Decentralized finance ( DeFi The crypto space continues to expand impressively, building upon the Ethereum blockchain. However, with Ethereum's older infrastructure struggling to keep up with increasing demands, many users are turning to alternative options.

The Kava blockchain represents a top-tier up-and-comer in the cryptocurrency sub-sector. This initiative seamlessly merges the flexibility and innovation of Ethereum with Cosmos’s functions focused on scaling and interoperability — a bidirectional core DeFi protocol.

In this beginner-friendly guide, we will explore all aspects of the Kava blockchain and examine the various ways to invest in KAVA, its native token.

Where to Buy Kava Network KAVA

This section covers our preferred methods and platforms for purchasing the Kava Crypto token, informed by hands-on experience and considerations such as fees, security measures, payment alternatives, and platform reputation.

- Binance: The Top Crypto Exchange with Competitive Fees

- Coinbase: Highly Regarded and Intuitive for Novice Users

- Kucoin: Highly Regarded and Intuitive for Novice Users

Visit The Top Pick

Binance: Reputable Exchange with High Liquidity

Binance: Reputable Exchange with High Liquidity

Binance As the most prominent cryptocurrency exchange by daily trading volume globally, Binance grants investors the ability to trade over 600 crypto assets seamlessly.

This well-known platform provides a learning curve accompanied by sophisticated trading tools, catering to seasoned traders eager to explore diverse cryptocurrencies. While Binance sports a user-friendly interface for a smooth journey, the platform mostly appeals to traders with extensive experience.

Read: Our Full Binance Review Here

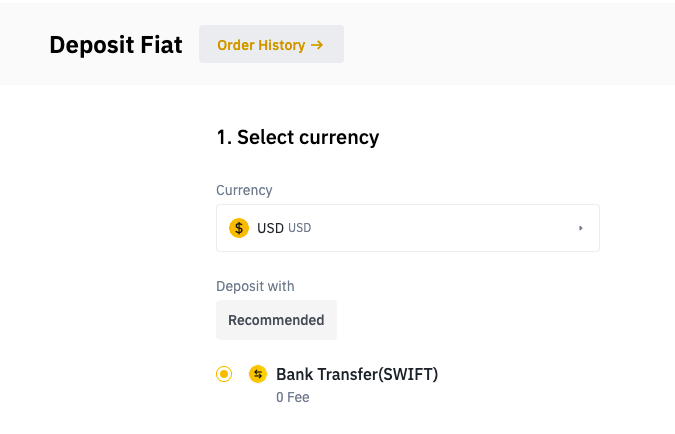

With a minimal deposit requirement of just $10, Binance offers an accessible entry point for investors ready to start with budget-friendly fees. Deposits can be made effortlessly through several payment options, including wire transfers, credit/debit cards, peer-to-peer (P2P) systems, and other e-wallet solutions.

Binance's deposit fees vary depending on the payment method chosen. For example, deposits made using a debit/credit card incur a standard fee of up to 4.50%.

Trading on Binance offers low costs, with a standard fee of 0.1%. However, those using the Binance token (BNB) can enjoy a 25% discount on trading fees.

Furthermore, investors have peace of mind knowing their assets and data are exceptionally safeguarded on Binance. The platform employs cutting-edge security protocols such as two-factor authentication (2FA), cold storage for most coins, whitelisting, and advanced data encryption. Operating effectively in over 100 countries, Binance also maintains a U.S. specific platform, Binance.US, tailored to local traders and investors.

Pros

- Trading fees at 0.01%

- High liquidity

- Wide range of payment methods

- 600+ crypto assets in library

Cons

- The Platform's Interface Caters Well to Experienced Traders

- U.S. Traders Face Limitations Regarding Crypto Variety on its U.S. Version

Coinbase: Simple & Easy to Use Exchange

Coinbase: Simple & Easy to Use Exchange

Coinbase Coinbase emerges as another excellent venue for hassle-free cryptocurrency transactions, offering a user-friendly interface that simplifies buying, selling, and staking digital currencies.

Supporting over 10,000 blockchain-driven assets, Coinbase enjoys popularity for allowing users to invest in cryptocurrencies without undue complexity.

Read: Our Full Coinbase Review Here

Registration and verification on Coinbase take less than ten minutes. For investors searching for an uncomplicated platform, it's a fantastic alternative to Binance.

Coinbase accepts a meager deposit minimum of $2, the lowest in the current marketplace. The platform accommodates a range of deposit routes, such as automated clearing house (ACH), wire transfer, debit card, e-wallet solutions, and even cashouts in local currencies like USD, GBP, and EUR. Debit card deposits attract fees of up to 3.99%.

Investors receive a 4% cash-back reward by using a Coinbase debit card for crypto purchases.

Fees on Coinbase are competitive, ranging from 0.5% to 4.5%, varying by payment method, cryptocurrency, and transaction size.

Coinbase has advanced beyond a simple exchange, offering retail and institutional investors a wealth of services, from an in-built crypto wallet, self-issued cashback with Visa cards, to staking, derivatives, asset management hubs, and beyond.

Investors' assets are protected by Coinbase's strict security measures, including 2FA verification for extra username and password protection, coverage against theft and fraud, and other features.

Additionally, Coinbase is authorized by the SEC and regulated by top watchdogs like the Financial Conduct Authority (FCA), FinCEN, and the New York State Department of Financial Services (NYSDFS).

Pros

- Beginner-focused

- Licensed and reputable platform

- Insurance in case of hacks

- Low minimum deposit

Cons

- High fee compared to competitors

- U.S. Users Unable to Deposit via Credit Card

KuCoin: Exchange With Lots of Listings

KuCoin: Exchange With Lots of Listings

KuCoin Known as one of the oldest and most reputable cryptocurrency exchanges worldwide, this Seychelles-based platform remains synonymous with traders eager for a diverse range of derivatives for market speculation.

Currently, KuCoin boasts an extensive catalogue featuring over 600 cryptocurrencies. More than just trading support, it allows users to save, stake crypto, and participate in Initial Exchange Offerings, establishing itself as a comprehensive crypto haven.

Read: Our Full Kucoin Review Here

Similar to its peers, KuCoin might overwhelm newcomers with its sophistication. Its focus lies with competent traders interested in sophisticated market products, leaving beginners potentially confounded.

Despite such complexities, KuCoin promises a wealth of benefits, with a low minimum balance of $5. It supports deposits via a broad array of fiat currencies, P2P transfers, and several credit card options.

Trading fees on KuCoin stand at a mere 0.1%. Yet investors can benefit from fee reductions, depending on their 30-day trading volume and ownership of KuCoin's KCS token.

KuCoin impresses with robust security infrastructure, employing bank-grade encryption to secure users' funds and details. A specialized risk control unit enforces stringent data usage policies.

Pros

- Reduced Fees Available for Active Traders

- Extensive Functionality for Staking

- Quick P2P trading system

- Anonymous trading available

- Low minimum balance

Cons

- No bank deposit option

What is Kava Crypto?

Kava Crypto serves as the operational token within the Kava protocol. Launched in 2020, KAVA performs several functions in the next-generation DeFi platform, including fees, governance, collateralisation, and staking.

Launched in 2020, KAVA performs several functions in the next-generation DeFi platform, including fees, governance, collateralisation, and staking.

The digital token hit a historical peak of $9.19 in September 2021, reflecting a 516% ascent compared to the previous year. With 250.8 million KAVA tokens in circulation, the platform enjoys a solid $468 million market worth.

In deciding whether to invest in the digital asset, the smart step is to learn what the Kava blockchain is all about.

In deciding whether to invest in the digital asset, the smart step is to learn what the Kava blockchain is all about.

Info About The Project

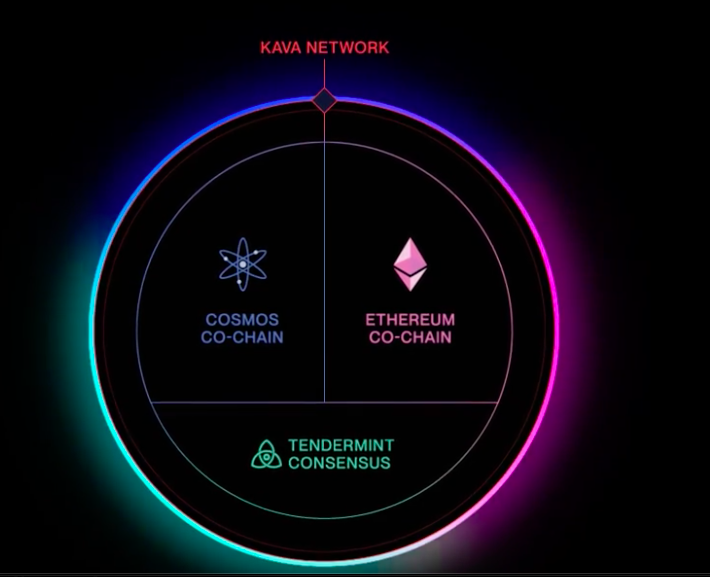

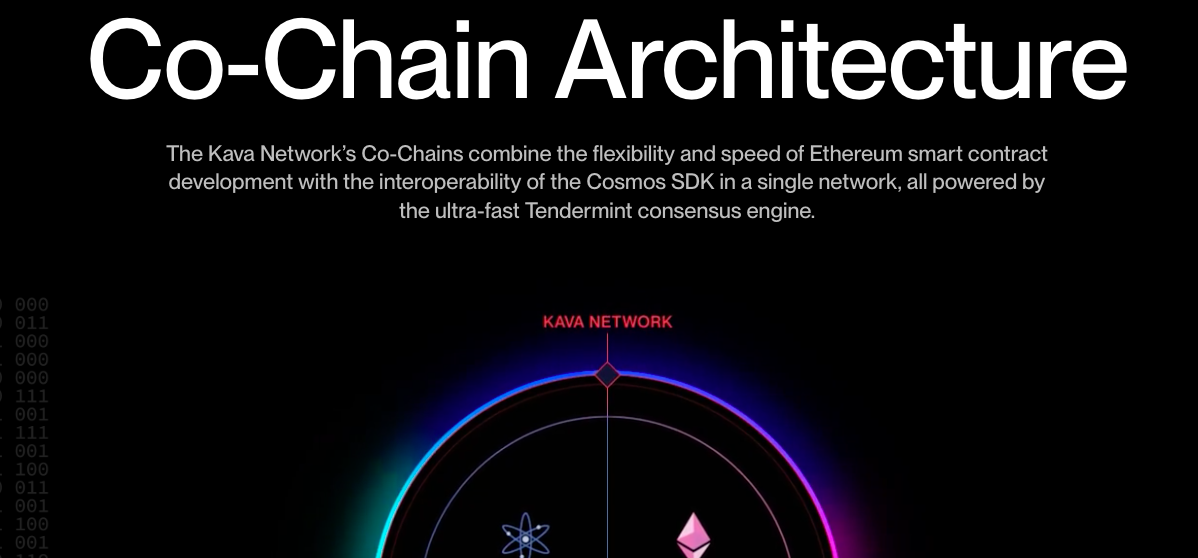

Leveraging a co-chain architecture, Kava, constructed by Kava Labs, takes the best from Ethereum and the Cosmos blockchain, establishing itself as a formidable layer-1 blockchain.

The platform comes with cross-chain capabilities as it adopts the adaptability and robustness of the Ethereum network with the scalability of the Cosmos blockchain. In its build-up, the Kava development team relies on the highly regarded proof-of-stake (PoS) consensus mechanism rather than the proof-of-work (PoW) protocol. This offers users faster transaction speed, lower costs for accessing DeFi-enabled loans, and lower energy demands.

The platform comes with cross-chain capabilities as it adopts the adaptability and robustness of the Ethereum network with the scalability of the Cosmos blockchain. In its build-up, the Kava development team relies on the highly regarded proof-of-stake (PoS) consensus mechanism rather than the proof-of-work (PoW) protocol. This offers users faster transaction speed, lower costs for accessing DeFi-enabled loans, and lower energy demands.

Promoting itself as the vanguard of 'DeFi for Crypto,' Kava democratizes access to collateralized loans using different cryptocurrencies.

While Kava shares some similarities with the popular MakerDAO protocol, key differences set it apart. Unlike MakerDAO, restricted to Ether and other ERC-20 tokens for collateralization, Kava users can utilize any crypto asset for borrowing.

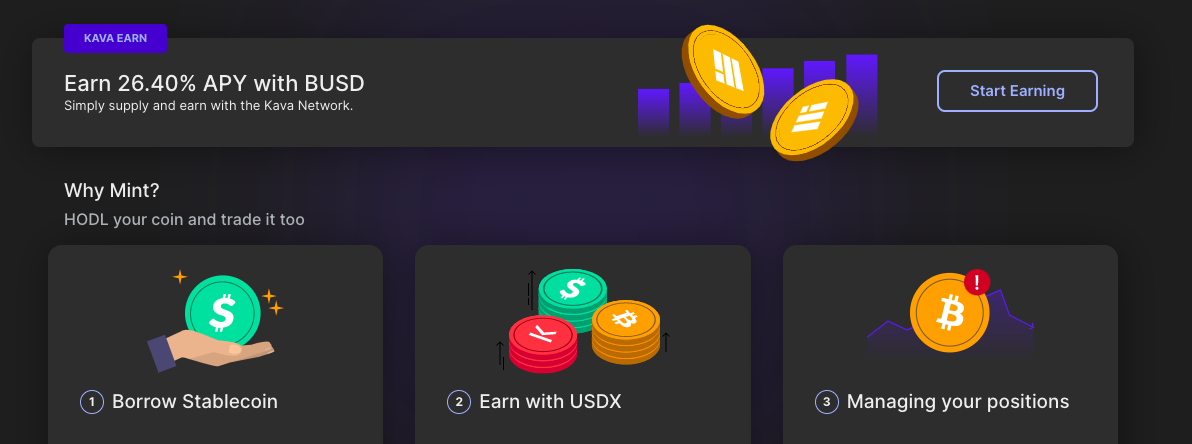

Aside from the KAVA token, the protocol relies on the USDX stablecoin for its operations. The fiat-backed stablecoin allows users to receive rewards for creating collateralised debt positions (CDPs). These stablecoins are then burnt once the debt is repaid or if the collateral becomes liquidated from a significant value drop.

Aside from the KAVA token, the protocol relies on the USDX stablecoin for its operations. The fiat-backed stablecoin allows users to receive rewards for creating collateralised debt positions (CDPs). These stablecoins are then burnt once the debt is repaid or if the collateral becomes liquidated from a significant value drop.

The Kava team emphasizes the limited options available for collateralized borrowing in the evolving crypto sphere, offering a robust remedy through their initiative.

Kava Mint dApp

This protocol's workings are powered by three distinct services:

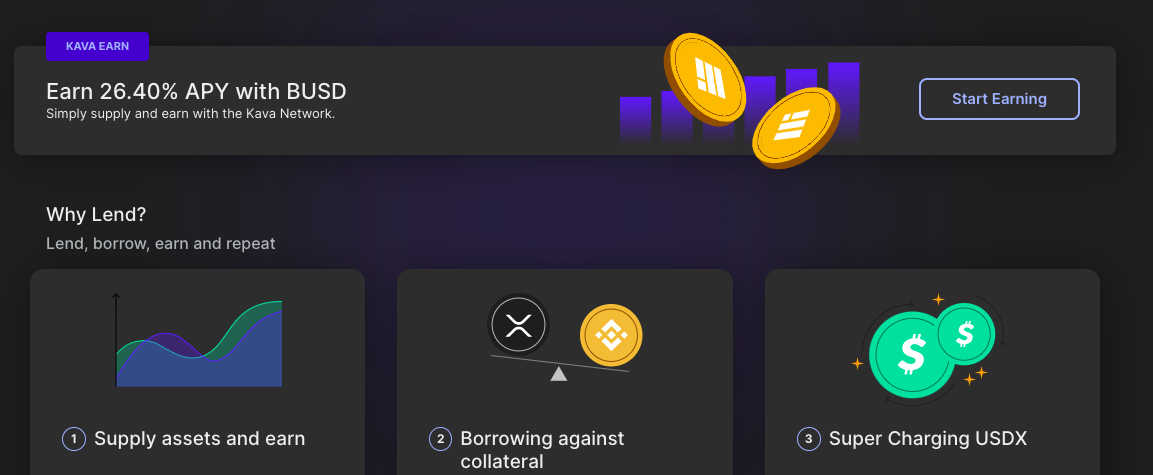

Users can lock in their digital assets to mint or produce USDX stablecoins matching the asset's value. Kava Mint operates akin to MakerDAO's Dai stablecoin, offering lower fees and impressive cross-chain proficiency.

Kava Lend

Launched in 2020, Kava Lend The decentralized app facilitates the creation of collateralized debt positions (CDP), enabling users to lock up supported crypto in a smart contract and utilize the funds as needed. HARD Earning more from digital assets has never been more accessible, thanks to Kava's world-first cross-chain money market. It allows users to lend, borrow, and prosper from multiple cryptocurrencies. The HARD token powers Kava Lend, similar to KAVA crypto.

Launched in 2020, Kava Lend The decentralized app facilitates the creation of collateralized debt positions (CDP), enabling users to lock up supported crypto in a smart contract and utilize the funds as needed. HARD Earning more from digital assets has never been more accessible, thanks to Kava's world-first cross-chain money market. It allows users to lend, borrow, and prosper from multiple cryptocurrencies. The HARD token powers Kava Lend, similar to KAVA crypto.

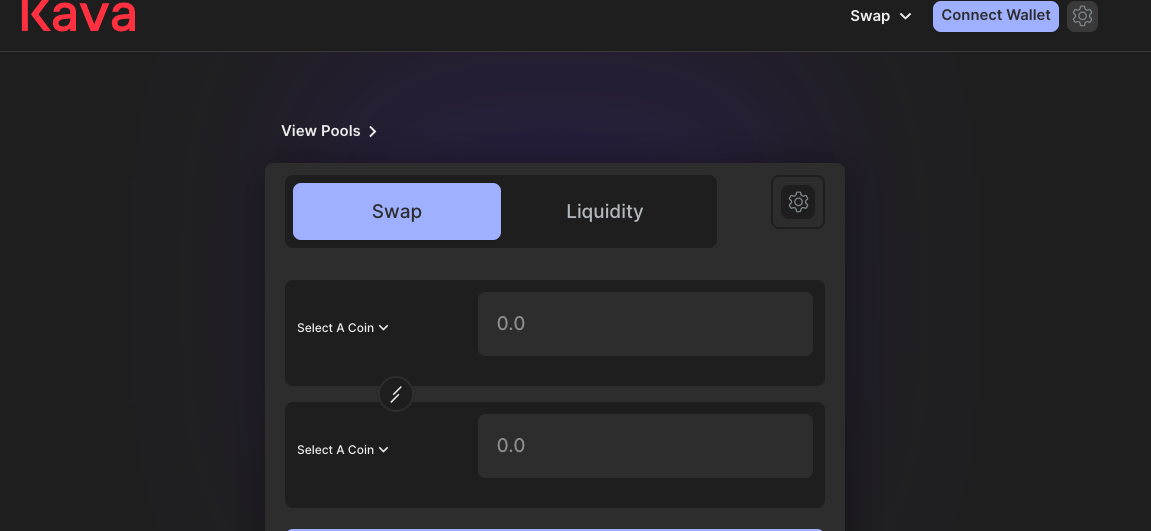

Kava Swap

The third and final service is the Kava Swap platform. This operates as an automated market maker (AMM) system wherein users can easily exchange digital assets without sanction from a centralised entity. The Kava Swap provides lower fees and high efficiency and allows liquidity providers to its smart contract pools to earn sizable returns on their digital assets. SWP coins power the service.

The third and final service is the Kava Swap platform. This operates as an automated market maker (AMM) system wherein users can easily exchange digital assets without sanction from a centralised entity. The Kava Swap provides lower fees and high efficiency and allows liquidity providers to its smart contract pools to earn sizable returns on their digital assets. SWP coins power the service.

Use Cases

This digital asset is instrumental in governance, staking, and processing transactions within the Kava ecosystem.

Governance

Eager to assess the token's use cases? The Kava blockchain holds significant potential, especially in tackling various challenges faced by the crypto landscape.

Contrary to traditional governance models confined to a select few decision-makers, Kava's ecosystem thrives on community involvement. Here, KAVA plays a pivotal role as a voting tool.

Holders of KAVA tokens enjoy a say in setting the parameters that shape the Kava network. These include the list of supported assets for all integrated dApps, debt ceilings, collateral assets, fee structures, and more.

Security

The token is also crucial for deciding the budget allocation for the insurance protocol and reward distribution within the Kava network.

Adapting Cosmos blockchain’s Tendermint engine, Kava Network runs on a PoS consensus mechanism. In this framework, users commit their assets to fortify the network due to the absence of competitive mining. The KAVA token stands as the guardian, shielding the DeFi protocol from potential 51% attacks that aim to reverse transactions.

How Does Kava Crypto Work?

Just How Can You Get Your Hands on Kava (KAVA) Coin: 2023 Guide

In this guide, we'll unravel the Kava blockchain and its practical applications. Let's also delve into the best places and methods to purchase the KAVA token.

Once the loan is repaid, the system automatically burns the issued USDX stablecoin, and the process begins again.

Once the loan is repaid, the system automatically burns the issued USDX stablecoin, and the process begins again.

Is Kava A Good Investment?

How to Purchase Kava Crypto Coin (KAVA): A Beginner's Handbook

Access to Dual Ecosystems

A Newbie's Guide to Buying Kava Crypto Coin (KAVA)

More Possibilities

Born out of the Ethereum blockchain's limitations, the thriving industry constantly sought new solutions as the original smart contract network started buckling under demand.

Different Tokens Cater to Distinct Services

Kava blockchain stands tall as one of the leading up-and-comers in the crypto scene, merging Ethereum's flexibility and resourcefulness with its own distinctive approach.

Partnerships

Think of it as a dual-core approach to DeFi with scalability and cross-chain interactions. SushiSwap This introduction offers you a deep dive into the essence of the Kava blockchain—its case studies included—plus the most efficient ways and platforms for investing in KAVA, its native token.

Consensus

Binance: Known for High Liquidity and Strong Reputation

How to Buy Kava Crypto on Binance

KuCoin: Packed with a Wide Array of Listings

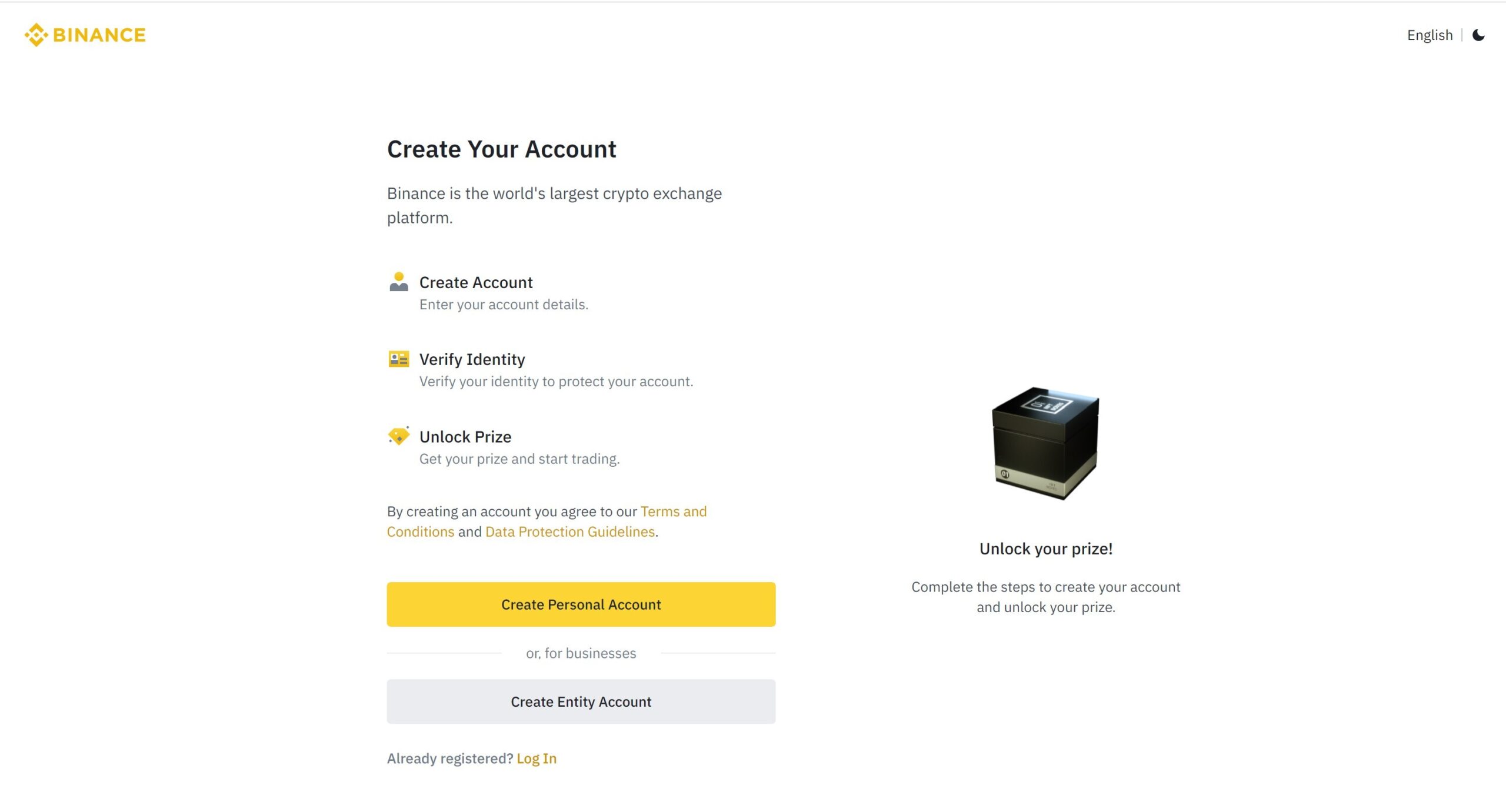

Register on Binance

The first step is to sign up on the Binance exchange before buying KAVA. To do this, visit the Binance official website to register an account. This should take less than 2 minutes.

The first step is to sign up on the Binance exchange before buying KAVA. To do this, visit the Binance official website to register an account. This should take less than 2 minutes.

Verify Account

Different Tokens, Tailored Services

Deposit

Here, we feature our recommended platforms for purchasing the Kava Crypto token, all chosen based on first-hand experience. We factored in fees, security, payment methods, and platform reputation.

Buy Kava

Once the deposit has been made, type “KAVA” into the search field and choose “Spot” trading. Once you are prepared to buy, enter the desired amount and select “Buy KAVA.”

Once the deposit has been made, type “KAVA” into the search field and choose “Spot” trading. Once you are prepared to buy, enter the desired amount and select “Buy KAVA.”

Kava Wallets

Software Wallet

Top Crypto Exchange with Affordable Rates

Respected For Ease of Use, Ideal for Beginners

The world's principal cryptocurrency exchange based on daily trading volumes grants over 600 digital assets for investors to explore.

Hardware Wallet

While its user interface is very friendly, Binance caters slightly more to seasoned traders with its advanced learning curve and sophisticated trading utilities.

With a $10 starting deposit, Binance allows investors to embark on their investment journey comfortably. Deposits can be executed through various hassle-free payment methods like wire transfers, credit/debit cards, peer-to-peer (P2P) payments, and e-wallet systems.

Deposits to Binance carry a fee that may differ depending on the selected payment method. Typically, a standard charge of up to 4.50% applies to debit/credit card deposits.

On Binance, trading fees are pleasingly minimal, standing at a flat 0.1%. Use Binance's own token (BNB), and enjoy a hearty 25% fee discount.

Mobile wallet

Be at ease knowing your funds and personal data are safeguarded with Binance's robust security protocols, including two-factor authentication (2FA), cold storage for most coins, whitelisting, and advanced encryption technologies. Operating in over 100 countries, Binance also provides a specialized and regulated platform, Binance.US, for American traders and investors.

Interface Design Suited for Seasoned Traders

Desktop wallet

Restrictions on Coin Trading for U.S. Users

Paper Wallet

For seamless cryptocurrency purchases, this U.S.-based platform offers a user-friendly experience for buying, selling, and staking crypto assets.

Conclusion

Coinbase is a platform that takes user-friendliness seriously, offering support for over 10,000 blockchain-gathered assets.

Finish signing up and verifying your account on Coinbase in under 10 minutes. For quick and easy investments, it's a viable alternative to Binance.

Kava FAQs

Can I buy KAVA on Coinbase?

Holding a market-low $2 for minimum deposits, Coinbase presents a broad range of deposit options like ACH, Wire Transfers, debit cards, e-wallets, and cashouts in USD, GBP, and EUR. It charges up to 3.99% for debit card deposits.

What Exchange is KAVA On?

Whenever you opt for crypto purchases using a Coinbase debit card, enjoy a rewarding 4% cashback.

Can I buy KAVA on Binance us?

Coinbase stands strong with fees ranging between 0.5% and 4.5%, dictated by your choice of payment, specific cryptocurrency, and transaction size.

How do you get KAVA on Binance?

Coinbase has transitioned from a classic exchange into a multifaceted platform offering stellar services for both personal and institutional traders, boasting features like an integrated exchange wallet, self-issued cashback Visa card, staking, derivatives, asset hubs, and venture opportunities.