Over recent years, Bitcoin and other digital currencies have surged in popularity due to significant trading volumes, financial investments, and heightened public interest, driven also by the basic forces of supply and demand.

Newcomers might be exploring how to navigate between the realms of cryptocurrency and traditional money, understanding the mechanics of their exchange.

There are several approaches for this transition. Individuals may have concerns about exchanging large amounts and aim to ensure the process is secure, which is a prudent consideration.

This discussion will highlight three primary strategies for withdrawing your Bitcoin into traditional cash, often praised as the most secure and cost-effective methods for converting digital assets into official currencies.

What is Fiat?

First off, let's clarify what we mean by the term 'Fiat' or 'Fiat Currency'. Fiat refers to currency issued by government authorities. but which is not backed by a physical commodity .

The worth of fiat currency arises from market supply and demand dynamics rather than its material value. Historically, money was tied to physical assets like gold or silver, but fiat is anchored by the economic system's faith and credit.

Definition via Investopedia:

Fiat presents risks due to inflation issues; when governments create more currency, its value diminishes. This is the problem cryptocurrencies were designed to address.

The Central Banking Apparatus

Many people presume their money has inherent value. However, modern fiat is backed solely by debt. The current financial structure is built upon tremendous amounts of debt rather than tangible assets.

Fiat currency essentially symbolizes debt. If the global debt were cleared, money itself would cease to exist.

Isn’t that weird?

On a global scale, government-backed fiat currency forms the basis of our financial systems. Cryptocurrencies like Bitcoin initially aimed to disrupt fiat by fostering a decentralized framework that minimized central banks' leverage.

Attempting to transition away from debt-based money globally poses challenges, as most individuals prefer receiving payments in fiat. This situation demands crypto traders engage with a system often opposed to decentralized units.

Closing the Gaps

Prior to 2017, conventional financial sectors largely dismissed cryptocurrencies. The scene changed when Bitcoin sharply climbed, nearly reaching $20,000, forcing banks to cut credit to crypto clients and some countries like China to impose bans.

Central banks took notice of the significant capital influx into decentralized currencies, possibly fearing its prolonged effects.

There were also issues surrounding Know-Your-Customer KYC regulations. Initially, most crypto platforms lacked adequate client oversight, unlike other financial bodies. Banks, for example, must meticulously document their client's transactions, an area crypto largely disregarded.

Recently, KYC regulations have gained traction among crypto exchanges. Platforms converting cryptos to cash must adhere to similar rules as financial institutions, ensuring detailed records of user identification and conduct.

Coinbase

Cryptocurrency exchanges represent the most favored way to convert cryptos and other digital currencies into traditional cash currently. While many have limits on how much you can convert without proper identification, they are ideal for beginners and those making smaller withdrawals, due to the straightforward process. BTC Once you've set up an account, link it with your debit/credit card or bank account. Then, decide on the amount of BTC to exchange, select the desired currency, and initiate the transaction.

The completion time varies, ranging from a few minutes to several days, governed by the exchange chosen and your financial institution.

stands out as one of the most reliable and user-friendly exchanges for withdrawing your digital assets.

Coinbase Though most exchanges charge modest fees, a significant caveat is the delay in fund availability. Emergency cash needs might mean waiting several business days for banking processes to conclude. read our review to find out more.

After processing, Bitcoin owners can cash out at ATMs using their cards or directly through bank tellers.

Coinbase earns its mention for being one of the most active exchanges globally, with seamless integration into the US banking ecosystem.

While accepting users from over 30 countries, converting crypto to cash on Coinbase necessitates US client registration, complete with a US bank account.

Provided you possess all necessary credentials and verifications, cashing out through Coinbase is smooth sailing.

Coinbase allows conversion from Bitcoin, Ethereum, Litecoin, and Bitcoin Cash to USD. Simply connect your US bank account to Coinbase and request the transfer. Certain states like Hawaii, Wyoming, and Minnesota restrict Coinbase transfers, limited by local laws.

made history as the first licensed exchange globally, unsurprising in offering crypto-to-cash conversions. However, unlike Coinbase, Gemini supports only Bitcoin and Ethereum but facilitates trading most tokens into BTC or ETH.

Gemini

Gemini Primarily catering to US customers, Gemini only supports US bank accounts, though it does offer both ACH and wire transfers. ACH takes up to 4 days, while wire transfers conclude within a day post-approval.

It's essential to note that Gemini only processes fiat exchanges and transfers for personal accounts. Transactions involving joint accounts should ensure all members are listed on the Gemini account.

With verified matching bank details, exchanging cryptos for fiat on Gemini is just a few clicks away.

operates from Luxembourg and is favored by crypto enthusiasts managing sizable investments. While offering crypto-to-fiat services, it demands more documentation than US rivals like Coinbase and Gemini.

Bitstamp

Bitstamp On the brighter side, Bitstamp serves international clients as well, which benefits those outside the US banking network, exchanging Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash into fiat for US clients via wire transfers.

bitFlyer, a global exchange, caters to Asia, the USA, and EU clients. Known for massive daily trade volumes, it has at times led in Bitcoin trade. Like many exchanges, it facilitates crypto-to-cash swaps, with funds wired to user's bank accounts.

bitFlyer

To access fiat currency via bitFlyer, possessing a valid bank account and completing ID verification is a must. This Japan-based exchange extends fiat withdrawal services even beyond USA borders.

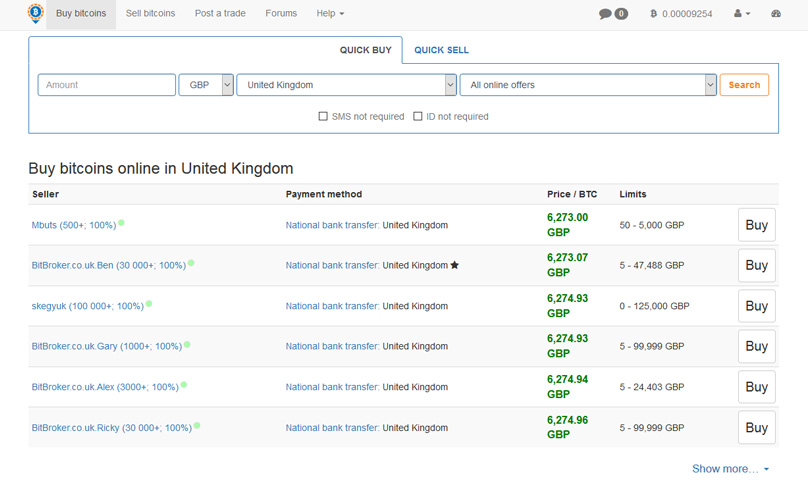

You'd be amazed at the number of individuals keen to swap cash for cryptos. Especially in cities, numerous people prefer acquiring Bitcoin without dealing with the stringent KYC protocols of leading platforms.

Try Local Services

Local crypto platforms generally provide buyer-seller protection, offering a more secure option than cash deals at casual venues. Be sure to understand the platform intricacies and potential service fees before proceeding.

aim to cultivate a P2P trading environment for buying and selling digital currencies. Typically escrow-based, these platforms are renowned for transparent fees, mitigating trust issues.

LocalBitcoins.com

Services like LocalBitcoins.com LocalBitcoins.com facilitates interactions between buyers and sellers, offering flexible arrangements. Transactions may range from personal cash meetings to more creative exchanges, such as gift cards or Western Union.

claims the ambitious title of a 'universal money exchanger.' Offering over 300 Bitcoin exchange avenues, including fiat, Paxful presents a straightforward user interface. It's wise to familiarize yourself with its operations and reviews before engaging.

Read our LocalBitcoins review here .

Paxful

Paxful Converting Bitcoin and Other Cryptocurrencies to Fiat Money in 2022: A Guide

Ready to change your Bitcoin into traditional money? Dive into our all-encompassing Beginner's Handbook for the Safest and Most Straightforward Methods.

The Process of Exchanging Bitcoin and Cryptocurrencies for Regular Cash

Read our Paxful Review here.

Bitquick

Over the past few years, Bitcoin and various cryptocurrencies have seen a tremendous surge in popularity due to the booming trading activity, significant investments, widespread public interest, and the basic principles of supply and demand.

For newcomers, the challenge often lies in connecting the dots between cryptocurrencies and conventional money, discovering how the two can be exchanged.

There are numerous ways to accomplish this. Understandably, people who want to cash out large amounts are concerned with ensuring that the process is both secure and trustworthy.

Bitcoin prepaid cards

Bitcoin prepaid, or debit cards In light of this, let’s explore three primary techniques you can utilize to convert your bitcoin into traditional cash. These methods are widely acknowledged as the safest and most economically efficient in turning your digital wealth into government-issued currency.

Crypto Loans: Consider This Alternative to Direct Cash-Out

Before proceeding further, let’s clarify what we mean by ‘Fiat’ or ‘Fiat Currency’.

Read: Bitcoin Debit Cards Guide

Fiat refers to money authorized by a government.

The worth of fiat money depends on the dynamics of supply and demand, rather than the intrinsic value of the material it comprises. Historically, most currencies were tied to tangible assets like gold or silver, while fiat money relies purely on the economy’s trust and creditworthiness.

Fiat can be risky because of its susceptibility to inflation. When a government opts to print more fiat currency, the value of everyone’s money diminishes. This is precisely the flaw cryptocurrencies aim to address. Monaco and Tenx.

Most individuals believe their money holds intrinsic value. However, modern fiat currency represents debt and nothing more. Unlike being backed by valuable goods, today’s financial systems rest on staggering amounts of debt.

Crypto Loans: An Alternative to Cashing Out

Fiat currency essentially embodies that debt. Without global debt, currency wouldn’t exist.

Worldwide, fiat money issued by government-endorsed central banks forms the foundation of our financial framework. Originally, cryptocurrencies like Bitcoin emerged to replace this with a decentralized model, disrupting the authority of central banks.

Eliminating debt-based currency from the global economy poses challenges since many prefer receiving payment in fiat money. As a result, crypto enthusiasts must navigate a system often resistant to decentralized assets.

Up until 2017, the conventional financial world didn’t seriously acknowledge cryptocurrencies. This shifted when Bitcoin led a dramatic market rally, pushing its value to nearly $20,000. Banks reacted by suspending clients’ credit lines for crypto exchanges, while countries like China put a ban on digital currencies. Ethlend and Salt , and we have also made a comparison of the two companies here .

Private Banks

Central banks became mindful of the significant capital flowing into decentralized assets, potentially recognizing the looming repercussions.

KYC, or Know Your Customer, regulations. Initially, most crypto exchanges didn't have stringent customer verification needed for seamless interactions with other financial bodies. Financial entities maintain comprehensive customer records, something the crypto industry initially neglected.

In recent years, the implementation of KYC regulations has intensified across crypto exchanges. Those looking to switch crypto for cash must adhere to the same protocols as other financial institutions, meticulously logging user identity and transaction history.

are among the top solutions currently available for transitioning cryptocurrencies to fiat. Most platforms have constraints on non-verified exchanges, but they’re excellent starting points for newcomers with modest amounts to convert. The process is user-friendly, even for beginners.

The Legal Side of Crypto Cash

Once you’ve registered, link your account to a debit or credit card, or a bank account. Following this, deposit the desired amount of BTC for exchange, select your preferred currency, and initiate the transaction.

The exchange duration can vary widely, ranging from mere minutes to several days, influenced by the chosen platform and your bank/card provider.

stands out as one of the most user-friendly and secure exchanges for cashing out your digital currencies.

Paying Your Taxes

Many exchanges have reasonable fees, but they come with certain caveats. Chief among them is the inability for instant access to exchanged funds. If immediate cash is required, you might face a waiting period before the bank processes and deposits your funds.

Once converted, bitcoin can be withdrawn from ATMs using linked cards, or directly by visiting a bank clerk.

We have put together a cryptocurrency tax guide We included Coinbase as a prime example because it actively engages with the US financial system and sets the standard for global exchanges.

While Coinbase is accessible in over 30 nations, those wanting to switch crypto to cash need to be verified US clients with a domestic bank account.

There were also issues surrounding

Given the proper credentials and authentication, utilizing Coinbase for cash-outs becomes effortless.

Coinbase facilitates conversion from Bitcoin, Ethereum, Litecoin, and Bitcoin Cash into US dollars. To accomplish this, connect a US bank to your Coinbase, and execute the transfer accordingly. Note that Hawaii, Wyoming, and Minnesota have local laws preventing transfers from Coinbase.

holds the distinction of being the pioneering licensed global exchange, offering services to transform cryptos into fiat. Unlike Coinbase, Gemini only covers Bitcoin and Ethereum, but most cryptocurrencies can be exchanged to BTC or ETH.

20Gemini Exchange Review

In contrast, also welcomes patrons from regions beyond the US, supporting their crypto-based financial activities. The exchange offers transactions converting Bitcoin, Ethereum, Litecoin, Ripple, and Bitcoin Cash into fiat, wiring to US accounts for domestic patrons.

operates globally, serving clients in Asia, the US, and the EU. The exchange sees significant transaction volumes and has periodically led Bitcoin trading markets. Like other major platforms, it enables crypto to fiat swaps, transferring currency directly to a verified bank account.

Similar to other exchanges, establishing a valid bank and completing identity checks are prerequisites before turning to fiat on . Originating in Japan, it also supports international users outside the US.

You might be astonished by how many locals might wish to trade cash for your cryptos. Particularly in metropolitan locales, there's a substantial interest in acquiring Bitcoin sans the extensive KYC measures inherent in formal exchanges.

Community-based crypto exchanges typically offer security assurances for both buyers and sellers, making them favored over informal, in-person transactions. Be informed about the nuances of these marketplaces, including their compensation structures and fees prior to initiating any deals.

aim to create a peer-to-peer market where individuals can freely buy or sell digital currencies. Typically escrow-centric with transparent fee models, such systems effectively mitigate trust-related issues.

https://www.reddit.com/r/Bitcoin/comments/7lu6ze/an_extensive_guide_for_cashing_out_bitcoin_and/

LocalBitcoins.com mediates between the involved parties, enabling them to agree on payment methods. Options include physical cash meetups, gift cards, and services like Western Union. Creativity knows no bounds here.

aims to be the ultimate money exchange hub. It offers over 300 options for Bitcoin swaps, including numerous fiat currencies. Known for its straightforward user interface, Paxful encourages evaluation and user reviews ahead of utilization.

How to Convert Bitcoin and Other Cryptos to Traditional Money in 2022

Cryptocurrency exchanges

Looking to Change Your Bitcoin to Cash? Check Out Our Complete Beginner's Guide for the Safest and Simplest Methods!

Steps to Turn Bitcoin and Other Cryptocurrencies into Regular Currency

In recent years, Bitcoin and other cryptocurrencies have skyrocketed in popularity, fueled by high trading volumes, substantial investments, growing public interest, and the age-old principles of supply and demand.

LocalBitcoins.com

Newcomers might want to find ways to link their cryptocurrencies to traditional money and understand how these two economic systems interact.

Paxful

There are numerous approaches to handling this exchange. If you’re worried about safely converting large amounts, your concern is valid, and securing your transactions is wise.

Thus, this article will delve into three primary techniques to convert your Bitcoin into traditional currency. These methods are often cited as the safest and most cost-efficient ways to swap your digital assets for government-backed cash.

Crypto Loans: You Might Not Have to Cash Out

Before going further, let's clarify what we mean by 'Fiat' or 'Fiat Currency.'

Fiat is the currency that governments churn out.

Fiat money's value comes from the interplay of supply and demand, not from any intrinsic material worth. Historically, currencies were pegged to physical assets like gold or silver, but fiat rests solely on economic trust and credit.

Fiat is perceived as volatile due to inflation risks—when a government prints more currency, the value of everyone's money diminishes. This runs contrary to what cryptocurrencies aim to resolve.

People generally see their money as holding intrinsic value, yet modern fiat currency is mainly debt, nothing more. Our financial framework is built on a staggering level of indebtedness, rather than valuable commodities.