Bybit Bybit is a rising star in the Peer to Peer (P2P) cryptocurrency derivatives space, rapidly gaining traction among margin and leverage enthusiasts since its 2018 inception. Despite its young age, the platform has carved a niche by welcoming a growing community of crypto traders.

This exchange facilitates global access to leveraged trading with a curated selection of digital assets like BTC, ETH, EOS, and XRP, obtainable with up to 100x leverage.

Operating from Singapore, Bybit sticks to a crypto-for-crypto model, sidestepping heavy KYC procedures, and boasts nearly $1B in daily trading volume.

Bybit draws on the latest technology and robust security measures, paired with a dedicated support team, aspiring to compete with top derivatives trading platforms.

Who is Behind ByBit?

Bybit Launched in March 2018 by the visionary Ben Zhou, who previously honed his skills as XM’s China District General Manager for seven years.

XM, a top-tier brokerage, alongside Bybit’s core team, consists of veterans from investment banking and the Forex realm, marking them as early movers in blockchain.

Officially registered in the British Virgin Islands, Bybit's main office resides in Singapore, with additional branches in Hong Kong and Taiwan.

Bybit Fintech Limited, its official designation, keeps certain registration and incorporation details private, but it operates from 6 Shenton Way, #12-11/11A, Singapore.

Details about the team are on their LinkedIn page, featuring notable figures like Latica Qiu, another XM alum, and tech professionals with backgrounds in firms like Morgan Stanley, Tencent, Ping'an Bank, and Nuoya Fortune.

Roughly 50 Bybit team members maintain public profiles on LinkedIn, offering transparency into the minds shaping the exchange.

Bybit’s Main Features

As a P2P crypto derivatives platform, Bybit offers traders across various locales the advantage of trading with up to 100x leverage.

Excluding the US, Bybit welcomes users globally and integrates several features to enhance their trading journey.

These range from a responsive customer support service with live chat to a Grey release feature that ensures non-stop access to trading during maintenance.

Its P2P mechanism promotes fair pricing and transparency, plus Bybit syncs with TradingView and offers functional mobile apps for iOS and Android.

Other key features include:

- 1 Click Coin Swaps – Swap easily between cryptocurrencies within your account

- 100,000 TPS per contract – Exceeding industry standards tenfold, ensures no bottlenecks

- Up to 100x leverage – High leverage options bolster your profit possibilities

- Cold Wallet Storage/Manual Withdrawals – Three manual withdrawals daily secure your funds with cold storage

- Unlimited Withdrawals – Almost limitless trading and withdrawal capabilities

- No KYC – Accounts require only an email and username to get started

Specializing in leverage trading and perpetual contracts, Bybit allows both long and short positions across select cryptocurrencies.

Contracts have no expiration, stressing the crucial auto-settlement at no physical Bitcoin transactions.

Settlement occurs in underlying assets, with prices listed in major fiat currencies.

Bybit Account Types and Limits

Once an account is set, traders can venture into perpetual crypto derivative contracts pegged to USD, covering coins like Bitcoin, Ethereum, EOS, and Ripple.

Trades occur P2P with users agreeing with sellers over future asset prices.

Bybit supports the following leverages trading pairs:

- BTC/USD: 1:100

- ETH/USD: 1:50

- EOS/USD: 1:50

- XRP/USD: 1:50

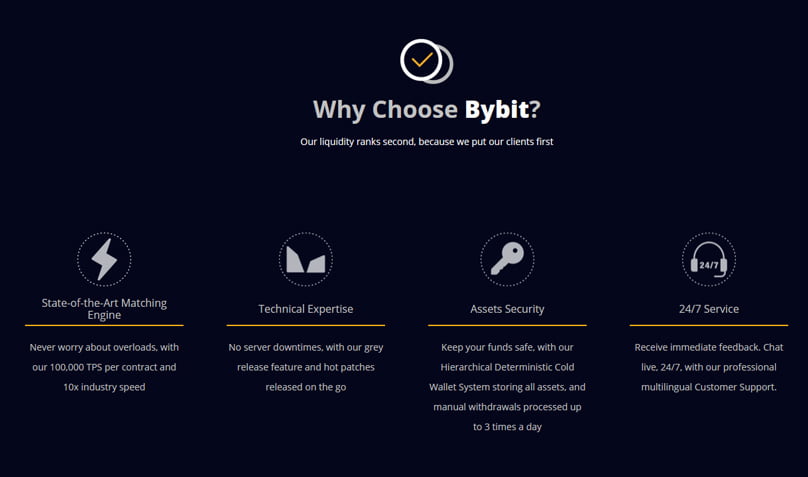

Straightforward as a crypto-only exchange, Bybit simplifies account setup to just an email address.

You may also register via mobile number, entering your country, phone number, and password.

How to Open an Account on Bybit

You can get started by clicking on the “Register” tab In the top right, choose Email or Mobile Registration to fill in your particulars.

For those registering via email, a special verification code unlocks your new account.

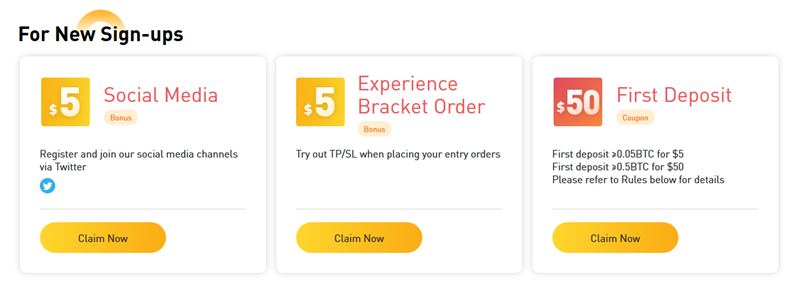

New sign-ups earn bonuses — $5 for deposits of ≥0.05BTC and $50 for ≥0.5BTC.

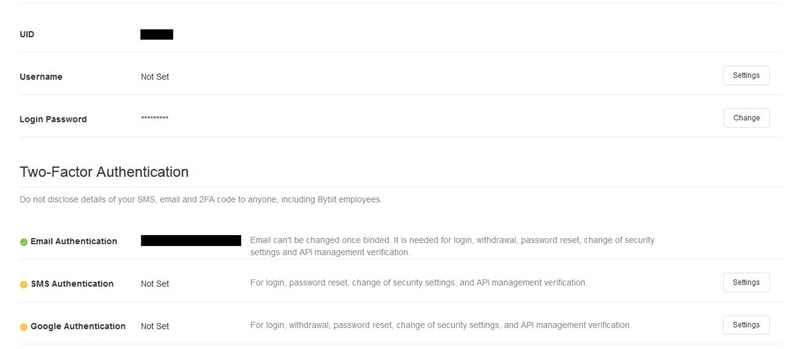

Access your “Account & Security” settings to create a username and enable two-factor authentication.

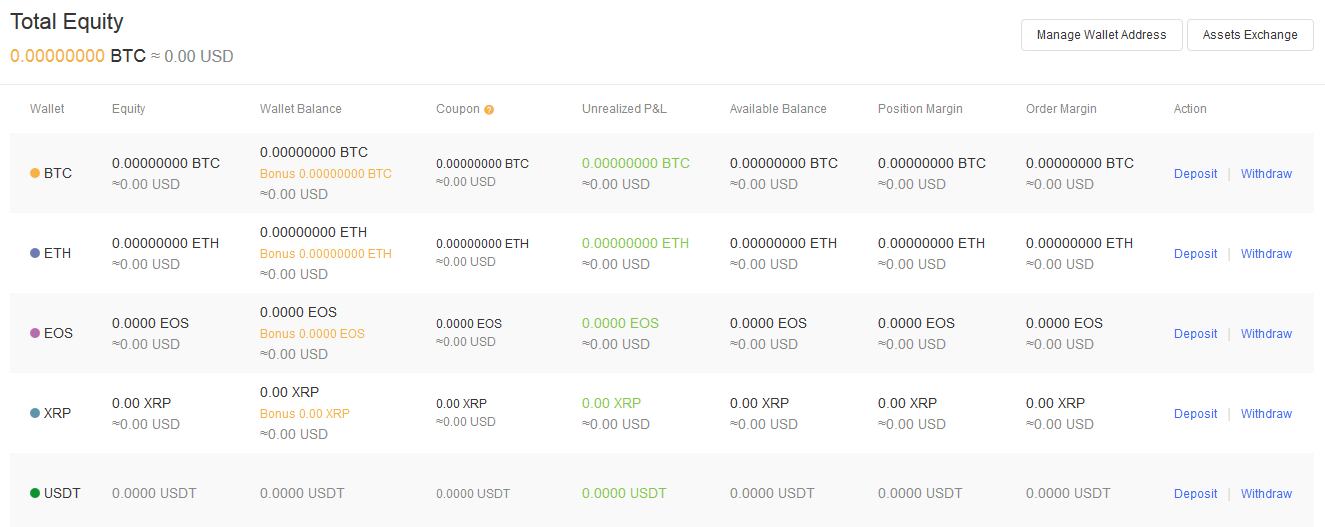

After customizing settings, deposit one of the supported currencies through “Assets/My Assets”.

The platform is yours once deposits translate into tradable assets.

Bybit Trading Arena

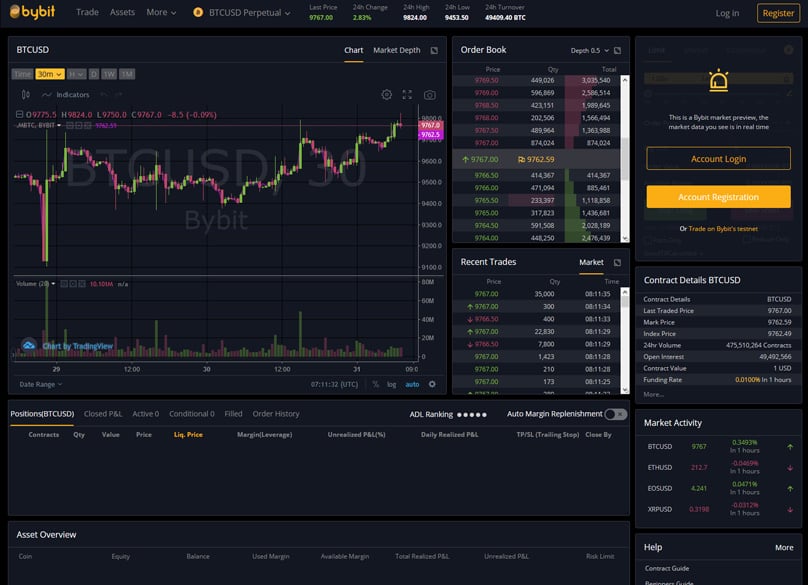

When we tested the trading arena Our initial take? It's slick and organized, with a minimalistic flair and a dark aesthetic, ensuring clarity of the trading interface.

This setup boasts a central chart with vivid green and pink candles, while order book details stand just to the right, along with the tools for configuring trades across different order types.

Before executing a trade, Bybit lays out your order's specifics. Vital for derivatives' complexity.

For chart analysis, Bybit lets you personalize your view, adjusting time frames from 1 minute to 1 month.

Modify the chart scale to include left and right axis metrics, indicator labels, and log scales, tweaking color and time zone preferences too.

Overall, Bybit offers a user-friendly yet comprehensive environment for trading that accommodates both newbies and experienced investors.

Next in our exploration of Bybit’s offerings, we’ll delve into its deposit and withdrawal process.

Supported Currencies

Bybit currently only accepts a supports a limited suite of digital currencies featuring BTC, ETH, EOS, XRP, and USDT. All currencies can be handled for deposits and withdrawals, however, fiat currency support is absent for now.

That said, fund values can be shown in these currencies:

- GBP

- EUR

- USD

- AUD

- CAD

- CNY

- CHF

- HKD

- JPY

- KRW

Deposits/Withdrawals

Unlike other platforms, Bybit has no minimum deposit thresholds but there are specified minimums for withdrawals.

| Coin | Minimum Deposit |

Minimum Withdrawal |

Miner Fee |

| BTC | No Minimum | 0.002BTC | 0.0005BTC |

| ETH | No Minimum | 0.02ETH | 0.01ETH |

| EOS | No Minimum | 0.2EOS | 0.1EOS |

| XRP | No Minimum | 20XRP | 0.25XRP |

Withdrawals are processed manually thrice daily at 0800, 1600, and 2400 (UTC), with submissions due 30 minutes prior for consideration, credited within 1-2 hours post-review.

ByBit Fees and Charges

While Bybit doesn’t add deposit or withdrawal fees, a miner's fee applies to all transactions. You can tweak fees on deposits; fixed fees apply on withdrawals irrespective of amount.

| Coins | BTC | ETH | XRP | EOS | USDT |

| Mining Fees | 0.0005 | 0.01 | 0.25 | 0.1 | 5 |

Each trade order incurs a fee adjusted from your balance, not impacting initial trade margins. Additionally, market makers, through liquidity and order book depth provision, see negative fees, contrasting market takers’ positive fees.

Trading Fee equates to Position Value multiplied by Trading Fee Rate.

| Perpetual Contracts | Highest Leverage | Maker Rebate | Taker Fee |

| BTC/USD | 100x | -0.025% | 0.075% |

| ETH/USD | 50x | -0.025% | 0.075% |

| XRP/USD | 50x | -0.025% | 0.075% |

| EOS/USD | 50x | -0.025% | 0.075% |

If, hypothetically, Trader A acquires 10,000 BTC/USD via market order and Trader B sells identical contracts at 8,000 USD using a limit order, then:

Taker fee for Trader A = 10,000/8,000 x 0.075% = 0.0009375 BTC

Maker rebate for Trader B = 10,000/8,000 x -0.025% = -0.0003125 BTC

Thus, Trader A incurs a 0.0009375 BTC Taker fee while Trader B gains a 0.0003125 BTC Maker rebate.

Funding Fee

A distinct funding fee also features, exchanged between long and short positions to align spot prices globally. It's between traders bi-hourly looked at jointly every 8 hours.

With a positive rate, long pays short; when negative, it's reversed. Closing positions before funding intervals avoids fees.

The way we determine the funding fee involves multiplying the position's value by the funding rate. To find out the position's value, you divide the number of contracts you've got by the mark price. For instance, if at 8:00 UTC you're holding onto 10,000 BTC/USD contracts in a long position, with the mark price sitting at 4,000 USD, and the funding rate being 0.02%, you'd end up with a position value of 2.5 BTC. Crunch the numbers, and the funding fee would be 0.0005 BTC.

Bybit Order Types

At Bybit, you've got access to different types of orders. Take market orders for example; you execute trades instantly at whatever the current market rate is. Want more control? Limit orders are your go-to—they let you pick your price for execution. Whether you're planning to go long or short, Bybit lets you use either type of order.

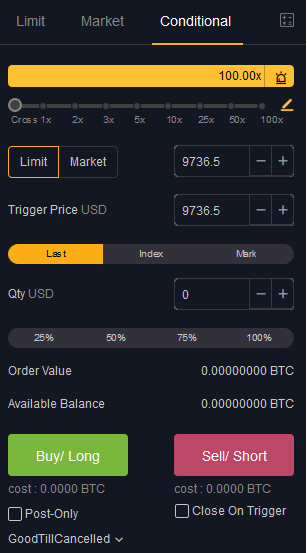

Conditional Orders

Conditional orders come into play when a certain event triggers them, such as hitting a price you've set up. Bybit gives you a few extra options to configure these conditional orders.

- In the Post-Only order type, you'll only face a maker fee. Even if your limit price taps into the liquidity pool, it's treated as a maker order.

- There's the Close On Trigger choice, ensuring your stop loss acts on reducing your position regardless of any other orders you have open.

- GoodTillCancelled keeps your order active until it either fills completely or you decide to cancel.

- ImmediateOrCancel does what its name implies—processes your order on the spot or cancels it if that's not immediate.

- FillOrKill is another choice, canceling your order if it can't be filled in a single attempt.

You'll find all the configuration options for conditional orders in the Conditional Orders section, where you can make your selections.

Bybit Leverage

For those willing to play in risky waters, Bybit's leverage trading might pique your interest. The leverage you'll find varies with the derivative contract you're eyeing.

With contracts like BTC/USD or ETH/USD, you can leverage yourself up to 100x. For EOS/USD and XRP/USD, you're looking at a max of 25x. Quite a bit of leverage, so you must understand its mechanics since you could potentially lose your whole account.

Bybit also has risk limit levels for its derivative contracts. Unless you're trading on an institutional level, these won't affect you much as the limits adjust once you're trading above certain thresholds.

When it comes to finance charges, they're drawn from two main elements. The interest rate plays a part, along with premium or discount factors. These are settled every eight hours.

Supported Countries

The list of countries that can access Bybit's services is quite wide-ranging.

- United Kingdom

- Germany

- France

- Australia

- Canada

- Italy

- Spain

- Brazil

- China

- Japan

- India

- Portugal

- Norway

- Sweden

- Netherlands

- Austria

- Switzerland

- Peru

- Argentina

- Ukraine

- Ireland

- Romania

- Poland

- Belgium

However, there are some areas where Bybit isn't accessible at the moment.

- United States of America

- Québec

- Singapore

- Cuba

- Crimea

- Sevastopol

- Iran

- Syria

- North Korea

- Sudan

How Suitable is Bybit for Beginners?

Right from the start, it's clear that Bybit might not be the best fit for newcomers. Leveraged trading can balloon your losses beyond expectations due to the inherent volatility of futures markets, demanding more seasoned traders to steer in.

Yet, for those seasoned in the craft, Bybit provides resources like the testnet and demo trading features, along with a robust Support Center stacked with FAQs, so they can sharpen their skills.

A critical feature includes a live chat for instant support and dedicated emails for troubleshooting. Bybit also actively maintains Telegram groups and a Facebook presence to engage with users.

Bybit doesn't stop there—with detailed trading charts from TradingView, a mobile app for iOS and Android, and API functionalities, connecting trading bots is seamless.

Advanced traders might appreciate the no-limits trading environment, abundant liquidity, and diverse order types offered with Bybit, aligning with the needs of high-frequency traders.

Active traders can also opt for the Referral Program. Convince a friend to sign up and deposit just 0.02 BTC, and Bybit thanks you with a $10 bonus.

Bybit’s Referral Program

Indeed, Bybit allows users to earn through referrals. Bring someone aboard, and for their participation, you earn 10 USD in Bitcoin terms.

Just a note that your referral must deposit at least 0.02 BTC to qualify for the bonus at this time, which only applies to BTC deposits.

How Secure is Bybit?

Bybit has stood its ground against security threats, which is expected given its young age. It employs several security measures such as full SSL encryption to safeguard personal data.

Two-factor authentication protects user accounts, with methods like email, SMS, and app verification.

Client funds are securely held in a Deterministic Cold Wallet System, ensuring immediate withdrawals via smaller hot wallets.

A multi-signature cold wallet system boosts security further, with manual withdrawals processed thrice daily to fend off hacker exploits.

The platform incorporates its Grey release system, allowing for minimal downtime during maintenance and keeping traders active by sourcing index prices from Coinbase Pro, Bitstamp, and Kraken. Kraken There's also an insurance fund at play, keeping user funds safe against a spectrum of risks that could arise.

Insurance Fund

The insurance fund principally limits the risk of Auto-Deleveraging. If a trade liquidates at a lesser price than the bankrupt price, the insurance fund fills the gap, only triggering auto-deleveraging if the fund itself falls short.

The balance and use of the insurance fund fluctuate based on the disparity between a position's liquidation and bankruptcy prices.

- If a market execution price is favorable, any surplus, the margin funnels into the insurance fund.

- Conversely, should the execution price be unfavorable, the insurance fund shoulders the contract loss.

Take an instance where a trader's position is set to liquidate at 7,000 USD but has a bankruptcy price of 6,950 USD. A favorable execution over 6,950 USD funnels the remaining margin into the insurance fund. Otherwise, the fund compensates for the loss.

If the insurance fund can't bridge the gap between final execution and bankruptcy prices, the Auto-Deleveraging System takes over. Bybit users can monitor the insurance fund's balance. Daily Insurance Fund Balance .

Conclusion

Having been founded in March 2018, Bybit Emerging in the cryptocurrency derivatives landscape, Bybit stands as a newer player but quickly establishes itself as a go-to alternative to giants like BitMEX.

Suiting an array of traders, especially those dabbling in high-frequency and volume trading, Bybit excels with demo trading on its testnet and valuable trading resources.

Absent KYC requirements and constraints on huge trades, Bybit appeals to those looking to transact anonymously, benefiting largely from its consistent high liquidity levels.

Even as Bybit grows, it maintains solid security, tech, and trading features, indicating it's here to contribute alongside numerous other exchanges tapping into futures.

Ultimately, Bybit stands out for crypto margin traders, potentially serving as a robust alternative to existing options. BitMEX , PrimeXBT , Huobi, and Deribit .

Still, given how new many traders might be to margin trading, perhaps starting with testnet accounts and trying out demo trades is prudent.