As blockchain technology and its ecosystem advance, many new initiatives aim to provide services traditionally offered by established financial institutions.

The most revealing trend is apparent in the decentralized finance (DeFi) sector, and BlockFi is a financial service platform that allows users to earn interest on their digital assets or utilize them as collateral to borrow funds.

This initiative seeks to revolutionize the finance sector by enabling crypto holders to leverage their assets actively, additionally presenting appealing conditions for those participating with their platform.

BlockFi Overview

BlockFi operates out of New York, USA with headquarters at 201 Montgomery Street, Second Floor, Suite 263, Jersey City, New Jersey 07302.

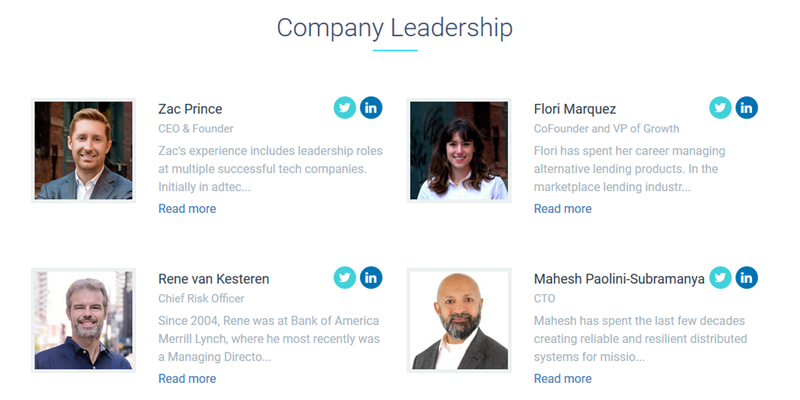

Founded by Zac Prince and Flori Marquez in August 2017, the company has amassed over $60 million through four funding rounds, with the latest in December 2018.

Notable entities like ConsenSys Ventures, Kenetic Capital, SoFi, Galaxy Digital led by Mike Novogratz, and Morgan Creek Capital by Anthony Pompliano have backed BlockFi with investments.

Categorized as a secured non-bank lender, BlockFi provides USD loans backed by cryptocurrency assets and operates under Article 9 of the Uniform Commercial Code (UCC), overseeing secured lending practices.

The firm records UCC-1 financing statements in each borrower's state. BlockFi stores client assets with Gemini, an accredited crypto exchange and custodian, and offers loans deposited as USD into clients' bank accounts. Additionally, they partner with Scratch for loan servicing and repayments.

Currently, the platform operates across roughly 35 U.S. states, offering collateral options such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Gemini’s GUSD, with plans to expand to more cryptocurrencies soon.

Why Use BlockFi?

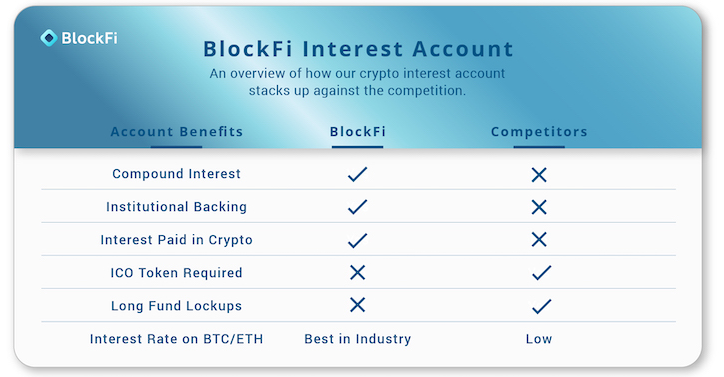

Compliant with U.S. federal regulations, BlockFi employs a team with substantial expertise in digital finance and lending. A chief attraction is how it enables users to either deposit their cryptocurrency into interest-bearing accounts or as collateral for borrowing.

The company also offers lenient repayment options with competitive interest rates, mostly targeted at those needing quick cash while keeping their crypto assets for potential future price rises.

Additionally, those who previously bought Bitcoin or Ethereum for much less than their current value could face considerable capital gains tax upon selling.

BlockFi resolves these challenges by offering crypto-backed USD loans, allowing crypto holders fast access to fiat currency without sacrificing the potential value increase of their digital assets. Concurrently, depositing crypto with BlockFi lets users benefit from compounded interest growing their portfolio passively.

What Features Does BlockFi Offer?

BlockFi's core services involve their Interest and Loan Accounts offerings.

The BlockFi Interest Account

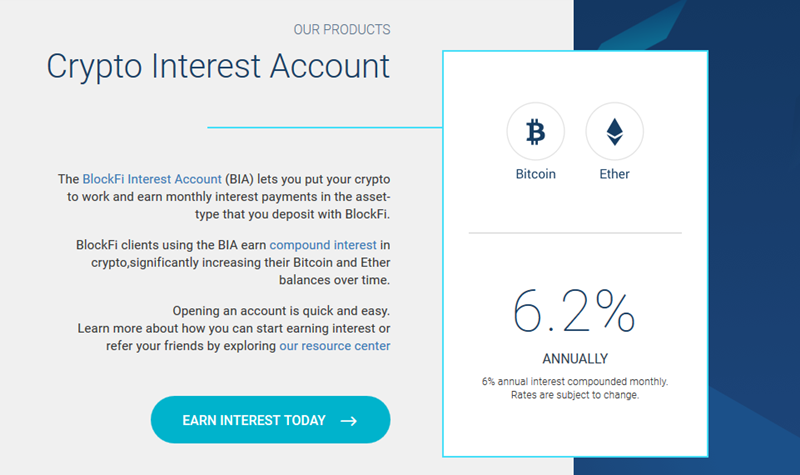

The BlockFi Interest Account (BIA) lets users accrue compound interest on their BTC and ETH deposits. To receive the monthly payouts in either Bitcoin or Ethereum, all that's needed is to keep those assets with BlockFi, which offers a rough annual yield of 6%.

The BlockFi Cryptocurrency-Backed Loan Account

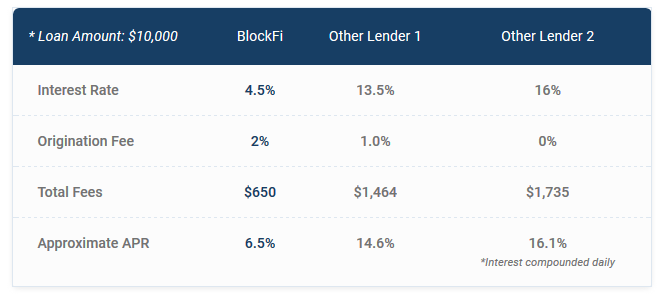

On this platform, assets like BTC, ETH, or LTC can be deposited for a loan in USD, with lendable amounts reaching up to 50% of deposited value. Interest rates begin at around 4.5%, for standard 12-month loans, with options to prepay or refinance post-loan term.

How Does BlockFi Work?

Users can opt to store their crypto in an interest account or utilize it as loan collateral in USD. Interest accounts yield about 6% annually with monthly compounding and payouts in Bitcoin or Ethereum. For loans, be aware that BlockFi retains the collateral until loans are repaid.

BlockFi's setup runs similarly to a mortgage, with non-payment resulting in collateral possession. Once loan-approved, assets are moved to Gemini's wallet, held till loan settlement.

After collateral submission, BlockFi credits accounts with USD, requiring monthly interest with the option to finalize through either fiat or crypto. In case of setbacks, necessary collateral gets appropriated to settle the loan.

The application is swift, taking mere minutes, with a usual response within hours. To get approved, certain criteria must be fulfilled.

Initiating a loan requests registering on BlockFi’s site, stating the loan amount, selecting the crypto, and submitting KYC/AML details. BlockFi's no hard credit checks imply your credit score remains untarnished. Using Gemini for collateral storage diminishes risks.

Who Can Take Out a Loan on BlockFi?

Before finalizing a loan, personal details, social security, and financial history get shared. Approval hinges on these factors including:

Критерии соответствия для получения кредита

No existing liens on assets (tax liens too)

- Минимум $15,000 в крипто активах

- Furthermore, BlockFi Interest Accounts are open to users over eighteen, barring US-sanctioned countries or regions under watch. EU, New York, Connecticut, and Washington residents can't use Interest Accounts either.

- Отсутствие банкротств

Outlined are BlockFi’s loan process steps:

Как работает процесс получения кредита

Expect a decision back in less than 24 hours

- Создайте учетную запись на https://app.blockfi.com/signup

- Нажмите на вкладку Кредиты

- Нажмите Подать заявку и заполните заявку.

- Evaluate the loan offer and ratify the agreement

- Deposit collateral into BlockFi’s safe storage

- Get your funds the same day, wired to banks or wallets as USD or stablecoin.

- Make monthly interest payments in USD, BTC, ETH, or LTC

- Conclude by paying principal or refinancing at term's end

- An Individual Account at BlockFi can be managed by one person who controls deposits and withdrawals. Also available are Business Accounts for corporations or commercial entities.

Условия BlockFi

BlockFi Interest Account users can park their Bitcoin or Ethereum, receiving up to 6% annual interest, compounding monthly to 6.2%. For instance, depositing 1 BTC in late February earns 1.005 BTC by March’s end, growing over months until funds are withdrawn.

Сложные проценты BIA

From June 1, 2019, rates for BIA adjust as such:

BlockFi раскрыл в недавнем выпуске новостей For BTC over 25 balances, interest shifts to 2.15% (up from 2%). Holdings between 0.5 and 25 BTC continue at 6.2% APY

- Deposits of 25 - 100 ETH see rates drop from 6.2% to 3.25% APY

- BlockFi Interest Accounts lack minimum/maximum deposit requirements. However, only balances over 0.5 BTC or 25 ETH gain interest, with up to 25 BTC or 250 ETH earning 6.2% APY. Beyond this, excess balances earn a tiered 2% rate. For instance, 25.5 BTC in a BIA sees the initial 25 BTC netting 6.2%, while the remainder gets 2%.

- Балансы выше 100 ETH будут получать 0.2% APY

The minimum and maximum limits for the BlockFi Interest Account (BIA)

Blockfi Insights 2021: Leverage or Profit with Bitcoin & Cryptocurrency-Fueled Financing

Условия криптокредита

Dive into our in-depth analysis of BlockFi, the Bitcoin & Crypto Lending powerhouse - Secure a loan or boost your finances through lending your crypto reserves.

Blockfi Exploration: Cryptocurrency and Bitcoin Backed Asset Lending

Надежен ли BlockFi?

Our thorough examination of BlockFi, the Bitcoin & Crypto Lending firm - Obtain a loan or enhance your income by lending your digital wealth.

As blockchain innovation and its economic sphere continue to advance, numerous projects are stepping up to offer services traditionally provided by established financial giants.

This trend is particularly pronounced in

Подходит ли BlockFi для новичков?

is a digital wealth management platform empowering users to earn yields on their crypto assets and access loans with those assets as collateral.

The initiative aims to shake up the financial sector by enabling individuals to capitalize on their digital assets, complemented by enticing terms for engaging with their platform. Центр ресурсов , Блог , Страница FAQ , и Калькулятор кредита What Offerings Does BlockFi Present?

BlockFi's Crypto-Backed Lending Opportunity

Boundaries in the BlockFi Interest Account

operates out of New York, USA, with an official business location at 201 Montgomery Street, Second Floor, Suite 263, Jersey City, New Jersey 07302.

Founded in August 2017 by Zac Prince and Flori Marquez, the duo has successfully amassed over $60 million in funding through four investment rounds, with the latest occurring in December 2018.

Некоторые моменты, которые стоит учитывать

BlockFi has attracted investments from respected entities, including ConsenSys Ventures, Kenetic Capital, SoFi, Galaxy Digital led by Mike Novogratz, and Morgan Creek Capital spearheaded by Anthony Pompliano. условия использования Recognized as a secured non-bank lender, BlockFi provides cryptocurrency-backed US Dollar loans and operates under Article 9 of the Uniform Commercial Code, which governs secured financing.

The firm files UCC-1 financing declarations in all borrowers’ states. Clients' cryptos are entrusted to Gemini, a licensed digital asset exchange and custodian, while loans are issued in USD to their bank accounts. Third-party loan servicer Scratch facilitates contract management and repayments.

Currently, the platform serves approximately 35 US states, with collateral options including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Gemini's GUSD, alongside plans to welcome more crypto assets soon.

Complying with federal laws in the US, BlockFi boasts a team of industry veterans with extensive backgrounds in digital finance and lending. Their prime advantage is allowing crypto holders to leverage their assets for interests or to secure loan collateral.

The company facilitates personalized repayment schemes with fairly reasonable interest rates, aiming to support individuals requiring liquidity in the short to medium term without liquidating their digital assets, retaining potential future value.

Плюсы

- For those who bought assets like Bitcoin and Ethereum at lower costs compared to current valuations, selling would incur significant capital gains taxes.

- BlockFi resolves these concerns by providing fiat access without losing hold of crypto assets during potential market upswings and allows deposits to generate compounded interest, enhancing portfolio value effortlessly.

- Essentially, BlockFi’s main offerings are their Interest and Loan Accounts.

- Кредит, соответствующий налоговым преимуществам США

- Доступны крупные кредиты

Минусы

- Централизированная услуга

- Процентная ставка не фиксирована

- Модель бизнеса с фракционным резервом

Заключение

The BlockFi Interest Account (BIA) permits earners to receive compounded interest on Bitcoin (BTC) and Ethereum (ETH) deposits. With monthly payouts in either Bitcoin or Ethereum, users simply need to store assets with BlockFi, realizing approximately a 6% annual yield.

Platform users can also pledge Bitcoin (BTC), Ethereum (ETH), or Litecoin (LTC) to receive US Dollar loans. Up to 50% of deposited value is loanable, with initial interest rates around 4.5% over a 12-month duration, including options for prepayment or refinancing.

Individuals may either place cryptos in an interest account or leverage them as USD loan collateral—yielding around 6% annually with monthly compounding interest paid in Bitcoin or Ethereum. As a secured lender, BlockFi retains deposited assets legally in case of a default.

Much like a mortgage, where property serves as bank security, failure to repay allows the lender to repossess the property. Similarly, BlockFi transfers client assets to Gemini's care upon loan approval, retaining them until full repayment.

Once collateral is accepted, clients receive dollar amounts credited to their accounts with obligated monthly loan interest repayments. Final settlements are made via fiat or Bitcoin/Ethereum.

BlockFi

Плюсы

- For those who bought assets like Bitcoin and Ethereum at lower costs compared to current valuations, selling would incur significant capital gains taxes.

- BlockFi resolves these concerns by providing fiat access without losing hold of crypto assets during potential market upswings and allows deposits to generate compounded interest, enhancing portfolio value effortlessly.

- Essentially, BlockFi’s main offerings are their Interest and Loan Accounts.

- Кредит, соответствующий налоговым преимуществам США

- Доступны крупные кредиты

Минусы

- Централизированная услуга

- Процентная ставка не фиксирована

- Критерии соответствия для получения кредита

1Блог

Clear asset (including tax) liens