Ethereum, hailed as the world's second-largest cryptocurrency platform, has recently wrapped up 'The Merge,' an integration merging its proof-of-work system with the Beacon Chain.

Thanks to this transition, Ethereum has swapped its carbon-heavy proof-of-work framework for an eco-friendlier proof-of-stake network. While this change was welcomed by many developers, some proponents still favor proof-of-work for its perceived security benefits, thus giving rise to Ethereum Proof-of-Work, popularly called Ethereum PoW.

In this piece, we delve into the ins and outs of Ethereum PoW, covering the basics of what it is and giving clear guidance on acquiring the ETHW token.

Where to Buy EthereumPOW ETHW

In this section, we've selected our preferred platforms for purchasing EthereumPOW ETHW tokens, basing our choices on personal experience and evaluating factors such as fee structures, security measures, payment options, and the platform's overall reputation.

- Kraken: Top Platform With High Liquidity

- Poloniex: Easy Exchange With Lots of Listings

- Bitfinex: Well Established & Trusted Exchange

Visit The Top Pick

Kraken: Top Crypto Platform with High Liquidity

Kraken: Top Crypto Platform with High Liquidity

Founded in 2011, Kraken is one of the oldest and most popular cryptocurrency exchanges currently in operation.

This exchange has garnered trust as a safe haven for crypto trading, becoming a favorite among traders and institutions from all over the globe.

Read: Our Full Kraken Review Here

Kraken is recognized globally, offering seamless trading across multiple fiat currencies. It is also the leading exchange worldwide for trading Bitcoin in exchange for Euros.

While Kraken is famed for its Bitcoin and Ethereum exchanges for cash (namely EUR and USD), it also supports a diverse array of fiat and crypto trading pairs.

Pros

- A tailored service for institutional clients

- Great for beginners to use

- High trading liquidity

Cons

- The lengthy ID verification process

Poloniex: User-Friendly Platform with Extensive Listings

Poloniex One of the veteran Bitcoin exchanges in the crypto domain, this platform commenced operations in 2014 and has had its fair share of ups and downs.

Despite past challenges, Poloniex has maintained a robust customer base due to appealing low trading fees and its role as an entry point for Tron blockchain's array of decentralized offerings.

Read: Our Full Poloniex Review Here

Poloniex's increasing popularity stems from its lower transaction fees, broad crypto asset availability, and its previous lack of stringent verification processes due to lighter regulatory demands at the time.

Easy to navigate for both new and veteran traders, this platform allows for versatile trading forms — including crypto-to-crypto, crypto-to-fiat exchanges, along with margin and futures trading opportunities. It boasts one of the most affordable trading fee structures in the burgeoning crypto market.

Pros

- Lots of Listings

- Low Trading Fees

- Staking Rewards

- Crypto Futures

- Well Established

Cons

- Not for USA Users

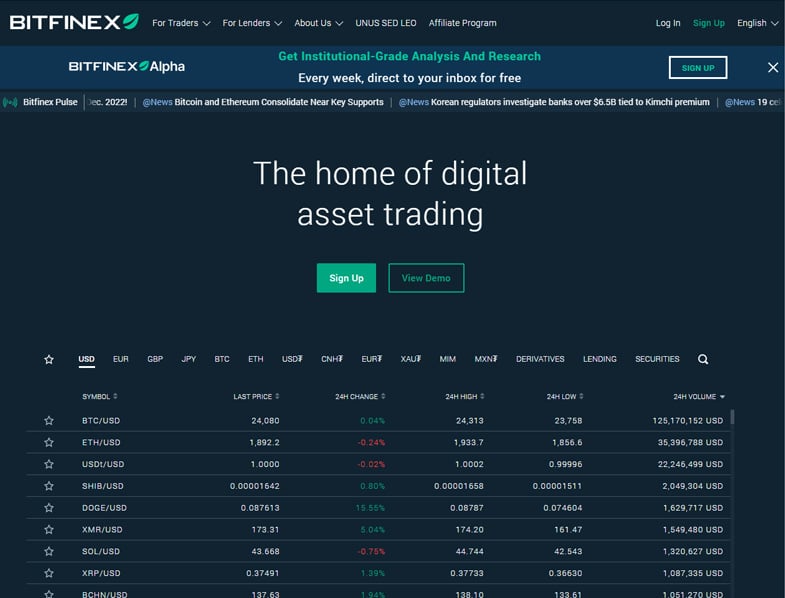

Bitfinex: A Trusted Exchange

Bitfinex: A Trusted Exchange

Based in Hong Kong, Bitfinex Managed by iFinex Inc, a financial company also behind Tether Limited, Bitfinex is acclaimed for its highly liquid order books, facilitating effortless crypto transactions for buyers and sellers.

Much like other leading platforms, Bitfinex offers a dynamic interface for newcomers to the crypto sector, enabling activities such as buying, trading, staking, and lending cryptocurrencies to earn interest.

Read: Our Full Bitfinex Review Here

The user experience on Bitfinex is commendable, blending an easy-to-use interface with minimal deposit requirements. Users can fund their accounts through direct crypto transfers, wire transfers, or card payments, though card payments processed through third parties may incur additional fees.

Alongside its trading features, Bitfinex offers hassle-free access to services such as margin trading, derivative products, and lending. Investors executing large transactions can utilize Bitfinex's OTC trading services, while those seeking low-risk returns can take advantage of Bitfinex's staking protocols.

Bitfinex adopts a maker-taker fee model. Fees vary between 0% and 0.2%, decreasing with increasing order volumes. Large OTC transactions incur no fees, while bank transfers attract a fee of 0.1% for both deposits and withdrawals — expedited withdrawals face a 1% fee. Crypto withdrawals involve a small fee, depending on the specific coin.

The platform ensures the protection of funds and information using measures like 2FA, advanced API key settings, and storing 99% of assets in cold storage.

Pros

- Easy-to-use interface

- Staking protocol with remarkable features for PoS assets

- Highly liquid order book

- Offering high levels of leverage for derivative trades

- Unlimited withdrawals

Cons

- Higher costs for card transactions

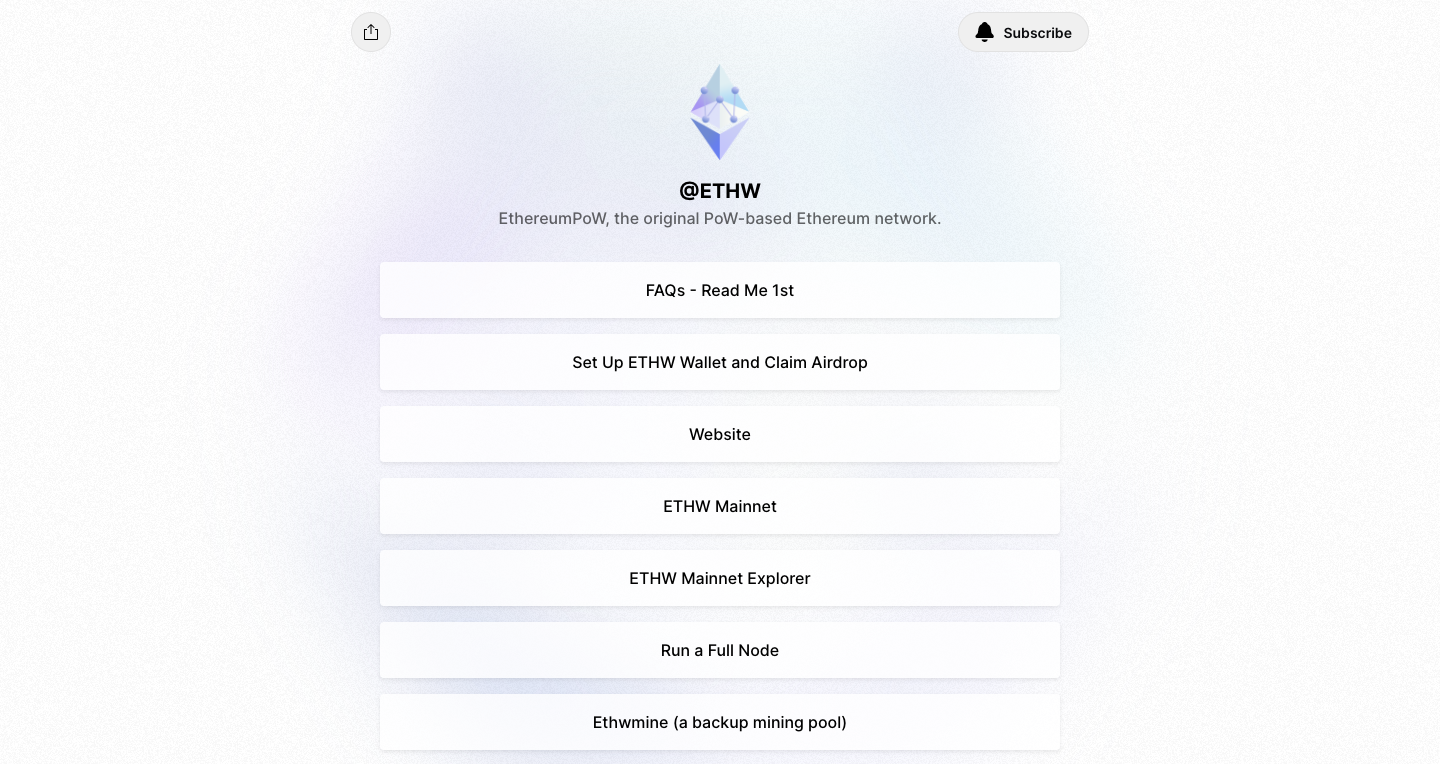

What is EthereumPoW (ETHW)?

EthereumPoW is a clone of the proof-of-work (PoW) blockchain used by the Ethereum network before the switch to a proof-of-stake (PoS) consensus algorithm.

blockchain used by the Ethereum network before the switch to a proof-of-stake (PoS) consensus algorithm.

The platform maintains the pre-Merge functionality of the Ethereum network, with some in the mining audience favoring EthereumPoW as they can no longer profit under Ethereum’s new structure.

The native token of the blockchain, ETHW, can be used to buy products and services from decentralised applications (dApps) created on the platform. The token is also useful to cover network transaction costs and receive rewards for mining to secure the protocol.

The native token of the blockchain, ETHW, can be used to buy products and services from decentralised applications (dApps) created on the platform. The token is also useful to cover network transaction costs and receive rewards for mining to secure the protocol.

Info On Project

Ethereum shifted from a proof-of-work model to a proof-of-stake approach to lower energy consumption and enhance security. Nevertheless, a segment of the network's computing base did not partake in 'The Merge' update.

Helmed by Chandler Guo, a group of miners opposed the transition to a greener security protocol, arguing that Ethereum 2.0 would make conventional crypto miners redundant. Guo, a prominent Ether miner, is also a staunch supporter of Ethereum Classic, another Ethereum PoW offshoot.

Those holding ETHPoW tokens are confident that both the token and its ecosystem will steer clear of the regulatory hurdles faced by the new Ethereum. As mentioned by Gary Gensler the SEC, the staking tools available in the latest Ethereum iteration could classify it as a security under the Howey Test framework.

Currently, only a handful of exchanges list ETHW, EthereumPoW’s native currency. On supporting exchanges, users can partake in spot trading, accessible on platforms like FTX, ByBit, Kraken, and BitMart.

Following its official launch, the EthereumPoW team issued an update to inform users of various refinements and updates. Since the debut, transaction numbers have surpassed 1.7 billion. Furthermore, the number of ETHW address holders is now around 254 million .

Use Cases

Many projects Various projects have thrown their support behind the EthereumPOW network since its inception. Among them are Uniswap V3, MetaMask, DefiEdge, alongside other decentralized wallets, platforms, and Web3 solutions.

.

Mining pools that had previously operated on other networks before Ethereum's transition have now started mining committed to ETHW, with F2pool and other mining pools reallocating resources to bolster the token, collectively accounting for 41.7% of the known hash rate.

How Does EthereumPoW Work?

Just hours after Ethereum's successful move to a PoS framework, anonymous developers diverged the Ethereum blockchain, unleashing the EthereumPoW token employing the Proof-of-Work methodology akin to Ethereum’s prior functioning.

The underlying algorithm used by proof-of-work blockchains determines mining operations’ rules and difficulty level. The “work” itself is mining. It involves adding legitimate blocks to the chain. Computers must solve cryptographic puzzles as proof of work to be compensated with the capacity to validate blockchain transactions. It’s similar to competition and is known as bitcoin mining. It operates on the concept that one can fend off a malicious attack and confirm the authenticity of a transaction by using a lengthy string of letters and numbers, known as hashes.

The underlying algorithm used by proof-of-work blockchains determines mining operations’ rules and difficulty level. The “work” itself is mining. It involves adding legitimate blocks to the chain. Computers must solve cryptographic puzzles as proof of work to be compensated with the capacity to validate blockchain transactions. It’s similar to competition and is known as bitcoin mining. It operates on the concept that one can fend off a malicious attack and confirm the authenticity of a transaction by using a lengthy string of letters and numbers, known as hashes.

The ETHPoW fork aims to perpetuate Ethereum's original proof-of-work consensus, despite plans difficulty bomb purposefully making mining on the PoW chain impractical, ETHPoW persists with mining activities guided by multiple mining pools.

The ETHPoW offshoot, which mirrors the transactional history of Ethereum's primary network, will begin block production upon the activation of the Merge update. This means all smart contracts and token balances existing pre-Merge will migrate too.

Consequently, anyone currently holding ETH on the original chain will receive a corresponding amount of ETHW on the ETHPoW chain. However, ETHW will solely belong as a native asset to the PoW fork — entirely separate from Ethereum’s original (ETH) tokens.

By forking the Ethereum blockchain, ETHW begins with the same circulating supply as its proof-of-stake counterpart. However, post-Merge Ethereum will experience slower inflation due to reduced emission rates, causing the EthereumPoW supply to outpace it if mining continues.

Is ETHW a Good Investment?

The development of ETHW was driven by community efforts to ensure miners continued operations, preventing obsolescence. Ethereum's creator, Vitalik Buterin, has criticized those advocating the hard fork, accusing them of merely seeking financial gain. Conversely, renowned figures like Justin Sun and Chandler Guo have backed the fork.

Consider the following before investing in ETHW:

- Speculative Value: While not as globally recognized as the original Ethereum, the new PoS chain has gained backing from esteemed crypto ventures and the Ethereum Foundation, with several projects already supporting it, potentially driving up its value.

- Volatility: Ethereum is the cryptocurrency world's second-largest by market cap, promoting liquidity and market stability. ETHW, on the other hand, experiences lower trading volumes, making it susceptible to market manipulation and heightened volatility.

- Exchange Listings: The demand and security of digital assets determine their exchange listings. Secure coins with robust trading activity are more likely to remain listed; however, if an asset fails to generate sufficient trade profits, exchanges may delist it. Presently, ETHW is available on various platforms like Kraken, FTX, Poloniex, Gate.io, MEXC, and Huobi, pointing to growing interest.

How to Buy EthereumPOW on Kraken

As awareness spreads, interest in EthereumPOW will likely augment. Acquiring ETHW is straightforward, following just a handful of steps:

Register an Account

First, users should visit the Kraken site , click 'Create Account,' and complete registration by entering a username, email address, and password. Follow up by verifying the email address used during sign-up.

First, users should visit the Kraken site , click 'Create Account,' and complete registration by entering a username, email address, and password. Follow up by verifying the email address used during sign-up.

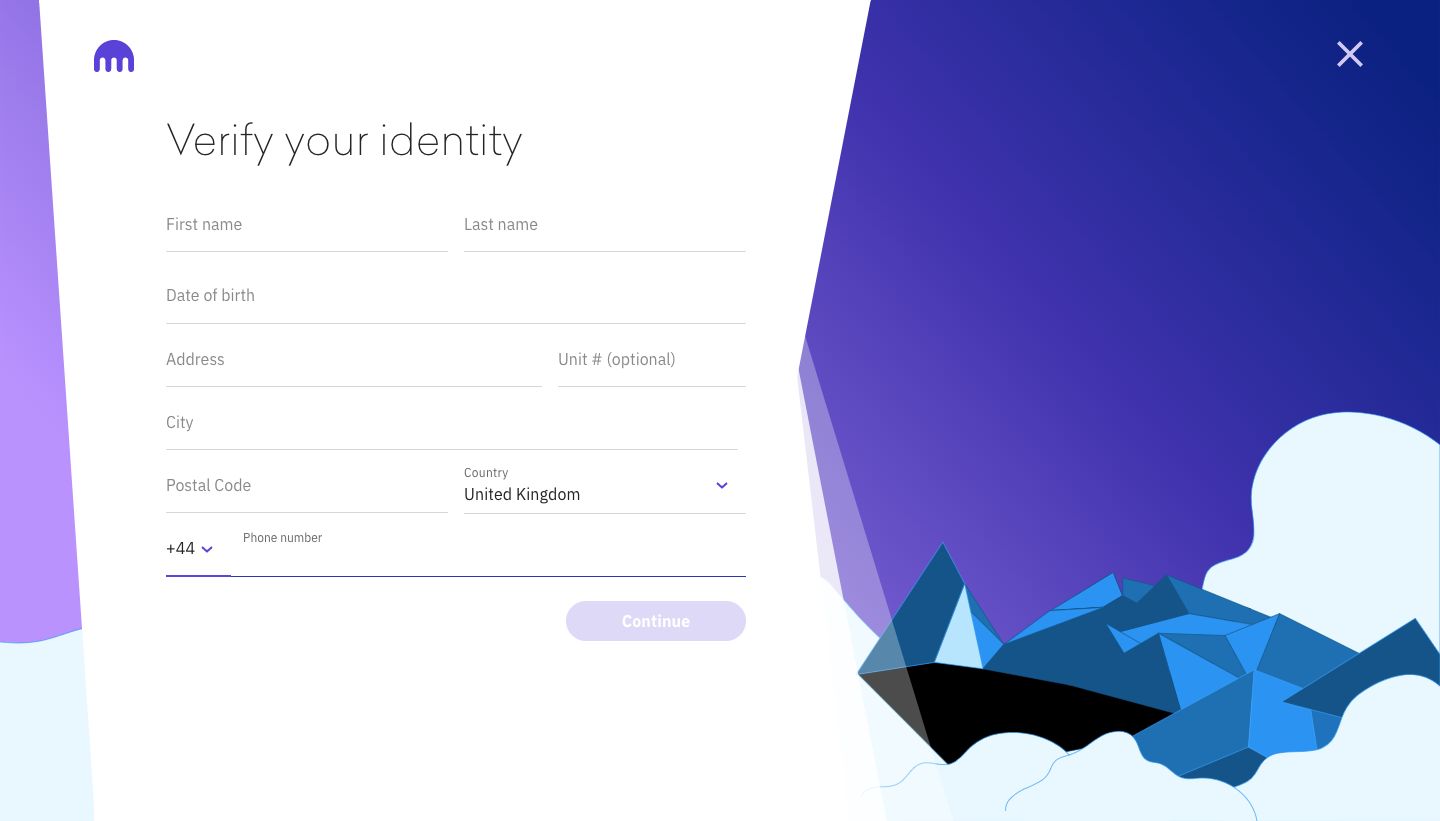

Verify

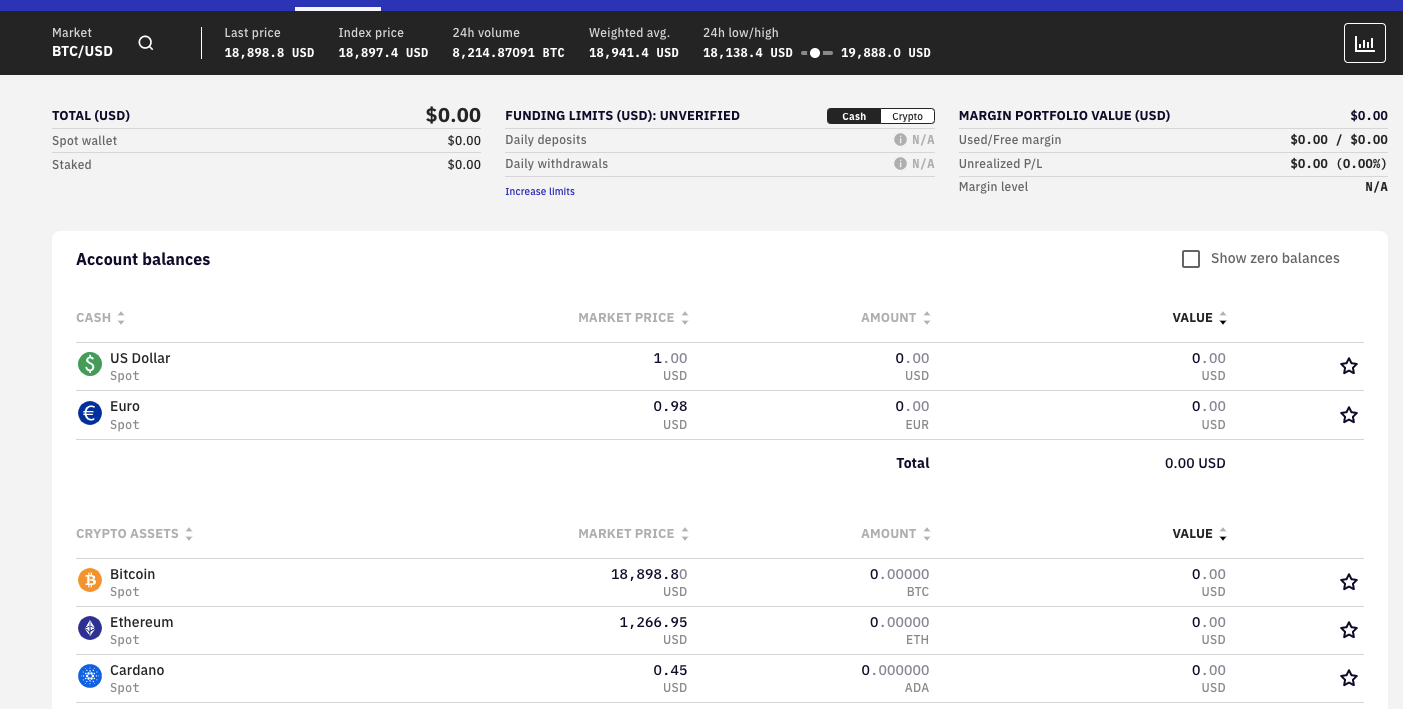

Following registration, account verification is essential, aligning with the KYC requirements of the platform. Attaining 'Starter Level' verification involves providing basic information like one’s name, email, address, and phone number.

The 'Starter' verification process is automated and typically completes in under an hour.

A Beginner's Roadmap to Buying Ethereum PoW (ETHW) Crypto in 2023

Deposit Funds

Traders can fund their Kraken account using a credit or debit card, bank account, and cryptos.

Traders can fund their Kraken account using a credit or debit card, bank account, and cryptos.

This write-up delves into the intricacies of what Ethereum POW entails and guides readers on the nuances of purchasing ETHW tokens.

Buy ETHW

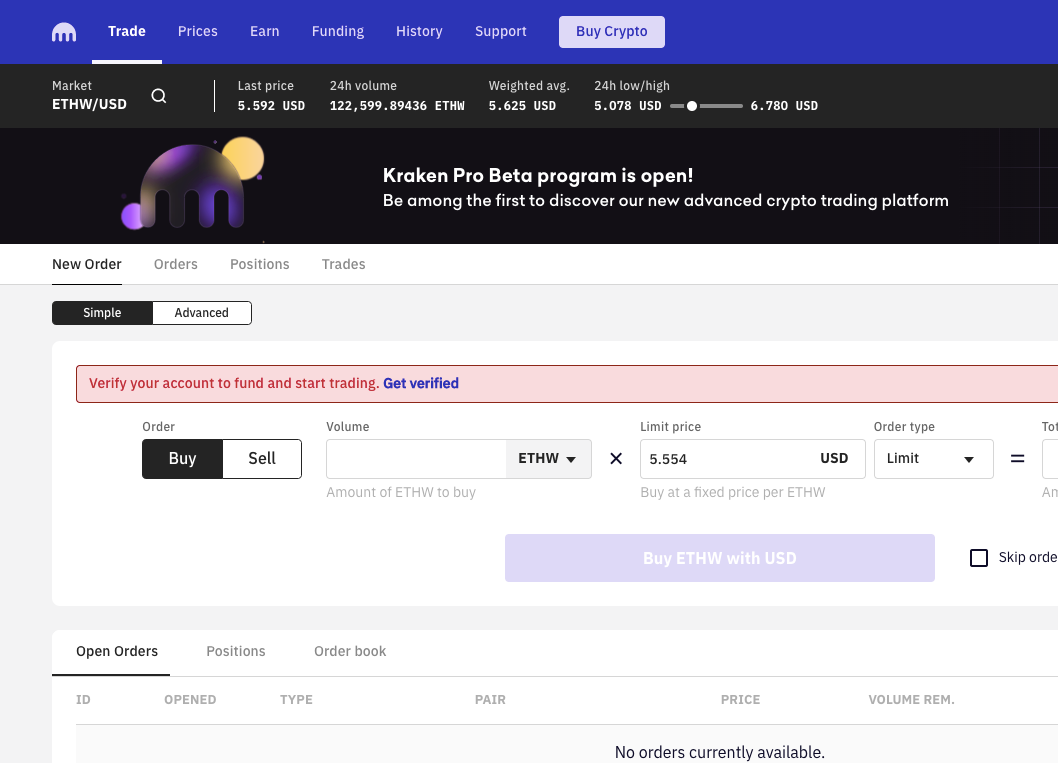

Customers should return to the website and place their first order after receiving notification from Kraken that their cash has arrived. Select “Trade” then click “New Order” from the menu. Users can create customised orders by choosing “Simple” or “Advanced.”

Customers should return to the website and place their first order after receiving notification from Kraken that their cash has arrived. Select “Trade” then click “New Order” from the menu. Users can create customised orders by choosing “Simple” or “Advanced.”

Newcomer's Resource for Acquiring Ethereum PoW (ETHW) Crypto

EthereumPOW FAQs

Will Coinbase support ETHW?

An Introduction to EthereumPoW (ETHW) Crypto: Buying Guide for Starters

What is Ethereum PoW?

Ethereum, renowned as the world’s second-biggest blockchain endeavor, has seamlessly integrated its proof-of-work structure with the Beacon Chain, marking an event known as The Merge.

Can you mine proof-of-stake?

With this merge, Ethereum transitioned from a notoriously energy-heavy system to a sleek proof-of-stake network. While many welcomed this evolution, a faction insists that the traditional proof-of-work methodology offers increased security. Hence, the emergence of Ethereum Proof-of-Work, often referred to as Ethereum PoW.

Which coins use proof-of-stake?

Kraken: Leading Crypto Hub with Rich Liquidity