In the booming world of cryptocurrency, it's easy to lose sight of the fact that blockchain technology and digital currencies are not yet part of everyday life for everyone. While adoption is increasing, widespread use is still limited. 50 million wallet users in the world, and State of the Dapps lists just over 3,500 dApps compared to over two million on the Apple App Store alone.

One reason for this is the many hurdles end-users face. For example, when someone wants to use a simple blockchain-based gaming application, they might need to go through numerous, sometimes even dozens, of steps.

Developers and validators face their own challenges too. A blockchain like Ethereum acts solely as an infrastructure solution, introducing its own programming language and complex tools, which creates additional obstacles for developers.

Lastly, becoming a validator on any of the proof-of-stake blockchains may not be as rewarding as it first seems, particularly when considering the ease of acquiring tokens from delegating community members.

Now, NEAR Protocol NEAR Protocol has surfaced as an open, developer-friendly blockchain platform. Its aim is to be secure enough to protect things like money and identity. With the combination of sharding and proof of stake, the network operates efficiently enough for everyday consumer use. However, NEAR stands out due to its strong emphasis on being user-friendly.

This guide delves deeper into the functionalities of the NEAR Protocol and also covers the methods and places where you can purchase NEAR crypto tokens.

Where to Near Protocol NEAR

This segment highlights our top recommendations for buying the Near Protocol NEAR Crypto tokens. Our selection is informed by our personal experiences using these platforms, considering aspects like fees, security measures, available payment methods, and reputation.

- Binance: The Leading Crypto Exchange with Competitive Fee Structures

- Kucoin: Highly Regarded and User-Friendly, Especially for Beginners

- FTX: Excellent Exchange for Both Beginners and Seasoned Users

- Gate: Solid Platform With Lots of Coins

Visit The Top Pick

Binance: Reputable Exchange with High Liquidity

Binance: Reputable Exchange with High Liquidity

Binance is a giant in daily cryptocurrency trade volumes. It provides full access to trading over 600 digital assets for its users.

This well-established platform also boasts a comprehensive learning curve and advanced trading tools, appealing especially to knowledgeable traders and investors eager to broaden their knowledge of crypto buys. While Binance offers a user-intuitive interface, it caters more towards those with significant trading experience.

Read: Our Full Binance Review Here

With a minimal deposit requirement of $10, Binance opens up investment opportunities at low fees. Deposits can be made through convenient methods including wire transfers, credit/debit cards, peer-to-peer (P2P) transactions, and other e-wallet solutions.

Deposit fees on Binance fluctuate depending on the payment method, with a standard fee of up to 4.50% for debit/credit card transactions on the global exchange platform.

When trading on Binance, investors benefit from minimal fees, with a standard 0.1% trading fee. If the Binance token (BNB) is used for purchases, there's a 25% discount on trading fees.

Moreover, Binance ensures a secure environment for trading with rigorous security measures like two-factor authentication (2FA), cold storage for most of the coins, whitelisting, and sophisticated data encryption. The platform operates in over 100 countries and includes a special regulated version, Binance.US, for traders and investors based in the United States.

Pros

- Trading fees at 0.01%

- High liquidity

- Wide range of payment methods

- 600+ crypto assets in library

Cons

- The interface is ideally designed for skilled traders.

- US-based users face restrictions on trading most coins through its subsidiary.

KuCoin: Exchange With Lots of Listings

KuCoin: Exchange With Lots of Listings

KuCoin stands among the oldest and most popular cryptocurrency exchanges worldwide. Based in Seychelles, this renowned broker is famous among traders seeking derivatives products to engage with the market.

Presently, KuCoin offers access to over 600 different cryptocurrencies. Aside from traditional trading and investing, users can also save, stake crypto, and engage in Initial Exchange Offerings via the platform. KuCoin provides an all-encompassing hub for all things crypto.

Read: Our Full Kucoin Review Here

As with many brokers of its caliber, KuCoin might seem daunting for newcomers. It's better suited for experienced traders who prefer to speculate and deal with complex products, posing some challenges for beginners.

Nevertheless, trading with KuCoin comes with several potential perks. It requires a low minimum balance of $5, allowing deposits through major fiat currencies, peer-to-peer (P2P) transfers, and select credit card options.

Trading fees on KuCoin are set at 0.1%, with potential reductions depending on a user's 30-day trading volume and ownership of the platform's KCS token.

KuCoin also excels in security, employing bank-level encryption and security frameworks to safeguard users' coins and data. It also houses a dedicated risk control team enforcing strict data usage policies.

Pros

- Eligible for fee discounts

- Comprehensive staking features

- Quick P2P trading system

- Anonymous trading available

- Low minimum balance

Cons

- No bank deposit option

FTX: A Top Exchange

FTX: A Top Exchange

FTX is premier among exchanges for purchasing coins & tokens. As a centralized multi-assets exchange, it supports derivatives, volatility products, NFTs, and leveraged products. FTX also backs the top-traded cryptocurrencies.

Read: Our Full FTX Review Here

With a wide array of tradeable assets and intuitive desktop and mobile platforms, FTX draws crypto investors from all levels, from novices to seasoned experts. It supports over 300 cryptocurrencies for spot trading, establishing a strong coin foundation.

FTX requires no minimum deposit balance. Maker fees on FTX range from 0.00% to 0.02%, while taker fees lie between 0.04% and 0.07%. Withdrawals below $10,000 incur a $75 fee. Deposit options include bank wires, instant bank deposits, credit/debit cards, and alternatives like the silver exchange network (SEN) and SIGNET.

FTX incorporates two-factor authentication (2FA) for account security during sign-up. Additional safeguards include sub-accounts with adjustable permissions, IP and withdrawal address whitelisting, and Chain analysis for suspicious activity monitoring. This distinguished broker also maintains its own insurance fund, aligning with standard security protocols.

Operating across multiple nations, FTX offers US-based traders access to FTX.US — a fully-regulated branch facilitating smooth trading for US residents.

Pros

- Comprehensive selection of cryptocurrencies and digital assets

- Very competitive fees

- Great trading platforms

- Offers crypto derivatives

Cons

- FTX.US has limited coins

Gate.io: Solid Platform With Lots of Coins

Gate.io: Solid Platform With Lots of Coins

Gate.io is a cryptocurrency platform aimed at providing an alternative for its members to the currently dominant exchanges.

Since its inception in 2017, the site seeks to capture a slice of the cryptocurrency market by granting hassle-free access to rare coins and emerging projects.

Additionally, the platform helps investors access specific information related to their favorite coins and broader market trends.

Read: Our Full Gate.io Review Here

Most trading unfolds on a web-based platform similar to other crypto exchanges. It features several functional perks like an order book, trading history, and charting tools.

Pros

- A wide range of currencies

- A low fee structure

- Simple registration process

- Functional platform with an available mobile app

Cons

- Unregulated

- The team is not very transparent

- No fiat currency transfers

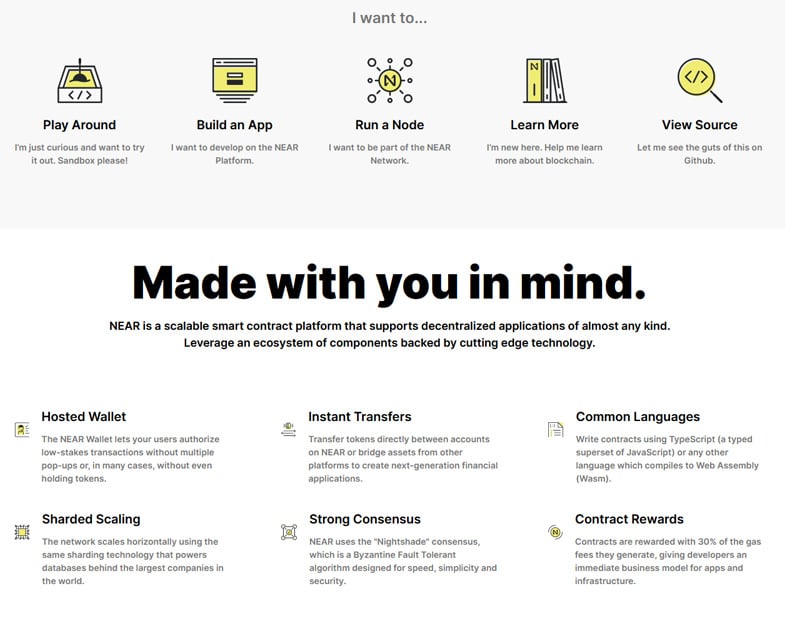

NEAR Protocol Elements & Features

NEAR Protocol incorporates a variety of elements tailored to its main users—developers, end-users, and validators. Its design philosophy revolves around usability, scalability, simplicity, and sustainable decentralization.

Developer Features

For developers, NEAR allows transaction signing and prepayments on behalf of users, diminishing the technical expertise required to interact with dApps, thereby enhancing their attractiveness. NEAR also offers developer kits for application and smart contract creation, using various existing programming languages. As such, the platform could entice more developers who are averse to learning Solidity or other blockchain-specific languages.

Developers who craft smart contracts with widespread application usage enjoy a slice of transaction fees every time the contract activates. This serves as an incentive to bolster the platform's infrastructure.

User Features

NEAR Protocol implements a 'progressive UX' that ensures newcomers can utilize the platform without needing wallets or tokens. As users become more knowledgeable about blockchain concepts, their user experience becomes more nuanced.

The whole account setup provides a more streamlined onboarding experience with fewer steps involved.

Validator Features

The consensus method used by NEAR Protocol is 'Thresholded Proof of Stake'—a spin on delegated proof of stake. Delegators stake their tokens to a specific validator within a contract-managed staking pool. This enables validators to offer varied services, making NEAR enticing for validators.

Elements of NEAR Protocol

NEAR operates as a foundational layer akin to other development platforms, such as Ethereum. Developers launch dApps, with operational functions like account creation or transaction implementation managed by network nodes.

NEAR's development suite includes tools and reference implementations like software development kits (SDKs), a wallet, and a blockchain explorer.

Additional components of the NEAR Protocol incorporate the NEAR token (more on that later) and tokens or assets launched on the NEAR platform. Eventually, assets from other blockchains might also bridge to the NEAR Protocol. Recently, the NEAR team has rolled out ' Rainbow Bridge, bridging both NEAR and Ethereum ecosystems for seamless interaction.

How It Works

The NEAR Protocol's documentation is quite detailed, reflecting its complex technology. To break it down, it primarily consists of four key elements: sharding, consensus mechanisms, a selection process for validators based on game theory, and the element of randomness.

NEAR Protocol utilizes a unique approach to horizontal sharding known as Nightshade, which shares similarities with Ethereum 2.0’s system of a Beacon chain connected to various shard chains. In Nightshade, transactions across all shards are collected into a block, with each shard providing its slice of the block, termed as a 'chunk'.

Within this framework, validators are tasked with the assembly of these blocks, gathering segments from each shard. Shards independently assign validators to produce their respective chunks, chosen through a secure and randomized method.

public blockchain

The consensus strategy employed here is named Thresholded Proof of Stake. The 'threshold' component involves an algorithm designed to maximize validator participation during a timeframe known as an epoch.

The mechanism incorporates a slashing protocol which penalizes validators for incorrect transaction validations, reducing their stakes. This progressive approach mitigates accidental mistakes. Additionally, 'hidden validators' are covertly deployed to shards, actively scanning for malicious network behavior.

NEAR's approach to randomness, coupled with deterrents against malicious activities, can withstand up to two-thirds of network participants behaving dishonestly without adversely affecting the network, ensuring robust security and resistance against attacks.

The NEAR Token

Just as ETH functions within the Ethereum 2.0 framework, NEAR serves as both the transaction payment method and the staking currency for validator nodes on NEAR Protocol.

Beyond transaction fees and staking, NEAR token holders have the privilege to delegate their tokens to validators and take part in community governance decisions, like the one that sanctioned the mainnet launch in 2020.

The genesis block saw the issuance of one billion NEAR tokens. The tokenomics plan permits up to a 5% annual increase in tokens, which are generated proportionate to the rewards available for running validator nodes.

Of the new token issuance, validators can earn a 4.5% share, while the remaining 0.5% is meant for the Treasury, designated for the advancement of NEAR Protocol.

Transaction fees on NEAR Protocol do not reward validators. Instead, 30% of these fees go to the creators of the smart contracts involved, while the remaining 70% are burned to control supply.

Team

Alexander Skidanov and Illia Polosukhin are the driving forces behind NEAR Protocol, initially collaborating with a vision to streamline development processes. By July 2018, they envisioned NEAR as a decentralized platform facilitating developers and entrepreneurs in easily launching their software into new markets.

Skidanov's career began at Microsoft in 2009, later becoming the pioneering engineer at MemSQL. He boasts medals from the International Collegiate Programming Competition, a prestigious worldwide contest.

Polosukhin brings a decade of development experience, including a stint at Google, and is also an International Collegiate Programming Competition finalist.

Together, Skidanov and Polosukhin have built a formidable programming team comprising former colleagues from Google and MemSQL. This team operates as the NEAR collective, an assembly of decentralized teams with expertise spanning various domains such as programming, business, finance, UX, and marketing.

History and Roadmap

A significant achievement for NEAR Protocol occurred in July 2019, when it secured substantial funding from notable investors like Electric Capital and Pantera Capital. $12.1 million After the initial launch of the mainnet in April 2020, another funding cycle spearheaded by Andreessen Horowitz’s blockchain fund A16Z secured additional investments.

In August 2020, NEAR held a public token sale that witnessed tremendous success, selling out rapidly. $21.6 million .

Other major achievements in 2020 included collaborating with Chainlink and softly launching the 'Rainbow Bridge', which allows NEAR to engage with Ethereum. two hours .

The full mainnet release is slated before the end of 2020, pending community consent, with a road map to bolster the mainnet with further features beyond the initial version's scope, such as forkless upgrades and secure asset operations spanning contracts and shards.

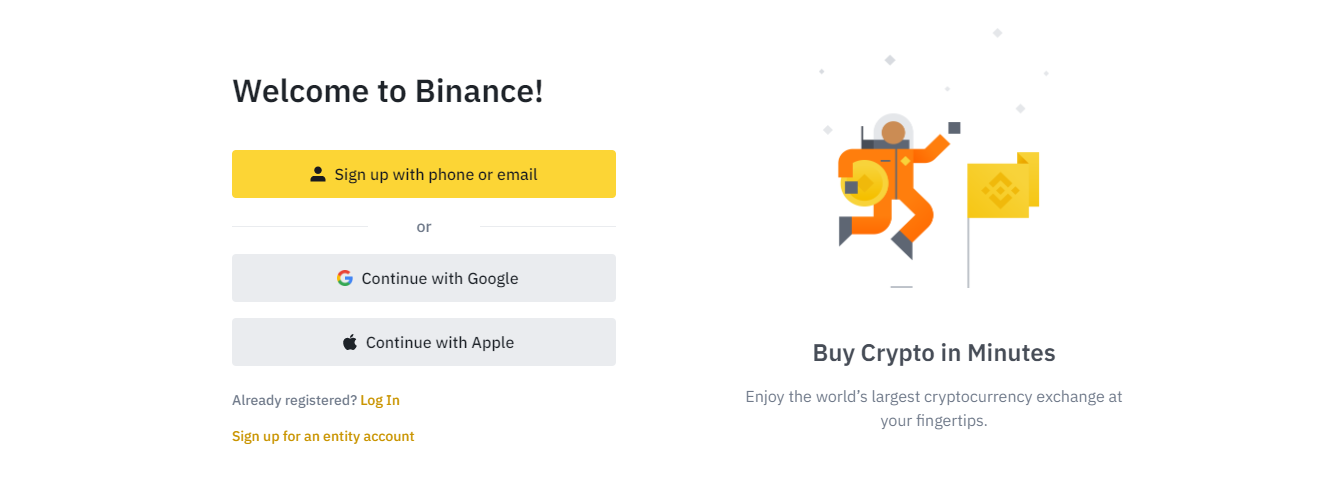

After understanding NEAR's purchase options and its opportunities, the next step is learning how to acquire it. Binance stands as our recommended platform, and here's how to utilize it for purchasing.

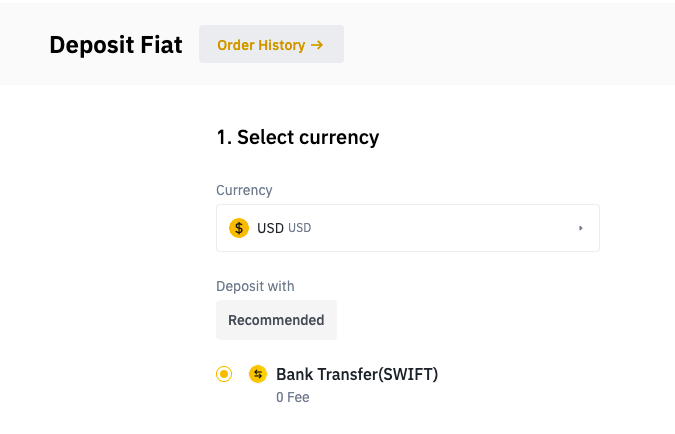

How to Buy NEAR on Binance

Investors can sign up on Binance with a phone number, email, or Google account, though many opt for either phone or email sign-ups. A verification link will then be sent, which users need to click to confirm their accounts.

Step 1: Sign Up

Go to the Binance home page and click on “Register”.

Similar to many regulated platforms, Binance requires identity verification from investors before allowing any purchases.

Step 2: Verify Your Identity

This process involves navigating to the 'Identification' tab, where users must provide personal details, proof of address, and a valid government ID, typically completing in just a few minutes.

Following verification, investors need to fund their Binance wallets. The platform supports deposits via several methods including payment processors, bank transfers, or direct crypto transfers, with a minimum deposit requirement of $10.

Step 3: Deposit Your Funds

To deposit, visit the 'Payment' section, choose 'Add a new payment method', and enter your payment details. Alternatively, the 'Buy Crypto' option can be used to select a payment method and proceed with the deposit.

With funds loaded into their wallets, investors are set to proceed with their purchase. They can move to the 'Buy Crypto' section, input the desired amount, review conditions, and click 'Continue', promptly reflecting the update in their wallet.

Step 4: Buy

Commonly known as software wallets, hot wallets are favored for cryptocurrency storage owing to their always-online nature, making them convenient. By registering with an exchange, investors can secure hot wallets to store and manage their private keys, verifying their asset holdings on the blockchain network. Hot wallets cater to everyday transactions and can be custodial or non-custodial.

NEAR Wallets

Software Wallet

Custodial wallets handle the asset storage on behalf of users, who simply initiate transactions while the platform finalizes them, akin to traditional banking operations. Conversely, non-custodial wallets provide end-users complete control.

Despite being offered for free, hot wallets are less secure due to their constant connection to the internet. A prime example is the Binance Wallet.

Hardware wallets, in contrast, are dedicated devices aimed at bolstering security during interactions with cryptocurrency holdings.

Hardware Wallet

These devices ensure private keys never leave the hardware, which safeguards them from malware on computers that could otherwise compromise or steal funds.

Hardware wallets protect private keys away from potentially infected computers, thereby securing funds even in case of malware infections, making them ideal for substantial crypto holdings.

Prominent hardware wallet options, known for their cold storage capabilities, include Ledger and Trezor. Detailed reviews are available:

A mobile wallet functions as a hot wallet on a smartphone, offering users an even more convenient means of utilizing their funds daily. These wallets safely store and manage private keys, supporting payment for transactions.

Mobile wallet

Mobile wallets are usually available for free and remain perpetually connected, facilitating seamless transactions. Well-known mobile wallets include eToro Money Wallet and Coinbase Wallet.

A desktop wallet is designed for PCs as a variation of the hot wallet, allowing users to download it to manage their digital funds conveniently. They may also include a browser extension for more effortless usage without downloading the complete software package. However, their internet connectivity does introduce a risk of vulnerability to hacking, such as with the Exodus Wallet.

Desktop wallet

The paper wallet is an early form of cryptocurrency wallet, less popular now, storing users' public and private keys. Often seen as least secure since they are prone to misplacement, theft, or damage.

Paper Wallet

NEAR Protocol is gaining traction as a promising blockchain contender, paralleling projects like Ethereum 2.0 and Polkadot by addressing foundational security concerns while enhancing throughput through sharding.

Conclusion

Despite these technical intricacies, NEAR is committed to usability for developers, validators, and end-users alike, positioning itself as a competitive alternative in the blockchain space.

With robust financial investment already in place, NEAR Protocol must now focus on marketing efforts to grow its adoption in what is an already competitive landscape, offering a genuine opportunity to outpace rivals.

\" bridging the NEAR and Ethereum networks.