Hedera seeks to enhance the transfer of decentralized assets. Leveraging cutting-edge direct acyclic graph (DAG) technology, it surpasses traditional blockchain frameworks in speed, cost-efficiency, and security.

Hedera empowers developers to construct on its platform using its eco-friendly native token (HBAR). Anyone interested in utilizing this protocol needs to understand the process of acquiring Hedera (HBAR).

This guide will delve into what Hedera HBAR is about, evaluate its investment potential, and offer a comprehensive walkthrough for buying Hedera using Binance.

Where to Buy HBAR Crypto

This section identifies top recommendations for purchasing the HBAR Hedera Crypto token. These choices are based on personal experiences with these platforms, considering factors like fees, security, payment methods, and overall reputation.

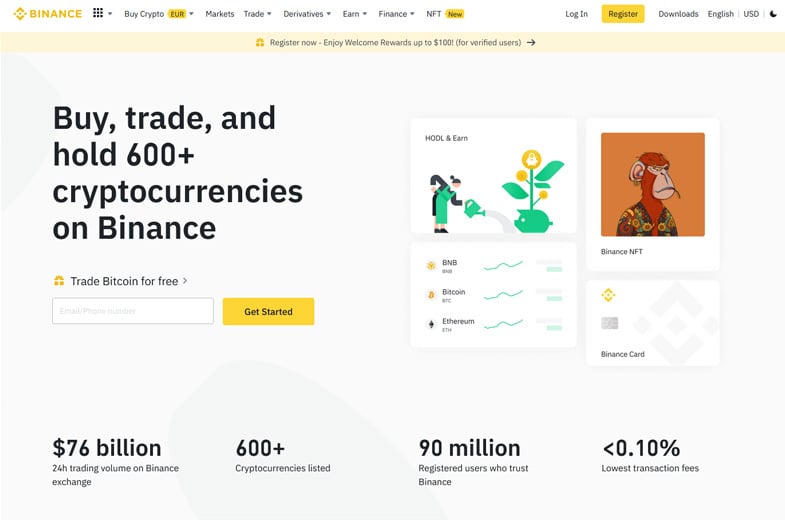

- Binance: Renowned as the Largest Crypto Exchange With Competitive Fees

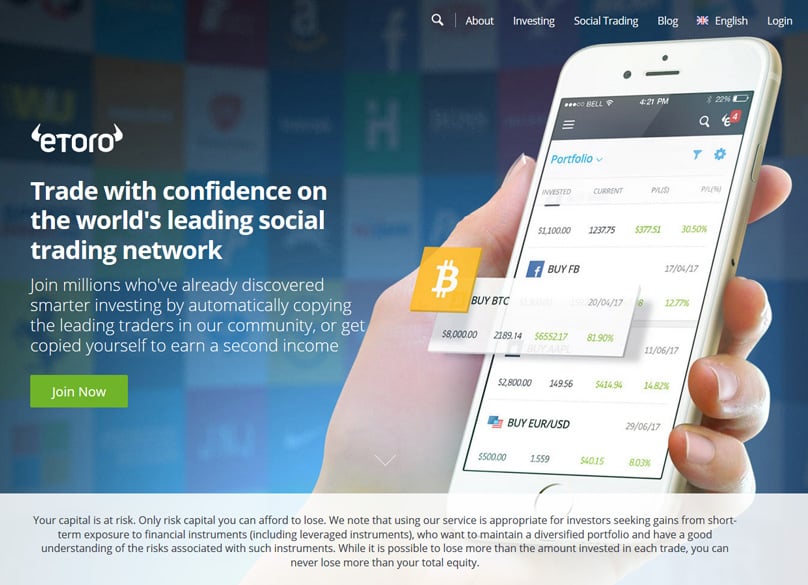

- eToro: A User-Friendly Platform Integrated With Social Trading

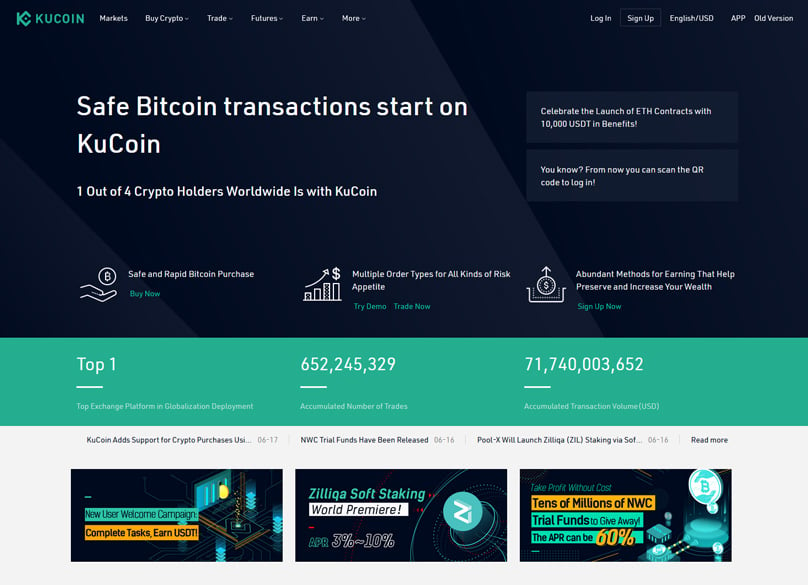

- Kucoin: Highly Valued and Intuitive for Novices

- Gate: Solid Platform With Lots of Coins

Visit The Top Pick

eToro USA LLC; All investments involve risk, including potential loss of principal.

Binance: Reputable Exchange with High Liquidity

Binance: Reputable Exchange with High Liquidity

Binance stands as the biggest cryptocurrency exchange globally by daily trading volume. It grants investors comprehensive access to an extensive array of over 600 crypto assets.

This acclaimed platform offers a comprehensive learning experience alongside advanced trading tools beneficial for skilled traders and investors eager to expand their crypto purchasing knowledge. Although Binance's interface is user-friendly, it's tailored towards seasoned traders.

Read: Our Full Binance Review Here

With Binance, starting your investment journey is cost-effective, with a minimum deposit of merely $10. Users can easily make deposits using a variety of methods, such as wire transfers, credit or debit cards, peer-to-peer (P2P) transactions, and other e-wallet solutions.

The fees on Binance deposits fluctuate depending on the chosen payment method. Generally, a standard fee up to 4.50% might apply for debit or credit card transactions on the global platform.

Traders on Binance benefit from remarkably low fees since it charges a straightforward trading fee of 0.1%. If using Binance coin (BNB) for purchases, a 25% discount on trading fees is available.

Binance goes to great lengths to secure user funds and data, incorporating advanced security measures such as two-factor authentication (2FA), cold storage for most cryptocurrencies, whitelisting, and sophisticated encryption technologies. Operating in over 100 countries, Binance also has a specialized platform, Binance.US, dedicated to serving traders and investors in the United States.

Pros

- Trading fees at 0.01%

- High liquidity

- Wide range of payment methods

- 600+ crypto assets in library

Cons

- Interface caters to more experienced traders

- US-based users face restrictions trading many coins through its arm

eToro: Easy to Use Platform

eToro: Easy to Use Platform

eToro is recognized as an outstanding platform for buying a range of cryptocurrencies and tokens. Known as a leading social trading exchange, it empowers investors to trade over 78 crypto assets including major names like Bitcoin and Ethereum.

With a straightforward interface that caters especially to those new to crypto trading, eToro allows a smooth start with just creating an account. For both US and UK investors, transactions as low as $10 are possible for purchasing tokens and cryptocurrency assets.

Investors benefit from zero charges on all USD deposits, which includes debit card payments. However, there is a fixed $5 withdrawal fee across the board, a uniform 1% fee for each executed trade, and a $10 monthly inactivity fee if no trading activity occurs for a year.

eToro provides multiple options for depositing funds, ranging from bank transfers and direct crypto deposits to debit or credit cards and payment processors such as PayPal. Though USD deposits are handled fee-free, all bank transfers demand a minimum deposit of $500.

A remarkable feature of eToro is its innovative CopyTrader function, permitting inexperienced investors to mimic seasoned traders' strategies on the platform, gaining when they gain.

Exemplifying top-notch security, eToro integrates robust two-factor authentication (2FA), advanced encryption, and data protection technologies. It accepts users from over 140 countries and is under the supervision of leading financial watchdogs like the U.S. Securities and Exchange Commission (SEC), the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CYSEC). It is also linked with the Financial Industry Regulatory Authority (FINRA).

Pros

- Regarded as the premier social trading platform for purchasing

- User-friendly interface

- CopyTrader and CopyPortfolio

- Highly regulated broker

Cons

- Charges an inactivity fee

- Charges a withdrawal fee

eToro USA LLC; All investments involve risk, including potential loss of principal.

KuCoin: Exchange With Lots of Listings

KuCoin: Exchange With Lots of Listings

KuCoin stands out as one of the most venerable and widely used crypto exchanges globally. Based in Seychelles, this broker is highly acclaimed in the trading world, especially among those seeking exposure to derivative products for speculation efforts.

KuCoin currently supports access to an extensive selection of over 600 cryptocurrencies. Beyond merely trading and investing, it permits users to save, stake cryptocurrency, and participate in Initial Exchange Offerings. KuCoin serves as a comprehensive crypto ecosystem for investors.

Read: Our Full Kucoin Review Here

Like many of its peers, KuCoin's complexity might make it daunting for novices. It is tailored more for experienced traders interested in advanced trading products and speculation. Hence, beginners may face challenges using this platform.

However, trading with KuCoin offers numerous advantages. With a very low minimum balance requirement of just $5, deposits in major fiat currencies, peer-to-peer transactions, and select credit card options are supported.

Regarding trading fees, KuCoin maintains a 0.1% charge; though, this might reduce based on an investor's 30-day trading activity and possession of the company's own KCS token.

KuCoin boasts impressive security by employing bank-level encryption and robust security architecture safeguarding user data and assets. It also features a dedicated risk management team that upholds stringent data protection policies.

Pros

- Discounts possible on trading fees

- Offers a wide range of staking opportunities

- Quick P2P trading system

- Anonymous trading available

- Low minimum balance

Cons

- No bank deposit option

Gate.io: Solid Platform With Lots of Coins

Gate.io: Solid Platform With Lots of Coins

Gate.io serves as a digital currency trading platform striving to propose an alternative to currently leading exchanges by delivering trouble-free access to a broad selection of elusive coins and innovative projects.

Active since 2017, the website targets a slice of the crypto trading sector by facilitating straightforward access to a myriad of rare cryptocurrencies alongside nascent ventures.

The service is structured to help investors find refined insights on their preferred coins as well as general market dynamics.

Read: Our Full Gate.io Review Here

Most trading activities occur on an online platform akin to typical cryptocurrency exchanges with features like an order book, past trades, and charting tools.

Pros

- A wide range of currencies

- A low fee structure

- Simple registration process

- Fully functioning site with a mobile application accessible

Cons

- Unregulated

- The team is not very transparent

- No fiat currency transfers

What Is Hedera (HBAR)?

Since Bitcoin’s launch in 2009, The term “blockchain” has gained traction in several media outlets. Although the innovative solution has been ground-breaking and led to the launch of several impressive decentralised solutions, it has struggled with some issues.

The term “blockchain” has gained traction in several media outlets. Although the innovative solution has been ground-breaking and led to the launch of several impressive decentralised solutions, it has struggled with some issues.

Hedera Hashgraph is designed to address the notorious blockchain trilemma—security, scalability, and decentralization. While envisioning an improved alternative to existing blockchains, it remains a public distributed ledger in design. Unlike traditional blockchains that clump transactions together, it organizes them through graphs.

Employing what's known as a direct acyclic graph (DAG), the protocol uses the Hashgraph consensus mechanism. This emerging tech purportedly handles transactions substantially faster, claiming speeds ten times that of conventional blockchain solutions and benefits from low delay. According to the developers, Hedera supports an impressive rate of 10,000 transactions per second (TPS) with finality times between 3 to 5 seconds.

In terms of security, the Hedera Hashgraph uses what it calls Asynchronous Byzantine Fault Tolerant (ABFT). The protocol has a much lower bandwidth consumption in terms of energy use, making it one of the few carbon-neutral solutions in the crypto space. According to data illustrated on its website, the amount of energy used per transaction is below 1KW/h.

In terms of security, the Hedera Hashgraph uses what it calls Asynchronous Byzantine Fault Tolerant (ABFT). The protocol has a much lower bandwidth consumption in terms of energy use, making it one of the few carbon-neutral solutions in the crypto space. According to data illustrated on its website, the amount of energy used per transaction is below 1KW/h.

Hedera users and developers enjoy cost-efficiency, accessing the protocol features for under a dollar. The Hedera Governing Council governs the prices, with the HBAR token fueling computational tasks, governance, and staking functions.

Moreover, Hedera offers remarkable services, notably three. First, there's the token service, empowering users to create and manage digital collectibles or NFTs for application payments or governance functions. In addition to NFTs, the Hedera Token Service (HTS) facilitates the creation of fungible instruments like tokenized assets.

Another service within Hedera is the consensus layer, facilitating users to produce unalterable, verifiable, well-sequenced records for blockchain apps and restricted network systems. This functionality lets developers seamlessly, trustlessly integrate authentic logs of events into their solutions.

The third service is the smart contract service which allows users to run Ethereum-native Solidity smart contracts. This makes it Ethereum Virtual Machine (EVM) compatible, meaning developers familiar with the Ethereum network can build and deploy applications with the programming language they are familiar with instead of going through another learning curve.

The third service is the smart contract service which allows users to run Ethereum-native Solidity smart contracts. This makes it Ethereum Virtual Machine (EVM) compatible, meaning developers familiar with the Ethereum network can build and deploy applications with the programming language they are familiar with instead of going through another learning curve.

How Does Hedera Work?

A coalition of over 50 international technology and financial conglomerates, called the Hedera Governing Council, largely administers Hedera. Their primary goal is to ensure the sustained growth and triumph of the Hedera protocol.

Another responsibility is designing the platform's pricing model. This entails deciding on the fees levied on users for employing the platform, although this council mainly offers guidance.

In its most basic setup, the Hedera protocol works in the this manner:

In its most basic setup, the Hedera protocol works in the this manner:

- Nodes on Hedera communicate through a method known as 'gossip.' This involves dispersing newly acquired information among all nodes, ensuring full network participation while sustaining node resilience.

- Information is 'gossiped,' meaning it's disseminated among all nodes, including those that were previously offline. Thanks to its graph framework, Hedera does not need each node to be flawless for achieving consensus; it is designed to be fault-tolerant.

- Imagine a data structure that's like a digital ledger, holding numerous transactions, their timestamps, digital marks, and a couple of hashes pointing to previous transaction data that's been shared around. This setup ensures everyone in the network stays informed about who initiated a transaction and the exact timing of its discovery, as well as the node responsible for uncovering it. This system is known as virtual voting within the network.

To reach an agreement on what's valid, every node goes through a process of mathematical verification for each transaction, without gobbling up unnecessary bandwidth. This involves picking a few prominent nodes, the so-called 'famous witnesses', that first received the transactions. The rest of the network then checks the information shared in order to pass the voting stage.

Is Hedera a Good Investment?

Thinking about investing in HBAR? Hedera might just be a hidden gem worth your attention, and here are a few compelling reasons why:

High Scalability

Speeding up the time it takes for a block to finalize a transaction is a topic generating buzz in the crypto sector. As technology leaps ahead, payment systems are racing to improve transaction and confirmation speeds for users. Unfortunately, Bitcoin hasn't kept up, lagging due to its dependence on the competitive proof-of-work system.

Hedera emerges as a strong contender here, delivering a reliable 10,000 transactions per second tailored for demanding business needs. This positions the project as a promising choice among consumers seeking more decentralized ways to transfer assets.

Managed by Leading 50 Multinational Technology Companies

Some hardcore crypto enthusiasts might see Hedera's structured system as a downside, but in a space where dubious characters abound, it's often praised. Beyond Bitcoin and a handful of other well-known altcoins, many bad actors have swindled investors, some on purpose, while others were caught in faulty security systems.

Hedera's governance model, led by major financial and tech powerhouses, brings together industry experts to craft a secure, consumer-centric solution adhering to international standards.

Providing Several Services (Token, Consensus, File Storage)

Hedera goes beyond mere scalability. It offers a plethora of services, from creating non-fungible tokens (NFTs) with its token service to providing a consensus layer for an auditable event log and decentralized file storage. It's a comprehensive next-gen digital ledger protocol.

Lower Transaction Fee

A common grievance with PoW protocols is the fee structure. A prime example is Ethereum, which can see gas fees spike above $200 during busy periods, making it impractical for everyday users.

By leveraging proof-of-stake technology, Hedera manages to keep transaction fees under a dollar. This economical approach positions Hedera for a breakthrough.

Carbon Neutral

Hedera's commitment to carbon neutrality is another feather in its cap. While PoW protocols draw criticism for devouring vast amounts of energy, sometimes exceeding entire countries, Hedera's Hashgraph and asynchronous Byzantine Fault Tolerance systems operate at a minimal energy consumption of just 0.00001 kW/h.

How to Buy Hedera on Binance

Curious about how to get Hedera? Binance is our top platform choice for grabbing some HBAR tokens. It's established itself as a reliable hub for trading digital assets with unparalleled daily trading volumes.

Binance doesn't just draw in users with its deep liquidity. The platform boasts one of the most competitive trading fee structures, multiple earning options, and a robust trading interface. Dive into our step-by-step guide below if you want to snag some Hedera on Binance swiftly.

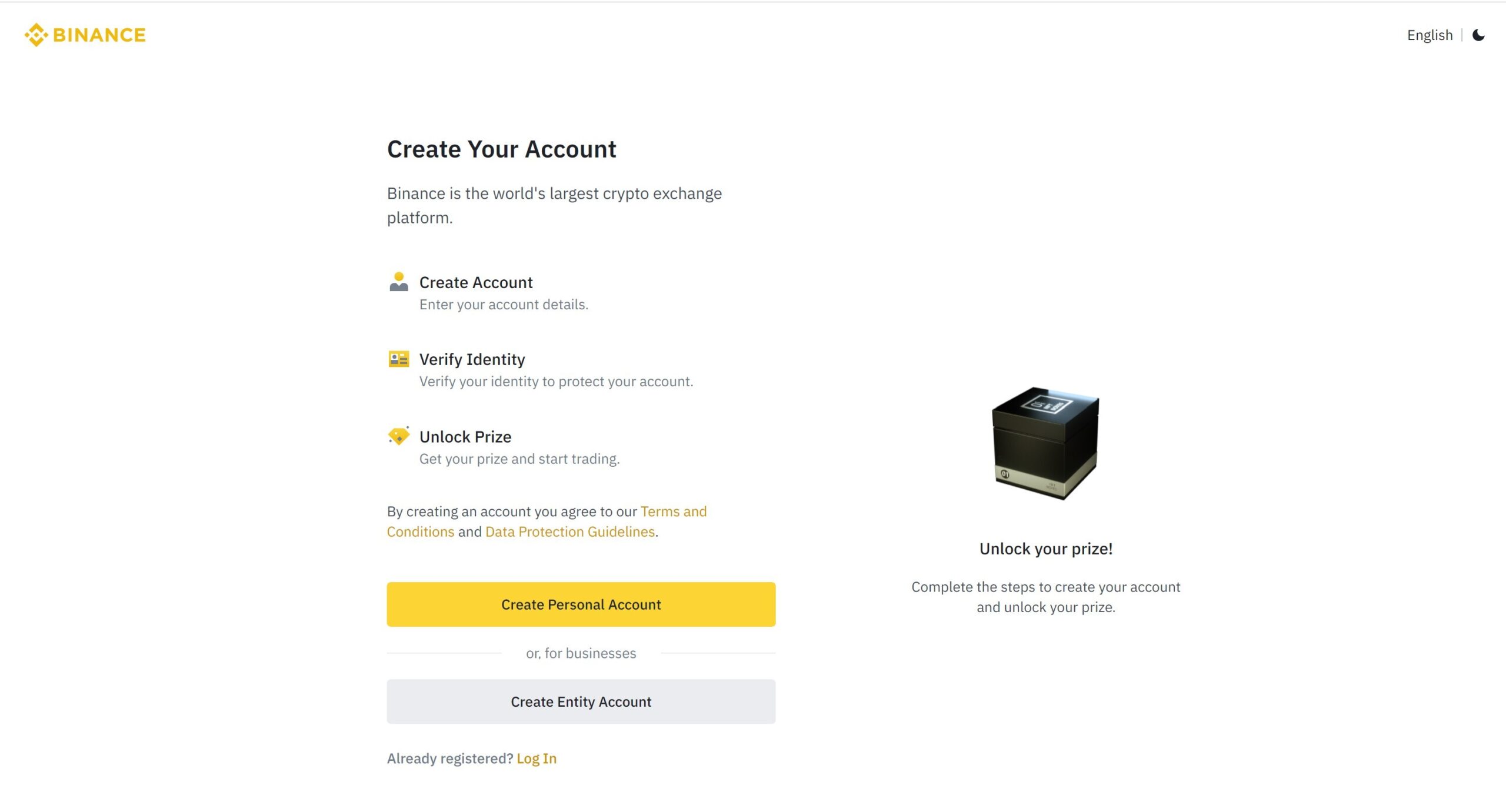

Create Account

First, open an individual account on the Binance platform by tapping the ‘Register Now’ button. Insert an email address and a mobile number to proceed. A verification link and code would be sent to both the email address and submitted phone number.

First, open an individual account on the Binance platform by tapping the ‘Register Now’ button. Insert an email address and a mobile number to proceed. A verification link and code would be sent to both the email address and submitted phone number.

Verify ID

New to the game? To access the full suite of services on Binance, you'll need to authenticate your ID first. Head to your profile, hit the 'Verify' button, and upload a recent driver's license. Don't forget to complete the face verification for standard access, and submit proof of address for a deeper verification process.

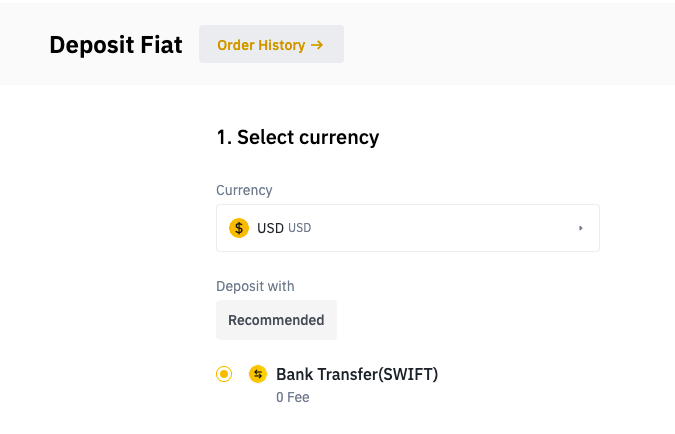

Deposit

Ready to fund your journey? Head over to 'Wallet', then 'Deposit'. Pick 'Cash' and choose your preferred currency. Enter the deposit amount (remember, Binance's minimum is $10), and follow the prompts to fund your account.

Buy HBAR

Once a deposit is completed, investors can initiate a purchasing order. To do this, type ‘HBAR’ into the search bar and click on the applicable trading pair. Tap on ‘Buy’ to open up the order page and insert how much of the digital asset to purchase. Once done, tap on ‘Buy HBAR’ to complete the process.

Once a deposit is completed, investors can initiate a purchasing order. To do this, type ‘HBAR’ into the search bar and click on the applicable trading pair. Tap on ‘Buy’ to open up the order page and insert how much of the digital asset to purchase. Once done, tap on ‘Buy HBAR’ to complete the process.

Hedera Wallets

Software Wallet

Hot wallets, also known as software wallets, are a favored choice for storing crypto. Because they're always connected to the net, they've earned the 'hot' tag. Once you register with a crypto exchange, you can access a hot wallet, which lets you manage private keys to verify asset ownership. They're handy for day-to-day transactions and can be custodial or user-managed.

Custodial wallets act as vaults for assets held with an exchange or third-party platform. Users simply request transactions, and the exchange handles the rest, similar to traditional banking. On the other hand, self-custody wallets put the user in complete control.

While hot wallets are generally free, their constant internet connectivity makes them more vulnerable. An example is the Binance Wallet.

Hardware Wallet

A hardware wallet is designed to layer up security, enhancing the protection of your crypto dealings.

While it's common to move funds with private keys, a compromised computer puts them at risk of being snatched by malware. Hardware wallets sidestep this risk by keeping keys off the computer, ensuring their safety even if security is breached.

These devices are ideal for securely storing large crypto stashes, far safer than hot alternatives.

Top cold storage options include Ledger and Trezor hardware wallets. Check out our reviews for more insights:

Mobile wallet

A mobile wallet mirrors a hot wallet but on your smartphone. It offers a super convenient way to handle daily spends with ease, keeping your keys secure while allowing you to use your digital assets for everyday needs.

These wallets are free, available for on-the-go transactions. Some of the popular ones include eToro Money Wallet and Coinbase Wallet.

Desktop wallet

On the flip side, desktop wallets bring the hot wallet experience to your PC. It's software you download, allowing seamless digital asset management on your computer, with browser extensions for quick access. However, their online setup makes them hack-prone, with Exodus Wallet being a well-known example.

Paper Wallet

Often cited as the earliest form of crypto wallets, paper wallets have largely faded out of contemporary use. They contain both public and private keys, but as the least secure wallet, they face risks like loss, theft, or damage.

Conclusion

Promoting itself as the forefront of distributed ledger technology, Hedera Hashgraph makes waves with its scalability, security, and cost-effective decentralization.

Potential investors can quickly get in on Hedera via Binance, a platform touting a sterling reputation with deep liquidity and favorable trading fees. Within its suite, the Earn program offers users the chance to earn passive income.

Hedera FAQs

What exchanges sell HBAR?

HBAR trading is supported by top-tier platforms, yet Binance is our recommended choice. Newcomers can register and verify their ID for access. Once token deposits are verified, trades can be executed, transferring stablecoins to banks for a $15 fee or zero-cost transactions on Binance's peer-to-peer market.

How do I buy HBAR coins?

Purchasing HBAR is simplified further. Simply sign up on Binance, submit a driver's license, deposit $10 at minimum, and conduct your transactions through the Spot trading feature.

Can I buy HBAR on Binance?

Yes, Binance facilitates HBAR trades. New users can register, input personal details, complete their KYC, and make a $10 deposit to purchase tokens seamlessly.

Will Hedera be on Coinbase?

As of now, Hedera protocol isn't featured on Coinbase. An announcement is eagerly awaited though. via a blog post that they will be listing it soon.

Can you buy HBAR on Coinbase pro?

Coinbase is winding down its Pro platform, and currently doesn't support Hedera trading on its network.