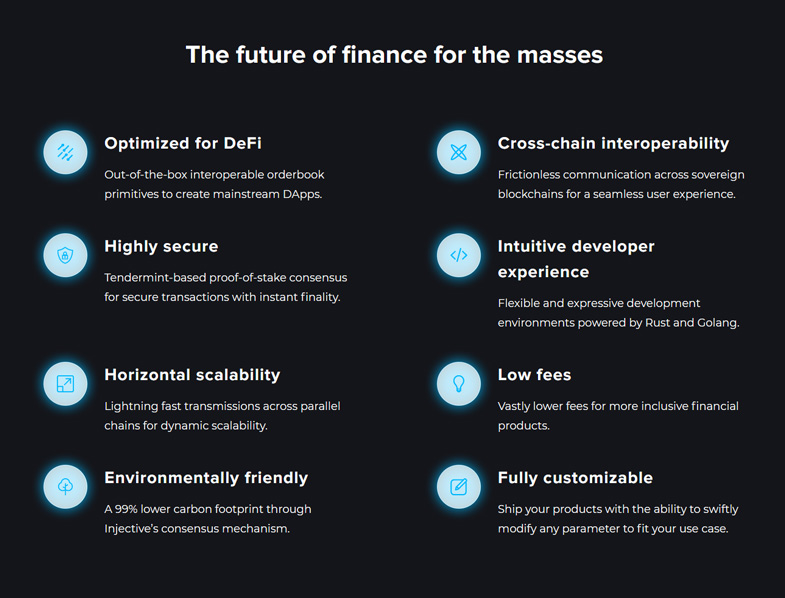

Price volatility and order manipulation pose significant challenges on decentralized exchanges. Injective Protocol claims to solve these issues with its innovative layer-2 framework designed specifically for derivatives trading.

With Injective By offering a decentralized trade execution module alongside an order book, the protocol safeguards against frontrunning activities. It employs a layer-2 blockchain that works smoothly within an EVM-compatible setting to process transactions.

The framework builds on the Cosmos SDK, extending its capabilities as a sidechain to enhance Ethereum's scalability.

Explore how the Injective environment functions and learn the process of acquiring its native INJ tokens through this extensive guide.

Where to Buy Injective INJ

Here's our curated selection of prime platforms for purchasing the Injective INJ Cryptocurrency token. Our choices are experience-based, factoring in fees, security protocols, convenience, and market standing.

- Binance: Largest Crypto Trading Platform with Attractive Fee Structures

- Coinbase: Widely Respected and Beginner-Friendly for New Users

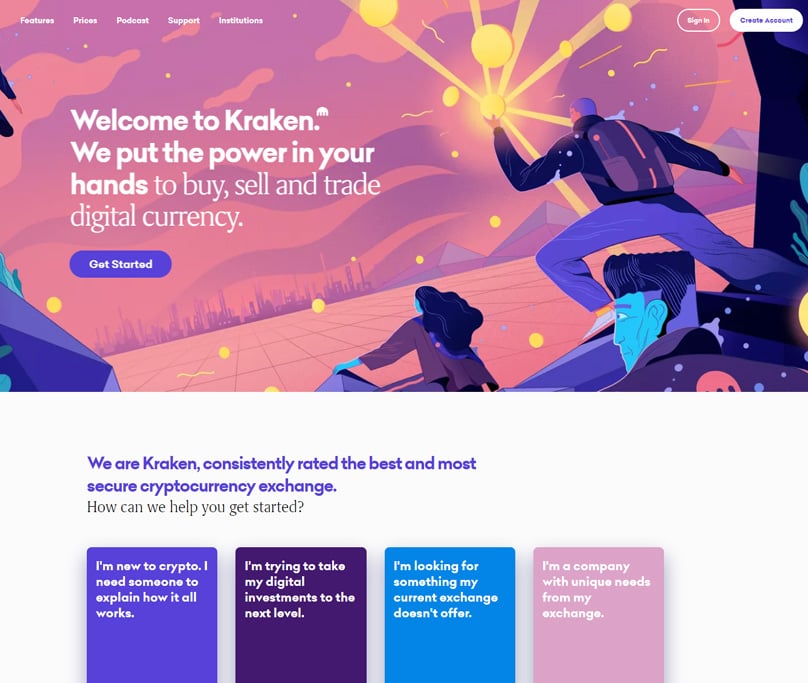

- Kraken: Top Platform With High Liquidity

- Kucoin: An Established Platform with a Broad Selection of Listings

Visit The Top Pick

Binance: Reputable Exchange with High Liquidity

Binance: Reputable Exchange with High Liquidity

Binance Leading the charge in daily cryptocurrency trade volumes, Binance facilitates over 600 crypto asset transactions.

Not only does the recognized platform boast an exhaustive educational structure, but it also offers sophisticated trading tools that cater to experienced traders eager to explore diverse cryptos. While the intuitive interface is user-friendly, Binance tends to attract seasoned traders.

Read: Our Full Binance Review Here

Offering an entry point with just $10, Binance makes it easy for new investors to commence their journey with minimal financial requirements. Existing payment options include wire transfers, card payments, P2P, and various e-wallet facilities.

Binance's funding comes with variable fees, depending on the payment method, such as a 4.5% charge for card-based deposits.

Benefit from exceptionally low fees at Binance, with a 0.1% standard trading rate. Holders of Binance Coin (BNB) enjoy a 25% discount on these trading charges.

Trades on Binance are shielded by robust security procedures like 2FA, cold storage for most currencies, whitelisting, and solid data encryption practices. Operating across 100+ countries, Binance also offers a US-centric platform under the Binance.US umbrella.

Pros

- Trading fees at 0.01%

- High liquidity

- Wide range of payment methods

- 600+ crypto assets in library

Cons

- Interface tailored for seasoned traders.

- US-based clients face coin trading limitations via its subsidiary.

Coinbase: Simple & Easy to Use Exchange

Coinbase: Simple & Easy to Use Exchange

Coinbase An appealing solution for U.S. traders, Coinbase eases the process of buying, selling, and staking cryptos without complications.

Enhancing ease-of-use, Coinbase supports trading for over 10,000 blockchain-related assets.

Read: Our Full Coinbase Review Here

Setting up on Coinbase is swift, clocking in under 10 minutes, making it an outstanding alternative to Binance for fuss-free investments.

With a low deposit threshold of $2, Coinbase stands out, offering a range of deposit pathways like ACH, wire transfers, cards, and e-wallets, with debits charged at a rate of up to 3.99%.

Using a Coinbase debit card for crypto purchases yields a cash back reward of 4%.

Fee structures vary, with 0.5% to 4.5% rates, based on payment methods, crypto types, and transaction magnitude.

Coinbase has transformed itself into a multifaceted platform, sporting features like a built-in exchange wallet and cashback incentives for both retail and institutional clientele.

Enhanced security practices in Coinbase, including 2FA, bolster asset safety, complemented by crime insurance against theft and fraud.

Licensed by the SEC, Coinbase stands under the watchful eye of financial bodies like FCA, FinCEN, and NYSDFS.

Pros

- Beginner-focused

- Licensed and reputable platform

- Insurance in case of hacks

- Low minimum deposit

Cons

- High fee compared to competitors

- US customers face limitations with credit card deposits.

Kraken: Top Crypto Platform with High Liquidity

Kraken: Top Crypto Platform with High Liquidity

Founded in 2011, Kraken is one of the oldest and most popular cryptocurrency exchanges currently in operation.

Gaining a name as a secure haven for crypto enthusiasts, this platform is favored by traders and institutions globally.

Read: Our Full Kraken Review Here

Kraken's global allure offers engaging trading of fiat currencies, particularly excelling in Bitcoin-Euro transactions.

Famed for its BTC and ETH to cash markets (EUR and USD), yet features a wide array of tradeable fiat and digital currencies.

Pros

- Targeted services catering to institutional clientele.

- Great for beginners to use

- High trading liquidity

Cons

- The lengthy ID verification process

KuCoin: Exchange With Lots of Listings

KuCoin: Exchange With Lots of Listings

KuCoin Recognized as a heritage crypto exchange, Seychelles' KuCoin is a market stalwart in derivatives trading.

Diving into 600+ cryptocurrencies, KuCoin provides comprehensive services like staking, savings, and initial offerings, presenting itself as a complete crypto hub.

Read: Our Full Kucoin Review Here

New investors may find KuCoin intimidating, with its advanced trading environment, making it ideal for seasoned speculators.

Despite this, KuCoin offers significant gains with a low starting balance of $5, accessible through fiat, P2P, and limited card options.

Trading at KuCoin incurs a 0.1% fee, adjustable based on recent volumes and possession of KCS tokens.

KuCoin demonstrates commendable security measures, employing bank-grade encryption and strict data protocols overseen by a dedicated control team.

Pros

- Available discounts on trading fees.

- Comprehensive staking options abound.

- Quick P2P trading system

- Anonymous trading available

- Low minimum balance

Cons

- No bank deposit option

Injective Protocol Derivative Dex

Weekly blockchain project launches are commonplace, yet launching the testnet for Injective Protocol prompted strong reactions in the blockchain community, hinting at significant impacts on decentralized crypto trading approaches.

Injective Protocol

Initiated in a 2018 whitepaper, Injective Protocol comprises a skilled team tackling large-scale blockchain challenges, fostering anticipation surrounding its contributions.

Acting as a decentralized derivatives exchange, the Injective Protocol seeks to unite decentralized finance with centralized exchange benefits.

Historically, the DEX offered regulatory relief over CEXs, yet balancing liquidity and usability remained challenging.

Though embodying blockchain ideals, DEXs face hurdles affecting adoption, striving to deliver CEX-comparable liquidity in the DeFi sphere.

Taking an in-depth look at Injective Protocol's design unveils its groundbreaking role in DeFi innovation.

Decentralized Exchanges Explained

Crypto exchanges bifurcate into centralized (CEX) and decentralized (DEX) platforms. Firms like Coinbase and Binance exemplify CEXs, holding key custodianship of traded digital goods.

DEXs leave key control with digital owners, like in Uniswap, forming their fundamental advantage over the user-friendly CEX setups.

CEXs simplify crypto adoption, ushering in fresh users but bringing forth associated challenges, prompting DEX correction efforts. The adage 'not your keys, not your coins' resonates widely online.

Navigate the World of Injective Protocol (INJ) Crypto: Your Comprehensive 2025 Guide

Injective Protocol Features

Dive deep into the functionality of the Injective platform, and discover where and how to purchase the native INJ tokens efficiently.

Comprehensive Guide: Navigating the Purchase of Injective Protocol (INJ) Crypto Coins

Step-by-Step Approach to Purchasing Injective (INJ) Crypto Coins: An All-Inclusive Guide

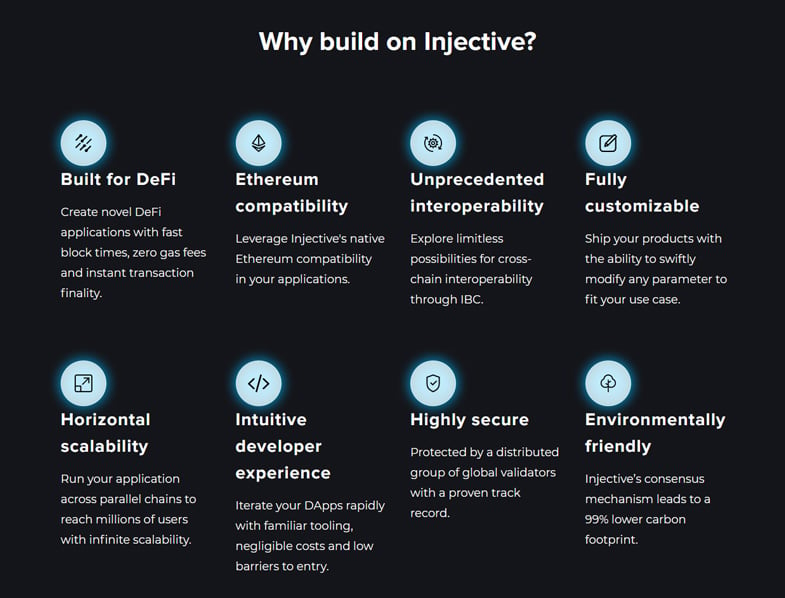

A notable challenge faced by decentralized exchanges is the vulnerability to price and order manipulation. Injective Protocol steps up by offering a solution through its advanced layer-2 platform focused on derivatives trading.

The system grants users a decentralized setup for trade execution and an order book, thwarting any frontrunning attempts on the exchange. It utilizes cutting-edge layer-2 blockchain technology in an EVM-compatible setting to streamline on-chain transfers.

Enhancements in DEX User Accessibility Offered by Injective Protocol

Injective Protocol's robust design incorporates the EVM within the Cosmos-SDK, functioning as a side chain to enhance the scalability of the Ethereum Network.

Uncover the operational depths of the Injective platform alongside practical insights on acquiring the project’s native INJ token effectively.

Injective Platform's Competitive Edge

Binance: A Highly-Trusted Exchange Offering Ample Liquidity

Kraken: Leading Crypto Platform Known for Its Robust Liquidity Levels

KuCoin: A Platform Abundant in Cryptocurrency Listings

Injective Protocol Enhances User Experience and Efficiency on Decentralized Exchanges

Understanding the Benefits of Engaging with the Injective Exchange

Decoding the Mechanisms Behind the Injective Protocol

Here's our curated list of the top platforms where and how to purchase the Injective INJ Crypto token, based on our in-depth experience and evaluation of factors like fees, security, payment options, and reputation.

Insights into the Operation of Injective Protocol

Leading Crypto Exchange with Minimal Fees

Widely Respected and Transparent Platform for Newcomers

An Esteemed Exchange Offering an Expansive Array of Listings

Ruling as the largest cryptocurrency exchange with impressive daily trade volumes, this platform opens doors for investors to seamlessly trade over 600 varied crypto assets.

Acknowledged for its comprehensive learning resources and sophisticated trading tools, this platform caters well to seasoned traders, providing an intuitive interface for an enhanced trading journey.

Kickstart your trading experience with a deposit as low as $10, along with the ease of multiple funding options such as wire transfers, credit/debit cards, P2P payments, and diverse e-wallet solutions.

You might encounter varying deposit fees based on your chosen payment method. Notably, there's a typical fee of up to 4.50% for deposits via debit/credit cards.

- Via the INJ Peg zone smart contract.

- Benefit from competitive trading fees set at 0.1%, with the added perk of a 25% discount for trades involving Binance's own token (BNB).

- Experience the reassurance of having your funds and data safeguarded by top-tier security features, including two-factor authentication (2FA), cold storage for safeguarding the majority of coins, and sophisticated data encryption.

- Professional Interface Tailored for Experienced Traders

Limited Trading Access to Certain Coins for US Users

Here's a fantastic alternative for traders exploring straightforward methods to buy crypto. This US-based platform streamlines the buying, selling, and staking of digital coins, eliminating unnecessary complexities.

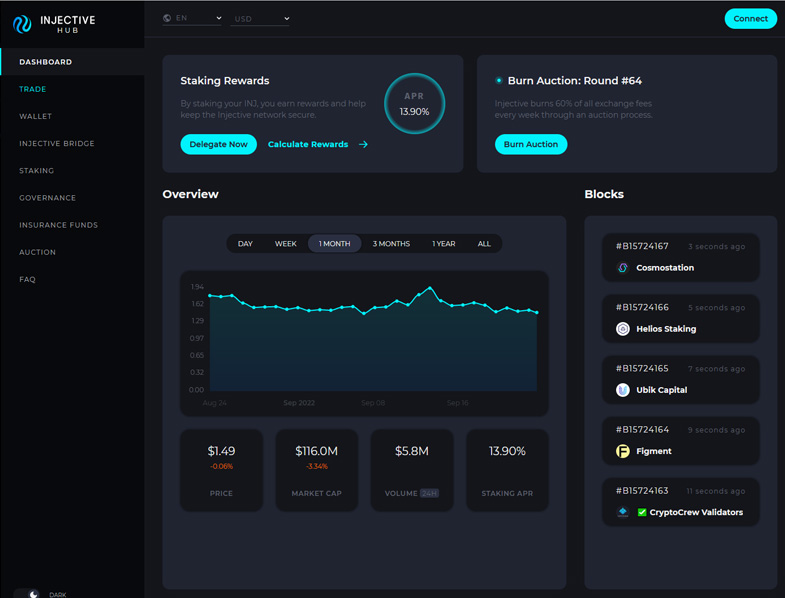

- Trade Execution Coordinators.

- Bi-directional token bridges.

- Staking.

- Futures contracts trading.

- ERC20 contracts.

INJ Tokenomics

Boasting a user-friendly design, the platform effortlessly demystifies crypto trading, supporting over 10,000 blockchain-related assets.

Streamlined signup and verification channels mean swift access to trading, lasting no more than ten minutes. The platform is a worthy alternative for those finding ease-of-use paramount.

Offering a market-leading deposit minimum at just $2, the exchange places itself in a competitive position. It embraces a broad spectrum of deposit methodologies, including ACH, Wire transfer, debit cards, and e-wallet avenues to cash out in major currencies.

Enjoy garnering a 4% cashback reward on crypto purchases made through its debit card.

Competitive fee structures range from 0.5% to 4.5%, varying with payment methods, crypto-types, and transaction sizes.

Transitioning from traditional exchange confines, it has evolved into a multi-faceted platform rich with services for both retail and institutional investors, featuring an integrated wallet, cashback visa card, and robust staking, among other offerings.

Robust security practices include 2FA verification enhancing the protective layers around user accounts, along with crime insurance safeguards against theft and fraud.

INJ – Mainnet Launch

With licensing from SEC and regulation by significant financial bodies like FCA, FinCEN, and NYSDFS, the platform operates under stringent compliance norms.

Absence of Credit Card Deposit Facility for US Customers

Recognized as a secure, go-to hub for cryptocurrency trading, the exchange appeals to traders and institutions across varied geographies.

While primarily known for its Bitcoin and Ethereum cash markets, users can delve into a wide array of fiat and crypto trading opportunities here.

Specialized Services Curated for Institutional Entities

Amongst the stalwarts of crypto trading, this Seychelles-based exchange stands as a prime contender, ideal for market derivatives enthusiasts.

How to Buy INJ Token on Binance

Aiding access to over 600 cryptocurrencies alongside multifaceted investment options, this exchange doubles as a comprehensive crypto hub.

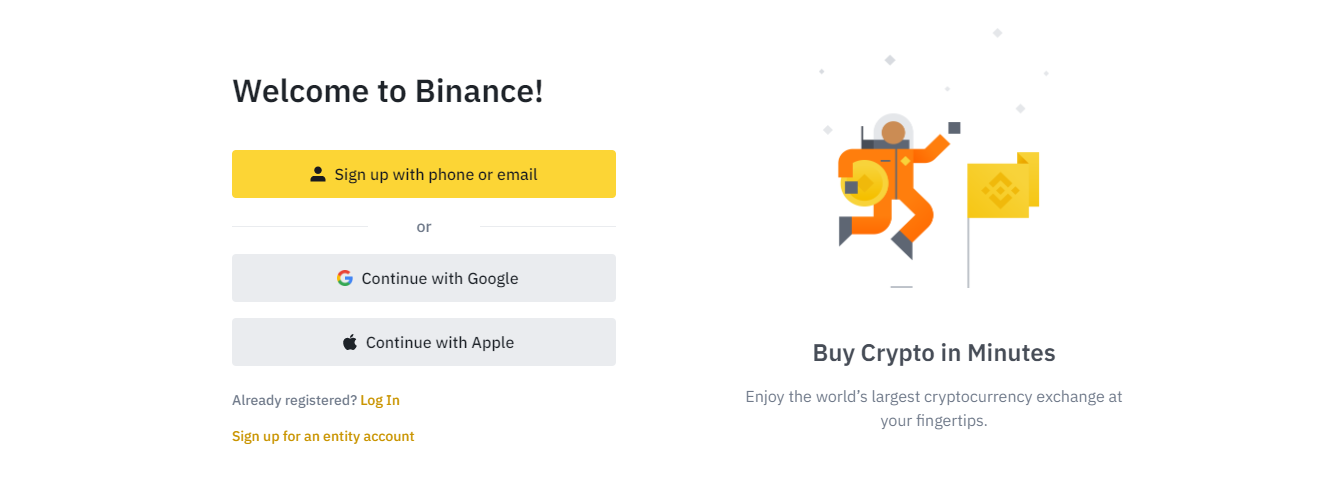

Step 1: Sign Up

Go to the Binance home page and click on “Register”.

While thriving as a preferred platform for seasoned speculators, beginners might initially find the overwhelming array of services challenging.

Step 2: Verify Your Identity

Despite this, users gain from countless advantages, including a low minimum balance threshold and diverse deposit facilities like major fiat currencies, P2P transfers, and credit card options.

Aspiring traders encounter a manageable 0.1% fee structure, potentially declining with greater engagement marked by trading volume and KCS token utilization.

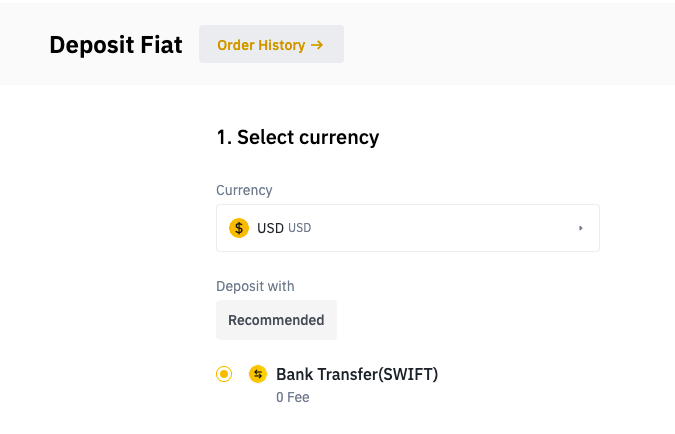

Step 3: Deposit Your Funds

Taking security to the next tier, the system employs bank-grade encryption and design protocols ensure user assets and data remain secure.

Fee Reductions Available for Traders

Step 4: Buy

Vast Staking Horizons