Cryptocurrency volatility poses a significant challenge, with Bitcoin, the leading digital asset, experiencing frequent price fluctuations. The Terra blockchain was created with the intent of addressing this instability. Terra aims to emulate the price stability of fiat currencies while ensuring its technology remains immune to censorship.

Although the Terra blockchain was later rebranded to Terra Classic, the enthusiasm among investors for the protocol’s mission remains strong. This guide will examine how to purchase Terra Classic and illustrate how the project upholds price stability and resistance to censorship.

Where to Buy Terra Classic LUNC

In this section, we spotlight our top recommendations for purchasing the Terra Classic LUNC cryptocurrency. Our selections are based on our personal experiences, considering factors like fees, security, payment options, and reputation.

- Бинанс: Largest Cryptocurrency Exchange with Minimal Fees

- Кукоин: Highly Acclaimed and User-Friendly for New Participants

- Гейт: Солидная платформа с множеством монет

Посетите лучший выбор

Binance: Reputable Exchange with High Liquidity

Binance: Reputable Exchange with High Liquidity

Binance This platform is the largest in terms of daily cryptocurrency trading volumes, allowing investors to trade over 600 digital assets.

The platform is renowned for its comprehensive learning curve and sophisticated trading tools, designed to accommodate experienced traders and those eager to learn more about diverse cryptocurrencies. While Binance offers a friendly interface for users, it is particularly suited for seasoned traders.

Читать: Наш полный обзор Binance здесь

With a minimum deposit requirement of just $10, Binance allows investors to embark on their investment journey with low fees. It supports multiple payment methods like wire transfers, credit/debit cards, P2P payments, and other e-wallet solutions for deposit initiation.

Deposit fees on Binance depend on the chosen payment method, with a typical charge of up to 4.50% for credit/debit card deposits.

Trading on Binance comes with significantly low fees, offering a standard trading fee of 0.1%. Investors using the Binance token (BNB) for transactions benefit from a 25% discount on trading fees.

Traders can feel confident that their funds and data are secured on Binance, thanks to its robust security measures such as two-factor authentication (2FA), cold storage for the majority of coins, whitelisting, and cutting-edge data encryption. Binance effectively operates in over 100 countries and offers a regulated spin-off platform (Binance.US) for users in the United States.

Плюсы

- Торговые сборы 0,01%

- Высокая ликвидность

- Широкий выбор способов оплаты

- 600+ криптоактивов в библиотеке

Минусы

- Interface Designed for Advanced Traders

- US Clients Cannot Access Most Coins through its Subsidiary

KuCoin: Exchange With Lots of Listings

KuCoin: Exchange With Lots of Listings

КуКоин As one of the longstanding and acclaimed crypto exchanges, the Seychelles-based KuCoin is a leading choice for traders interested in derivatives products for market speculation.

With KuCoin, users can explore over 600 cryptocurrencies. Beyond trading, the platform also allows users to save, stake, and even engage in Initial Exchange Offerings, forming a comprehensive crypto ecosystem.

Читать: Наш полный обзор Kucoin здесь

KuCoin, like many exchanges of its kind, may seem daunting for newcomers. It caters more to advanced traders interested in speculating and dealing with complex products. Beginners may find it challenging to navigate.

Nevertheless, KuCoin offers numerous benefits, including a low minimum balance of $5 and a variety of deposit options via major fiat currencies, P2P transfers, and some credit card options.

KuCoin trading fees are set at 0.1%. However, based on an investor’s 30-day trading volume and KCS token ownership, the fees may be reduced.

KuCoin's security is commendable, employing bank-level encryption and strong security infrastructures to protect users' assets and information. The exchange also has a specialized risk control team dedicated to enforcing strict data policies.

Плюсы

- Available Discounts on Trading Fees

- Comprehensive Staking Options

- Быстрая система P2P-торговли

- Доступна анонимная торговля

- Низкий минимальный баланс

Минусы

- Нет опции депозита через банк

Gate.io: Solid Platform With Lots of Coins

Gate.io: Solid Platform With Lots of Coins

Gate.io Gate.io is designed to offer its members an alternative to the market’s leading exchanges.

Initially launched in 2017, the platform strives to capture a share of the crypto trading landscape by facilitating easy access to a variety of hard-to-find tokens and emerging projects.

Gate.io is engineered to assist investors in locating detailed information about their chosen tokens and general market trends.

Читать: Наш полный обзор Gate.io здесь

The platform primarily operates through a web-based trading interface similar to common cryptocurrency exchanges, featuring functions like an order book, trading history, and chart analysis.

Плюсы

- Широкий выбор валют

- Низкая структура сборов

- Простой процесс регистрации

- Functional Platform with a Dedicated Mobile App

Минусы

- Нерегулируемый

- Команда не очень прозрачная

- Нет переводов в фиат

Что такое Terra Classic?

Terra Classic Founded in 2018 by Daniel Shin and Do Kwon of Terraform Labs, Terra sets out to advance blockchain adoption by addressing volatility issues.

To realize the vision of stable pricing, the Terraform Labs team introduced UST, the industry’s first algorithmic stablecoin. Other algorithmic stablecoins developed include the South Korean Won, Mongolian Turik, and IMF’s Special Drawing Rights (SDR).

UST was designed to be pegged, one-to-one, to the US dollar. The Terra blockchain also created the infamous network token, LUNA, to keep its peg. When UST prices fall below one dollar, a certain amount of LUNA is minted to ensure it repegs.

UST was designed to be pegged, one-to-one, to the US dollar. The Terra blockchain also created the infamous network token, LUNA, to keep its peg. When UST prices fall below one dollar, a certain amount of LUNA is minted to ensure it repegs.

The Avalanche of Troubles

Terra's innovative strategy for price stability had its limitations...

Central to Terra's ecosystem is TerraUSD, an algorithmic stablecoin. Without a physical fiat currency backing it, UST sets itself apart from other stablecoins in the market.

To sustain its value, UST employs an arbitrage mechanism. If its value deviates from a dollar, LUNA tokens are bought or sold to recalibrate the demand for the UST peg.

The blockchain began to fall in May 2021, when the UST stablecoin’s value dropped from $1 to $0.96 in a one-week period, providing traders with a lucrative arbitrage opportunity.

The blockchain began to fall in May 2021, when the UST stablecoin’s value dropped from $1 to $0.96 in a one-week period, providing traders with a lucrative arbitrage opportunity.

To guard against potential depegging, Terraform Labs established the Luna Foundation Guard (LFG), acquiring a record $3.5 billion in Bitcoin as a UST reserve. and the AVAX token .

In the bear market of May 2022, both UST and LUNA suffered dramatic declines.

Amidst the turmoil, Terraform Labs discovered that Anchor, their yield-generating protocol, was retracting its pledged 20% APY, causing UST to lose its $1 parity. Trying to curb the drop, the network minted billions of LUNA tokens, leading to hyperinflation and market saturation. The LFG subsequently liquidated all its crypto assets, exacerbating the downfall.

In response to the collapse, the Terra blockchain opted for a hardfork reminiscent of Ethereum’s infamous split. The new smart contract network was named Terra 2.0, with Terra Classic and Luna Classic as the remnants.

Use Cases

Despite its turbulent history, Terra Classic remains a valuable entity. The platform continues as a censorship-resistant smart contract network, empowering developers to create decentralized applications (dApps) to satisfy growing market needs.

Though its stablecoin hasn't returned to its $1 peg, LUNC remains a prominent name within the cryptocurrency space.

The platform's native coin boasts a market capitalization exceeding $3 billion.

Partnerships

Once celebrated as a leader in cryptocurrency, Terra Classic enjoyed collaboration with both traditional tech firms and innovative crypto companies.

In July 2019, Terra partnered with Chia, a South Korean mobile payments firm. That same year, Terra's Alliance group of companies was engaged in capturing a major stake in the rapidly growing crypto landscape, including ten notable companies with a collective net worth of $25 billion.

How Does Terra Classic Work?

Terra Classic is not vastly different from its successor; it is primarily a smart contract network that functions as a testing ground for dApps and other decentralized ecosystems.

How do Terra Classic's stablecoin and native token interrelate? As previously mentioned, TerraUSD is an algorithmic stablecoin requiring an auxiliary token to maintain its value. This balance is achieved by minting and burning LUNA tokens utilizing arbitrage tactics.

To purchase one UST, an investor must mint it, and the equivalent value is accrued to LUNA tokens. Terra Classic subsequently burns these amounts, permanently removing them from circulation. This constant LUNA burning decreases its supply in the market, elevating its price.

To buy or mint LUNA, users need to convert their UST stablecoin, establishing a balancing act between the two digital assets.

Key players in Terra Classic's framework are arbitrage traders—individuals profiting from slight price shifts. They ensure the network maintains its balance. If UST dips below $1, they sell LUNA for the stablecoin; if it surpasses $1, they obtain UST using LUNA, promoting controlled scarcity across both assets.

Is Terra Classic a Good Investment?

Amidst the ongoing developments within the Terra ecosystem, does Terra Classic still represent a valuable investment opportunity?

Code is law

The current standoff between Terra Classic and Terra blockchain draws parallels to a historical crypto clash... 2016 Ethereum split Just as some committed code purists sustained Ethereum Classic, Terra Classic continues to hold a notable position in the cryptocurrency sector.

For those who believe in the enduring power of code, investing in Terra Classic could be a viable strategy to ensure its persistence.

Potential Supply Reduction

Following the May 2022 crisis, the Terra Classic community has not remained passive. Despite Do Kwon’s shift to Terra 2.0, the dedication within the Terra Classic community remains strong.

There is a developing optimism around LUNC’s potential to reclaim its past stature, encouraged by a... community proposal Proposal submitted on September 1, advocating for a 1.2% modification in tax parameters.

The strategy involves cutting down the quantity of LUNC tokens in the market, hoping to stir up demand and elevate the token's worth. Should the community approve this, investors might find themselves possessing a promising cryptocurrency asset.

How to Buy Terra Classic on eToro

We recommend that traders consider acquiring Terra Classic via the eToro platform You might ask, why go with eToro? It's a multi-asset broker with a strong sense of community. Established in 2007, eToro aimed to make investing in a variety of assets like stocks, commodities, and foreign exchange more accessible.

Over time, eToro pivoted towards cryptocurrencies, amassing a collection of over 75 digital assets for trading.

Its social climate has helped it become one of the top destinations for its 23.3 million users. Because eToro is a social trading platform, investors can communicate, interact, and learn from one another. CopyTrader is also available on eToro. This means that users can mimic their counterparts’ trading strategies and positions while only paying a small fee. This enables inexperienced investors to learn about the underlying asset and financial market while still making a reasonable profit.

Its social climate has helped it become one of the top destinations for its 23.3 million users. Because eToro is a social trading platform, investors can communicate, interact, and learn from one another. CopyTrader is also available on eToro. This means that users can mimic their counterparts’ trading strategies and positions while only paying a small fee. This enables inexperienced investors to learn about the underlying asset and financial market while still making a reasonable profit.

eToro also has a CopyPortfolio The platform also includes a feature that allows users to diversify their investments by following top companies, ensuring their portfolio remains balanced automatically.

eToro is known for offering some of the lowest transaction fees in the realm of cryptocurrencies, with just a 1% spread between buying and selling prices. Plus, there are no hidden charges for deposits, though there is a flat withdrawal fee of $5 for any payment method.

The platform takes security seriously with two-factor authentication and data masking to safeguard users' accounts. It's overseen by regulatory bodies like the FCA, CySEC, ASIC, and FINRA, ensuring a tightly regulated environment.

Due to Binance's announcement about ending support for Shuttle Bridge integrations between Ethereum and Binance Smart Chain, limited exchanges are now supporting the LUNC token, making eToro a viable choice for those looking to invest in it.

For those wondering how to get Terra Classic, here’s a step-by-step guide to buy it on eToro:

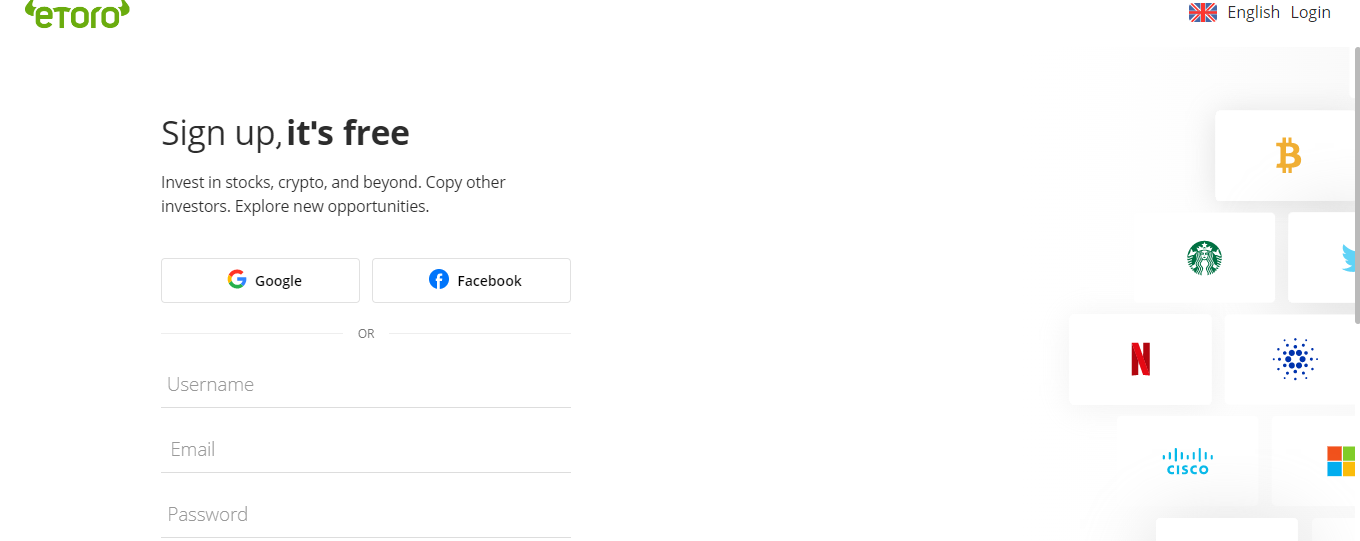

Register on eToro

To start, create an account on eToro. Visit their official site and click on the ‘Start Investing’ button. Fill in details like your full name, email, and password.

eToro allows users to sign up using their Google, Apple, or Facebook accounts for a more streamlined sign-up process.

eToro allows users to sign up using their Google, Apple, or Facebook accounts for a more streamlined sign-up process.

Verify ID

Since eToro is a regulated platform, all new users must confirm their identity before they begin trading. Click on the profile icon, select ‘Verify’, and upload a copy of your driver’s license or passport showing your full name as registered on the platform.You'll also need to submit proof of residence, which could be a bank statement or a recent utility bill showing your address.

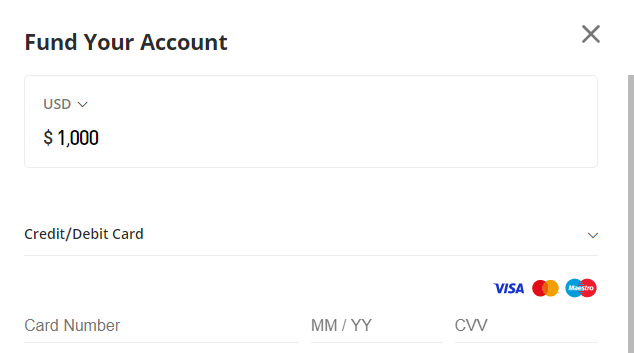

Deposit

Next, you’ll need to add funds to your eToro account. Click on the action tab, select ‘Deposit Funds’, choose your payment method, and follow the instructions. eToro doesn’t charge for deposits regardless of the method, offering options like bank transfers, credit and debit cards, PayPal, Skrill, Neteller, among others.

Enter the amount to invest. eToro has a regional minimum deposit requirement. eToro allows investors in the United States and the United Kingdom to get started with as little as $20.

Enter the amount to invest. eToro has a regional minimum deposit requirement. eToro allows investors in the United States and the United Kingdom to get started with as little as $20.

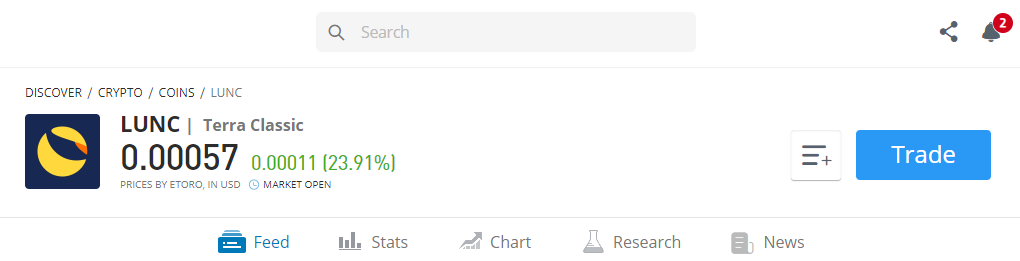

Buy Terra Classic

Then it’s time to buy Terra Classic. The simplest way is to enter ‘LUNC’ in the search box at the top of the dashboard and click on the related results.

Tap ‘Trade’ in the upper right-hand corner and enter the amount of the token to buy. Then, click ‘Open Trade’ to finish the process.

Tap ‘Trade’ in the upper right-hand corner and enter the amount of the token to buy. Then, click ‘Open Trade’ to finish the process.

Conclusion

Terra Classic has managed to stay a notable name in the crypto world despite previous downturns. Coders who value its technology continue to invest, seeing it as an undervalued crypto opportunity.

We suggest eToro for purchasing Terra Classic. Known for its social trading capabilities, eToro allows you to replicate more seasoned traders’ actions. Its CopyPortfolio feature further helps diversify investments effortlessly. The competitive fee of only 1% and zero-cost deposits make it a crowd favorite.

Luna Classic FAQs

Where can I buy Terra Crypto?

Terra cryptocurrency can be found on numerous exchanges. Popular options include Binance, Coinbase, and eToro. However, all new users must verify their identity and meet minimum funding requirements to begin.

Can you buy Terra Classic on Binance?

Binance still permits LUNC buying for its users. But anyone relying on the Shuttle Bridge will find Terra Classic no longer available there.

Can I buy Luna on Coinbase?

The newer Terra 2.0 token, called LUNA, is listed on Coinbase for trading. New users need to verify their accounts by uploading a driver's license or an ID card. A small $2 minimum deposit is necessary to start using Coinbase.

How do I get LUNC Crypto?

To trade LUNC cryptocurrency, open an account on your chosen platform, proceed with ID verification using a driver's license or passport and add funds as required.