City Index Renowned as a cornerstone of CFD trading, spread betting, and forex, City Index has carved a niche for itself with over three decades of expertise. Originating from the UK in 1983, this London-based provider has become synonymous with top-tier execution speeds and reliability. Offering traders access to more than 12,000 diverse markets, including cutting-edge cryptocurrencies, equities, forex pairs, indices, and various commodities, City Index leads the way.

City Index is deeply committed to equipping traders with the essential tools needed to hone their trading prowess. Ensuring top-notch services with straightforward, equitable pricing along with a robust customer support system is at the heart of their mission.

City Index at a Glance

| Broker | City Index |

| Regulation | FCA (UK), MAS (Singapore) & ASIC (Australia) |

| Minium Initial Deposit |

£100 |

| Demo Account |

Yes |

| Asset Coverage | Diverse CFD Markets: Encompassing Forex, Indices, Equities, and Cryptos |

| Leverage | Varies |

| Trading Platforms | Web Trader, Desktop Platform (Windows), MetaTrader 4 |

City Index’s Parent Company

City Index falls under the umbrella of GAIN Capital Holdings Inc., a heavyweight in the institutional and retail trading sphere, listed on the New York Stock Exchange as GCAP. Established in 1999, GAIN Capital stands among the top-tier providers on a global scale. Its public listing ensures an added layer of trust for traders, alongside being subject to regulation across eight global jurisdictions. Adherence to exemplary corporate governance, transparency, and financial reporting remains central to GAIN Capital’s operations.

For a perspective on GAIN Capital’s robust standing and reliability, consider their 150,000-strong community of retail traders worldwide, carrying client assets amounting to $978 million. As per data from the fourth quarter of 2016, GAIN Capital boasted $1.430 billion in assets, $945.5 million in client equity, and maintained a cash and liquidity pool of $182.9 million, with a regulatory capital requirement of no less than $113 million. With roots in Bedminster, New Jersey, the company extends its footprint globally, employing over 800 professionals.

Account Types

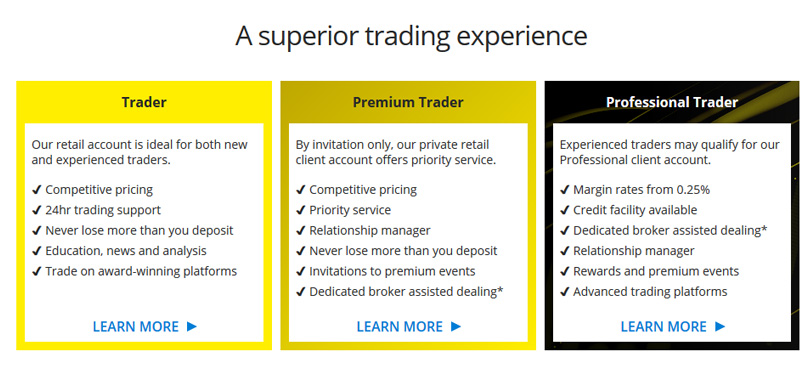

City Index operates a network of offices across the UK, Australia, Singapore, and the Middle East, each offering slightly varied account functionalities. The Australian and Singaporean branches provide both Trader and Premium Trader accounts, whereas branches in the UK and Middle East accommodate Professional Trader Accounts too. All branches facilitate CFD trading, with the UK branch exclusively offering additional options. spread betting .

Those residing in the UK or EU can opt to open their accounts with offices in the UK, Australia, or Middle East. UK and Middle Eastern accounts incorporate mandatory negative balance protection, while those in Australia and Singapore feature optional risk management tools.

Standard Trader accounts are fortified with negative balance protection, a 50% margin threshold for closeouts, and prioritized trade execution.

Demo Accounts

City Index offers demo accounts tailored to CFD, spread betting, MT4, and joint CFD activities, replete with £10,000 in virtual funds for practicing over 12 weeks. Though the demo duration is fixed, there's always an option to apply for a subsequent one to continue honing your skills.

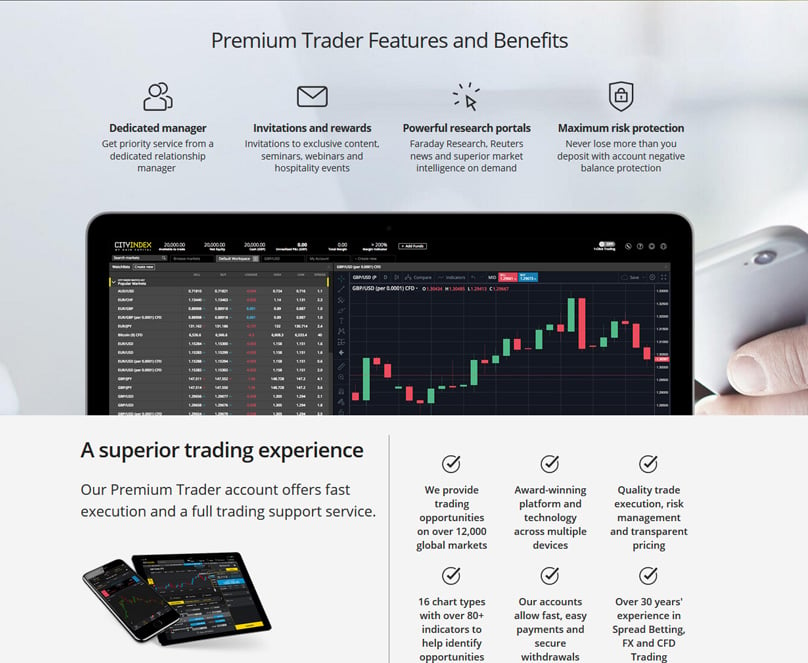

Premium Trader Accounts

The premium trader account is a by-invitation tier imbued with premium customer service and dedicated account managers for active retail investors. It also comes with vigorous risk management on each trade, competitive pricing, and an assurance that losses will never exceed your deposit amount.

Premium traders relish access to a treasure trove of exclusive content, webinars, seminars, and exclusive events. They also benefit from privileged research material, including insights from Faraday Research, top-tier market intelligence, and real-time updates from Reuters.

To transition to a premium trader status, you need to actively engage in trading while maintaining a balance of no less than £10,000. Upon meeting these criteria, you can either await an invitation or reach out to City Index to expedite the process.

Professional Trader Accounts

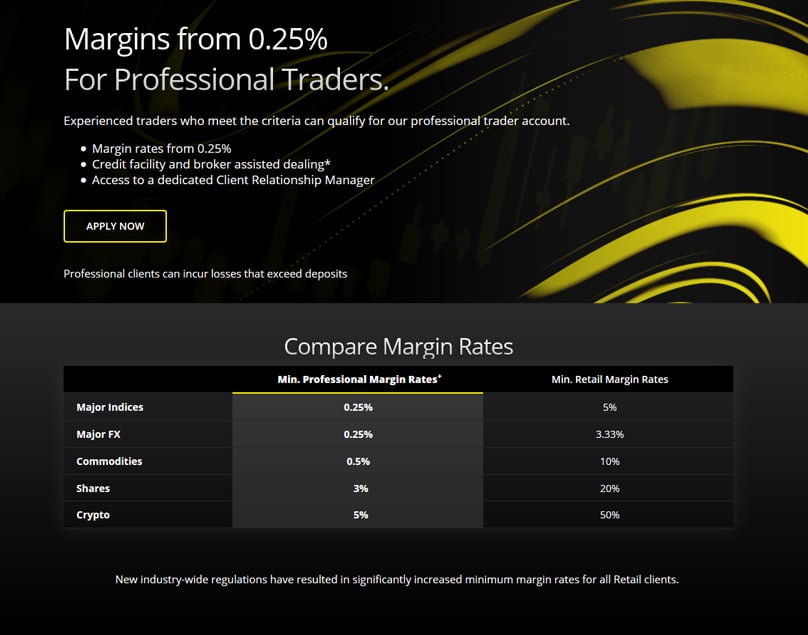

Veteran traders who meet the qualifications can opt for a professional trader account with City Index. Such accounts come equipped with credit facilities, broker-assisted trade handling, and a dedicated client relationship manager. Margins can be as favorable as 0.25%, yet note that potential losses can exceed initial deposits.

Despite new regulations impacting the industry, professional traders still benefit from unrivaled margin rates—starting at 0.25% for major indices and top-trade pairs. forex Commodities have a margin of 0.5%, shares operate on 3%, and crypto stands at 5%. Such margins are up to 20 times more appealing compared to those for retail clients.

With City Index, professional traders partake in loyalty perks, inclusive of elite hospitality invitations and other rewards. An added credit facility ensures superior financial flexibility and expedited service.

Professionals in the trading space only need to fill out a concise application for consideration. Eligibility hinges on meeting two out of three specific criteria: conducting an average of 10 significant-size trades each quarter over the last four quarters, possessing a financial portfolio exceeding €500,000 (inclusive of cash deposits), or accumulating at least a year’s experience in a financially intensive role with requisite leverage product expertise.

While professional trader accounts aren’t bound by the same legalities as retail accounts, City Index consistently segregates client and corporate funds, adheres to superior execution tactics, shares essential information documents, and retains uniform trade confirmation detail.

That said, professional accounts do forgo certain FCA safeguards aimed at retail clients—such as mandated margin closeout protocols and the like. The distinction may reflect sophisticated dialogue with professionals, drawing on their presumed proficiency and knowledge of leveraged product risks. FSCS protection remains intact.

Intriguingly, professionals gain access to specially tailored resources and platforms beyond what standard and premium traders enjoy. Platform-wise, there’s room for AT Pro and Meta Trader 4 integration, along with exclusive tools from Dataminr.

Which Markets Are Available for Trading with City Index?

By joining forces with City Index, you unlock over 12,000 opportunities across spread bet and CFD ecosystems, spanning indices, shares, forex, commodities, and cryptos. Accounts with Australian or Singaporean branches yield access to over 4,500 CFD outlets, while Middle Eastern branches offer 100+ CFD pathways, focusing on key commodities, forex, and indices.

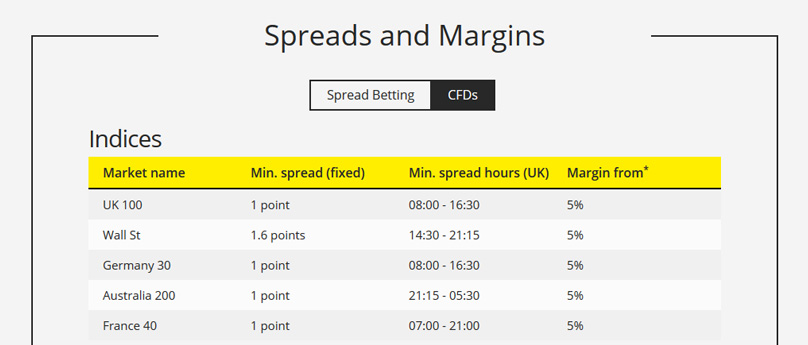

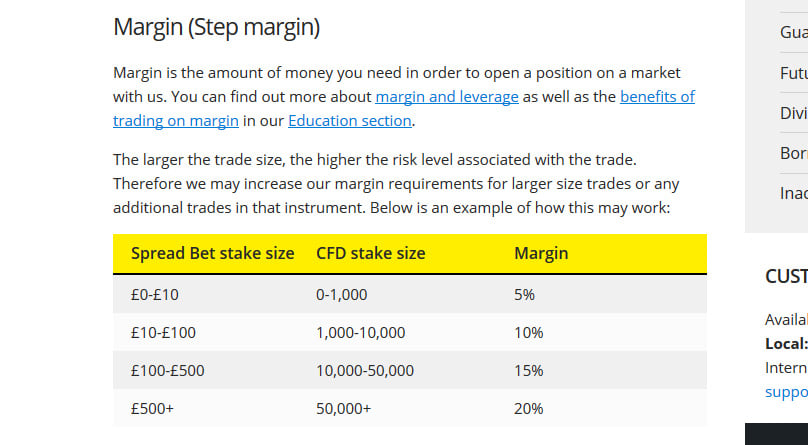

Minimum Leverage & Margin

The leverage ratio and margin requirements at City Index correlate with your respective office choice and market activities. UK-based accounts offer leverage of 20:1, with a margin of 5% for major indices, 30:1, and 3.33% for major FX values, 5% with 20:1 for commodities, 20% and 5:1 for shares, culminated by 50% and 2:1 for crypto pairs.

Under an Australia-based account, numbers adjust to 0.5% margin with 200:1 leverage across major indices, FX, and commodities, with 5% & 20:1 on shares, and 25% & 4:1 for crypto. Singapore footprints feature 5% & 20:1 for indices, 2% & 50:1 for FX, and lower ratios for other categories.

It's worth noting that the Middle Eastern branch doesn’t cover shares or currencies, but provides 5% margin & 20:1 leverage for indices, 3.33% margin with 30:1 on major FX, and 5% & 20:1 across commodities.

Trade Execution on City Index

City Index subscribes to a best execution doctrine, ensuring rapid execution on every trade. Additionally, should market movements favor you post-order, trades are finalized at adjusted rates. Execution mechanics at City Index entail functionalities for holding simultaneous opposite positions, use of price advancement technologies, and various adaptable order types.

Leveraging City Index’s prowess further, traders can utilize unrealized gains as margin base for new positions—maximizing all available trading resources. Additional incentives include eligibility for future roll-over discounts, phased trade adjustments (FIFO or otherwise), coupled with a safety net against negative balances. This, however, doesn't substitute the practical need for stop-loss placements.

City Index Spreads

Spread differentials on significant indices with City Index initiate from 0.4, albeit Middle East trades start from 2. UK and Australian forex commencing at 0.6, Singapore at 0.5, Middle East at 3. Commodities exhibit spreads beginning at 0.06, equity spreads trace from 0.1, and crypto starts at 0.8—irrespective of regional positioning.

City Index Deposits & Withdrawals

Introductory Guide to City Index Evaluation 2019: Assessing its Safety? Discover All Advantages & Disadvantages

Considering opting for City Index as your broker? Is it reliable or a potential scam? Dive into our in-depth review to uncover crucial insights. Explore every Pro & Con.

City Index Fees

Comprehensive Guide for Beginners: City Index Detailed Evaluation CFDs City Index stands as an international entity in the realm of CFD trading, spread betting, and forex trading, boasting over three decades of expertise. Established in London back in 1983, this UK-based firm is renowned for dependable, swift execution. As a leading name in spread betting, CFDs, and forex trading, it provides entry to a whopping 12,000+ markets, covering everything from cryptocurrencies to shares, indices, and commodities.

City Index is devoted to equipping traders with essential tools to elevate their trading prowess. Their promise lies in offering top-level services with transparent pricing and thorough customer support.

Important Reminder: CFDs, with their complex nature, bear heightened risk due to leverage, often resulting in swift financial losses. 74% of investor accounts lose money while trading CFDs with this provider. It’s vital to evaluate your comprehension of CFDs and check if you are ready to face the significant risk of financial loss.

Which Markets Can You Trade on With City Index?

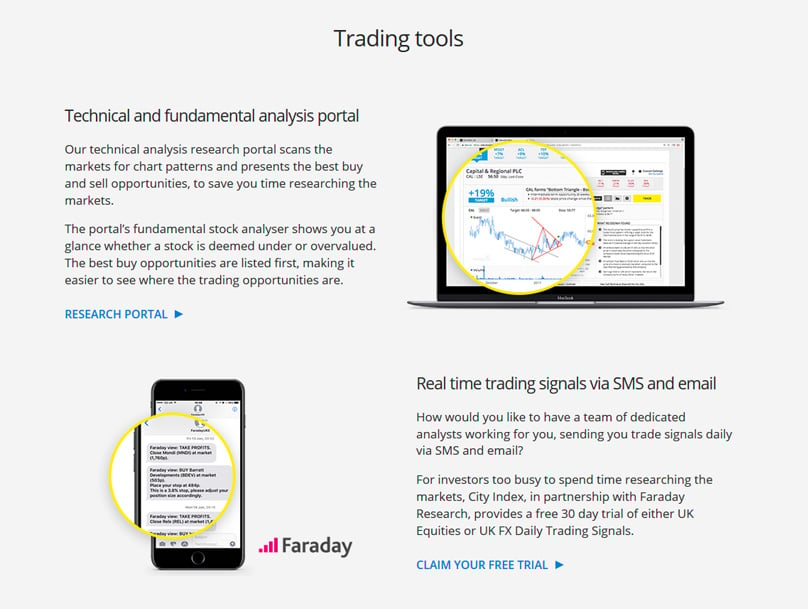

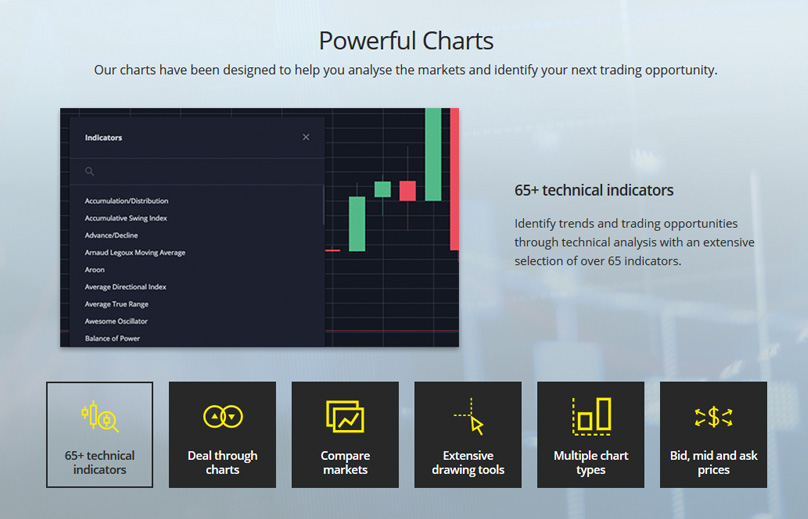

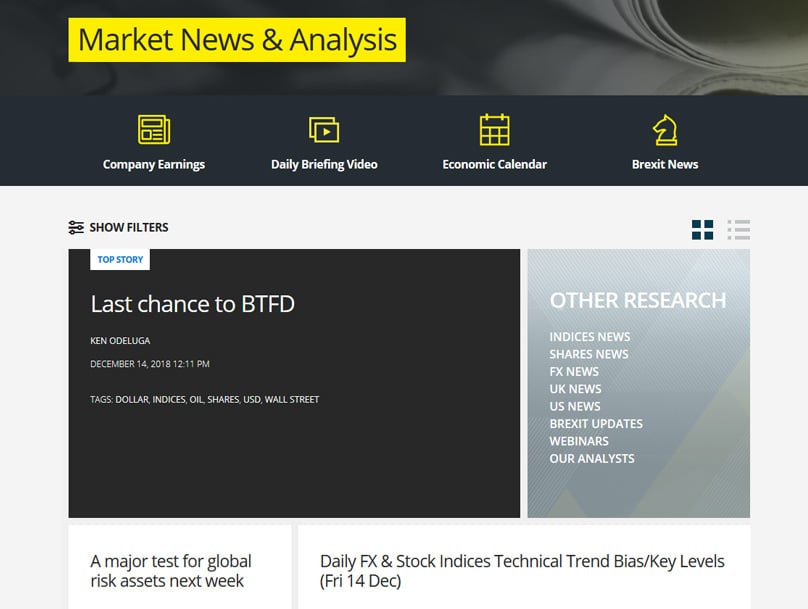

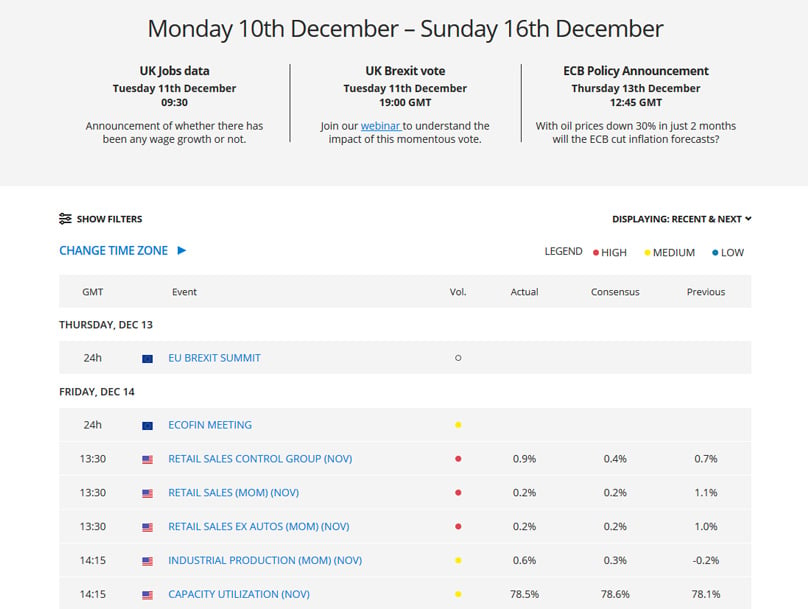

Intelligence Tools for Market Insights with City Index

CFD arenas include: Forex, Indices, Shares & Cryptocurrencies

Trading Platforms

Available Platforms: Web Trader, Desktop (Windows), MetaTrader 4

City Index is under the umbrella of GAIN Capital Holdings Inc., a prominent institution on the New York Stock Exchange identified as GCAP. Founded in 1999, GAIN Capital is a giant in both institutional and retail trading services worldwide. Being publicly listed fortifies the traders' trust in City Index, complemented by stringent regulation across eight jurisdictions globally. GAIN Capital upholds benchmark levels of governance, transparency, and financial reporting.

GAIN Capital, to give you a perspective on its stature and dependability, accommodates over 150,000 retail traders globally with client assets totaling $978 million. In the fourth quarter of 2016, it showcased $1.430 billion in total holdings, $945.5 million in customer equity, and accessible funds and liquidity amounting to $182.9 million, while adhering to a minimal regulatory capital requirement of $113 million. Its headquarters are located in Bedminster, New Jersey, further extending its reach with over 800 employees globally.

City Index has well-established branches within the UK, Australia, Singapore, and the Middle East, each with a nuanced account offering. While Trader and Premium Trader accounts are standard in Australia and Singapore, the UK and Middle East offices additionally present Professional Trader Accounts. Across all branches, CFD trading is accessible, with the UK site also offering spread betting.

Residents from the UK and EU can enroll with either the UK, Australia, or Middle East branches. UK and Middle Eastern accounts are protected against negative balances, whereas the feature is optional for Australia and Singapore accounts.

Orders Types

Routine Trader accounts encompass protection against negative balances, a 50% margin cut-off, and superior execution.

City Index offers demo accounts for CFD, spread betting, spread bet with MT4, and joint CFD accounts. These accounts come with £10,000 in virtual funds and unlimited usage for 12 weeks. While the demo accounts’ duration can't be extended, you can reapply for another one for additional practice.

The Premium Trader account operates solely by invitation, offering prioritized service and a dedicated manager for retail clients actively trading. It includes risk management per trade, competitive pricing, and a cap ensuring you don't lose more than your deposit.

City Index Trading Tools

Premium traders receive access to privileged content, webinars, seminars, and high-profile events. They also gain from extensive research resources, such as Faraday Research and premier market analyses, alongside Reuters news.

To join the ranks of premium traders, maintaining an active account balance of at least £10,000 is essential. Once eligible, you can either await an invitation or proactively reach out to City Index to accelerate the process.

Experienced traders meeting specific criteria can secure a professional trader account on City Index. This account variety avails credit facilities and broker-assisted dealing, with a dedicated client relationship manager. The margin rates for these accounts drop to as low as 0.25%, though it’s key to recognize that professional clients might suffer losses exceeding the deposit.

Despite the newer regulations affecting the industry, professional traders enjoy outstanding margin rates, which for significant indices can be as low as 0.25%, while commodities have 0.5%, shares at 3%, and crypto trading at 5%. These margin advantages can outperform retail client ones by up to 20 times.

Furthermore, professional clients with City Index benefit from loyalty perks, including invitations to exclusive hospitality events and other incentives. The credit facility contributes to more elastic financial possibilities, and professional traders receive prioritized services.

To embark on a professional trader’s journey, simply fill out a brief application and await approval. Qualifications include meeting any two of these three: executing an average of 10 substantial transactions quarterly over the past year, possessing a financial portfolio surpassing €500,000 (inclusive of deposits), or accruing a year’s experience in a financial role essential for trading leveraged products.

City Index's Array of Market Intelligence Instruments

Despite differing legal stipulations from retail clients, City Index retains its practice of keeping client funds separate from its operations, upholding superior execution methods, revealing pivotal information, and maintaining trade confirmation consistency.

Nevertheless, for professional trader accounts, some FCA protection waivers exist. Changes to product features protecting retail clients aren't mandatory for professionals, impacting margin closeouts and negative balance protection. Sophisticated language is sometimes used, with the assumption that professional traders have the requisite knowledge to grasp leveraged trading risks. Yet, FSCS protection remains intact for professional traders.

Professional traders can access special resources and platforms unavailable to regular traders. In terms of platforms, opportunities are present with AT Pro and MetaTrader 4, alongside auxiliary tools by Dataminr.

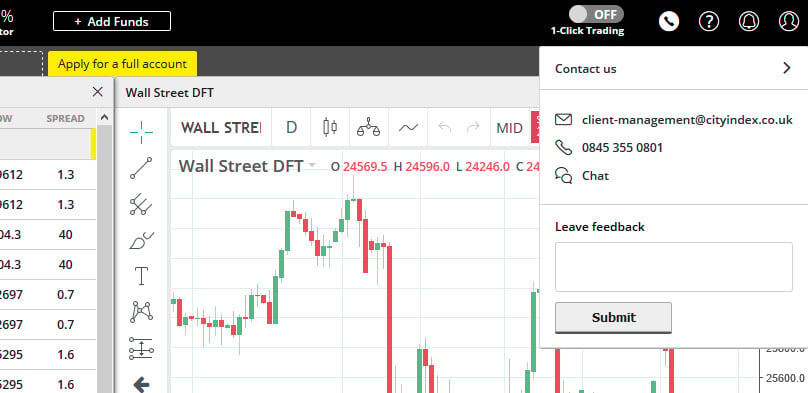

City Index Customer Support

With City Index, you'll tap into over 12,000 CFD and spread bet markets, including forex, commodities, indices, and cryptocurrencies. If your account is with the Australia or Singapore branches, you access over 4,500 CFD markets. Those with Middle Eastern accounts access over 100 CFD markets inclusive of indices, commodities, and forex.

City Index Regulations

Minimum leverage and margin requirements with City Index differ slightly based on your office branch and market type. For retail clients in the UK, for instance, the margin for key indices is at 5% and leverage at 20:1, whereas for major FX, it’s 3.33% with leverage at 30:1. Meanwhile, commodities stand at 5% and 20:1, shares at 20% and 5:1, and cryptocurrencies at 50% and 2:1.

The account specifics from the Australia office display figures such as 0.5% margin and 200:1 leverage across key indices, FX, and commodities, capped at 5% and 20:1 for shares, and 25% with leverage of 4:1 for cryptocurrencies. For Singapore, the figures generally are 5% and 20:1 for major indices, 2% and 50:1 for major FX, 20% with 5:1 for shares, and 10% and 10:1 for commodities.

Is City Index Safe?

The Middle East branch refrains from including shares or cryptocurrencies. Key indices have a 5% margin and 20:1 leverage, major FX has 3.33% with 30:1, and commodities stay at 5% with 20:1 leverage.

Competitors

City Index's dedication to a best execution policy guarantees the quickest possible execution on any trade. Should the price shift in your favor during processing, City Index secures the order at this improved rate. Trading execution facilities on City Index also offer dual-position capacities—going both long and short, price enhancement technologies, and diverse flexible order types.

- Plus500

- AVATrade

- IQ Option

- 24option

- ExpertOption

- Vantage FX

- Forex.com

- Pepperstone

- ETX Capital

- NordFX

- City Index

- Binary.com

- XTB

- FXTM

Conclusion

City Index also allows traders to leverage unrealized gains from open positions as a margin for new trades, optimizing resource use. Implementations include roll-over discounts for futures, options to scale trades incrementally (whether FIFO or non-FIFO), and a closeout threshold where trades aim to be closed if funds dip below 50% of the required margin, aligning with negative balance mitigation without replacing stop losses.

Spreads for primary indices at City Index initiate at a mere 0.4, increasing from 2 at the Middle East branch. Forex spread starts at 0.6 in the UK and Australia, drops to 0.5 in Singapore, and stands at 3 in the Middle East. Independently of the branch, spreads for commodities start from 0.06, shares from 0.1, and cryptocurrencies from 0.8.

Exploring City Index: A 2019 Overview for Beginners – Discover Its Safety and Weigh the Pros and Cons

Considering City Index as Your Broker? Delve into Its Safety and Authenticity by Reading Our In-Depth Review Featuring Pros and Cons