The notorious Centra (CTR) coin debacle has once again highlighted the monumental challenges regulators encounter as they strive to purge the tumultuous cryptocurrency realm.

Back in April 2018, the American-based financial technology entity known as Centra Tech, which developed the CTR digital asset, found itself entangled in a regulatory clampdown initiated by the U.S. Securities and Exchange Commission (SEC). According to the SEC , Centra Tech's Initial Coin Offering (ICO) managed to deceive substantial sums from unwary investors by inflating its claims of affiliations with established corporate behemoths.

Reports suggest that co-founders Sohrab “Sam” Sharma and Robert Farkas of Centra Tech hoodwinked potential backers by asserting partnerships with eminent financial entities, MasterCard and Visa. Yet, contrary to these assertions, no formal associations existed between Centra and these corporations.

The duo even enlisted the support of Floyd Mayweather, a prominent figure in the boxing world with a vast Facebook following of over 13.5 million, to promote these tokens. to advise his followers This debacle ultimately culminated in the apprehension of both founders.

In the wake of SEC's proclamation about the action against Centra Tech, the CTR token's value suffered a precipitous decline, slipping from $0.32 to $0.06. Though it temporarily found some stabilization, it ventured into a recovery trajectory until struck again on April 8 with Binance's move.

CTR – Still Trading

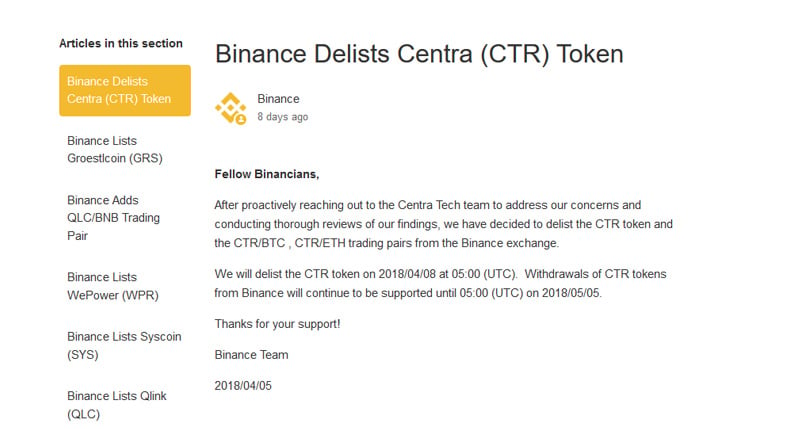

“After engaging in a thorough dialogue and assessment with the Centra Tech team, we resolved to withdraw the CTR token along with the trading pairs CTR/BTC and CTR/ETH from our platform,” as stated by Binance. delisted it, yet CTR continues to trade at $0.012.

Centra Price, from CoinMarketCap

“ We have set the timeline to delist the CTR token on 2018/04/08 at 05:00 (UTC), with withdrawal support continuing until 2018/05/05 at 05:00 (UTC).”

At this juncture, a minimum of three cryptocurrency exchanges have removed the token from their platforms. Ordinarily, these circumstances would signal the end for CTR. Yet, its persistent visibility signals the need for innovative regulatory strategies to prevent repeat occurrences. from Binance Presently, determining the exact number of crypto market players remains elusive, though

Binance Delists Centra

This entire saga starkly underscores the fact that the SEC wields greater authority over entities listed on stock markets. For instance, NASDAQ recently froze trading of Longfin Corp as allegations surfaced regarding securities law violations by individuals linked with the company.

“We are actively working on fulfilling the requested documentation and will fully cooperate with the SEC during their investigation,” Longfin disclosed, amidst seeing their stock price plummet roughly 31 percent, hitting a value of $9.89 per share. CoinMarketCap , CTR had a volume of $81,000 + in last 24 hours.

Such developments often lead to further regulatory oversight in cryptocurrency trade, as tokens flagged by the SEC as fraudulent continue to be traded even after official warnings.

Priyeshu Garg, a seasoned software engineer at a burgeoning tech giant, delves into the intricacies of blockchain and delves into cryptocurrency trading when not tackling complex coding challenges.

Dojima Network: Laying the Groundwork for a Truly Cohesive Web3 Ecosystem