Back in the day, acquiring Bitcoin At one point, buying with a debit or credit card was notoriously tough; even tech experts struggled to get their hands on the sought-after digital currency.

Luckily, a number of reliable and well-vetted exchange platforms have emerged, such as eToro , Binance , Coinbase and CoinMama . These platforms make it straightforward to buy bitcoins with the ease of credit or debit cards.

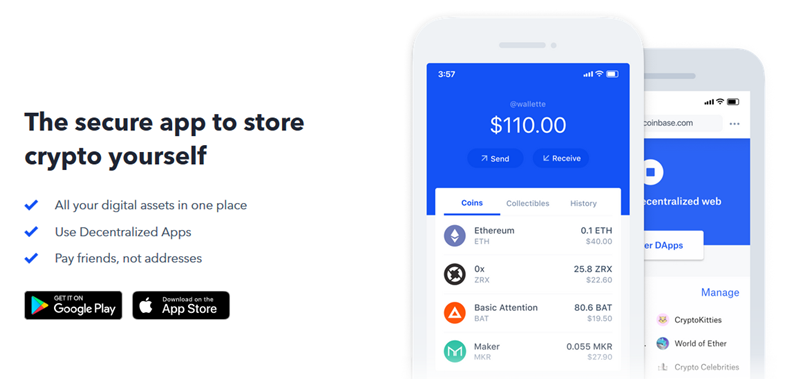

Before delving into the world of bitcoin exchanges, you'll need a bitcoin wallet. Setting up a wallet is fairly straightforward and can be paper-based, digital, or on a dedicated device — essentially anywhere secure.

A crucial detail when buying bitcoin is the transaction fees each exchange imposes. Take a moment to review and contrast the fees across the exchanges listed below to ensure you're snagging the best deal.

We've curated a list of the most trustworthy online exchanges where you can buy bitcoin using either a debit or credit card. Additionally, there are crypto-only exchanges tailored for cryptocurrency enthusiasts. While switching your regular currency to crypto can be tedious, moving between crypto exchanges is generally hassle-free.

With a myriad of crypto exchanges showcasing unique offerings, this post aims to guide you in finding the right one to fit your crypto ambitions!

Buying Bitcoin with Credit Cards or Bank Transfers: The Best Venues

For those of you looking to transform your traditional currency into Bitcoin, numerous avenues await. Also, considering a bank transfer could be advantageous as it sometimes proves more economical.

Before you give up on a platform you fancy, note that some regions have restrictions on purchasing cryptos with cards. Always check if a bank transfer is an option.

- Coinbase: Perfectly Suited for Novices and Commended for User-Friendliness

- eToro: Easy to Use Platform

- Binance: Leading the Market: The Largest Crypto Exchange with Minimal Fees

- FTX: Excellent Exchange for Both Beginners and Pro Traders

Visit The Top Pick

Coinbase: Our Top Pick & Easiest Method

Coinbase is the world's leading exchange by size. It operates in a myriad of regions, serving users in the US, Canada, Europe, the UK, Australia, and Singapore.

With just a few clicks — sign up, verify some details, log in — you can swiftly buy bitcoins using your credit or debit card.

For US residents, Coinbase stands out as a solid option, keeping abreast of all the pertinent tax regulations. Although some users were wary of their data being shared with US tax entities, such transparency is essential for any business playing in the US finance field.

Understanding tax obligations is critical for US-based traders, given that the IRS imposes hefty fees on delinquent taxes.

Occasionally, Coinbase might ask for a government ID like a Passport or Driver's License. Verifying with multiple IDs can up your limit, letting you acquire more bitcoins with your card.

As you continue, you'll notice your purchasing power increases. For high-value orders, you'll need to provide bank details and complete a wire transfer.

Upon completing verification, users can head to their profile to add payment options like PayPal, bank accounts, or cards. Note that transactions through bank accounts might take up to five days for verification.

Coins bought via Coinbase go straight to your Coinbase wallet. The platform doesn't levy card usage fees but does have a 3.7% charge on credit card buys.

For an in-depth look, don't miss our comprehensive Coinbase review .

CoinMama

CoinMama is a major player based in Israel, offering bitcoin purchases via cards to a global audience. While it charges some transaction fees, its purchase boundaries are markedly higher than Coinbase's.

Users can command up to $5,000 daily or $20,000 monthly. Signing up, logging in, and filling out personal details on CoinMama is all it takes.

Once done, users can proceed to select their desired bitcoin amount, add payment options, and provide a bitcoin address.

Phone number and email verifications are required. Unlike many peer platforms, CoinMama typically won't request a government ID.

CoinMama distinguishes itself with generous purchase limits and few user restrictions, making it appealing to those outside North America or the EU.

Coin Mama boasts a visually appealing platform offering many major and lesser-known cryptos. On the flip side, it's not the most economical.

Larger card-friendly exchanges aren't always in stiff competition with crypto-specific platforms. Exploring crypto-for-crypto trades might be sensible if you intend to trade substantially.

Find out more in our full review .

BitPanda

BitPanda Based in Austria, this esteemed bitcoin exchange has a limitation: its services are only for European residents. With full automation, transactions here are rapid and ultra-secure.

It also supports Ethereum purchases. BitPanda's verification steps mirror those of other big exchanges, but its card purchase limits extend up to $2,000 daily and $75,000 monthly.

Other payment routes let you buy up to $10,000 per day or $300,000 monthly with relatively low transaction fees, making BitPanda a solid choice for Europeans using cards.

BitPanda caters to holding multiple fiat and 25 cryptocurrencies in one account, which suits those seeking asset versatility.

Planning hefty crypto purchases on BitPanda? The origin of your funds might be questioned due to Austria's stringent banking rules.

All things considered, BitPanda is worth weighing if you intend to stockpile crypto with cards and reside within its coverage. They also support various other options like SEPA, Neteller, and Skrill.

Read our Bitpanda review here .

CEX.IO

CEX.io As a veteran in the bitcoin exchange arena, with operations in the US, Europe, and select South American countries.

CEX.io is a well-regarded pillar in the digital currency circles. Originally a mining powerhouse, it's since shifted focus to crypto trading, offering diverse service levels and verifications.

Its trading fees aren't steep, but the user verification process is more intricate than some other exchanges. Sometimes, users are asked to provide a photo ID.

Like most exchanges, CEX.io supports both brokerage services and trading but has notably higher fees on its brokerage platform.

There are location-based limitations on CEX.io's access. Depending on your residence, some funding options or entire platform usage might be restricted.

You can't use a credit card on CEX.io from these countries:

Afghanistan, Algeria, Bahrain, Iraq, Kuwait, Lebanon, Libya, Nigeria, Oman, Pakistan, Palestine, Qatar, Saudi Arabia, Yemen, Iceland, and Vietnam.

If wiring funds, these nation residents can't:

Afghanistan, Democratic Republic of the Congo, Côte d’Ivoire, Eritrea, Ethiopia, São Tomé and Príncipe, Somalia, Sudan, Syria, Tanzania, Tunisia, Turkey, Vietnam, Yemen, Zimbabwe, Guinea-Bissau, Haiti, Iran, Iraq, Kenya, Liberia, Libya, and Guinea.

If residing in these US States, account setup on CEX.io won't be possible:

Alabama, Alaska, Arizona, Colorado, Florida, Georgia, Guam, Idaho, Iowa, Kansas, Louisiana, Maryland, Michigan, Mississippi, Nebraska, New Hampshire, New Jersey, North Carolina, North Dakota, Ohio, Oregon, Tennessee, Texas, U.S. Virgin Islands, Vermont, Virginia, and Washington.

Assuming you're not blacklisted, CEX.io provides access to a variety of tools. However, if you want to handle substantial quantities of cryptos, prepare for a thorough verification parade. This process is pretty much industry standard now for exchanges dealing in fiat money.

Though we haven't interacted directly with CEX.io's customer support, the word on the street isn't very flattering. Before committing to a crypto exchange, delve into the wealth of online reviews and insights to ensure you're making a choice you'll be happy with.

Full Review of CEX located here .

Changelly

Changelly The essence of this platform is in facilitating transitions between different currencies. CEX.io also allows you to buy a wide array of popular cryptocurrencies using a credit card, which are then smoothly transferred to your crypto wallet.

The user experience CEX.io offers is straightforward and accommodating, boasting an extensive selection of cryptocurrencies. Transactions can be done in USD, and payments through Mastercard or VISA are available, streamlining your journey to acquire Bitcoin using your bank or credit facilities.

Over its two-plus years of operation, Changelly has garnered trust, reflected in its high TrustPilot rating. Signing up is a cinch, with only email verification needed, so you'll have your selected currency in your wallet in no time.

Getting started with Changelly and purchasing cryptocurrencies is a breeze. Just ensure you have a hardware or software wallet ready and understand how to transfer your cryptos there.

Changelly collaborates with high-profile crypto exchanges like Bittrex and Poloniex, providing customers top-tier rates and deep market liquidity, a significant advantage for managing large transactions.

To use credit or debit cards on Changelly, identity verification is necessary. However, for smaller sums, this process might be as simple as entering a code sent via SMS, after supplying basic personal details.

If you're looking into a well-regarded crypto exchange with competitive rates, Changelly should definitely be on your radar.

Our review of Changelly is here .

Even Crypto-Only Exchanges Have Their Perks

After you've acquired cryptocurrencies, there's an array of exchanges available to suit your preferences.

These exchanges currently don't allow direct crypto purchases via credit or debit cards (though this is subject to change, so it's worth checking), but they do provide robust trading platforms with competitive fees.

It's crucial to clarify your intentions within the crypto domain. Some are in it for the long haul, simply acquiring tokens to hold over time. If long-term investment is your goal, securely storing purchases made via credit or debit card is perfectly reasonable.

Over time, the transaction fees pale in significance compared to anticipated market movements. For those actively trading, comprehensively understanding an exchange's fee structure is essential.

Exclusively crypto exchanges often offer enticingly low fees and additional unusual token pairings.

Binance

Binance has swiftly ascended in the ranks to become a globally favored cryptocurrency exchange. Originating in China, it now captivates clients from its new base in the crypto-haven of Malta.

What's particularly appealing about Binance is its versatility in trading platforms: a simple version for novices, and a sophisticated one equipped for those requiring advanced features.

Like many crypto-exclusive exchanges, Binance demands minimal Know Your Customer (KYC) compliance for users trading modestly. A level 1 account permits a daily withdrawal ceiling of 2BTC, whereas a level 2 account allows for 100BTC.

Subscribing to a level 2 account necessitates photographic identification, with further withdrawal limits achievable upon request. For extensive transactions, contacting Binance is advised to sort out the requisite ID verification.

Binance stands out with exceptionally low fees, further reduced when utilizing their native token. For deeper insights into the exchange, do some research. our review right here .

Note: U.S. residents must register with a specific platform to comply with regulations. Binance.US

Bittrex

While Bittrex still doesn't accommodate credit or debit card transactions, it facilitates USD deposits via wire transfer. Established in Seattle in 2014, Bittrex enjoys a solid reputation, consistently appearing in the top-tier of global exchanges by daily turnover.

The diversity of BTC pairings on Bittrex is impressive, boasting over 450, alongside other significant cryptocurrencies. Although it avoids card payments, customers can benefit from favorable bank transfer rates.

Be mindful—Bittrex enforces a $10,000 minimum deposit requirement for fiat currency funding, a potentially high threshold for some investors. Don't overlook other exchanges that accommodate smaller initial deposits.

Bittrex's founder comes from an expertise-rich background in software engineering, including prestigious tenures at Amazon and Blackberry focusing on data security. The platform is known for its stringent security measures, matching leading trading services globally.

To find out more about Bittrex, delve into comprehensive reviews and testimonies. full review here .

Poloniex

Poloniex has carved a niche in the North American crypto-exchange landscape, boasting substantial daily trading volumes and impressive liquidity. Its acquisition by Circle, backed by Goldman Sachs, adds a layer of prestige.

Poloniex is a fantastic choice for crypto enthusiasts, but it's not suggested for everyone. As a purely crypto-oriented exchange, it eschews fiat transactions entirely, accepting only cryptocurrency deposits.

Poloniex does make Tether available to its users, a stablecoin aligned with the U.S. dollar's value. Though fluctuations occur, it's a solid option for those prioritizing cryptocurrency over fiat dealings.

Remarkably, Poloniex secured regulation under the SEC and FINRA, elevating its status in a heavily regulated U.S. market. This regulatory backing gives it a competitive against offshore counterparts with less oversight.

Designed for seasoned traders, Poloniex's platform may not cater to every user's needs. However, its fee structure is appealing, and it offers substantial liquidity and token variety.

If Poloniex piques your interest, a detailed review might provide further clarity.

HADAX

An intriguing venture from Huobi, HADAX represents the new frontier in the uncharted crypto landscape. Designed for trading niche and volatile tokens, it adds excitement to your crypto journey.

For mainstream tokens like BTC, ETH, or XRP, HADAX might not be your fit; it thrives on user-driven token listings via HT tokens, decentralizing and automating the voting process.

HADAX exclusively accepts cryptocurrency deposits, not fiat. Despite this, its zero-cost deposit policy and low trading fees are advantageous. It’s worth exploring if you’re drawn to high-risk digital assets.

Finding Other Exchanges

Thorough diligence is essential before engaging with any crypto exchange, be it for bitcoin or other cryptocurrencies. Prioritize platforms with trustworthy reputations and vetted customer reviews.

Scams and dubious practices abound; unfortunately, some bitcoin exchanges fall into unfair practices by exploiting their users' personal information.

For those determined to purchase Bitcoin elsewhere, a multitude of alternative methods exist, circumventing extensive personal data sharing online, albeit with additional hurdles.

Feel Like Using Cash to Buy Bitcoin?

Bitcoin's original allure was its near-anonymity. Now that ID checks are standard for most exchanges (especially for fiat purchases), acquiring Bitcoin privately is much tougher.

Complete anonymity might be out of reach, but if you're willing to explore less conventional methods, buying cryptos with cash remains a viable path.

Buy at a Bitcoin ATM

Crypto ATMs increasingly appear in North America and the EU. Despite concealment challenges, these machines enable relatively discreet Bitcoin acquisitions.

The primary drawback of in-person Bitcoin purchases lies in ATM transaction limits. While adequate for modest sums, these machines are ill-suited for substantial investments.

Whenever you find yourself at a crypto ATM, expect to be surrounded by both curious onlookers and cameras. Store employees may notice your frequent visits with wads of cash for your cryptocurrency purchases, if the vigilant security cameras don't capture it first.

Bitcoin ATMs might not be the perfect fit for everyone, but they offer a legitimate way to directly convert your cash into cryptocurrencies. If your area is plentiful with these machines, you could make a circuit around town and discreetly amass a tidy sum of crypto.

LocalBitcoins

LocalBitcoins This platform has an intriguing backstory. Founded in 2012 in Finland, it aimed to streamline Bitcoin transactions between individuals, circumventing traditional exchanges, and continues to be a robust solution for those preferring P2P crypto transactions.

Utilizing LocalBitcoins is a straightforward affair. Just sign up and input some basic details. You’ll find varied payment methods for Bitcoin, such as ‘cash in the mail’, unlocking numerous barter possibilities.

Given LocalBitcoins operates on a P2P model, due diligence on your trading partner is crucial. Check their transaction history and steer clear of those with any concerning reviews or lack of activity.

LocalBitcoins keeps its fee structure relatively low, primarily affecting the advertiser. However, market prices for Bitcoins on the site tend to surpass exchange rates, coupled with reduced liquidity compared to larger exchanges.

Interested in diving deeper into LocalBitcoins? Head over to our resourceful guide. full review here .

Wrapping up – Final Thoughts

Even though there are risks in purchasing bitcoins through exchanges with your bank cards, it's undeniably one of the most straightforward methods for acquiring the digital currency.

Much like online shopping, buying bitcoins with credit or debit cards can be convenient, though the associated fees are steep and come with potential risks. Direct bank account purchases incur lower fees, typically offering a safer option.

Exchanges have implemented stringent verification processes to deter the use of stolen bank cards for bitcoin purchases, making anonymous transactions virtually impossible.

Unfortunately, pre-loaded debit or credit cards Prepaid debit or credit cards face compatibility issues with most major exchanges. In this case, LocalBitcoins becomes an alternative avenue for acquiring bitcoins.

Dedicating time to thoroughly vet exchanges and platforms is indispensable before any bitcoin purchase. The stringent verification processes are in place to safeguard your personal information and ID from ending up with unscrupulous entities.

It’s wise to transfer bitcoins from exchange platforms to your personal wallets right away, ensuring your assets remain shielded from potential theft.

Don't limit yourself to a single exchange; owning accounts across multiple reputable ones like Coinbase, BitPanda, CoinMama, LocalBitcoins, CEX.io, and Changelly can breezily navigate transaction limitations.

1Comment

Is it feasible to purchase Bitcoin and have it sent to Lagos, Nigeria, via a bank account or debit card?

I need to remit $9,500 there by December and plan to send $1,300 monthly.

Lonnie Chapman Sgt/USMC