Everyone who ventures into the realm of cryptocurrencies has likely encountered with Binance , a leading platform for trading digital currencies. The platform's native cryptocurrency is the BNB token, or Binance Coin. It was crucial in securing funds for Binance during the ICO and now performs many essential functions. The BNB token adheres to the ERC20 standard and is inherently part of the Ethereum blockchain.

What Should You Know About Binance?

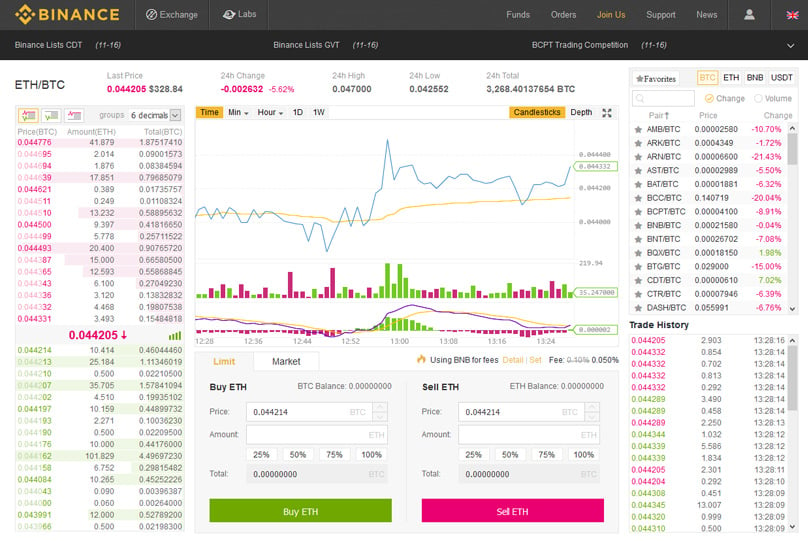

Before diving deeply into the details of the BNB token, it's essential to grasp at least the basics of the Binance platform . If you're not familiar, this is among the most popular of all cryptocurrency exchanges . Despite being relatively new, launching in mid-2017, the exchange has already built a stellar reputation and boasts immense popularity. As of this writing, BNB's 24-hour volume reached 1,472,557.47, while BTC's was 176,076.88.

Binance has the capacity to handle up to 1.4 million transactions per second, meeting the growing demand with aplomb, and supports almost all devices, including a comprehensive web platform. This efficiency is due to Binance's bespoke trading engine, which addresses the shortfalls of competitors that struggle to meet demand. What truly sets Binance apart is its high liquidity and competitive fees, even without factoring in the BNB discount.

BNB Coin Price

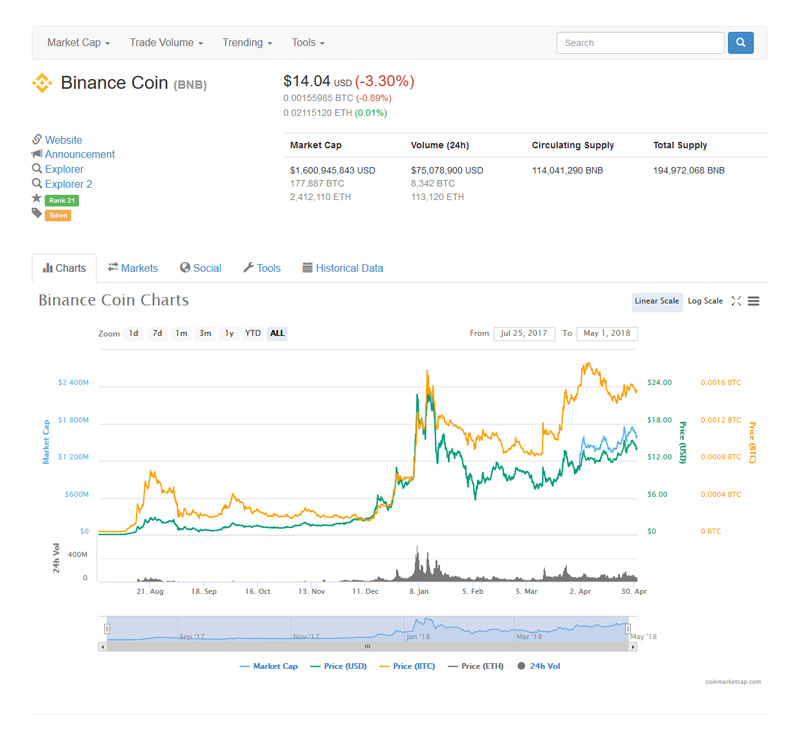

At this point in time, the Binance Coin's value is $14.010. Considering its issue price was set at $0.1553, this marks a whopping 8,921.25 percent increase in value. The Binance launch was on July 8, 2017, which means this substantial growth occurred in less than a year. Currently, the market cap stands at $1,597,718,473 with a maximum circulation of 194,972,068 BNB and a circulating supply of 114,041,290 BNB. When introduced, the total supply was 200 million tokens.

What Is the BNB Burning?

A pivotal aspect of the BNB token strategy involves the buy-back and burning of tokens. This is elaborated in the Binance white paper. Essentially, Binance commits to utilizing 20 percent of its quarterly profits to repurchase and incinerate BNB. This initiative will persist until the total supply is reduced by half to 100 million tokens. Every repurchase and subsequent burn is transparently documented on the blockchain.

Each quarter, 20% of Binance's profits will be allocated to buy back BNB and then burn them. This will continue until we've repurchased and destroyed half of the BNB supply (100MM tokens). Every buy-back will be clearly announced on the blockchain. Ultimately, this will leave the BNB supply at 100 million.

The latest BNB burning took place on April 15, 2018, taking 2,220,314 BNB out of circulation. The subsequent burn is anticipated around July. The maneuver of burning Binance Coins is meticulously strategic. Reducing circulating token supply tends to increase the value of those remaining, assuming constant demand. This increase can be even more pronounced if demand escalates, which is probable given Binance's rising prominence.

How Does BNB Burning Affect Price?

While the theory of token burning is intriguing, what most seek is empirical evidence of its effectiveness. If one were to scrutinize a BNB price chart closely, focusing on the periods leading up to, during, and following a burn, the positive ramifications become evident. Prices often spike significantly just before a burn, followed by a dip post-burn. However, this dip remains generally higher than pre-burn values.

What Functions Does BNB Serve?

The primary utility of BNB lies in being the gas fueling the entire Binance ecosystem. Platform users can utilize BNB to pay trading fees, benefiting from a 50 percent discount in the first operational year.

Additionally, the Binance Coin extends its utility beyond its home platform due to various strategic partnerships. For instance, Monaco allows BNB transactions within its mobile application and Visa Card. Moreover, the Uplive platform accepts BNB for purchasing virtual gifts.

What Savings Do You Gain by Using BNB for Binance Fees?

Similar to other cryptocurrency platforms, Binance derives a portion of its revenue from fees. BNB can be used for these fees including listing and trading fees. Throughout BNB's initial deployment year, fees paid via BNB receive a 50 percent discount. Although this discount diminishes each year, it provides significant cost savings. The second-year discount cuts to 25 percent, third year to 12.5 percent, and fourth-year discount to 6.75 percent. From the fifth year onward, there is no discount, although using BNB for fee payment remains convenient.

To enjoy the discount, retaining BNB tokens in your exchange account is sufficient, with applicable fees automatically reduced by the corresponding token amount. If preferred, there is an option to disable this automatic deduction, conserving your BNB holdings instead. BNB is an ERC-20 token, indicating that you can also withdraw it from the exchange and store it on your Ethereum wallet or Hardware wallet such as Trezor or Ledger .

What is Binance Chain, and How Does BNB Fit into Its Framework?

Binance has plans to develop a new exchange that is decentralized , known as Binance Chain . The upcoming Binance Chain will leverage the BNB token, promising to stimulate demand, consequently raising its value. The Binance Chain aims to be a public blockchain focusing on the trade and transfer of blockchain assets.

Conclusion

BNB, the Binance Coin, is the signature currency of the acclaimed Binance exchange. This token is primarily employed to settle fees, offering discounts on trading fees when used. Additionally, BNB has other roles and will be central to the proposed Binance Chain.

1What Functions Does BNB Serve?

Binance has truly revolutionized the realm of cryptocurrency! I'm always on the lookout for the freshest and most promising digital currencies to back, and I eagerly jump aboard when they're fresh on the block. Adding Binance investments to my finance apps is thrilling, as I anticipate watching my money flourish. Eagerly awaiting the added perks from using BNB!