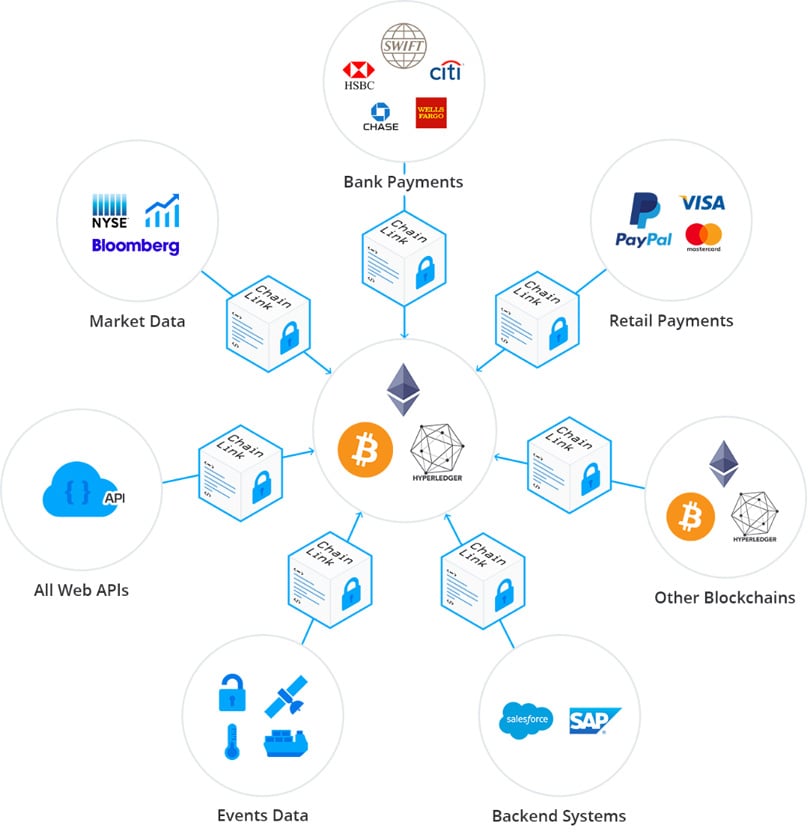

The Launch of Chainlink: A Venture Initiated by a San Francisco-Based Fintech Company SmartContract in June 2017, Chainlink Chainlink is pitched as a robust blockchain intermediary, aiming to bridge smart contracts across different blockchains. It achieves this by enabling these contracts to tap into vital off-chain resources like data feeds, web APIs, and conventional banking payment systems.

The developers behind Chainlink posit that while smart contracts have the potential to transform numerous fields by eliminating the necessity for standard legal deals, the consensus mechanisms intrinsic to blockchain technology hinder smart contracts from communicating seamlessly with external systems.

At the heart of the Chainlink ecosystem are its connective elements and the LINK network. By releasing APIs and other platforms, the creators aspire to broaden the scope and practicality of smart contracts in the commercial realm. LINK token Smart contracts, first conceptualized back in 1993, are essentially computer programs that run on decentralized frameworks like blockchains. Traditional contracts lay out the terms of an agreement enforceable by law. In contrast, smart contracts execute these agreements using cryptographic code.

What are Smart Contracts?

Once specific preconditions are met, smart contracts spontaneously execute. Their integration into a decentralized network ensures that nobody can tweak or meddle with their functioning post-execution. This immutability ensures that all involved parties are bound by the agreement without relying on trust in any single entity.

Still, as highlighted by Chainlink's developers, smart contracts have inherent limitations on blockchain structures. These contracts, residing on blockchain-secured information, face compatibility issues with external resources like data feeds, APIs, or traditional banking frameworks.

Traditionally, the use of 'oracles' — a form of blockchain middleware — has been the way around this. Chainlink's vision is to present a blockchain-based, decentralized oracle network facilitating connectivity between smart contracts and external (non-blockchain) resources.

Blockchains inherently lack the ability to access external data. Oracles serve as intermediaries, identifying and validating real-world occurrences before funneling this information to a blockchain, enabling its utilization in smart contract logic and functions.

What are Oracles?

Due to the centralized nature of oracles, which fall outside blockchain consensus protocols, trust issues arise concerning the accuracy of data sourced from them for smart contracts.

Given that smart contracts can be self-executing upon specific conditions, the integrity and reliability of the oracle-provided information become paramount. For instance, incorrect stock pricing data, if transmitted to the blockchain and utilized by a smart contract, could result in unintended outcomes.

Some oracles verify data through notarization; others depend on human-fed unstructured data. Chainlink developers argue that both techniques have shortcomings: while notarization could face perpetual verification loops, human-fed data could be costly, resource-heavy, and inadequate for real-time needs.

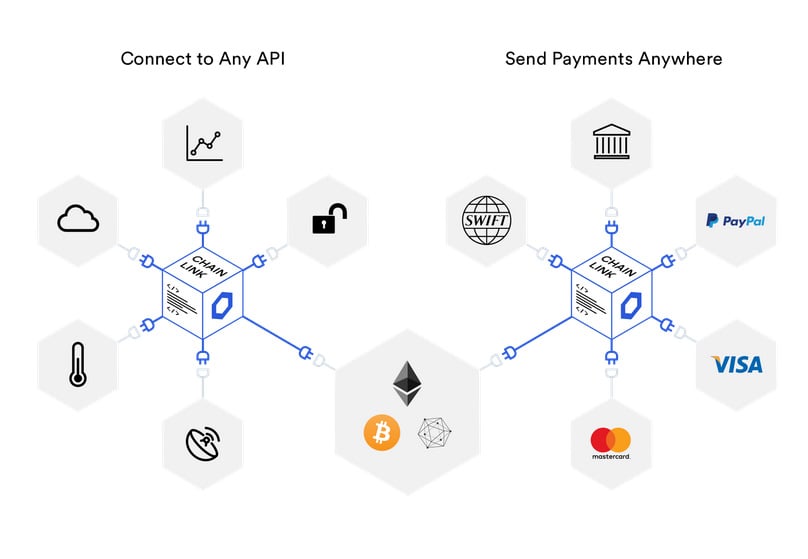

Chainlink aims to tackle these challenges with a decentralized oracle network, fostering secure interactions between smart contracts and external blockchain resources, such as secure data feeds, while promoting cross-blockchain interoperability.

According to Chainlink's architects, their network is designed to allow any entity providing data feeds or APIs to interact directly with smart contracts in return for Chainlink tokens. These entities, referred to as Node Operators, enable data or service providers to offer their API-based services to smart contracts for LINK tokens.

The decentralized framework proposed by Chainlink is geared to enable data inputs, off-chain payments, and APIs in a way that is scalable, secure, and open to auditing.

At its core, the Chainlink Network is a decentralized assembly of Chainlink Nodes, selling access to specific data feeds, APIs, and diverse off-chain payment options directly to smart contracts.

We go into more detail about Chainlink and Oracles in this guide .

The Chainlink Network

The architecture of the Chainlink Network is dual-faceted, featuring both on-chain and off-chain elements. These must collaborate to ensure service delivery. With upgradeable components, the network can evolve by embracing enhanced techniques and technologies as they emerge. The on-chain section vets oracles based on metrics specified by smart contract stakeholders through service-level agreements (SLAs).

By utilizing these metrics, Chainlink compiles oracle responses to SLA inquiries, organizes them using reputational and aggregation models, and provides a cumulative outcome that the smart contract can implement.

Off-chain, the network comprises oracle nodes that independently collect and process responses to external requests. These nodes can operate across varied sectors; for example, a New York Stock Exchange node might deliver real-time trade data to Chainlink, while a Visa node could handle a transaction through the Chainlink framework by interacting between purchaser and merchant.

Chainlink technology is poised to integrate nodes from myriad industries into a versatile platform, acting as an affordable intermediary to accurately sort and channel data. Chainlink ensures the accuracy of oracle-supplied results while allowing oracles to maintain autonomy concerning the data they provide. Ethereum network Any data, payment, e-signature, or API supplier, including solo developers, can seamlessly join the Chainlink network by linking a familiar API. After connecting an API to Chainlink, a user assumes the role of a Chainlink Node Operator, responsible for sustaining their API's link to the network. Node Operators receive LINK tokens as rewards upon fulfilling on-chain requests successfully.

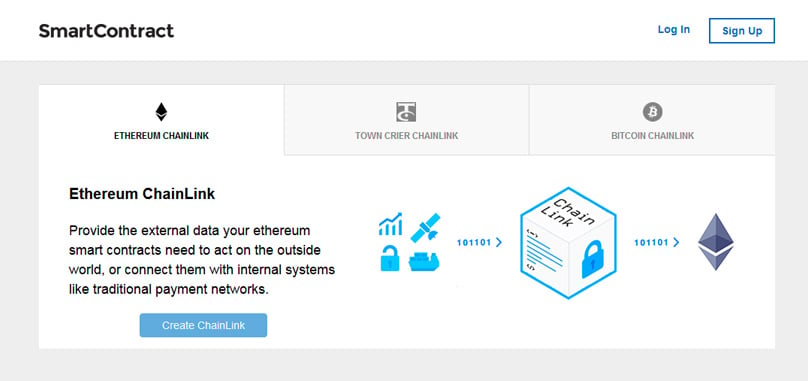

Offering a decentralized oracle network, Chainlink already supports Bitcoin, Ethereum, and Hyperledger, with plans to accommodate additional blockchains. This paves the way for cross-chain connectivity between smart contracts and any other public or private blockchain, widening Chainlink's accessibility regardless of platform. Service providers will reliably furnish smart contracts with critical external data and even manage off-chain payments.

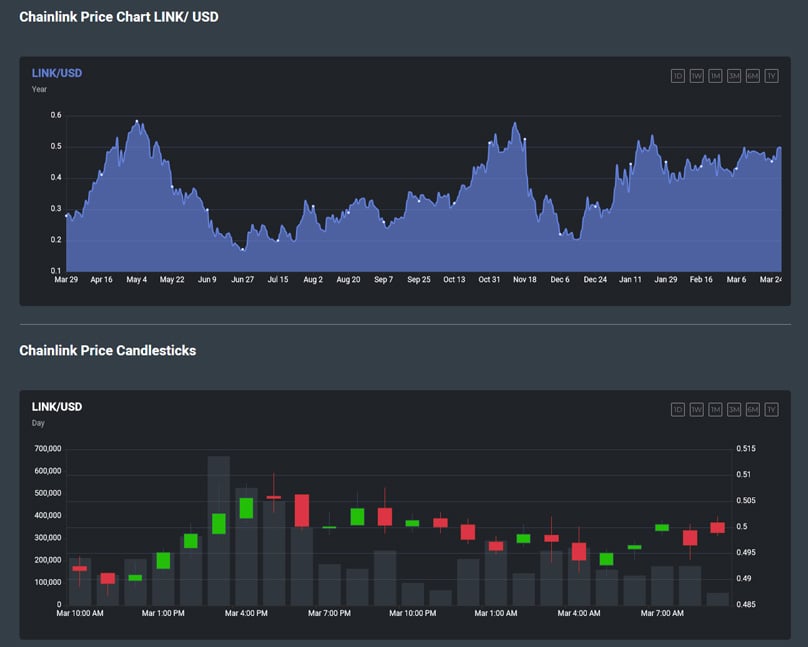

To address Chainlink's off-chain requirements, LINK tokens have been designated as the compensation medium for Node Operators. Developers suggest LINK's role in this capacity is indispensable, with the token's demand and value linked to the number of operators extending off-chain services to the network.

As LINK serves as the Chainlink platform's currency, its valuation should escalate with increased platform usage. Still, there are perspectives doubting the necessity of LINK tokens for compensation, suggesting other cryptocurrencies might fulfill this role effectively, given oracles' vested interest in maintaining their network and data accessibility constant.

Chainlink Token

A crucial element of Chainlink's framework is its reputation system, where node operators with more LINK staked have access to bigger contracts. Delivering inaccurate data incurs penalties via token deductions. This system benefits token holders: greater amounts of tokens tied up in contracts can lead to reduced supply and potentially increased token pricing.

The actual utility of LINK tokens for the system's efficiency will become clearer once operational, gauged by the number of Node Operators onboarded. Insufficient adoption could signify lower token valuation.

The partnerships announced ahead of the mainnet launch hint at substantial initial network engagement, expected to expand as more companies participate.

Chainlink developers depict the LINK token as an 'ERC20 token,' endowed with ERC223's 'transfer and call' capabilities, enabling token transfers and processing by contracts in a single transaction.

The LINK token offering was capped at $32 million, from a total supply of one billion LINK tokens. According to the team, 35% of LINK tokens will incentivize node operators, with an additional 35% available in the public token sale.

Monitor the price of LINK on our Price Page

Discover Chainlink Coin (LINK): A Comprehensive Guide and Analysis

Explore the Chainlink Cryptocurrency (LINK): A Deep Dive into How It Connects Smart Contracts to Real-World Data

Understanding Chainlink: An Introduction to the Decentralized Oracle Network

Chainlink Updates

Origin Story: A Creation of a Fintech Firm Based in San Francisco decentralized finance (DeFi) According to its creators, Chainlink acts as a robust blockchain middleware, intending to bridge smart contracts with various blockchains by enabling access to off-chain resources like data feeds, web APIs, and traditional banking transactions.

Chainlink's team envisions that smart contracts could transform numerous sectors by eliminating the lengthy processes associated with traditional legal contracts. However, blockchain's consensus protocols limit smart contracts' interaction with outside systems.

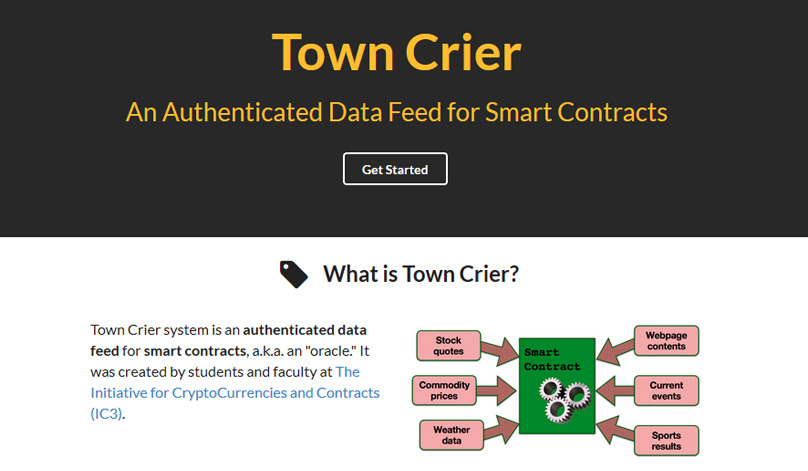

Town Crier Acquisition

In particular, Chainlink recently acquired At the core of Chainlink's framework is its network and the LINK token. Through APIs and innovative platforms, developers aim to expand smart contracts' functionality and relevance in global commerce. Town Crier system Dreamt up in 1993, smart contracts are software applications running on decentralized setups like a blockchain. Unlike conventional agreements that depend on legal enforcement, smart contracts self-execute applications governed by cryptographic code.

The acquisition was officially announced Smart contracts spring into action when specific conditions are met. Operating within a decentralized network ensures the immutability of their code and execution, binding all parties to their terms without needing to place trust in any one party.

However, Chainlink's engineers identify several constraints in smart contracts' current blockchain architecture. These contracts can't inherently reach out to external entities like APIs, data streams, or conventional financial systems, given their reliance on secured blockchain data and miner consensus.

Conventionally, this dilemma is tackled using 'oracles', a middleware on the blockchain. Chainlink suggests a fully decentralized, blockchain-based secure oracle network, facilitating interaction between smart contracts and off-chain resources.

Oracles play a vital role as blockchains lack inherent capability to access off-network data. Defined as agents, oracles find and authenticate real-world events and interface this data with blockchains for smart contract engagement.

Oracles come with issues due to their third-party nature and central points of control. A critical concern is the trustworthiness of data oracle-supplied to smart contracts.

- Authenticity guarantee of data

- Accuracy and reliability of oracle information are crucial when smart contracts automatically execute decisions. Should false data about, say, stock prices enter a smart contract, it could trigger erroneous actions.

- Various oracles are notarized for truthfulness, while some depend on manual entry of unstructured information. Chainlink's developers criticize both: notarization for potential infinite loops, and manual input for being costly and impractical for real-time updates.

Chainlink's innovators aim to build a decentralized oracle system enabling smart contracts to securely access external data feeds and promote interoperability among different blockchains.

Per the developers, Chainlink allows any provider of a data feed or API to offer these directly to smart contracts in exchange for LINK tokens. Those supplying services are known as Node Operators, facilitating direct API services exchange with LINK tokens. partnerships The developers advocate that their decentralized architecture efficiently channels data, payments, and API services into smart contracts, ensuring security, scalability, and auditability.

Celer

ChainLink spans a decentralized network of Nodes, each vending the usage of specific data feeds, APIs, and off-chain payment options straight to a smart contract. joint announcement Comprising on-chain and off-chain segments, the Chainlink network requires their synergy to deliver services. Its modular construction allows for upgrades as superior methods and technologies develop. The on-chain section evaluates oracles based on criteria stipulated by a smart contract's service level agreement (SLA).

Chainlink compiles oracle responses to SLAs using metrics, refining them with reputation and aggregation frameworks, and delivers the consolidated result for smart contract integration.

Off-chain, the network features oracle nodes connecting to Chainlink, autonomously sourcing responses to off-chain requests. These nodes are viable in diverse industries; for instance, an NYSE-run node can feed real-time trades, and a Visa node might process transactions within Chainlink's ecosystem, catering to both buyers and sellers.

Katallassos

Chainlink’s partnership Chainlink aspires to incorporate a plethora of industries into a singular, cost-effective network, regulating and distributing data accurately through its intermediary apparatus, while ensuring oracle independence with data provision.

Developers, data providers, payment systems, and others can integrate the Chainlink network by connecting a familiar API. Once associated with Chainlink, they assume the role of a Node Operator, responsible for maintaining service linkages to the network, earning LINK tokens for successful request fulfillment.

Mobilum

Mobilum also recently partnered Currently, the venture offers a thoroughly decentralized oracle ecosystem suitable for Bitcoin, Ethereum, and Hyperledger, with future plans to accommodate an array of blockchains, enabling cross-chain smart contract connectivity. Thus, any platform can leverage Chainlink to furnish secure smart contract linkages with essential external datasets and potentially off-chain payments.

Tom Gonser

Addressing Chainlink's off-chain dependencies, the LINK token functions as the platform's currency, settling Node Operator fees. Developers argue that the LINK demand and token value correlate directly with the count of operators offering off-chain functionalities. signed on the board As a currency within Chainlink, escalating platform use should bolster LINK's value. Some analysts question the necessity of LINK, suggesting existing cryptocurrencies could suffice in rewarding operators, and oracles have intrinsic motivation to maintain network and data constancy.

In the Chainlink ecosystem, a reputation system incentivizes Node Operators to lock in a substantial LINK quantity, securing higher-value contracts. Inaccuracy penalties subtract tokens, potentially making the system profitable for token holders by decreasing supply and enhancing token value.

The viability of LINK's critical role will become apparent once the system is operational, hinging on the number of Node Operators joining. A limited adoption may depress token value. much-awaited mainnet launch Pre-mainnet launch partnerships hint at sweeping network uptake, anticipated to increase as more firms join the initiative.

The LINK token cap was set at $32 million, with a billion available tokens. Developers allocated 35% for Node Operators to stimulate ecosystem growth, with another 35% circulated through the public token sale.

Conclusion

What exactly is Chainlink? Here's a thorough breakdown of LINK, a cryptocurrency that's reshaping how smart contracts interact with the world.

A comprehensive look at Chainlink (LINK), the cryptocurrency conceived to extend the functionality of smart contracts beyond blockchain limitations.

Unraveling Chainlink: An Insightful Exploration of the Decentralized Oracle Network

2Comments

[Redacted] 1k eoy!

Smart contracts, conceptualized in 1993, are computational protocols executed on decentralized frameworks like blockchains. Unlike traditional contracts enforced by laws, smart contracts uphold relations through cryptographic protocols.

Smart contracts activate under specific conditions, and their presence within a decentralized setup ensures that no individual can modify its code or disrupt its operation, fostering a trust-independent relationship.