Mina Protocol, along with its exclusive token MINA, has created a revolutionary blockchain, maintaining a perpetual size of just 22 kilobytes, regardless of how many transactions are processed on its network.

Owing to its unmatched interoperability and the growing endorsement from developers eager to craft DApps swiftly and securely, MINA has surged as one of the swiftest expanding digital currencies.

This guide delves into the process and locations for acquiring Mina Protocol MINA while examining its attractiveness as a distinct investment option.

Where to Buy Mina Coin MINA

Here, we highlight the top platforms and methods to purchase the Mina Protocol Crypto token, drawing from our extensive user experience while factoring in elements like fees, security, payment choices, and credibility.

- Binance: The Largest Crypto Exchange Featuring Minimal Fees

- eToro: Our Top Pick & Easy to Use Platform

- Coinbase: Renowned for User-Friendliness, Ideal for Beginners

- Kraken: A Stellar Platform for Novice and Experienced Traders Alike

Visit The Top Pick

eToro USA LLC; Investments are risk-prone, including potential principal losses.

Binance: Reputable Exchange with High Liquidity

Binance: Reputable Exchange with High Liquidity

Binance Boasting the highest daily trading volumes, this exchange empowers investors to engage with over 600 different crypto assets.

This esteemed platform offers both a thorough learning curve and sophisticated trading tools, catering to adept traders eager to expand their crypto repertoire. While Binance showcases a user-friendly interface enhancing the trading experience, it's better-suited for seasoned traders.

Read: Our Full Binance Review Here

With a minimum deposit threshold of $10, Binance allows investors to embark on their trading ventures with cost-efficiency. Seamless deposit methods like wire transfers, credit/debit cards, P2P payments, and e-wallet solutions are available.

Binance imposes varied deposit fees, contingent on the chosen payment method. Typically, using a debit/credit card incurs a standard fee of up to 4.50% on this global platform.

Trading on Binance involves consistently low fees, with a standard rate of 0.1%. Those using the Binance token (BNB) for purchases enjoy a trading fee discount of 25%.

Investors can trade on Binance confidently, knowing that top-tier security protocols such as 2FA, cold storage for most cryptocurrencies, whitelisting, and advanced encryption are in place to safeguard funds and data. Operating across more than 100 countries, Binance also offers a regulated platform for US traders and investors, Binance.US.

Pros

- Trading fees at 0.01%

- High liquidity

- Wide range of payment methods

- 600+ crypto assets in library

Cons

- Platform Interface Tailored for Skilled Traders

- Due to certain limitations, US-based clients face restrictions trading most coins through its subsidiary.

eToro: Easy to Use Platform

eToro: Easy to Use Platform

eToro Outstanding in its ability to facilitate the purchase of crypto coins and tokens, this exchange stands out as a preferred social trading venue globally. It renders full access to trading over 78 digital currencies, including well-known ones like Bitcoin and Ethereum.

eToro’s intuitive interface appeals to beginners in crypto trading. Commencing their journey on eToro requires investors to establish an account. Minimal deposit requirements of $10 allow US and UK investors to access tokens and other digital assets effortlessly.

Deposits made in USD benefit from zero transaction fees, applicable also to debit card deposits. Nevertheless, $5 fees for withdrawals and a flat 1% fee per transaction exist, coupled with a $10 monthly inactivity charge if no trading occurs for a year.

eToro provides a spectrum of deposit options, ranging from direct bank transfers and crypto deposits to debit/credit card payments, along with PayPal for processing. Bank transfers mandate a $500 minimum deposit.

What distinguishes eToro is its notable CopyTrader feature. This tool empowers beginners to emulate strategies from seasoned traders and consequently share in their earnings.

In terms of security, eToro shines, integrating safeguards like 2FA, encryption, and protective technologies to ensure user account safety. Operational in over 140 countries, it is regulated by major financial bodies, including the SEC, FCA, ASIC, and CYSEC, with registration under FINRA.

Pros

- Overall, the Leading Social Trading Platform for Acquisitions

- User-friendly interface

- CopyTrader and CopyPortfolio

- Highly regulated broker

Cons

- Charges an inactivity fee

- Charges a withdrawal fee

eToro USA LLC; Investments are risk-prone, including potential principal losses.

Coinbase: Simple & Easy to Use Exchange

Coinbase: Simple & Easy to Use Exchange

Coinbase A viable choice for seamlessly buying cryptocurrency, this US-centered trading platform allows straightforward buying, selling, and staking of digital currencies.

With its intuitive interface, Coinbase transforms crypto trading into a simple endeavor, supporting more than 10,000 blockchain-based assets.

Read: Our Full Coinbase Review Here

Completing the signup and verification steps on Coinbase takes under 10 minutes, offering a convenient alternative to platforms like Binance for hassle-free investing.

Positioned as the lowest in the market, Coinbase's $2 minimum deposit accommodates numerous payment methods, such as ACH, wire transfer, debit card transactions, and e-wallet solutions, alongside cashouts in USD, GBP, and EUR. Debit card deposits incur a maximum fee of 3.99%.

Utilization of a Coinbase debit card for crypto purchases rewards investors with a 4% cashback.

Depending on the payment method, crypto type, and transaction value, Coinbase's fee structure ranges from 0.5% to 4.5%.

Evolving beyond a mere exchange, Coinbase now offers a diversified service suite catering to both retail and institutional investors, providing features like an in-built exchange wallet, cashback Visa cards, staking, derivatives, asset hubs, ventures, and more.

Security is a prominent feature at Coinbase, integrating 2FA verification as an added layer protecting usernames and passwords, crime insurance guarding against theft and fraud, and more.

Licensed by the SEC, Coinbase is regulated by entities such as FCA, FinCEN, and NYSDFS, ensuring comprehensive compliance.

Pros

- Beginner-focused

- Licensed and reputable platform

- Insurance in case of hacks

- Low minimum deposit

Cons

- High fee compared to competitors

- No Credit Card Deposits Available for US Customers

Kraken: Top Crypto Platform with High Liquidity

Kraken: Top Crypto Platform with High Liquidity

Founded in 2011, Kraken is one of the oldest and most popular cryptocurrency exchanges currently in operation.

Coinbase has garnered a reputation as a reliable trading hub, popular among traders and institutions globally.

Read: Our Full Kraken Review Here

Internationally appealing, Kraken facilitates trading across numerous fiat currencies, maintaining its leadership in Bitcoin to Euro trading volumes.

Kraken is celebrated for its Bitcoin and Ethereum markets denominated in EUR and USD, though a broad array of fiat and cryptocurrencies are accessible.

Pros

- Service Dedicated to Institutional Users

- Great for beginners to use

- High trading liquidity

Cons

- The lengthy ID verification process

What Is Mina Protocol?

Known as a 'succinct blockchain,' the Mina Protocol is engineered to streamline computational needs, enhancing the efficiency of processing decentralized applications (DApps).

As blockchain technology grows in popularity and widespread usage, transaction volumes on most networks have seen significant growth. For example, the Bitcoin blockchain has reached 300 GB, and Ethereum's has soared from over 5 GB in 2016 to over 220 GB by 2021, processing millions of transactions in that timeframe.

Since blockchains are decentralised ledgers of recorded transactions, running a node has always required very high computing energy as the blockchain continues to scale in growth. This has created a downtrend, causing difficulty for average users seeking to participate in blockchain operations. It may also create centralisation as only those with the higher computing energy are most efficient in operating the large size of the blockchain.

Since blockchains are decentralised ledgers of recorded transactions, running a node has always required very high computing energy as the blockchain continues to scale in growth. This has created a downtrend, causing difficulty for average users seeking to participate in blockchain operations. It may also create centralisation as only those with the higher computing energy are most efficient in operating the large size of the blockchain.

To counter these issues, Mina presents a unique blockchain solution with a constant size regardless of its big usage growth, holding a mere 22 kilobytes network size—which pales compared to Bitcoin and Ethereum sizes. This compact size facilitates node operation and network security without intense computational demands.

Mina's developers hold that broader node operation will bolster decentralization, advancement, and security of the network. At its core is the MINA token, enabling all transactional operations and fee distributions within the network.

MINA Coin

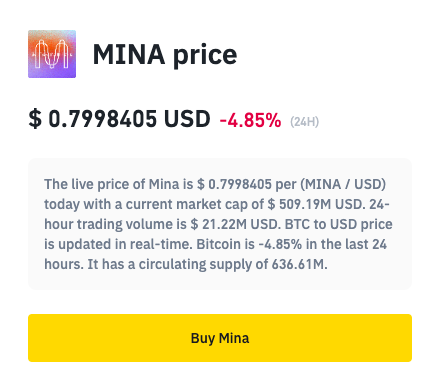

Established in June 2021, MINA participated in the crypto realm. This token compensates network contributors for roles like block production. Purchasable, sellable, and tradeable across several exchanges, MINA assists in engaging with DApps executed within the protocol. Sports a market cap beyond $552 billion, a circulating supply exceeding 637 million coins, currently valued at $0.87, MINA is backed by analysts for traders focused on decentralized applications.

What Can You Do With MINA?

Mina Protocol's openness caters to developers creating robust, utility-driven applications, serving as just one of its myriad applications. The protocol emphasizes three key utilities, bridging real and crypto worlds privately.

End-To-End Data Encryption

Through the power of Mina, traders can tap into online data seamlessly without compromising security. Mina acts as a bridge, allowing them to demonstrate compliance with certain standards. For example, leveraging Mina’s Snapps, users can connect to a credit card score provider to ensure their score exceeds a set threshold.

Permissionless Web Oracles

Through Mina’s Snapps, developers worldwide can leverage real-world data from any website to create decentralised applications. They can access, use, and protect sensitive data without that website’s permission.

Through Mina’s Snapps, developers worldwide can leverage real-world data from any website to create decentralised applications. They can access, use, and protect sensitive data without that website’s permission.

Private Internet Login

Mina champions privacy by enabling users to access online services without the hassles of account creation or divulging personal information. With Mina, users log in securely, free from the threats of centralized authority restrictions.

How Does Mina Protocol Work?

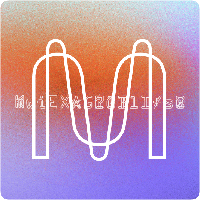

Much like the robust chains of Bitcoin and Ethereum, the Mina protocol stands out due to its reliance on Zk-SNARKs, a cutting-edge cryptographic element. These allow users to confirm they hold specific information without disclosing it, ensuring data remains private.

Mina protocol network does not verify every transaction with every block created. Instead, the network features a cryptographic proof (Zk-SNARK). This proof is minuscule compared to other blockchains and represents the state of the whole blockchain rather than a block.

Mina protocol network does not verify every transaction with every block created. Instead, the network features a cryptographic proof (Zk-SNARK). This proof is minuscule compared to other blockchains and represents the state of the whole blockchain rather than a block.

Mina features Ouroboros Samasika, a unique type of Proof-of-Stake consensus mechanism combined with Zk-SNARK implementation, which trims down resources often needed to process and record all transactions. Users or participants must run nodes to send and receive transactions on the Mina protocol network effectively. More so, the protocol requires two unique nodes deployed on the network to work effectively:

Mina features Ouroboros Samasika, a unique type of Proof-of-Stake consensus mechanism combined with Zk-SNARK implementation, which trims down resources often needed to process and record all transactions. Users or participants must run nodes to send and receive transactions on the Mina protocol network effectively. More so, the protocol requires two unique nodes deployed on the network to work effectively:

Block Producers

In the Mina network, block producers are akin to the miners or validators seen in other blockchain ecosystems; they make decisions on transactions to append to the block, reaping the rewards of doing so.

Snarkers

Snarkers play a pivotal role by leveraging computing power to condense network data into validated transaction proofs. Once produced, these proofs are auctioned off, with Snarkers receiving Mina tokens as compensation.

Is Mina a Good Investment?

Investing in cryptocurrency typically carries high risk, yet some assets have demonstrated long-term profitability. Thanks to its streamlined nature, the Mina protocol carves out a niche for itself, offering investors a unique opportunity in the financial world.

Effortless Cross-Chain Accessibility

The Mina protocol's svelte architecture, coupled with its ZkApps smart contracts, equips users with the capability to employ Mina-proof systems derived from other blockchain networks seamlessly.

In addition, Mina developers are currently building a pathway between Mina and Ethereum, and every progress made on this can be distributed towards building trustless pathways between different blockchains. This will facilitate the ability of decentralised applications on other chains to leverage efficient proofs of high computation and secure login features of Mina’s ZkApps.

In addition, Mina developers are currently building a pathway between Mina and Ethereum, and every progress made on this can be distributed towards building trustless pathways between different blockchains. This will facilitate the ability of decentralised applications on other chains to leverage efficient proofs of high computation and secure login features of Mina’s ZkApps.

Global Community

Unlike conventional blockchains upheld by intermediaries, Mina thrives on the spirit of its community. This decentralized network, fueled by passionate global participants, is primed to influence cryptocurrency's market dynamics.

Accessible Node

While many blockchains depend on intermediaries to function, leading to reliance on the same for node operations, Mina sets itself apart with a more participant-driven approach.

However, Mina’s 22KB minuscule chain enables anyone to effectively connect peer-to-peer and validate all transactions like a full node in a simplified way. As this continues, the Mina protocol has a strong chance to increase value due to high adoption as more participants use the network to leverage its features.

However, Mina’s 22KB minuscule chain enables anyone to effectively connect peer-to-peer and validate all transactions like a full node in a simplified way. As this continues, the Mina protocol has a strong chance to increase value due to high adoption as more participants use the network to leverage its features.

Best Undervalued Token

Since debuting in mid-2021, the MINA token has swiftly been recognized as a promising prospect among crypto enthusiasts. With a trading price of $0.87 and substantial daily volumes, analysts spotlight its untapped potential, heralding future gains driven by expanding utility.

Top Collaborations

Collaborations are vital in propelling cryptocurrencies towards success. Mina has strategically partnered with big industry names like Hashkey and Coinbase Ventures, raising a staggering $44.7 million, drawing in both individual and institutional interest, which forecasts a prosperous trajectory.

How to Buy Mina Protocol on Binance

To purchase Mina protocol, many find Binance to be a top contender due to its liquidity, fee structure, and secure environment. Here you'll find a guide that shepherds investors through the buying process in under ten minutes.

Once armed with knowledge about Mina's acquisition channels and applications, the next logical step is purchasing it for your portfolio, with Binance being the go-to exchange for this task.

Step 1: Sign Up

Go to the Binance home page and click on “Register”.

Registering with Binance is made easy by using your mobile, email, or a Google account. Typically, users opt for the first two, receive a verification link, and authenticate their account to jump into trading swiftly.

Step 2: Verify Your Identity

Just as with many other regulated platforms, Binance necessitates identity verification to proceed with any purchases, ensuring a secure trading experience.

To finalize your account setup, visit Binance’s 'Identification' section where investors submit their details and identification quickly and efficiently.

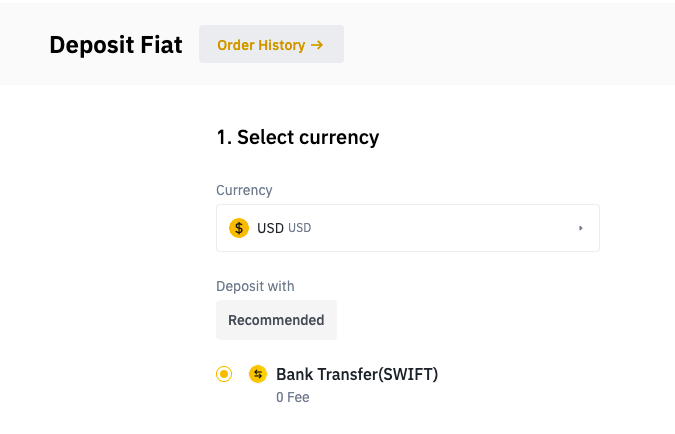

Step 3: Deposit Your Funds

To kickstart trading, a deposit to your Binance wallet is needed. The platform accepts deposits via numerous methods including crypto transfers, facilitating a smooth set-up.

To deposit, navigate to the 'Payment' portal and initiate a payment method registration. Alternatively, select 'Buy Crypto' to pick your preferred payment method and execute the deposit.

Step 4: Buy

With funds deposited, investors can easily make purchases. By heading to 'Buy Crypto,' they can specify amounts, consent to terms, and watch their wallet get topped up instantly.

After making a payment in their local currency, investors can type ‘MINA’ into the search bar and click on the relevant result. Investors must place a buy order, so Binance knows they want to purchase MINA. Once the order is placed, the tokens will be added to their wallets when the transaction is processed and completed.

After making a payment in their local currency, investors can type ‘MINA’ into the search bar and click on the relevant result. Investors must place a buy order, so Binance knows they want to purchase MINA. Once the order is placed, the tokens will be added to their wallets when the transaction is processed and completed.

Best Mina Wallets

Software Wallet

Hot wallets, commonly known as software wallets, provide convenient crypto storage and are ever-connected. On joining an exchange, users can easily secure their digital belongings, with options for custody or self-controlled access for routine transactions.

Custodial wallets offload asset management to exchanges or third-party entities, acting similar to banks. Conversely, self-custodial wallets give users independence and full control over their assets.

While hot wallets are generally free and provide constant connectivity, they present security challenges. One example is Binance Wallet, which is accessible and user-friendly.

Hardware Wallet

Designed for heightened security, hardware wallets are physical devices that isolate private keys from computer vulnerabilities, offering a safeguarded alternative for serious investors.

Typically, fund movements involve private keys, but if a computer is compromised, these keys risk exposure. Hardware wallets mitigate this risk by sequestering keys away from potential threats.

Hardware wallets, like the renowned Ledger and Trezor, are championed for safeguarding significant crypto holdings, offering the gold standard in secure storage.

A mobile wallet is a smartphone extension of a hot wallet, allowing users effortless transactions and purchases through digital currencies, merging ease with functionality.

Mobile wallet

Free and always online, mobile wallets provide ongoing reliability. Notable examples include the eToro Money Wallet and Coinbase Wallet, facilitating seamless transactions.

Desktop wallets, the PC variant of hot wallets, ensure user-friendly interaction with cryptocurrencies, available as downloadable software or as browser extensions.

Desktop wallet

The paper wallet, an old-school crypto storage method, provides a physical printout of keys. Yet, it carries substantial risks of loss and damage, making it far less practical today.

Paper Wallet

Investors have uninterrupted access to purchase MINA tokens across various platforms, with a straightforward and secure process emphasized by leading exchanges like Binance.

Mina FAQs

When Can You Purchase MINA?

The Mina protocol's utility has cemented its presence on major exchanges like Binance and Coinbase, where users can effortlessly trade and engage with this digital asset.

What Exchanges Have Mina Protocol?

In the U.S., enthusiasts can buy and trade MINA on domestic platforms such as Coinbase, along with Binance-US, which caters to the needs of U.S. clientele.

Can You Buy MINA In The US?

Indeed, buying Mina protocol (MINA) is an effortless process wherever Binance operates, given the platform’s competitive fees, high liquidity, and robust security measures.

Can I Buy Mina Protocol On Binance?

Based in the UK, Jimmy has been an ardent follower of blockchain innovations, seeing it as a beacon for financial democratization.