning insurance calculations into educated guesses at best.

Using blockchain to establish a credible ownership track can eliminate these uncertainties. Rebuilt titles are accurately recorded and communicated, allowing for precise documentation of significant repairs.

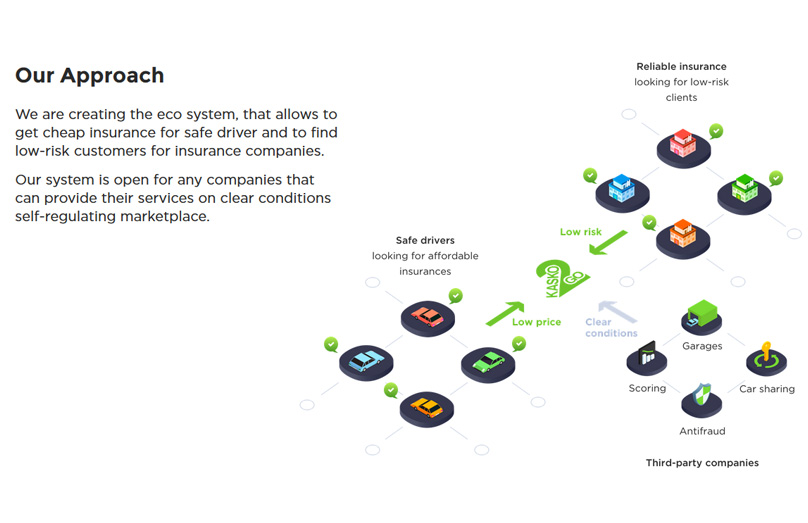

Beyond vehicles, this methodology extends to drivers, with blockchain providers enabling similar reliability. Kasko2Go details in its white paper .

Traditional insurance companies utilize broad client categories to simplify their pricing strategies, attempting to categorize each of us despite our unique characteristics. This lack of personalization leads us to pay collectively for uncertainties, making it easier for insurers to set higher premiums. This inefficiency stems from their internal bureaucracy, which ends up being borne by the policyholders.

When each vehicle or driver brings a transparent and reliable record to the table, insurers can perform precise calculations, potentially lowering premiums as risks inherent to the industry diminish.

Making a Claim

Navigating the intricacies of insurance claims is notoriously tedious, an ordeal perhaps deliberately designed. It's something we reluctantly engage with, typically only in emergencies.

The arduous task of making an insurance claim involves numerous stakeholders, each at different levels within the industry’s hierarchy. These stakeholders must efficiently handle billing and disputes as promptly and accurately as possible, often working with disparate systems, schedules, and criteria.

More often than not, this ends up a chaotic tangle. So much so that some companies boast entire marketing campaigns on their ability to process claims with ease. Liberty Mutual ’s recent campaign.

Deploying blockchain solutions can harmonize communications across the insurance ecosystem, ensuring consistent information flow. This synchronization holds particular promise within healthcare—enabling scenarios where a doctor's prescription reaches a pharmacist and the insurer concurrently.

Streamlining claim processing is just one benefit. Simplifying payments via smart contracts—a step away from traditional invoicing—could also reduce associated fees and costs. The net effect could mean decreased overhead for insurers, translating into lower premiums for customers. The adoption of blockchain technology could surmount previous barriers faced by insurers related to incompatible hospital networks or differing time zones.

The Insurance of Things

Embracing blockchain could transform the outdated frameworks of the insurance industry into something vastly more efficient. It may also unveil new paths previously unimagined.

The 'Internet of Things' (IoT) envisions a network where devices communicate through the cloud or blockchain, optimizing their interactions. Consider your fridge alerting you via your phone about temperature irregularities, prompting you to call for repairs.

Similarly, think of a sprinkler system integrated on the blockchain.

Devices could autonomously identify and report loss situations to insurers before the insured are even aware.

...And when sprinklers activate, sensors gauge the event scale, leading to expedited claims based on IoT data—long before the policyholder realizes there's an issue.

Managing the unforeseen is the essence of insurance. It’s ironically fitting that an industry stalwart against unpredictabilities may soon be overhauled by blockchain—a catalyst for efficiency in evaluation, estimation, and claims handling.

Disruption

Founder and Editor-in-chief of Blockonomi, a UK-based media outlet, advocating for open-source software, blockchain tech, and a free, equitable internet.

References

- https://www.cbinsights.com/research/blockchain-insurance-disruption/

- https://hackernoon.com/blockchain-use-cases-for-insurance-industry-in-2018-f80c46ab2d

- http://www.cityam.com/279761/insurance-industry-needs-embrace-blockchain-starting-now

- https://venturebeat.com/2018/03/02/kasko2go-uses-military-grade-tech-to-drive-its-blockchain-based-car-insurance/

- https://tokensale.kasko2go.com/uploads/setting/whitepaper/1/kasko2go__whitepaper.pdf

- https://www.youtube.com/watch?v=qT3ApnIK85I

- https://www.verisk.com/blog/four-killer-blockchain-use-cases-insurance/

- http://www.businessinsider.com/internet-of-things-devices-applications-examples-2016-8

- https://beebom.com/examples-of-internet-of-things-technology/