TLDR

- A 17.4% tumble in Cipher Mining's stock followed the dissemination of their 2024 financial earnings.

- The annual revenue witnessed a growth of 19%, reaching $151 million, yet operating losses expanded to $43.7 million.

- The company successfully enhanced its mining operations to a substantial 13.5 EH/s thanks to facility modernizations and new acquisitions.

- The fourth quarter was a bright spot with revenues jumping to $42 million, a 75% increase from the prior quarter, culminating in a $17 million profit.

- Set to debut in the second quarter of 2025, the 'Black Pearl' site is a key component of Cipher's ongoing growth initiative.

Based in the U.S., Cipher Mining reported varying financial outcomes in 2024. While revenue increased, operational losses also grew, which hasn't deterred the company from expanding its infrastructure and mining capabilities.

On February 25, Cipher Mining unveiled its fourth-quarter and full-year financial report for 2024. Revenue rose by nearly 19% year-over-year to $151 million, while operating losses more than doubled from the previous year, reaching $43.7 million.

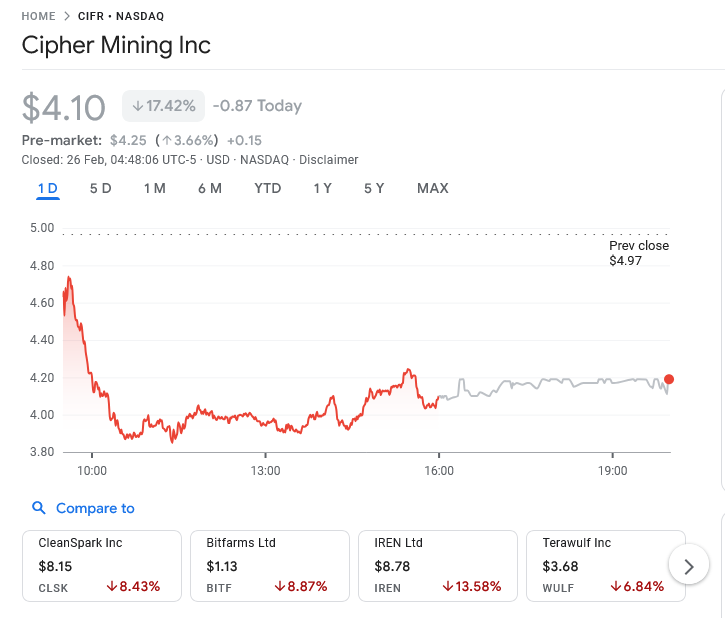

The financial disclosures triggered an immediate response in the market, with Cipher Mining's stock (CIFR) tumbling 17.4% to close at $4.10 on the announcement day. Despite the sharp drop, CIFR shares remain about 20% above where they were a year ago, although they've hit their lowest in 2025.

The mounting losses coincided with Cipher Mining's robust investments in expansion. An upgraded Odessa, Texas facility helped boost its self-mining hashrate to approximately 13.5 EH/s, reflecting the computing power dedicated to crypto mining.

Alongside Odessa's upgrades, Cipher acquired another data center site with 100 megawatts capacity in Texas and secured 337 acres of land adjacent to their Barber Lake operation. These expansion efforts are part of the company's grander growth strategy, contributing to increased operating costs.

Q4 Shows Signs of Recovery

Fourth-quarter results introduced some upbeat notes amidst annual losses. Cipher Mining's Q4 revenue hit $42 million, marking a 75% jump from Q3, and the company posted a $17 million profit, recovering significantly from the $91.4 million operating loss in Q3 of 2024.

CEO Tyler Page conveyed a positive outlook regarding the company's trajectory. 'The fourth quarter was extremely productive for us as we diligently pursued our growth and expansion plans on schedule,' Page remarked.

Page further emphasized progress on the 'Black Pearl' project, which he anticipated will be operational by Q2 this year. This endeavor is a part of the company's relentless expansion efforts.

Cipher Mining’s project pipeline capacity has reached 2.8 gigawatts, with ambitions to develop cutting-edge data centers for both high-performance computing and bitcoin mining. The company's management remains optimistic about future growth, despite present financial hurdles.

With a focus on creating and managing large-scale bitcoin mining and high-performance computing data centers, Cipher Mining aspires to stand out as a leading developer in the industry.

The crypto mining sector continues to face both opportunities and obstacles. While bitcoin's price impacts mining profitability, companies like Cipher Mining are reinforcing their infrastructure to escalate mining capacity and enhance operational efficiency over time.

Marathon Digital (MARA) and Core Scientific (CORZ), other big names in mining and data centers, were set to release their earnings on February 26, potentially shining more light on broader industry trends.

For investors eyeing Cipher Mining, the split between revenue growth and soaring operational losses paints a complex picture. Observers are likely to focus on the company's ability to proceed with expansion plans while addressing concerns stemming from the stock price decline.

Following market closure on February 25, CIFR saw a slight after-hours trading uptick of 2.2%, reaching $4.19. The small rise suggests some investors view the expansion of infrastructure as a beneficial long-term play despite current fiscal results.

In the highly competitive world of cryptocurrency mining, companies tirelessly update equipment and hunt for cost-effective energy to stay profitable. Cipher Mining's expanded facilities and increased hashrate position the company favorably for future positive shifts in the crypto market.

As Cipher Mining advances with its Black Pearl project and other expansion pursuits, balancing growth investments with financial performance becomes pivotal for rekindling investor confidence and stabilizing the stock.