The frenzied ups and downs of a typical cryptocurrency price chart can be overwhelming initially. While spotting whether a crypto's value is generally ascending or descending is straightforward, the challenge arises when you delve deeper into the intricate peaks and dips that compose the overarching trend.

Traditional securities markets have similar dilemmas, leading to the introduction of moving averages as a solution. Simple moving averages provide the across-the-board price of a security for a defined duration, whereas exponential moving averages allocate more importance to recent prices. These tools are designed to smooth out the common oscillations found in a price chart, making overall trends and patterns more apparent.

In the 1980s, John Bollinger, a financial analyst and author, further enhanced this system by introducing his eponymous bands. Bollinger bands Bollinger Bands involve calculating upper and lower bounds above a security’s moving average by employing standard deviation.

Adaptable History

Before Bollinger’s innovation, Chester Keltner had devised a method in 1960 known as Keltner Channels to plot high and low price bands around moving averages. Keltner’s influence stemmed from J. Welles Wilder's development of the average true range to determine volatility in commodity markets.

Keltner Channels utilize average true range as a basis to establish bands above and below moving averages. The average true range highlights pure volatility without predicting future trends. Keltner Channels enhance this tool by providing a means to visualize potentially overbought or oversold securities. Breaching the upper boundary foreshadows a bullish market move, while dropping below the lower boundary hints at an impending bearish trend.

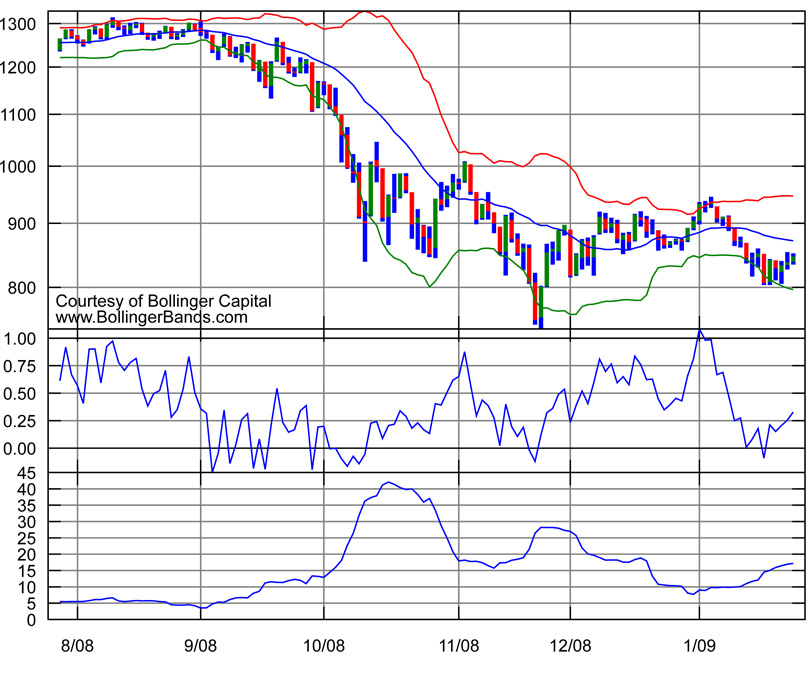

Bollinger Bands, however, use standard deviation instead of average true range, resulting in a more erratic band structure. However, this volatility makes Bollinger Bands more adaptable than Keltner Channels, forming a more evenly spread channel around the moving average.

John Bollinger, Image from YouTube

Bollinger Bands can evaluate exponential moving averages, unlike Keltner Channels’ reliance on simple moving averages. This adaptation grants the tool heightened sensitivity to market fluctuations.

Within the unpredictable realm of cryptocurrencies, Bollinger Bands are extensively applied to foresee potential breakouts and pinpoint entry or exit moments. Day traders find them especially beneficial, as they often face difficult decisions with incomplete information while striving to maintain their profits. A single misstep with a coin can quickly offset days or weeks of accumulated minor gains.

The Basic Rules

John Bollinger is still active in the financial sphere, and his website Highs and lows are relative in the context of Bollinger Bands. The upper band delineates highs relative to standard deviation, whereas the lower band signifies the opposite. This relative positioning of 'high' and 'low' enables the derivation of various indicators for pricing decisions.

Despite the versatility of each indicator, it's crucial to consider them individually. Momentum, volume, and sentiment might all be deduced from Bollinger Bands, yet they aren’t inherently interdependent.

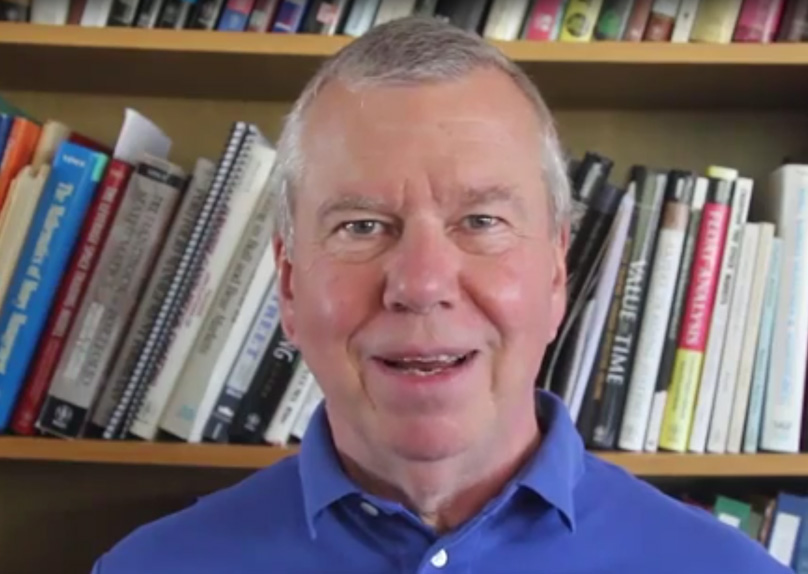

Bollinger Bands, Image from Wikipedia

For instance, a momentum indicator might squarely complement a volume indicator, but two momentum indicators don’t add additional value.

Thanks to their simplicity, Bollinger Bands can be effectively used in diverse financial settings. Bollinger himself suggested their relevance to equities, indices, exchanges, commodities, and futures. Although cryptocurrencies weren’t specifically mentioned, they too fit within the vague boundaries of these financial categories.

Bollinger Bands are adaptable over time, as long as the examined period offers enough detailed information to provide a meaningful snapshot of the market.

\"Bollinger Bands offer insights into favorable setups rather than ongoing guidance,\" noted Bollinger. \"Refrain from making statistical assumptions based on the standard deviation used in band construction. Security prices lack a normal distribution and most deployments of Bollinger Bands have limited sample sizes, making statistical significance elusive (practically, 90%, not 95%, of data fits within Bollinger Bands with default settings).\"

However, the key word here is snapshot.

Cryptocurrency traders and investors utilizing Bollinger Bands might explore various strategies.

How to Use Them

Bollinger Bands initially indicate a coin's volatility. The bands tighten or \"squeeze\" when the standard deviations are minimal, highlighting a phase of reduced volatility. Conversely, they expand when volatility intensifies, as the calculation involves growing standard deviations.

\"Bollinger Bands exhibiting low volatility stage, Image from\"

This shifting volatility could signify various prospects depending on the coin. The very act of increased or reduced volatility, however, might unveil investment possibilities or pending breakout scenarios, be it upward or downward. Cryptovest

Bollinger Bands account for around 90% of price actions within a particular security or coin. When price movements exceed or fall below a predefined Bollinger Band, it's crucial to take notice. If a price soars above the band, it could indicate overbuying, suggesting an imminent correction. This presents a prime selling opportunity before prices likely fall.

Conversely, if the price hovers at or beneath the lower Bollinger Band, the coin may be undersold, and astute traders should see this as an optimal buying point.

Shifts at Bollinger Band extremes help interpret immediate price direction. If the upper band is breached, only to see the price adjusting just below or at the upper band, it implies a general upward trend. The opposite applies to the lower band, suggesting a downward trajectory if prices dip below and barely recover above the band.

Bollinger Bands serve as a straightforward means to envision the cryptocurrency market. Fundamentally, purchasing is advisable when your coin's price rests between the moving average and the bottom band. Conversely, it's optimal to sell when positioned between the moving average and the upper band. If your coin unexpectedly transcends or descends past these bands, it might be the prime moment to act.

Conclusion

Despite this, Bollinger Bands constitute just one resource among many in a trader's arsenal, and the principles are not definitive. Traders may encounter lucrative buying or selling opportunities contrary to the insights given by the Bollinger Bands. To validate their findings using Bollinger Bands, many traders employ volume indicators or the relative strength index. Confirming trends seen within the Bollinger Band system independently is more dependable than relying solely on its findings. Remember, Bollinger himself cautioned that Bollinger Bands can’t offer continual guidance due to their nature as a lagging indicator, driven by standard deviations from a moving average.

Editor-in-chief at Blockonomi and founder of Kooc Media, a UK-based online media company. A proponent of open-source software, blockchain technology, and equal Internet access for all.

References

- https://www.investopedia.com/articles/technical/102201.asp

- https://www.investopedia.com/terms/m/movingaverage.asp

- https://www.investopedia.com/terms/s/standarddeviation.asp

- https://cryptovest.com/news/crypto-trading-tips-bollinger-bands-explained/

- https://www.bollingerbands.com/

- http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:keltner_channels

- http://stockcharts.com/school/doku.php?id=chart_school:technical_indicators:average_true_range_atr